Things about Synergi Partners Blog

Excitement About Employee Retention Tax Credit - Are you eligible for the ERTC

Page Last Examined or Updated: 26-Apr-2022.

ERTC Small Business Employee Tax Credit Recovery Expert Claim Support Launched - Digital Journal

ERTC Small Business Employee Tax Credit Recovery Expert Claim Support Launched - Digital JournalNew York City, United States, Feb. 10, 2022 (GLOBE NEWSWIRE)-- The Worker Retention Credit program has actually ended up being the biggest United States federal government stimulus program in history, with approximately $80 billion in funds to be declared. This brand-new quiz assists companies discover if they are qualified with just a few questions, so they can claim their credits prior to the deadline.

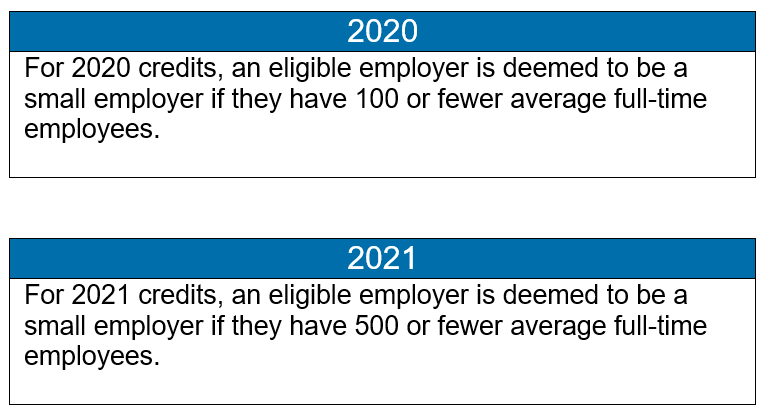

This may be triggered by confusion over eligibility, which is what triggered Scott Hall and ERTC Today to introduce this basic eligibility test. The absence of claims is most likely triggered by entrepreneur believing that they do not receive the program since the eligibility requirements have actually altered considering that it was initially presented.

The Best Guide To ASAE Applauds Bill to Restore ERTC - The Power ofSome employers might also be worried that the ERTC is a loan, like the Income Defense Program (PPP,) however the tax credit program is not a loan and does not need to be paid back. Companies who have actually currently applied for the PPP and got a loan through that program are likewise now qualified for the ERTC program, though they were not when the CARES Act was first passed.

If an employer is qualified, they can submit by themselves or have the ERTC Today team pre-qualify them for a refund and assist with the paperwork. To make Solution Can Be Seen Here with ERTC Today employers just require to submit their 941 returns, raw payroll information, and PPP loan documents to the company's protected online website.

How to Obtain the Employee Retention Tax Credit (ERTC) Under the Second Round of Covid Relief (Updated)

How to Obtain the Employee Retention Tax Credit (ERTC) Under the Second Round of Covid Relief (Updated)Services who have actually currently submitted their documents for 2020 or 2021 can also still claim their tax credit retroactively, by calling an ERTC specialist or submitting a 941-X type. To find out more about tax credits and the eligibility test, please visit https://ertcquiz. com/video Website: https://scotthall. co.

Rumored Buzz on ERTC Tax Credit Still Available in 2022 - SOUTHEAST[This post has actually been updated from an earlier version.] The Infrastructure Investment and Jobs Act authorized by the House on Nov. 5, 2021, accelerated completion of the credit retroactive to Oct. 1, 2021, instead of on Jan. 1, 2022 (except for wages paid by a recovery startup organization, for which the expiration date would remain the same).