The Ultimate Guide To CryptoSlam! NFT data, rankings, prices, sales volume charts

The 10,000 Faces That Launched an NFT Revolution - WIRED

The 10,000 Faces That Launched an NFT Revolution - WIREDHow Why Are CryptoPunks So Expensive? - Jumpstart Magazine can Save You Time, Stress, and Money.

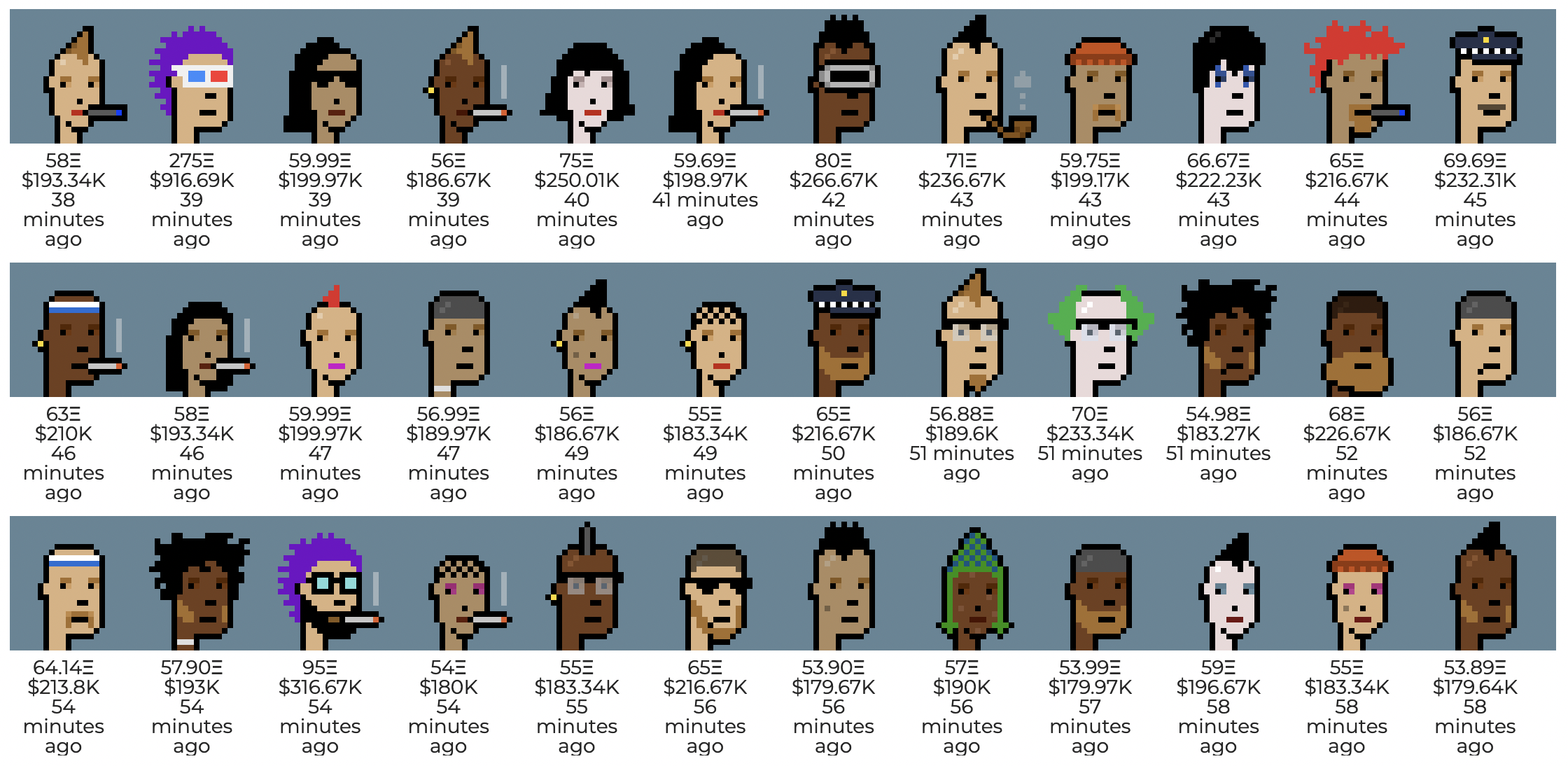

On Thursday night, a Crypto, Punk with wild hair and black lipstick, traits that aren't particularly rare as far as the pixelated NFT characters go, offered for an eye-popping half a billion dollarsin crypto, of course. A Twitter bot that tracks Crypto, Punk sales announced the news soon prior to 8 p.

E.S.T., sending crypto Twitter abuzz and making people question what the heck just happened. Was this enormous money laundering, or what? If this were a genuine art sale, it would have made Crypto, Punk 9998 the most pricey NFT ever, far surpassing Punk 7523, which cost $11. 8 million in June, and leaving the Beeple NFT that sold for $69 million in March in the dust.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22506332/cryptopunks_9_punks_larva_labs_nfts_at_christies_new_rvs_0409.jpg) Part 1: CryptoPunks & The Effects of Whale Takeovers - NFT Plazas

Part 1: CryptoPunks & The Effects of Whale Takeovers - NFT PlazasIt wasn't cash laundering or an exploit either. It was merely crypto traders trading as they do. The owner of Punk 9998 was having a little fun with crypto derivatives. To put it simply, the deal was a trick. Even Larva Labs, the developer of the pixelated alien creatures, erased the sale, suggesting it doesn't actually count.

CryptoPunk art NFTs expected to sell for millions at Christie's auction - Ledger Insights - enterprise blockchain

CryptoPunk art NFTs expected to sell for millions at Christie's auction - Ledger Insights - enterprise blockchainIn traditional finance, this is understood as a wash tradea type of prohibited market manipulation implied to make a product appear better than it really is. Second, the funds for the wash trade came via a "flash loan." If you're not familiar what a flash loan isand why would you be?it is a type of unsecured loaning that has actually become hugely popular in the world of decentralized financing, or De, Fi for brief.

The 30-Second Trick For CryptoPunks - Collection - OpenSeaImage courtesy Christie's. Ethereum-based De, Fi exchanges, such as Compound and Uniswap, make readily available a heap of their liquidity which anybody can "loan" for the duration of a single deal. Need More Info? use smart agreements (little bits of computer system code published onto a blockchain) to set out the conditions and regards to the loan.

The contract checks whether the "loan" has been paid back. If it hasn't, the transaction is reversed, as if it never took place, and the funds are returned to the lender. It all sounds like a low-risk proposition for lending institutions and borrowers, however the fact is flash loans are typically utilized by hackers to make use of loopholes in poorly composed agreements and steal countless dollars.