The Ultimate Guide To What Is Considered a Bad Credit Score - PrivacyGuard

Bad Credit Auto loans - Get a Car with Bad Credit - Virginia Residents Only

Bad Credit Auto loans - Get a Car with Bad Credit - Virginia Residents Only What is a bad credit score? - Lexington Law

What is a bad credit score? - Lexington LawAbout Bad Credit Auto Financing in Westerville, Ohio - Roush Honda

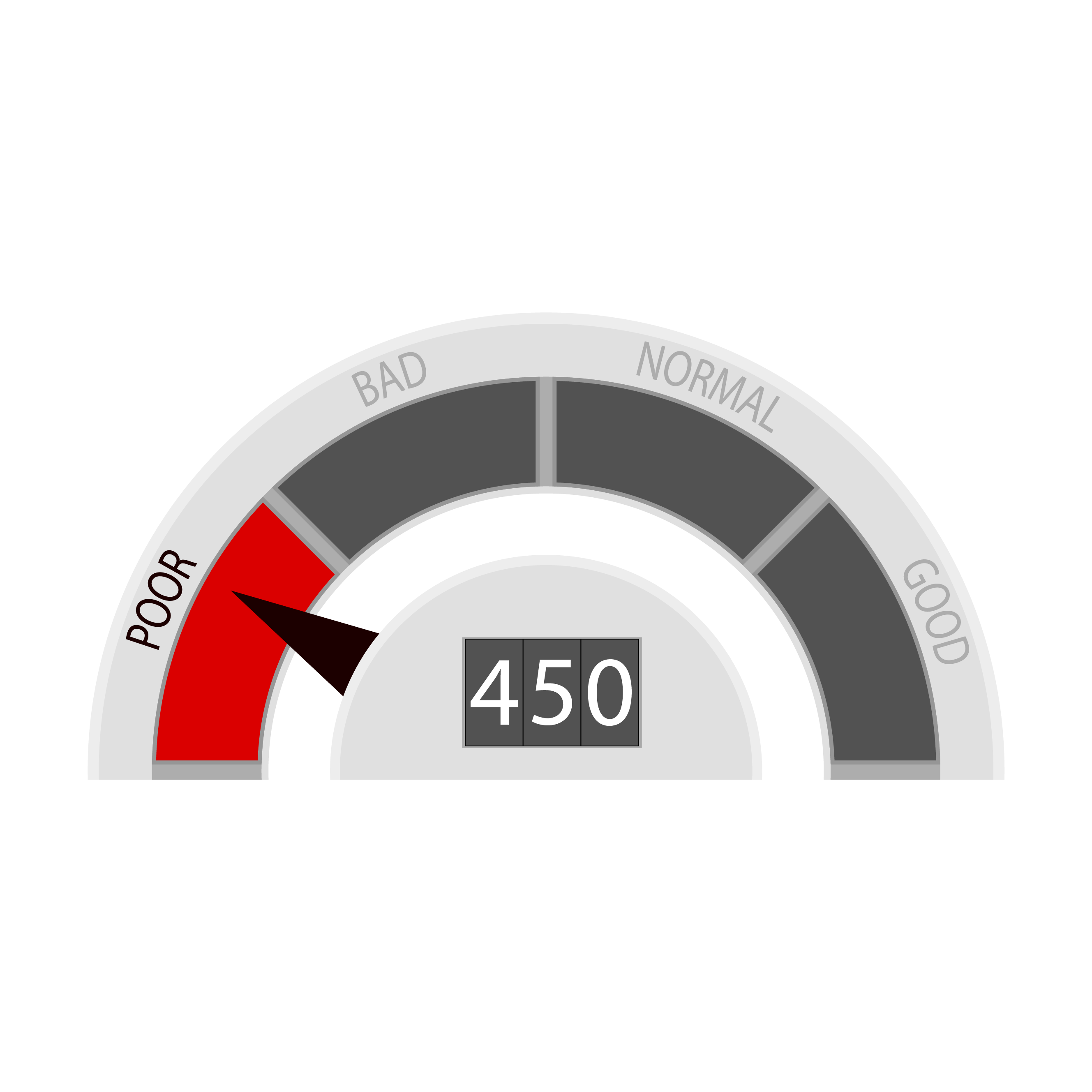

Some lenders set a limit on the minimum credit report a person can have and be authorized for a loan. That's due to the fact that lenders use credit report to judge how most likely it is that somebody will repay their loan. But you're not out of luck with a bad credit history.

How To Get A VA Loan If You Have Bad Credit

How To Get A VA Loan If You Have Bad CreditTo see individual loan lending institutions and their minimum credit rating requirements, check out Credible. Lenders generate income on individual loans through the rate of interest and fees they charge. The finest individual loans for individuals with good or exceptional credit will have low rates of interest and no charges. Personal loans for bad credit will usually have much higher rates of interest and can have significant charges.

These various rates can equate into extremely various expenses over the life of the loan. Here's an example of 2 scenarios, perhaps even from the very same loan provider. Did you see this? used in the example are drawn from Reputable's average minimum rates for various credit bands. Loan amount: $15,000 Loan term: 5 years, APR: 14%Month-to-month payment: $349Total interest charges: $5,941 Total repayment quantity: $20,941 Loan amount: $15,000 Loan term: 5 years, APR: 27%Regular monthly payment: $458Total interest charges: $12,481 Total repayment quantity: $27,481 Even though they're borrowing the exact same quantity and have the exact same amount of time to repay the loan, the individual with bad credit will pay more than two times the overall interest than the one with excellent credit will pay.