The Ultimate Guide To Zurich Commercial Insurance

How DrRick - Cleanse - Progressive Insurance Commercial can Save You Time, Stress, and Money.

In exchange for paying the regular monthly insurance premium, the insurer accepts supply financial coverage for the losses covered in your policy. If your storefront gets burned down and your insurance covers fire you can file a claim with your service provider to repay the losses. Your insurance business will process your claim and send out an adjuster to compute the damage.

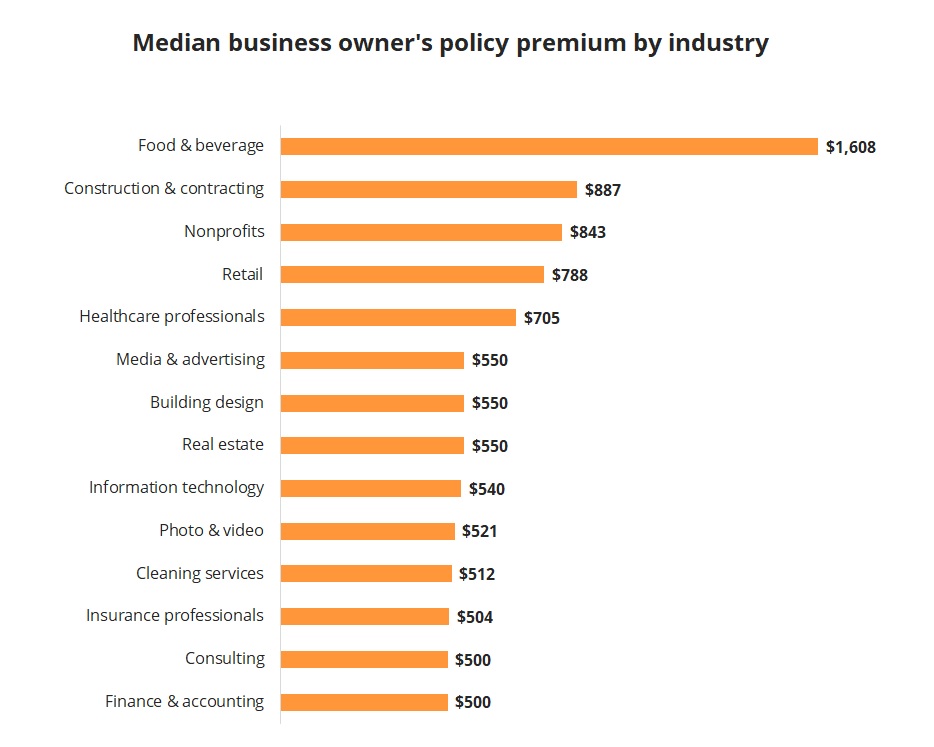

Here are the essential policy terms you must understand when searching for industrial insurance: The recurring amount of money you pay for your insurance plan. Commercial premiums can be paid monthly, quarterly, or annually. The quantity you need to pay towards a claim before your insurance company reimburses you. For instance, if you make a claim for $65,000 and have a $15,000 deductible, your insurer will pay you $50,000.

Maximum total amount of money your insurance provider will pay out over the policy's lifetime. Commercial insurance needs vary depending on the type of business. Still, the majority of organizations acquire the following 4 commercial insurance types: General liability insurance coverage, also known as organization liability insurance coverage, safeguards your service from a financial loss if your service operations cause physical injury or residential or commercial property damage.

Facts About Zurich Commercial Insurance UncoveredA basic liability insurance coverage protects you from losing your livelihood in case of a mishap and legal action. Many insurance providers integrate basic liability and business residential or commercial property coverage (described below) into a single policy understood as a Organization Owner's Policy (BOP). Is it needed? General liability insurance coverage is not lawfully needed, but it is extremely recommended for every company.

Business and Commercial Insurance - What's Covered?

Business and Commercial Insurance - What's Covered?With it, you get protection for home damage, vandalism, and theft. You can also customize your policy to consist of coverage for vital files and storage expenses sustained throughout repair work durations. Even if you run your organization out of your home, you need to acquire business residential or commercial property insurance as a normal property owner's policy leaves out protection for equipment utilized for company purposes.

B3i moves into commercial insurance - Ledger Insights - blockchain for enterprise

B3i moves into commercial insurance - Ledger Insights - blockchain for enterpriseCommercial auto insurance coverage covers any lorries utilized for your business, such as automobiles, trucks, and vans. It consists of protection for physical damage (for both car and individuals included), liability, and other costs connected with a car accident, such as towing and rental vehicles. Wondering where to fix The Most Complete Run-Down for utilized for service? If you only utilize your vehicle to commute to work, your vehicle insurance coverage will cover the damages to your automobile.