The Ultimate Guide To FHA Refinance Experts, Moreira Team, Promises Clients

The Best Guide To Cash-Out Refinancing - Mortgage Refinance - Chase.com

The cash that stays after your original mortgage is settled will make money to you as a check when the closing takes place. This part is the actual 'money out' part. Consider a home worth of $350,000 The example mortgage balance is $250,000 The re-financed loan balance is $280,000 The closing cash-out, minus closing costs, is $30,000 In this instance, the new loan must at first be applied towards paying off the existing home loan.

You will likewise need to pay any closing costs when you do a cash-out refi. These are typically 3% to 5% of the total loan quantity. Found Here for you is that if you refinance, you can perhaps roll the closing costs right into the loan balance, which indicates that you wouldn't need to pay them in advance.

Money Out Refinance Restrictions In some scenarios, lending institutions may reject your request due to a bad credit history, a high financial obligation to income ratio or not having enough house equity to support the amount of money you were wishing to take out. Normally, a debtor needs a credit rating of at least 580 to refinance.

16 Best Atlanta Mortgage Refinance Companies - Expertise.com

16 Best Atlanta Mortgage Refinance Companies - Expertise.comSome Known Factual Statements About Get a Cash Out Refinance Loan - Freedom Mortgage

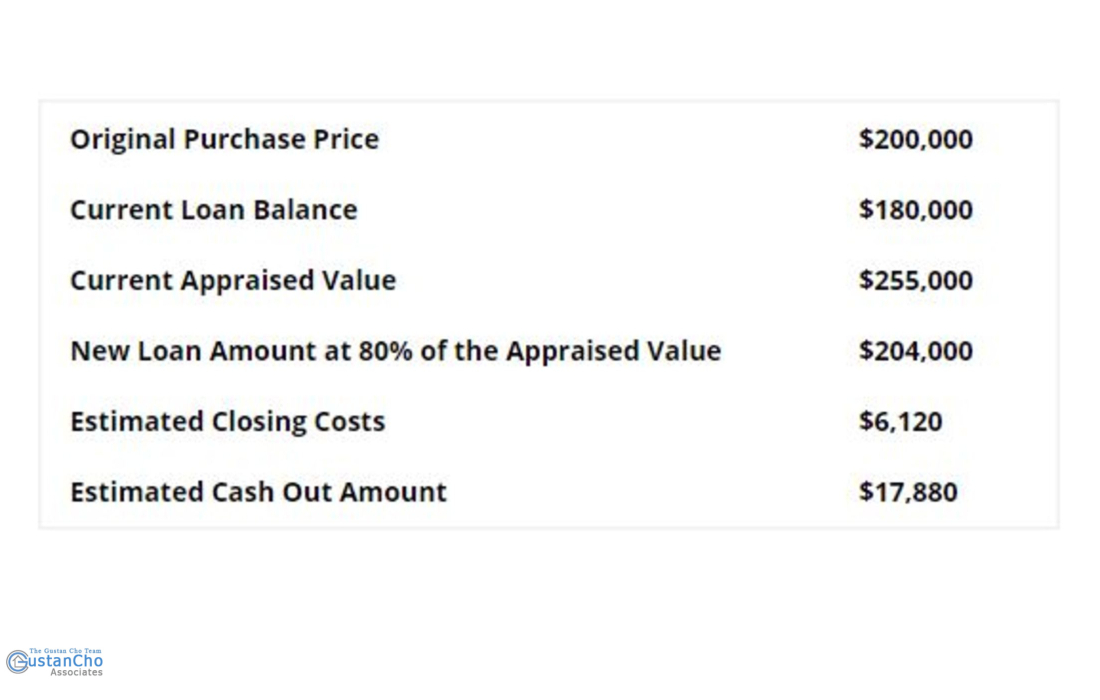

Discover Out Just How Much Your Home deserves! Enter your address above and and examine the esimated worth of your home. How Much Money Can a Cash-Out Refinance Offer You? For generally cash-out refis, you can take a brand-new loan out for as much as 80-percent of your general home value.

Keep in mind that you require to subtract any amount which you owe currently on your mortgage in order to establish how much cash you get to withdraw. Consider a home value of $400,000 The maximum re-finance loan quantity, which would be 80-percent of the house value, is $320,000 The present home loan balance is $250,000 The maximum possible cash-out would be $70,000 In the above example, a property owner would start with $150,000 in real house equity.

No Cash-Out Refinance Definition

No Cash-Out Refinance Definition Cash-Out Refinancing: When Is It A Good Option? - Bankrate

Cash-Out Refinancing: When Is It A Good Option? - BankrateNevertheless, given that a house owner needs to leave 20-percent of their house equity unblemished, they can only withdraw $70,000 at the maximum. If a homeowner currently had secured a second home loan that used the house's equity, for instance, a home equity-specific credit line, then the lender would require to deduct that loan quantity from the potential cash-out.