USD: After Dramatic Drop To Two Year Low, TD Sequential Triggers 9 & 13 Buy Signals

Global Crypto Consulting Group

Nearly every financial asset across any market is traded against the dollar and its exchange rate is valued in USD. Even Bitcoin, gold, and altcoins typically trade against the dollar as the dominant base currency pair.

The dollar’s status as the global reserve currency gives it incredible influence over all other markets. When the dollar is strong, so is the United States economy, and stocks boom as a result.

But when the dollar is in decline, as we’ve witnessed recently, hard assets like gold, Bitcoin, and real estate climb. The recent fall in the once almighty and dominant dollar set the currency back to a fresh two-year low.

According to the TD Sequential indicator, a dead cat bounce or perhaps a full comeback is near. The market timing indicator has triggered a 9 and 13 buy setup on daily DXY charts. DXY is the dollar currency index weighing its performance against the rest of the market.

Further technical analysis backs up the indicator’s call that a reversal could soon be coming in the dollar. DXY is currently forming a falling wedge ready to break out, coinciding with a bullish divergence on the Relative Strenght Index.

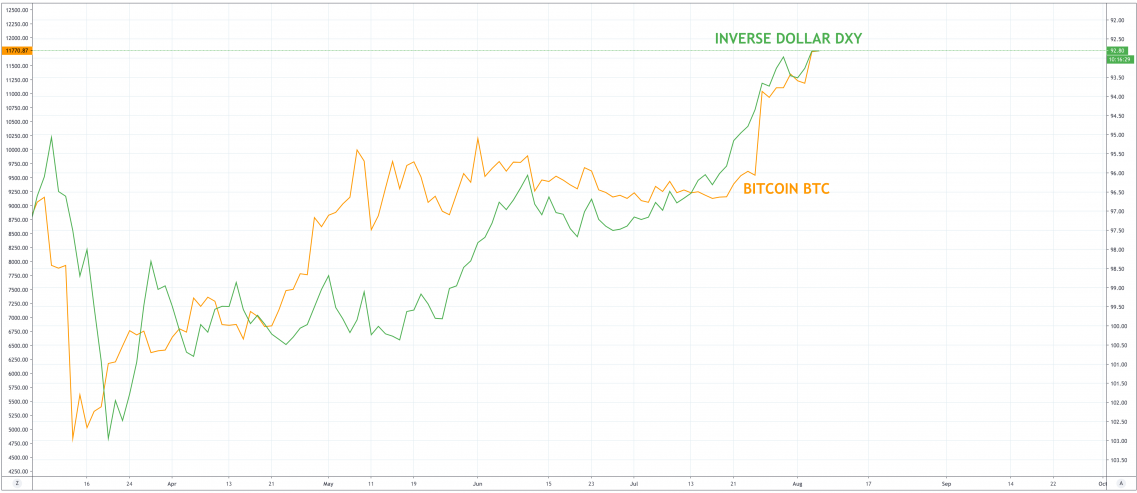

A bouncing dollar doesn’t bode well for Bitcoin’s recent rally, which could see a pullback as a result. This is best demonstrated by comparing Bitcoin against an inverse DXY dollar currency index chart to better depict the dollar’s continued weakness versus Bitcoin’s strength.

Flipping the DXY chart in the inverse, turns the falling wedge into a rising wedge, a bearish structure signaling a reversal.

Removing the trendlines completely, and adding in a Bitcoin BTCUSD line chart from Bitstamp very accurately lines up the cryptocurrency’s rise with the dollar’s inverse decline. The resemblance is undeniably uncanny. It also shouldn’t be surprising as the cryptocurrency trades against USD on its primary base currency pair.

A breakdown of the inverse dollar’s rising wedge could take Bitcoin price down with it. Not just Bitcoin, either. The dollar reversing will also tarnish gold’s recent gains, and potentially deal a major blow to the recent altcoin rally.

Major altcoins like Ethereum, XRP, and several others have benefit even more so than Bitcoin due to the dwindling dollar. With USD reversing, altcoins may nuke on their fiat-bound trading pairs.

Markets are unpredictable, however, and even with all signs pointing to a rebound in USD, anything is possible given the ongoing pandemic situation in the US.

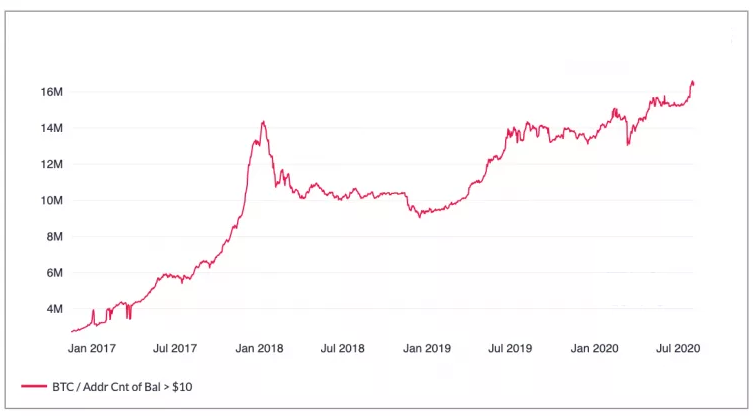

Bitcoin user adoption looks to be gathering pace as its price rises amid a coronavirus-induced rush for assets with safe-haven appeal.

The number of bitcoin addresses holding at least $10-worth of cryptocurrency recently rose to a record high of 16.6 million

That number is now up 14% from the previous peak of 14.5 million reached in January 2018, soon after the cryptocurrency's all-time price high of $20,000.

Essentially, there are now more addresses with a small balance than were seen at the height of the previous bull market.

The data suggests "a new bitcoin adoption cycle is brewing”

Address growth is not a precise indicator of bitcoin's user base because a single individual or entity can hold multiple addresses.

Adoption has gone up by 27% in the 4.5 months since the major crash in mid-March.

Bitcoin’s price has rallied by over 200% during the same period, and is up 64% year to date.

Relatively scarce assets like bitcoin and gold seem to have benefited from fears of a dwindling U.S. dollar and the inflation-boosting policies of central banks and governments.

Continued price gains could have an exponential effect on user growth as FOMO (fear of missing out) hits consumers.

Bitcoin may have a tough time scaling $12,000 in the short run if traders and crypto miners take advantage of the recent price rise and liquidate holdings.