Transform Your Business: Unlocking the Hidden Benefits of Accounting Software

In today's fast-paced business environment, staying on top of your finances is crucial for success. More than just a tool for managing numbers, accounting software for business can transform the way you operate. It brings efficiency, accuracy, and insight to your financial processes, allowing you to focus on what truly matters: growing your business.

Many business owners remain unaware of the full spectrum of benefits that accounting software offers. Beyond simplifying bookkeeping tasks, it can enhance decision-making through real-time data analysis, streamline compliance with tax regulations, and significantly reduce the margin for error. By leveraging these powerful tools, companies can unlock hidden advantages that lead to better financial health and improved operational performance.

Key Features of Accounting Software

Accounting software for business offers a variety of features that streamline financial processes and enhance productivity. One of the primary features is automated bookkeeping, which reduces the time spent on manual data entry. Automation not only minimizes human error but also allows businesses to maintain real-time financial records, ensuring that all transactions are accurately captured as they occur. This leads to improved accuracy in financial reporting and a better understanding of cash flow.

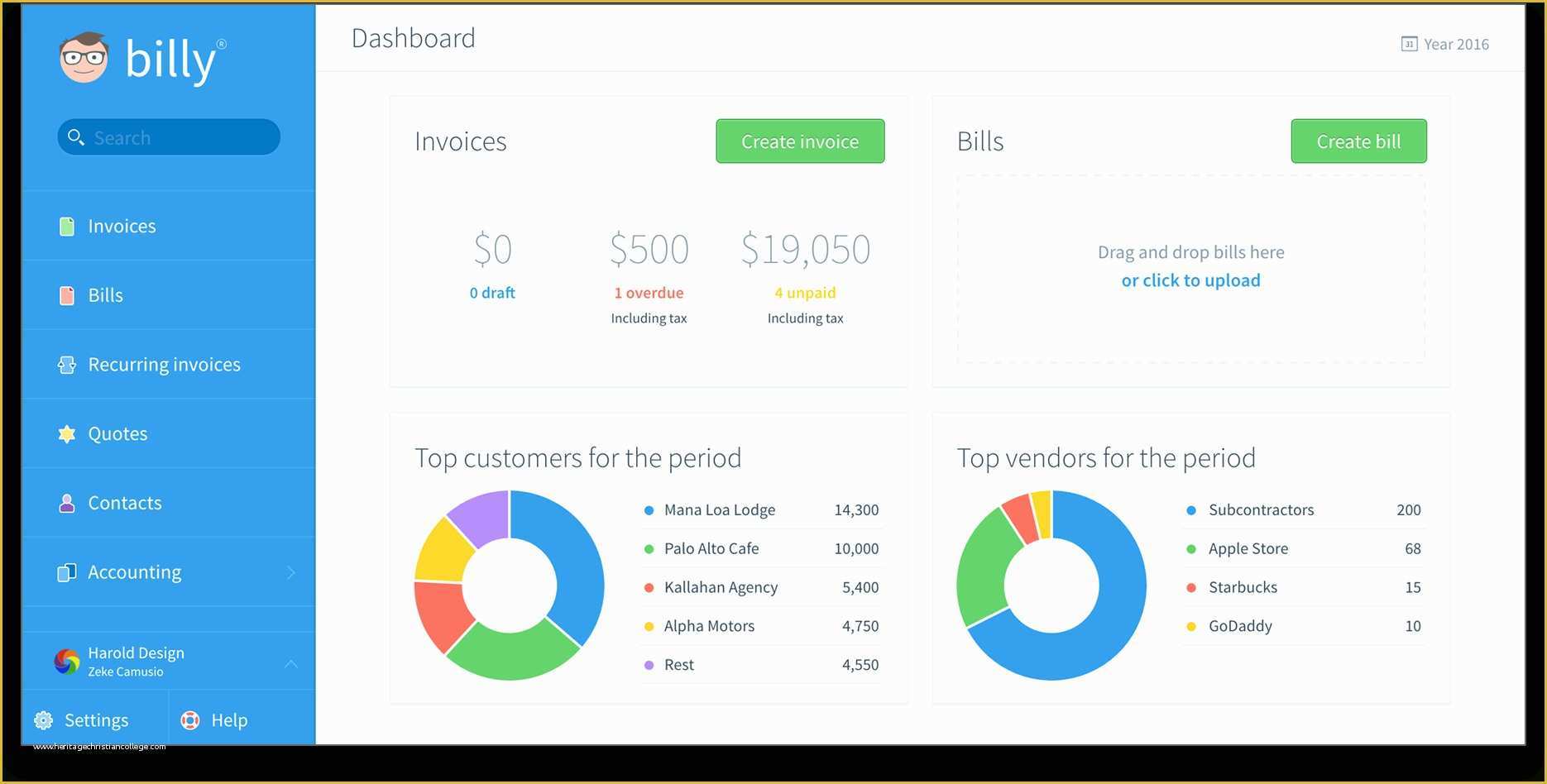

Another significant feature is comprehensive reporting capabilities. Accounting software enables businesses to generate a wide range of financial reports, including profit and loss statements, balance sheets, and cash flow forecasts. These reports provide valuable insights into financial performance, aiding decision-making and strategic planning. With easy access to historical data, businesses can identify trends and make informed decisions to drive growth and profitability.

Lastly, the integration capability of accounting software is crucial for modern businesses. This software can seamlessly connect with other tools and applications, such as payroll systems, inventory management, and customer relationship management software. This integration fosters a holistic view of the business's financial health and ensures that all departments are aligned and working with the same financial data. Consequently, businesses can enhance efficiency and effectiveness across their operations.

Advantages for Business Growth

Accounting software for business plays a crucial role in streamlining financial management, which can significantly contribute to overall growth. With automated processes, businesses can reduce the time spent on manual data entry and number crunching. This efficiency allows teams to focus on strategic initiatives that drive revenue and improve customer satisfaction. By minimizing human error, organizations can trust the accuracy of their financial reports, leading to better decision-making and resource allocation.

Additionally, modern accounting software provides valuable insights through real-time reporting and analytics. Business owners can access key performance indicators, track financial health, and forecast future trends at the click of a button. This data-driven approach enables informed decisions, allowing businesses to capitalize on opportunities and mitigate potential risks. The ability to assess financial performance quickly is essential for staying competitive in today’s fast-paced market.

Finally, investing in accounting software fosters scalability, which is vital for growth. As a business expands, its financial needs become more complex. Advanced software solutions can adapt to increasing transaction volumes, support multiple currencies, and integrate with other business systems. This adaptability ensures that businesses can manage their finances efficiently during various growth phases without needing to overhaul their accounting processes.

Choosing the Right Accounting Solution

Selecting the appropriate accounting software for your business is essential for maximizing its potential benefits. Start by evaluating your specific business needs, including the size of your organization, the complexity of your financial operations, and any industry-specific requirements. Consider whether you need features like invoicing, payroll management, or expense tracking. A clear understanding of your requirements will guide you in choosing software that aligns with your business goals.

Next, consider the ease of use and scalability of the accounting solution. As your business grows, your accounting needs may evolve, and it's important to choose software that can easily adapt to these changes. Look for intuitive interfaces and strong customer support to ensure that your team can navigate the software without extensive training. This will help maintain productivity as you integrate the software into your daily operations.

Finally, take the time to research different accounting solutions and read user reviews. This can provide insights into the strengths and weaknesses of various platforms, as well as customer satisfaction levels. Trial versions or demos can be invaluable, allowing you to experience firsthand how the software works in practice. By making informed decisions during the selection process, you can unlock the full potential of accounting software for your business.