Uk Spread Betting Interviewer

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

Home » Spread Betting UK – Spread Betting Explained

4, August 2021 | Last Updated: 17, August 2021

Spread betting is a form of financial trading that comes with a major stand-out benefit – all profits are exempt from capital gains and stamp duty tax. In addition to this, the best spread betting brokers offer thousands of financial markets, leverage, low fees, and even the ability to short-sell.

In this guide, we explain the ins and outs of how spread betting in the UK works and which brokers are worth considering in 2021.

In order to get your spread betting UK journey off to a flying start – you’ll need a good broker by your side. Below you will find a list of the best spread betting brokers in the UK for 2021.

We review the above spread betting UK brokers further down in this guide.

If you’re completely new to spread betting in the UK – below you will find a quickfire guide on how this form of financial trading works.

And that’s it – you’ve just placed your first spread betting UK trade at Capital.com!

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.25% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

In a nutshell, spread betting is a form of financial trading that allows you to speculate on the future value of an asset. For example, if AstraZeneca shares are trading at £8.20 on the London Stock Exchange – you need to decide whether you think the price will rise or fall. If you predict the future price of the shares correctly – you will make a profit.

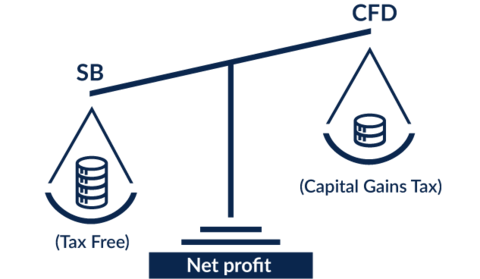

In this sense, spread betting is very similar to CFD trading. After all, when you place a spread betting order – you do not own the underlying asset. Instead, you are merely looking to predict whether the asset will increase or decrease in value. One of the major benefits of choosing a spread betting UK platform is that all profits are exempt from tax.

This includes both capital gains and stamp duty tax – so you get to keep all profits for yourself. In addition to this, many spread betting platforms in the UK offer thousands of markets – which ranges from UK and international stocks, ETFs, forex, precious metals (e.g. gold), oil, indices, and more.

Plus, you can also trade with leverage – which allows you to amplify the size of your stake. Furthermore, and as we cover later in our spread betting UK broker reviews – the best platforms in this space allow you to trade on a 0% commission basis. All in all, if you’re looking to speculate on the financial markets – spread betting is well worth considering.

So now that we have covered the basics of how spread betting in the UK works – we can now walk you through a more detailed explanation.

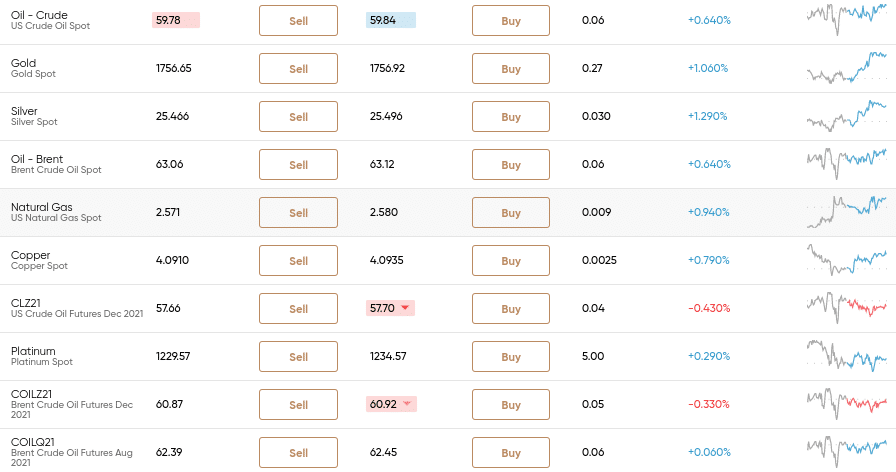

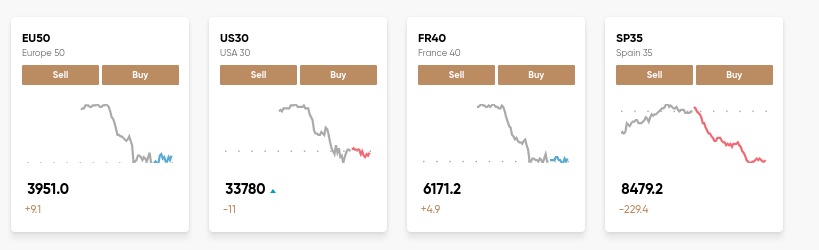

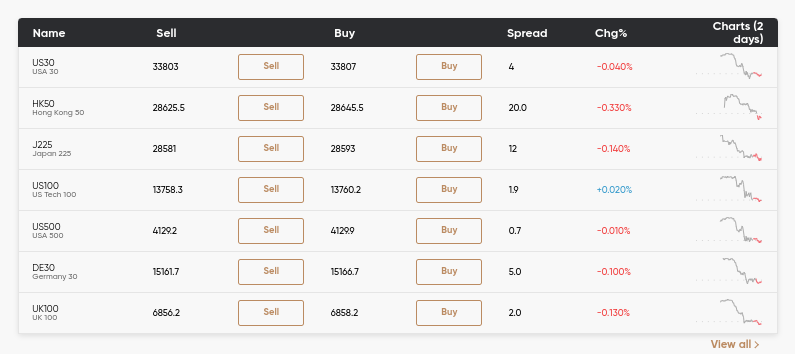

First and foremost, let’s have a quick look at the many spread betting UK markets that you will likely have access to when signing up with a top-rated broker.

As you can see from the above list, the best spread betting UK sites give you access to a wide range of financial markets. As such, you’ll never be short of trading opportunities.

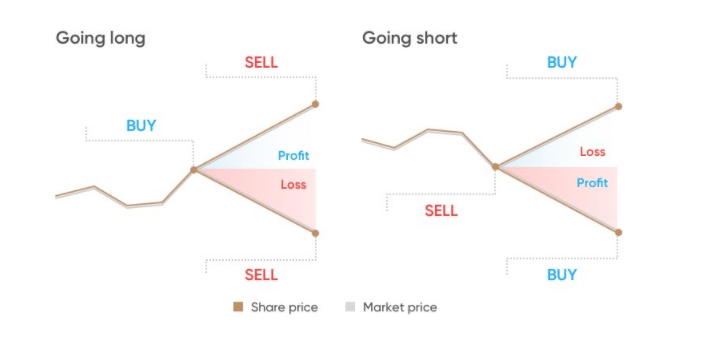

Once you have decided which financial instrument that you wish to spread bet, you then need to decide whether you think the price of the asset will rise or fall. This is another major benefit of choosing a spread betting UK platform as opposed to a traditional brokerage firm – as you always have the option of going long or short on your chosen market.

Here’s what you need to know about buy and sell orders:

If you place a buy order and the price of asset rises – then you will make a profit by closing the position with a sell order. And similarly – if you place a sell order and the asset falls in value, you can lock in your profits by closing the position with a buy order.

So far – the basics of spread betting UK might appear somewhat simple. However, we now need to move on to the point movement system that is utilized by spread betting brokers – which might be unfamiliar territory for you.

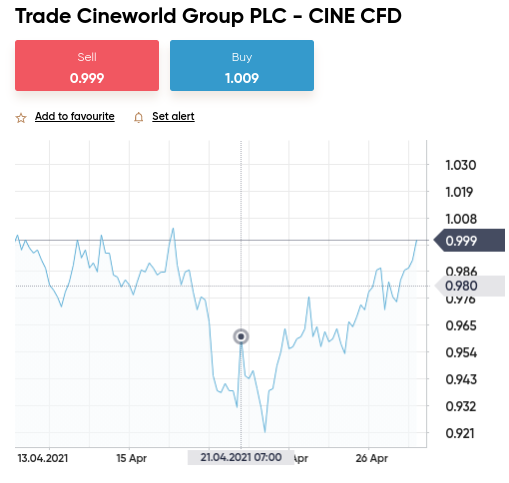

In a nutshell, when you buy traditional shares in the UK – the price of the respective stock moves in pence. For example, if you buy Cineworld shares at 82.01p and sell them at 85.05p – that’s a profit of 3.04p for each stock that you bought. However, in the case of spread betting UK – this price movement would be depicted in points. Furthermore, the point system operates in units – so 1p might amount to 100 points.

Let’s look at an example to help clear the mist:

The amount of money that you made on the above trade would be dictated by the size of your stake per point – which we cover shortly. But first – it’s worth us giving you another quick example of how to spread betting point system works to ensure there is no ambiguity.

To clarify, although a sum of [$70.50-$66.80] gives us a figure of $3.70 – don’t forget that 1 point amounts to 1 cent. As such, $3.70 amounts to 370 points.

Once you get your head around the point movement system – understanding the spread betting UK arena is actually very simple. As such, we now move on to stakes. Put simply, when you speculate on your chosen financial instrument – you need to tell your broker how much you wish to stake per point movement.

Many spread betting brokers in the UK allow you to trade from just 10p per point – which is great if you are just starting out. In order to determine your profits or losses – your chosen stake is multiplied by the number of points that the asset moves by.

Let’s look at an example to help clear the mist:

If, on the other hand, you staked just 10p per point on this trade – your profit would have amounted to £30 (300 points x 10p). Or, if you had staked £10 per point, your profit would have amounted to £3,000 (300 points x £10). As such can see, your profits are fully dictated by how much you decide to stake per point. This is also the case with losses – so it’s important to tread carefully if you are completely new to spread betting UK.

By this point in our spread betting UK guide – you should have a firm understanding of how to place orders. Next, we need to talk about the ‘duration’ of your chosen market. Put simply, when you’re spread betting a financial instrument – you do not own it. Instead, the spread betting market will track the price of the asset in real-time.

For example, if HSBC shares are trading at 401.90p on the London Stock Exchange – the spread betting market will mirror this price. A direct consequence of this is that spread betting brokers always place a market duration on your trades. You often get two options in this respect – which we explain below:

Irrespective of which duration you opt for – if you have an open position when the market shuts – the broker will automatically close your outstanding trades. With that in mind, beginners will be best suited for a quarterly funded bet – as you will have more time to assess the market and make an informed decision. Daily funded bets, on the other hand, are more suited for experienced day traders.

So now that you have a firm understanding of how spread betting UK works – we can now talk about the many benefits that this form of financial trading offers.

As we briefly covered earlier, spread betting profits in the UK are completely exempt from taxation. Not only does this include stamp duty (0.5%) – but capital gains tax (10-20% depending on your tax band). This is in stark contrast to traditional investment vehicles in the UK – which attract both of the aforementioned tax liabilities.

At the other end of the spectrum, if you risked £5,000 on a BT share trade via a spread betting broker – you wouldn’t pay any stamp duty. Already, that’s saved you £25. If you then closed the position at a profit of £2,500 – you would get to keep it all for yourself – not least because spread betting is exempt from capital gains tax.

When you purchase traditional shares – you are hoping that the markets are bullish – meaning that there are more buyers than sellers. In other words, the only way that you will make money from your traditional share investment is if the value of the stocks rises. This is where spread betting UK once again stands out – as the best brokers in this industry support buy and sell orders on all markets.

For example, there would have been plenty of short-selling opportunities in early 2020 when the impact of the coronavirus pandemic crahsed the stock markets. Similarly, if you think that at over $70 per barrel of crude oil is overvalued – once again you can attempt to profit from this by placing a sell order at your chosen spread betting broker.

Later in this guide on spread betting UK – we review three of the best platforms that are active in this space. All three brokers have one thing in common – they allow you to spread bet without paying any commission.

This means that in addition to 0% stamp duty and 0% capital gains tax – you’ll also be able to place buy and sell orders without paying a single penny in commissions or dealing fees. In addition to this, you’ll also benefit from super-low spreads.

Crucially, because you are not buying the underlying asset – top-rated platforms like Capital.com offer some of the tightest spreads in the industry.

When you use a traditional online broker to trade – you will likely have access to a small number of markets. This might include a collection of UK shares and perhaps some ETFs and mutual funds. However, when you use a spread betting UK broker – expect to come across thousands of financial assets.

As we covered earlier, this will include everything from shares, ETFs, and indices to forex, precious metals, and energies. This gives you ample opportunities to enter trades throughout the day.

For example, if tensions in the Middle East are on the rise, you might decide to place a buy order on crude oil – not least because global supply levels will likely fall. Or, if Turkey announces that its GDP fell by 2% in the prior quarter – you might decide to short-sell TRY/USD.

An additional benefit that the best spread betting UK brokers offer is leverage. In a nutshell, leverage allows you to trade with more money than you have deposited in your trading account. Leverage is usually displayed as a ratio – like 1:5. This means that a £50 stake would be amplified by a factor of 5 – taking your position to £250. Or, a leverage ratio of 1:20 would boost a £50 stake to £1,000.

All of the spread betting UK platforms that we review later in this guide offer leverage. The limits that you have access to as a UK retail trader are capped by the FCA to ensure you do not trade with more than you can afford to lose.

If you’re new to spread betting leverage – check out the example below:

You might be looking at the above example and think that applying the maximum amount of leverage on each spread betting order sounds like a no-brainer. However, it’s important to remember that while leverage can boost your profits – it will also do the same for your losses.

For example, if you went short on crude oil at $1,805 per oz and it dropped by 5 points – your losses on the above trade would have been boosted from £5 to £100. As such, tread with caution when applying leverage.

If you have read our spread betting UK guide up to this point – then you should now have everything you need to go started with your first buy or sell order. However, you won’t be able to spread bet without having a top-rated broker by your side.

To save you from having to conduct countless hours of research – below we review a selection of the very best UK spread betting brokers in the market right now.

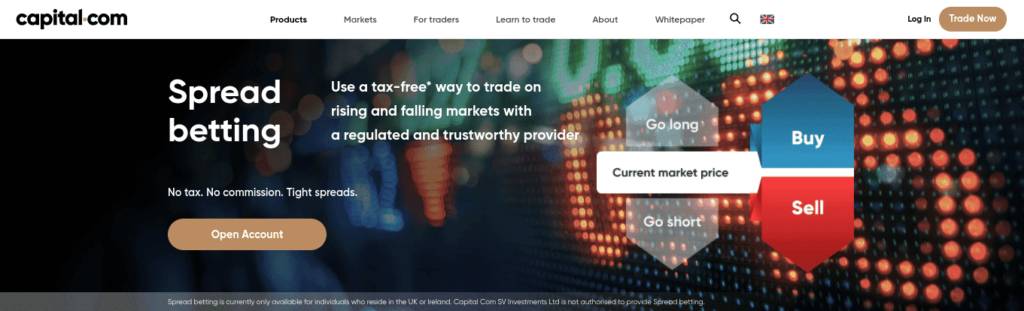

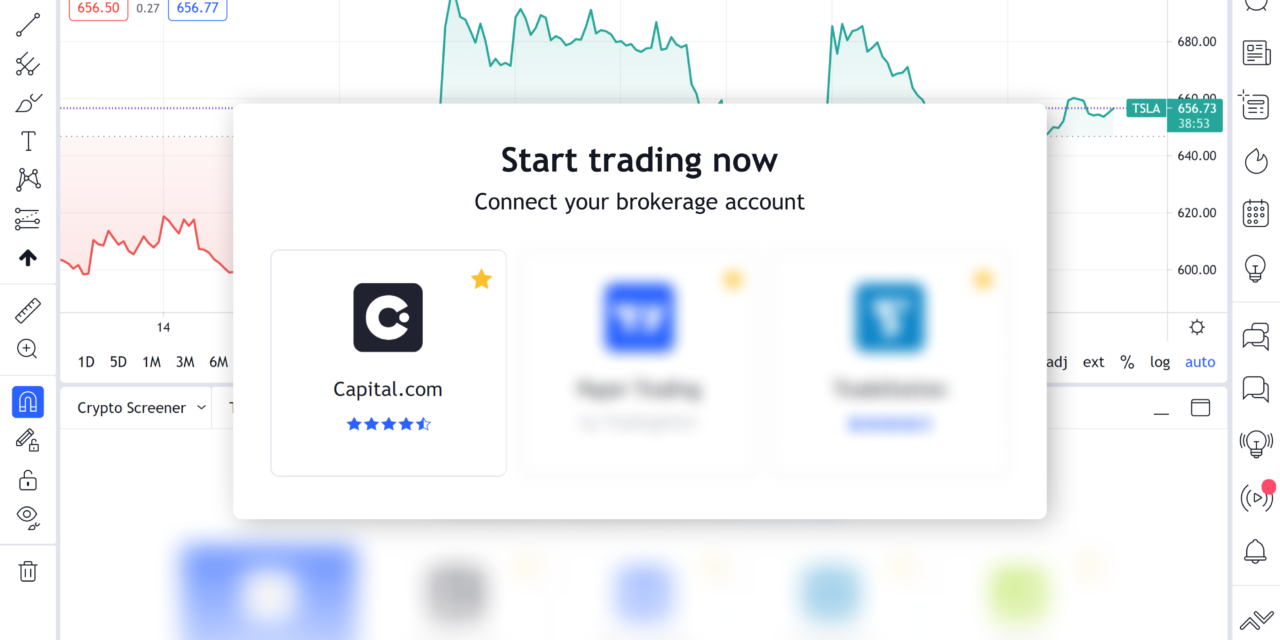

Look no further than Capital.com – which is the overall best spread broker in the UK for 2021. This top-rated trading platform is authorized and regulated by the Financial Conduct Authority (FCA) and covered by the Financial Services Compensation Scheme (FSCS). As such, you can place spread betting UK orders in the knowledge that you are using a safe and credible broker.

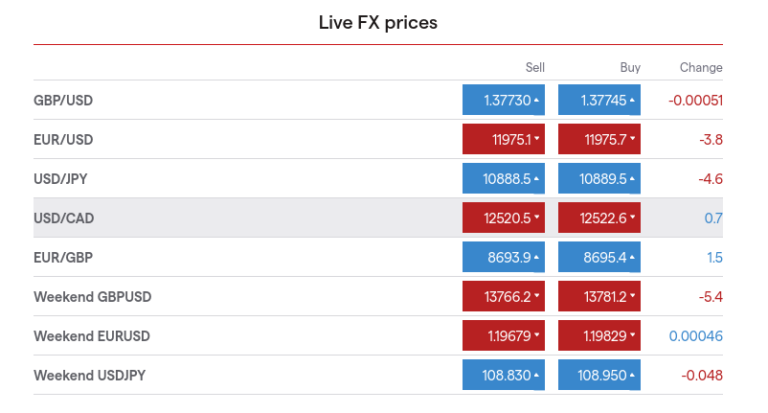

At Capital.com, you will have access to thousands of spread betting markets. This includes over 138+ forex pairs, 31 commodities, 26 indices, and more than 3,600 shares. The latter consists of stocks listed on the FTSE and AIM in the UK, as well as markets in the US, Europe, Asia, and the Middle East. Regardless of which spread betting market you decide to trade – Capital.com charges 0% in commission. Spreads are super-tight too. For instance, the spread on silver starts at just 0.018 points and EUR/USD at 0.6 points.

In terms of getting started, you can open a Capital.com account in less than two minutes. If depositing funds with a debit/credit card or e-wallet – you only need to fund your account with £20. Bank wires require at least £250. Either way, there are no fees to deposit or withdraw funds at this platform. Capital.com offers buy and sell positions on all markets – as well as leverage within FCA limits. You can trade on the main Capital.com website or download the provider’s mobile app – which is compatible with iOS and Android devices.

Top-rated spread betting and CFD broker

Regulated by the FCA

Minimum deposit just £20 (debit/credit cards and e-wallets)

0% commission on all markets

Tight spread and no deposit/withdrawal fees

Thousands of financial markets supported

Great for beginners

Advanced traders might find the platform too basic

Minimum deposit of £250 on bank transfers

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.25% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

If you have a bit of experience in the online trading arena – then you will likely find the MT4 platform conducive for your skillset. After all, this popular third-party trading platform comes packed to the rafters with advanced tools and features. This is inclusive of technical indicators, chart drawing tools, simulators, customized orders, and even the ability to install a trading robot.

If MT4 is the platform that you wish to access the spread betting market on – then AvaTrade is a great option to consider. This trusted CFD and spread betting broker is regulated in seven jurisdictions – so safety should be of no concern. Although you will only have access to 200+ spread betting markets, this does include the likes of stocks, commodities, ETFs, forex, and indices. As such, AvaTrade covers the most liquid marketplaces in the global trading scene.

Best of all, AvaTrade is a 0% commission broker – so once again, you only need to cover the spread. We also like the fact that AvaTrade offers a free demo account platform. All you need to do to gain access is open an account, download MT4, and then sign in with your AvaTrade credentials. If you want to start spread betting with real money – the minimum deposit is just £100. You can fund your account instantly with Visa or MasterCard and there are no deposit fees to contend with.

Regulated in seven jurisdictions

0% commission on all supported markets

Offers spread betting and CFD instruments

Minimum deposit of just £100

Free demo account

Supports MT4 and MT5

Spread betting department limited to just 200+ financial markets

Mobile app is a bit cumbersome to use

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Pepperstone is a popular CFD and spread betting broker that is authorized and regulated by the FCA. The platform is home to over 1,000+ financial markets that cover a wide range of asset classes. This includes dozens of forex pairs – with the broker offering a great selection of majors, minors, and exotics. You can also trade indices like the FTSE 100, Dow Jones, and S&P 500.

If you’re interested in commodities – Pepperstone offers spread betting markets on gold, silver, oil, natural gas, cotton, cocoa, and much more. In the stocks and shares department – you will have access to four major spread betting markets. This covers exchanges in the US, UK, Germany, and Australia. When it comes to pricing, Pepperstone allows you to spread bet on a 0% commission basis.

Much like Capital.com, you only need to cover the spread itself. To give you an idea of how competitive Pepperstone is in this respect – the spread on EUR/USD starts at 0.6 points, while on gold this stands at just 0.05 points. There is no minimum deposit requirement at Pepperstone – and you can instantly fund your account with a debit or credit card. You can access the spread betting via the Pepperstone website or through MetaTrader4 – which you can download to your desktop device. There is also a Pepperstone iOS/Android mobile trading app.

1,000+ markets covering shares, indices, commodities, forex, and more

Spread betting and CFD trading markets

0% commission accounts available

No minimum deposit

Authorized and regulated by the FCA

Compatible with both MT4 and MT5

Pricing structure is a bit confusing

Education department is limited

Capital.com – Recommended Spread Betting Broker

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This guide has explained everything there is to know about spread betting in the UK. We have also reviewed the best UK brokers that are active in this scene. To conclude this comprehensive guide – we are going to walk you through the step-by-step process of how to start spread betting from the comfort of your home.

Just like you would at a traditional stockbroker – you will first need to open an account with your chosen spread betting platform. As noted in our reviews earlier, Capital.com is the best spread betting broker for the job – as you will have access to thousands of commission-free markets.

To open an account with Capital.com – visit the provider’s website and click on the ‘Trade Now’ button. Next, follow the on-screen instructions by entering your personal information and contact details.

You will now be asked to upload a copy of your government-issued ID as per KYC (Know Your Customer) regulations. This can either be a passport or a driver’s license. Capital.com should be able to validate the ID document instantly.

Now it’s time to deposit some funds so that you can start spread betting with real money. If opting for a debit/credit card or e-wallet, not only will this be processed instantly – but the minimum deposit is just £20. However, if opting for a bank wire – the minimum jumps up to £250 and you’ll need to wait a few days for the funds to arrive.

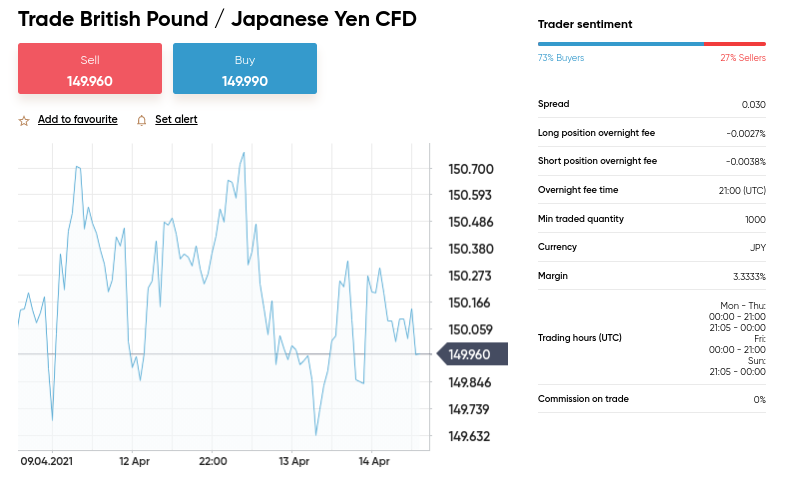

You can now search for the spread betting market that you want to trade. In the

Sexy Blonde Girl Porn Video

Smoking On Webcam Tube

Porno Years Tube

Twitter Foto Azur Lane Cosplay 18

Latex Fetish Scat

IG Index Spread Betting Interview

Spread Betting UK | What Is Spread Betting? Full 2021 Guide

Best Spread Betting Platform UK - Top 7 Brokers Compared

Financial Spread Betting for a Living

UK Best Spread Betting Platforms: The Complete List (2021)

Top 10 Best UK Spread Betting Brokers 2021 [UK Spread Betting]

Spread Betting UK - Open a Spread Betting Account ...

Top 10 Spread Betting Platforms With Low Spreads for UK ...

Best Spread Betting Platform UK 2021 - Trading Platforms UK

Uk Spread Betting Interviewer