UP/TON yield farming experience on STON.fi DEX

Ivan a. k. a. @Dobit4ikMore about STON.fi and why am I using it can be found in the article “How much can you make with STON.fi farming?”

Intro

I’ve started farming in the first 20 minutes since the official announcement.

I can’t find screenshots of the very first day, but if my memories are correct I got 6 $UP as a farm reward in the first 24 hours.

Fees and profit

Let’s calculate all of the fees.

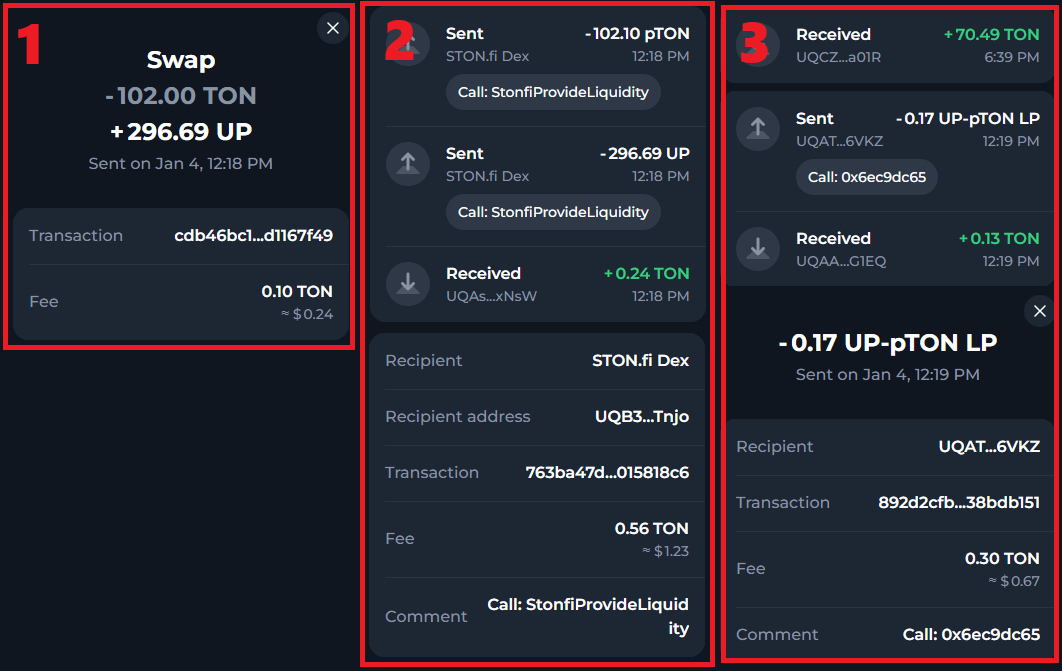

- TON -> UP swap 0.1 $TON

- Providing liquidity 0.56 $TON — 0.24 $TON = 0.32 $TON

- Locking liquidity points 0.3 $TON — 0.13 $TON = 0.17 $TON

To participate in the farming event I’ve spent 0.59 $TON on fees.

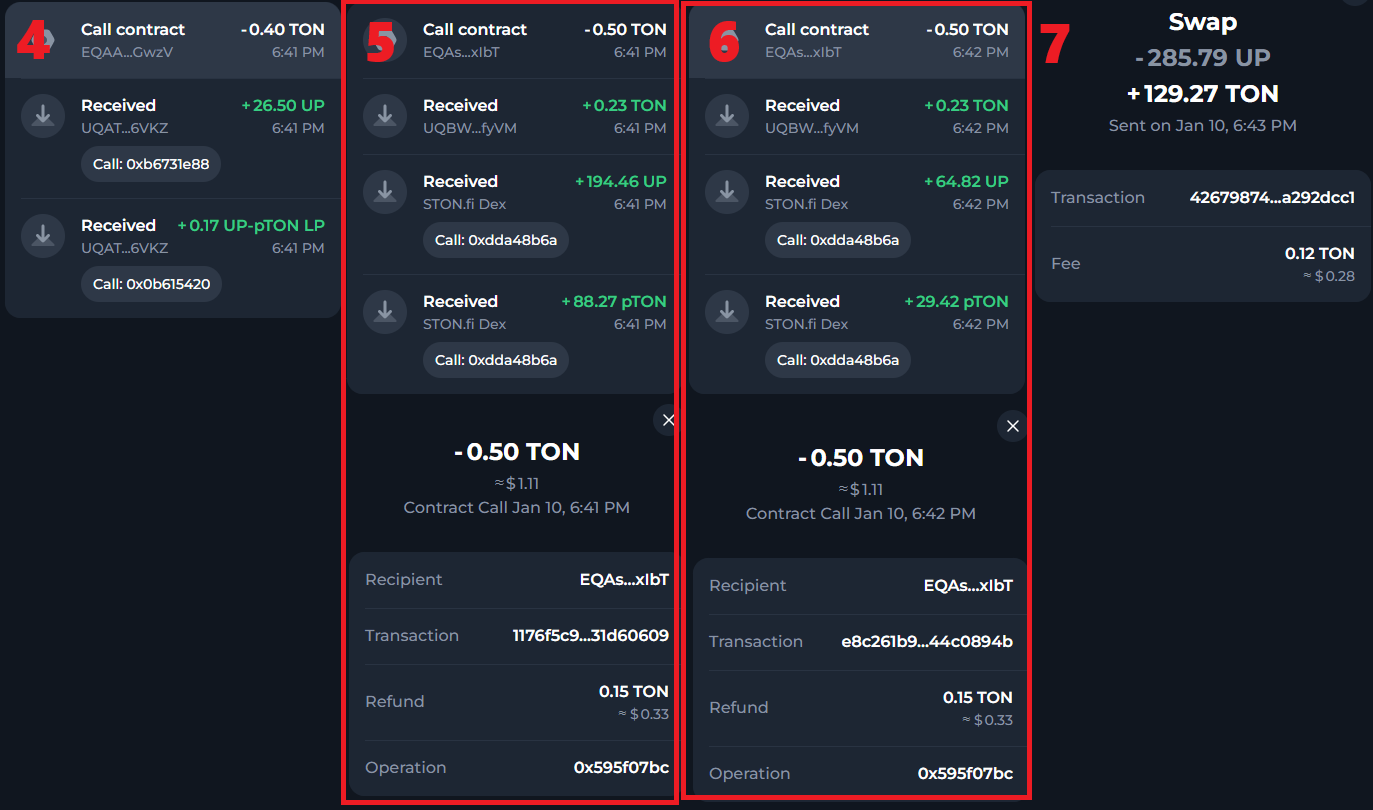

4. I’ve unstaked liquidity points 0.4 $TON

5–6. I’ve withdrawn 75% and then 25% of liquidity 1 $TON — 0.15 $TON — 0.15 TON = 0.7 $TON

This was a mistake. I thought that I needed to leave 25% of liquidity on the farm but then I understood that it was not my plan. It’s just an attempt to avoid the mistake described in JETTON / TON farm article.

7. I’ve swapped $UP to $TON 0.12 $TON

Total fee = 0.1 + 0.32 + 0.17 + 0.4 + 0.7 + 0.12 = 1.81 $TON

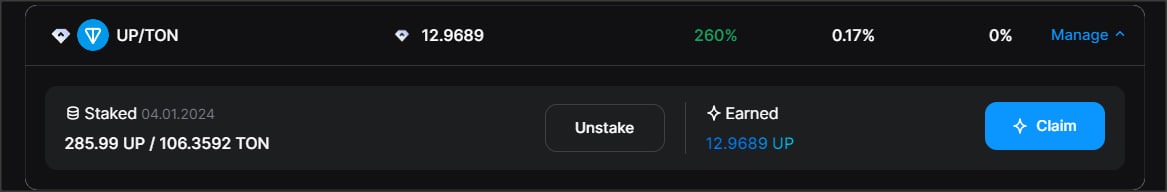

At the start of the farming event, I provided 102.1 $TON + 102 $TON (in $UP tokens) = 204.1 $TON. Today I’ve got 88.27 + 29.42 + 129.27 = 246.96 $TON.

Profit = 246.96–204.1–1.81 = 41.05 $TON or 41.05*100/(204.1+1.81) = 19.93%.

Conclusions

In this case, 26.5 $UP ~ 13 $TON is a profit from the farming event. And once again bigger part of the profit came from the token price change.

That’s why I’ve decided to play next farm in another way. Stay tuned to check out how.

STON.fi | STON.fi Telegram Channel | STON.fi Discord