The Ultimate Guide To 1031 Exchange Into A Fund

If your property is financed or mortgaged, you'll need to take on at the very least the very same financial obligation for the brand-new property. As Kaufman puts it: "If a financier's debt obligation lowers as a result of the sale and acquisition of a brand-new asset using much less financial debt, it is thought about earnings as well as will be exhausted appropriately (tax shelter real estate)." The 1031 exchange is intended for financial investment residential or commercial properties. what is 1031 exchange california.

The various types of like-kind exchanges, A 1031 exchange is a like-kind exchange - a deal that allows you to essentially swap one property for an additional one of a similar kind and value. Technically, there are several sorts of 1031 like-kind exchanges, including postponed exchanges, built-to-suit exchanges, reverse exchanges, and also others.

Postponed exchanges According to Getty, the delayed (likewise called delayed) exchange is "without a doubt the most common 1031 exchange." This is the traditional kind of exchange kept in mind above - where you have to determine a new financial investment within 45 days and also buy it within 180 days. Build-to-suit exchanges A build-to-suit 1031 exchange allows an investor to use the profits of their residential property sale to not just purchase a brand-new financial investment but fund improvements on the replacement residential or commercial property, also.

Reverse exchanges In a reverse exchange, the replacement home is bought first, as well as then the initial residential property is relinquished afterward. Various other kinds of exchanges, There are other types of exchanges, as well - consisting of a drop-and-swap exchange as well as a tenancy-in-common exchange.

10 Easy Facts About 1031 Exchange Described

"A drop-and-swap exchange happens when an investor has companions that either wish to pay out of the transaction or buy the replacement building," Kaufman clarifies. "In other words, the 'decline' describes the dissolution of the partnership and the companions cashing out. The 'swap' is when partners invest their usual passions right into the substitute residential property rather than paying out."With a tenancy-in-common, as lots of as 35 financiers can pool funds as well as buy a property.

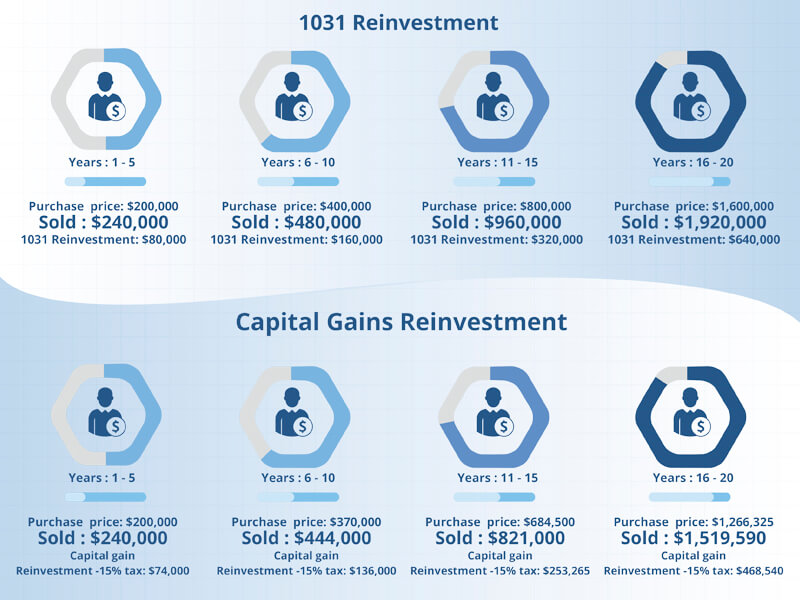

The economic takeaway, A 1031 exchange purchase can help you prevent temporary capital gains taxes and proceed expanding your wealth through actual estate. They are complicated purchases, though, so make certain you have an experienced intermediary in your corner, and also think about getting in touch with a tax expert before moving on. This can ensure you make the very best decision for your lasting economic wellness.

By Steve Haskell, Vice Head Of State, Kay Properties Whether you are a financier or a realty broker, selling financial investment or organization real estate can be a pricey venture unless you are prepared to carry out a 1031 exchange. Area 1031 of the government tax obligation code determines that no gain or loss will be identified upon the sale of a property residential property held for service or financial investment functions, as long as the seller acquisitions a substitute residential or commercial property of equal or higher worth.

However, the 1031 exchange can be a difficult process that has actually irritated lots of amateur and specialist investor alike. So, to help potentially stay clear of having your 1031 exchange strike up in your face, right here are 6 actions to think about as you advise a customer on endeavor and also entering into a 1031 exchange: Step 1: Know the suitable target dates The internal revenue service needs a financier to recognize a replacement home within 45 days, as well as to shut on the target property within 180 days of selling the given up residential or commercial property.

Examine This Report about Tax Shelter Real Estate

Dealing with a professional 1031 exchange financial investment company like Kay Feature can help financiers efficiently finish their 1031 exchange within these timelines. Action 2: Obtain enlightened about appropriate sorts of substitute properties The IRS requires an exchanger to reinvest in a "like kind" residential or commercial property. "like kind" does not necessarily indicate the very same type of home.

If you are selling a duplex in San Diego, that does not suggest you need to change it with one more duplex. The 1031 exchange enables capitalists to change relinquished real estate with a range of possession kinds. It can be a clinical building, single-family home, multifamily home building, raw land, self-storage facility or any other financial investment realty.

Tax Advantage 1031 Exchange

Address: 74710 Hwy. 111 Ste 102 Palm Desert, CA 92260

Phone: 888-470-2785

Preferably, financiers ought to know what they are searching for in a substitute residential or commercial property well before going right into escrow on the residential property they are selling. Once again, dealing with a 1031 exchange investment company like Kay Properties can substantially lower the anxiety and also confusion surrounding 1031 exchanges. Step 3: Narrow down the choices while in escrow I can not inform you the number of times I have seen 1031 exchange financiers in a hopeless panic once they hit day 30 of their 45-day window with not a single replacement choice identified for their exchange.

Don't worry, this article should help save you the misery. One good approach is to locate 5 to 10 prospective replacement residential or commercial properties as the closing day of the residential or commercial property you are offering obtains closer. Be prepared that as you move through escrow, many of the new residential properties you have actually determined will likely be obtained by other buyers or will certainly not show to be satisfying under the scrutiny of some due persistance.

Unknown Facts About 1031 Exchange Into A Fund

It is essential to ensure that they have the funding lined up before shutting on the home being marketed to spare themselves from a stressful and possibly pricey dilemma. That's one factor fractional possession frameworks for 1031 exchanges can be eye-catching for financiers wanting to finish a 1031 exchange (1031 exchange into a fund).

Furthermore, DSTs have a non-recourse funding component baked-in to each financial investment so the capitalist does not need to sign for a finance - what is a 1031 exchange. A DST may be an optimal chance for a capitalist seeking to a 1031 exchange to be a passive, turn-key option with required funding already established. Step 5: Have a back-up property determined just in instance The internal revenue service code allows financiers to recognize substitute buildings utilizing various policies (capital gains taxes in california).