Top Guidelines Of Refinance a Home - Fremont Bank

Excitement About Mortgage Refinance Calculator - Should I Refinance - Discover

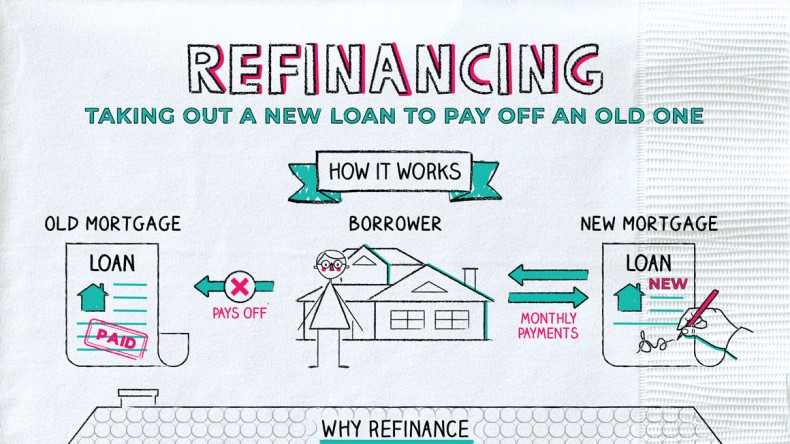

Because you're withdrawing money from your home's worth, the new home mortgage amount will be higher than your existing loan. Lenders normally restrict cash-out refinances to no more than 80 percent of your home's value so that you still have some equity left in your house. Often Check For Updates will likewise charge greater rate of interest since the loan amount is increasing.

Improve re-finance, Streamline re-finance is an item specifically for FHA-insured mortgages. The advantage of streamline refinancing is that there are very little credit requirements and the loan processing is generally quick (since appraisals aren't needed and there are less possession and earnings verification requirements). An improve refinance can also be less expensive than conventional refinancing.

Our Mortgage Refinance With SoFi - Start Refinancing Your Home DiariesClosing expenses for re-financing your mortgage can run countless dollars, generally between 2 and 5 percent of the loan quantity. These costs likewise vary by where you live, as origination costs, third-party charges and taxes differ by city and state. At the typical U.S. home rate of $404,700 in October 2021, you could expect to pay about $8,094 to as much as $20,235 in refinance closing expenses.

Whether it's worth it to re-finance depends totally on the numbers, no guesswork involved. It's all a matter of when the cost savings outweigh the expenses. Bankrate's home mortgage refinance calculator will run the numbers for your particular home mortgage rate and term and give you the specific number of months it will require to recover cost and begin saving.

Personal Loan Refinance Options for 2021 - LendingClub

Personal Loan Refinance Options for 2021 - LendingClubRefinancing a Home 101: Is it Right for Your Mortgage? - Trulia Fundamentals Explained

Likewise, figure that to get the finest rate, you'll require to have a credit rating of 740 or higher and have adequate equity in your house (a minimum of 20 percent) to avoid the cost of private home loan insurance. Here's a glance at why people re-finance their mortgage: Saving cash on interest expenses by decreasing your monthly payment and or the term (number of years) you pay the loan.

Colorado home buying: 6 reasons to refinance your mortgage - 9news.com

Colorado home buying: 6 reasons to refinance your mortgage - 9news.comThese loans with annual interest-rate resets have actually fallen out of favor and with good reason. Why take an opportunity on rates fluctuating when you can lock in a sure and low rate for the life of the loan? Raising money. If you need money to pay for home enhancements or fund college for your kids, house equity can be tapped with a cash-out refi where you get some of your equity as a check at closing.