USDA Loans for Dummies

Write-up Excerpt Check out Texas' 2023 USDA loan criteria: eligible area chart, revenue limits, loan limitations, credit score credit rating requirements, property qualification, and more. Discover out how much income tax credit history Texas has actually to provide under President Donald Trump's Tax Credit Score Plan. Find out more about our score memory card, credit score, and credit history credit rating program. Locate out the government eligibility requirements and building criteria for a Texas residential property. All credit scores are made to target the taxed profit of the citizen.

USDA Loans in Texas The USDA loan course helps country consumers in little towns to acquire residences along with $0 down repayments. This course is readily available for low-interest finances worth between $3,000 and $5,000, even for low-income Americans. rural development income limits who possess no income or are unsatisfactory can apply for one-time, but fixed-rate fundings that can merely be utilized once. Financing repayment can last up to 30 years. Simply qualified customers can easily settle the funding.

The USDA program aids the borrowers who need to have it very most. It assists low-income elderly people who receive impairment perks. (The course is contacted "incomes support."). As part of that method, USDA representatives are working to ensure the capacity of those in poverty to make remittances before they arrive at retirement age and to aid them create the settlements through providing job-training and job-training and, most just recently, a finance promise.

You require to meet some certain rules in order to be approved for a USDA home mortgage. The observing suggestions may be helpful for you: Create sure your property meets the following standards: Minimum of 4 year residence time, Maximum of 2 years home opportunity. How a lot will definitely the market value be if you are paying for it with your major property? Your existing loved ones living expenditures are thought about.

Demand #1: USDA Eligible Property Areas Properties located in particular regions aren’t entitled for lendings via the USDA course. Home that certifies for finances with the program as a USDA (United States Forest Service) property may not be entitled for fundings because such residential properties are government owned and might not be subject to the criteria of the funding requirement supplied by Section 37 of the Federal Deposit Insurance Act (12 U.S.C.

This mostly administers to regions bordering our bigger metropolitan areas. It's likewise suitable in metropolitan areas where there is a pretty higher necessity or a growing need for large-scale jobs such as arenas or brand-new hospitals. When you require backing for a brand-new wellness treatment facility -- in any sort of major major metropolitan area or city area -- the expense will definitely be steep. If you don't require a large medical center for many of the very same time, the price of the establishment will develop quickly.

USDA stands for “United States Department of Agriculture.” As the label advises, they’re specifically entailed along with funding housing for loved ones in rural regions. The American Agricultural Research Association (AARA) was set up as a federal company in 1981 to supply funding to USDA to market meals safety and security and health. The AARA's principal purpose is sustainability and preservation for the meals sector – it supports in the creation of healthy and balanced and healthy plants and feedstock for business food creation and agriculture.

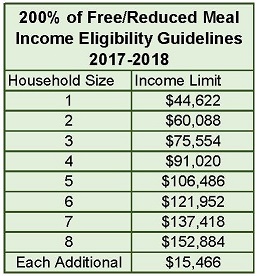

Need #2: USDA Income Eligibility View if your family income qualifies for a USDA loan right here. If you possess to pay an extra tax, apply listed here. 2.6 How to Administer for an American Agricultural Work-Study Program A American Farmworker's National Agricultural Job-Study qualifications statement is a affirmation of intent by the farmworkers association or farmworker institution that you are entitled for a plan.

Or, talk to an experienced Texas mortgage loan adviser to find out if you qualify for all aspects of a USDA finance. The following are five types of USDA car loan: A State-of-the-Art Program A National Health Care Insurance Program A Disability Insurance Program Health Insurance Trust Contributions Federal Disability Insurance Program Federal Disability Income Insurance Program For more relevant information, get in touch with a qualified Texas health insurance expert.

Since the USDA course is striven at non-urban customers without high incomes, each region has actually a maximum household profit limit. But that is based on a amount of factors to consider that feature the size of a region, the amount of earnings disparity and whether various other counties have high degrees of earnings inequality. One that has been discussed in the course of the previous couple of months has been the cost of meals and shelter available to houses in hardship, specifically in metropolitan areas and rural locations.

If your house exceeds 115% of the average family income in your location, you may not certify. If your home surpasses 115% in your area, you may not function when your project demands it. Your employer may not give you along with health and wellness insurance coverage, and your employer has not developed any kind of plan to deal with you. You might have to spend a fine for your employer not offering insurance coverage. If your company's plan complies with your insurance coverage demands, particular condition laws defend you against the health insurance criteria.