Trading plan for 08/09-08/13

TS Forecasts. Sergey IvanovCurrencies Commodities Indexes

Currencies

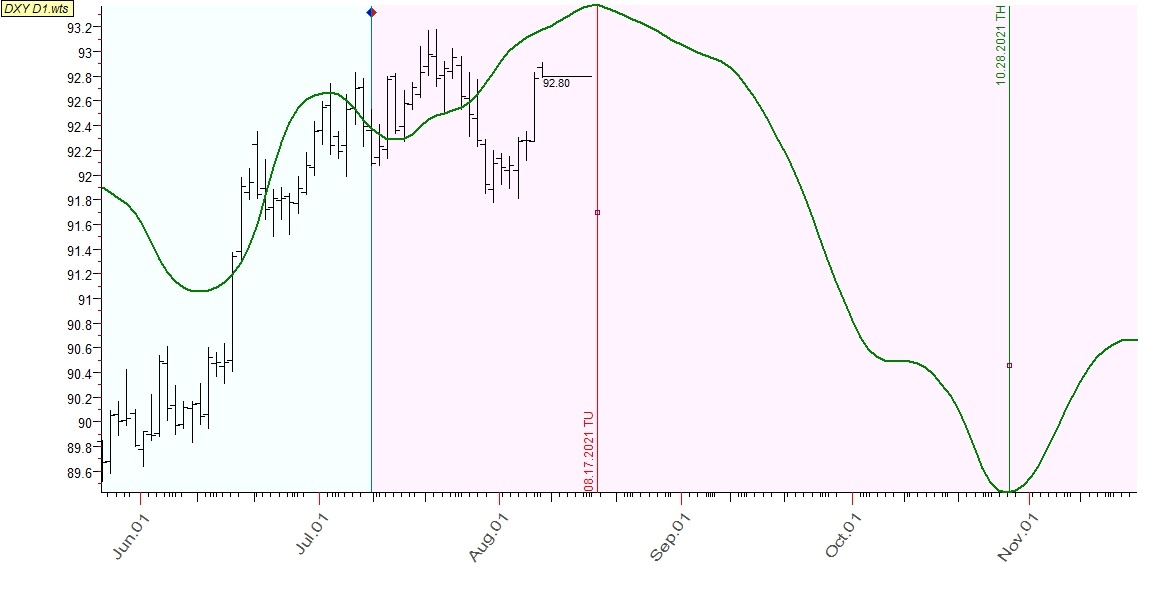

From weekly digests we know that DX NN projection line demonstrate the highest profitability. Thus, we have to rely on it in currencies trading plan development. This curve clearly let us know that current DX strengthening is limited is going to complete soon (probably by the end of this week).

So, having short positions in GBPUSD; AUDUSD and long position in USDJPY, I have to look for the date to close them prior reversal. In general, daily forecasts call for staying bearish till the end of the week.

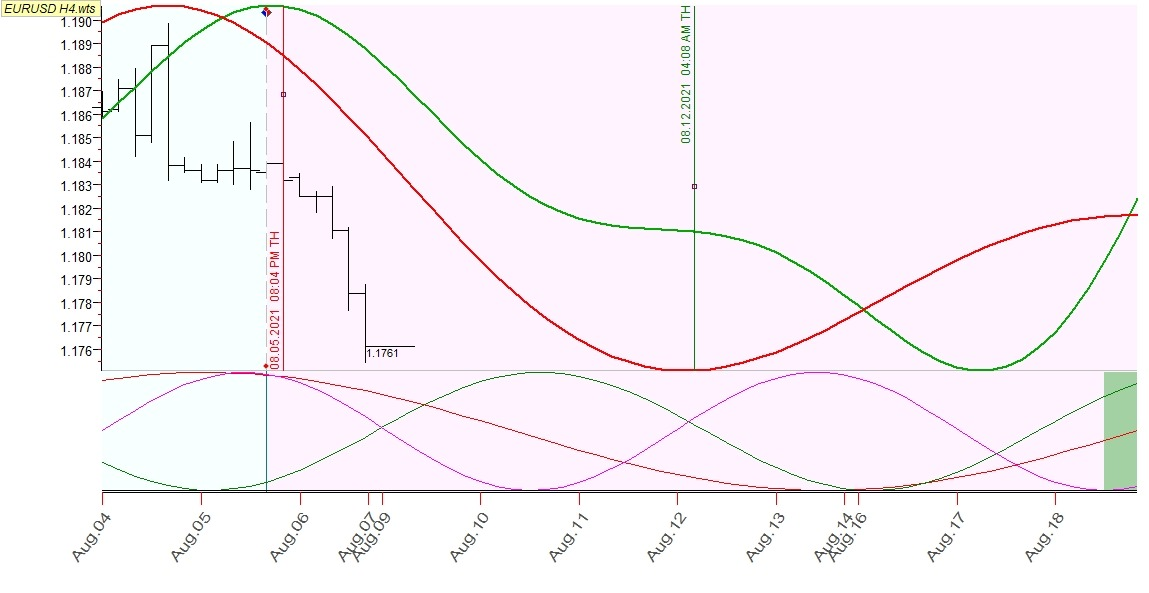

There is no any other bearish or bullish opportunities for this week. Yet, you may seek for sales in EURUSD at intraday level since this pair is going to continue its decline till the end of the week.

Commodities

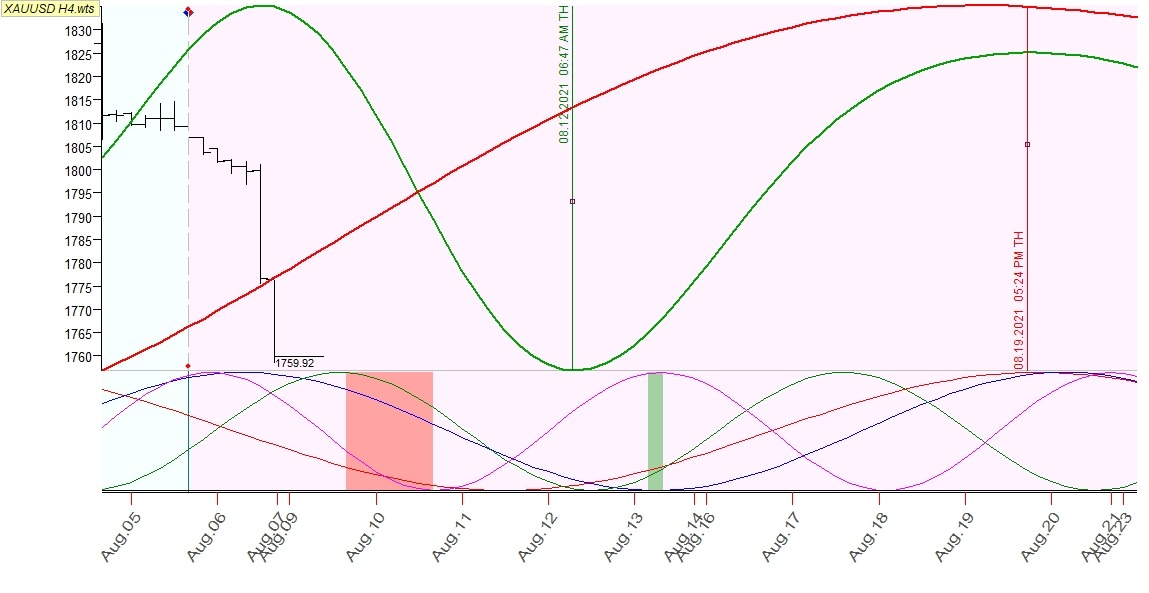

As it was suggested in the last weekly trading plan I entered bearish in gold from FR.

It is followed by NN and 180d dominant cycle that suggests to stay bearish till the middle of Sept.

H4 projection lines undermine partial close on late WD and re-enter bearish from the middle of the next week.

So, current strategy in gold is sales accumulation.

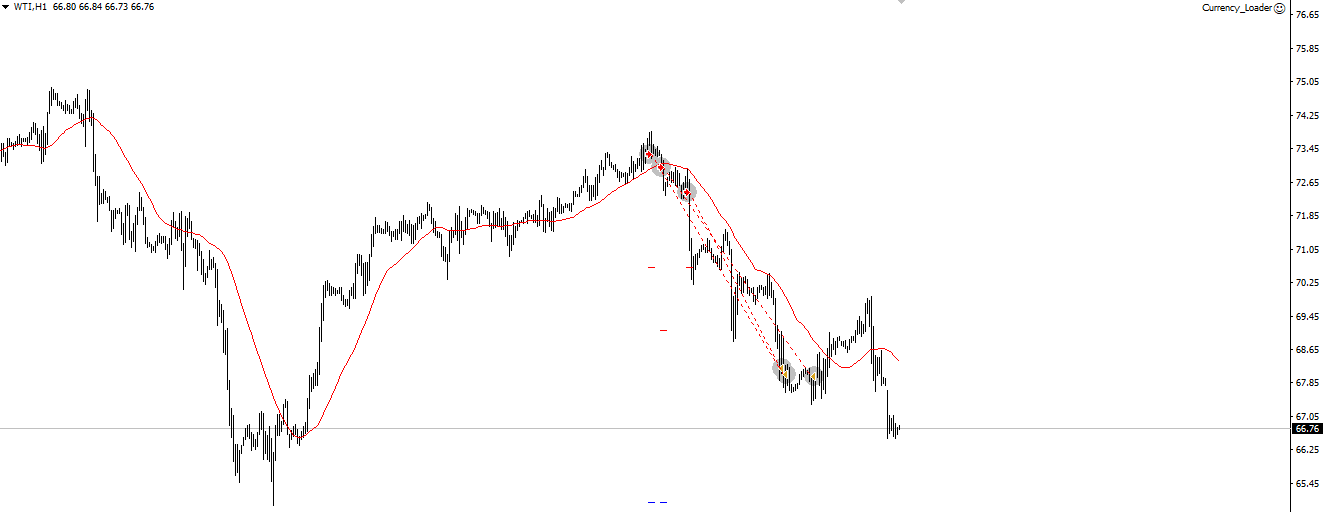

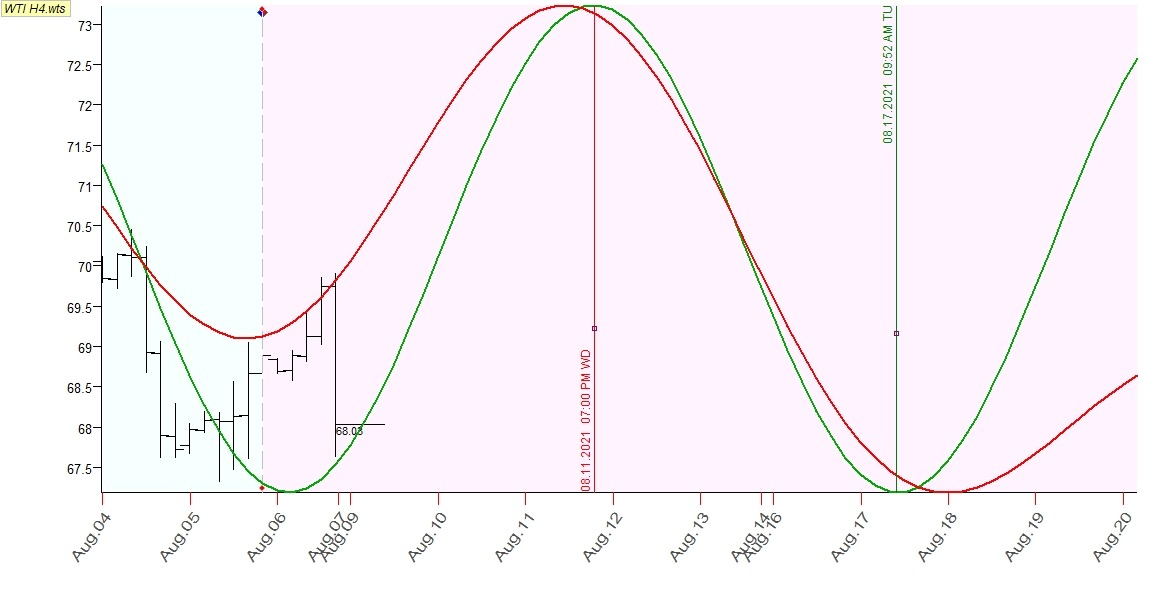

As for WTI I close short positions, as bullish bounce is expected prior the further decline.

This bullish bounce is detected at H4 only while D1 projection stay completely bearish. So, I will start looking for sales in the middle of the week.

In addition to these instruments I recommended to buy Soybean (ZS):

And this bullish expectation is still in work as all projection lines are going to stay bullish for the next few weeks at least:

The final trading opportunity in commodities arises in Copper (HG) in the end of this week. We have a considerably strong bullish turning point determined by 185d dominant cycle; Similarity line; Annual cycle lines.

Indexes

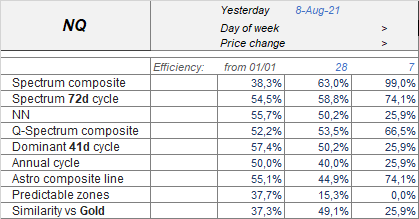

The instrument from category which I am going to focus on for this week is NQ. It was sold as it was recommended in the end of the last week.

This instrument has the highest rates of projection lines profitability.

According to these daily forecasts current decline is limited by this week, that is confirmed by H4 forecasts as well:

So I plan to hold current short position and shift SL while decline is developing.