Trading with iceberg orders mode on the Binance Exchange via Moonbot

CRYPTOMOON VIP LOUNGEBinance Exchange made an update which allow API users to trade with iceberg orders. It is important to note that iceberg orders are not available from the website or the official application of the exchange.

Iceberg orders also can be absolutely hidden in an order book, where only 1/10 of the order is visible and the remaining 9/10 is hidden.

How an iceberg order works: for example, you place an order to sell / buy 1000 coins. Of these, 100 coins (1/10 part) will be visible in the orderbook to other traders, 900 coins will not be visible in the orderbook.

In this case, the order exists on the exchange in full with all 1000 coins, and until it is filled out completely, the price will not go over it.

There are both positive and negative aspects in this.

Positive:

- Thanks to the developer, all Moonbot users reserve the same advantage over the exchange members as before.

- The ability to hide any amount in the trading book (showing only 1/10 of it), in order not to create walls when buying or selling, thereby confusing other market participants.

Negative:

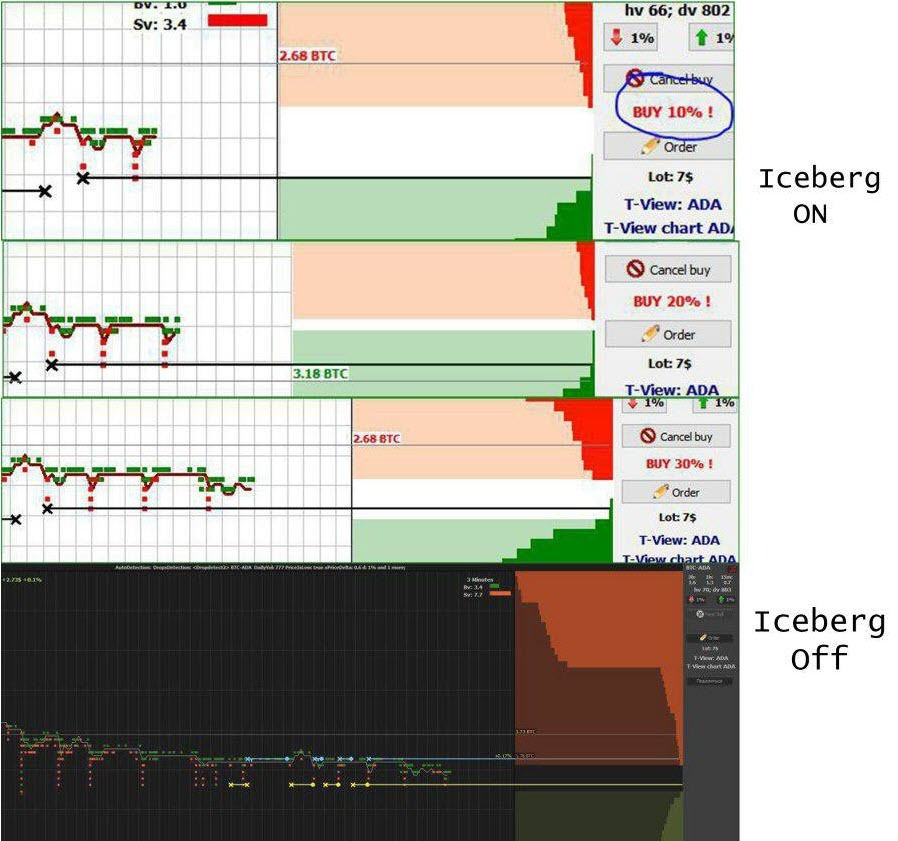

- The impossibility of high-quality scalping on coins with a price step of more than 0.08–0.1% (usually with a cost of up to 1,300 satoshi). Due to the accumulation of a large number of participants at the same price on such coins, the question of the queue of buying / selling becomes particularly relevant. So with the iceberg mode "On", only 10% of the order is filled, while for the other participants with the iceberg mode "Off", the full order is filled. This happens in a such way because the exchange places 10% of the order in the order book initially, and the next 10% is set only when the previous ones are filled. Then they are not set up within the same queue, and go to the end after the last buyer / seller. Therefore, the greater the price step (the smaller the value of the coin) - the more buyers / sellers at the same price, and accordingly the greater the turn and the final execution of the order in iceberg mode.

https://www.youtube.com/watch?v=9NbN7mVS86o - video review, which proves that even if one bot with an iceberg mode "On" opens order first, second bot with an iceberg mode "Off" off makes a deal faster.

EXAMPLE: Imagine a situation (picture below) where you want to buy a coin at the price of 1120 sats and put up at this price your limit order of 1 BTC with iceberg mode "On". After you have placed your order, another buyer (let's call him buyer "X") put his order at the same price in the queue (with iceberg mode "Off").

The order book will show the volume of 1.1 BTC for purchase at a price of 1,120 sats. After the sale of 0.2 BTC at the price of 1120, your order will be filled for 0.1 BTC, and the next 0.1 BTC will be queued after 0.9 BTC (0.1 BTC will also be partially fulfilled) of the buyer "X". Until the next execution of your order will have to stand in line at 0.9 BTC. If a third buyer appears at this time (buyer "Y") with a volume of 0.3 BTC at the price of 1120 sats, then after another 1.2 BTC is sold at a price of 1120 satoshi (0.9 BTC - order of the buyer "X" will be filled completely, 0.1 BTC - your part of the iceberg order will be filled, 0.2 BTC - part of the order of the buyer "Y" will be filled ), the next 0.1 BTC of your order will queue for the remainder of the order (0.1 BTC) of the buyer "Y".

And only if no one else places an order to buy at the price of 1,120 sats , your remaining 0.8 BTC volume will be completed without a queue.

2. The impossibility of the normal operation of the strategy of Moonshot for the reason above.

3. The impossibility of normal evaluation of the order book (the search for large buy / sell orders where the price usually seeks) due to the presence of invisible walls in it - often it is not enough sats to reach the necessary price where walls are based.

The official website of the bot: https://moon-bot.com/

To get a PROMO code with a discount of 3.33% on the PRO version of the bot contact: https://t.me/feelsun

Registration at the Binance Exchange: https://www.binance.com/?ref=19939658

Joining the CRYPTOMOON VIP LOUNGE Traders Club: https://t.me/rk_investor

Forum Moonbot: http://forum.moon-bot.com/index.php?showtopic=47

Youtube channel:

https://www.youtube.com/channel/UCy42WvQj-GY62oXLgf2zx_Q

Reproduction without attribution is prohibited.