The Ultimate Asset for Investors: Stock Evaluation Experts

the contemporary financial environment, investors constantly seeking ways to gain a competitive advantage in the financial market. Amidst the noise of fluctuating stock prices and economic uncertainties, one crucial avenue has emerged as a transformative force: equity analysis specialists. These experts possess the knowledge to break down complex financial data, providing understandings that can lead to informed judgments.

Equity research is not just about metrics; it is about understanding the underlying value of a company and its potential for growth. By harnessing the skills of equity analysis specialists, market players can better manage the complexities of the market, identify lucrative opportunities, and reduce financial risks. In this write-up, we will examine how equity analysis specialists can function as key allies for market participants aiming to improve their investments and achieve their monetary ambitions.

Understanding Equity Evaluation

Equity analysis is a method used to assess the price of a company's shares by reviewing different financial indicators and market dynamics. It entails assessing the company's economic stability through its earnings reports, revenue growth, and various critical metrics. Investors utilize stock evaluation to make informed decisions regarding purchasing, holding, or divesting stocks, enabling them to identify potential investment opportunities and manage risks.

At the heart of stock evaluation are basic and technological analyses. Fundamental analysis focuses on the true value of a firm by evaluating its balance sheets, market position, and market trends. This approach helps investors decide whether a share is priced too high or undervalued. On equity research report , technical evaluation analyzes historical price movements and trade volumes, enabling investors to forecast future price trends based on patterns and market behavior.

The role of equity analysis specialists is crucial in this context, as they provide knowledge and perspectives to the discussion. These specialists are well-versed in the nuances of financial data and market dynamics. By leveraging their skills, investors can skillfully navigate the complexities of equity markets, guide their investment choices, and boost their overall portfolio performance.

The Role of Professionals

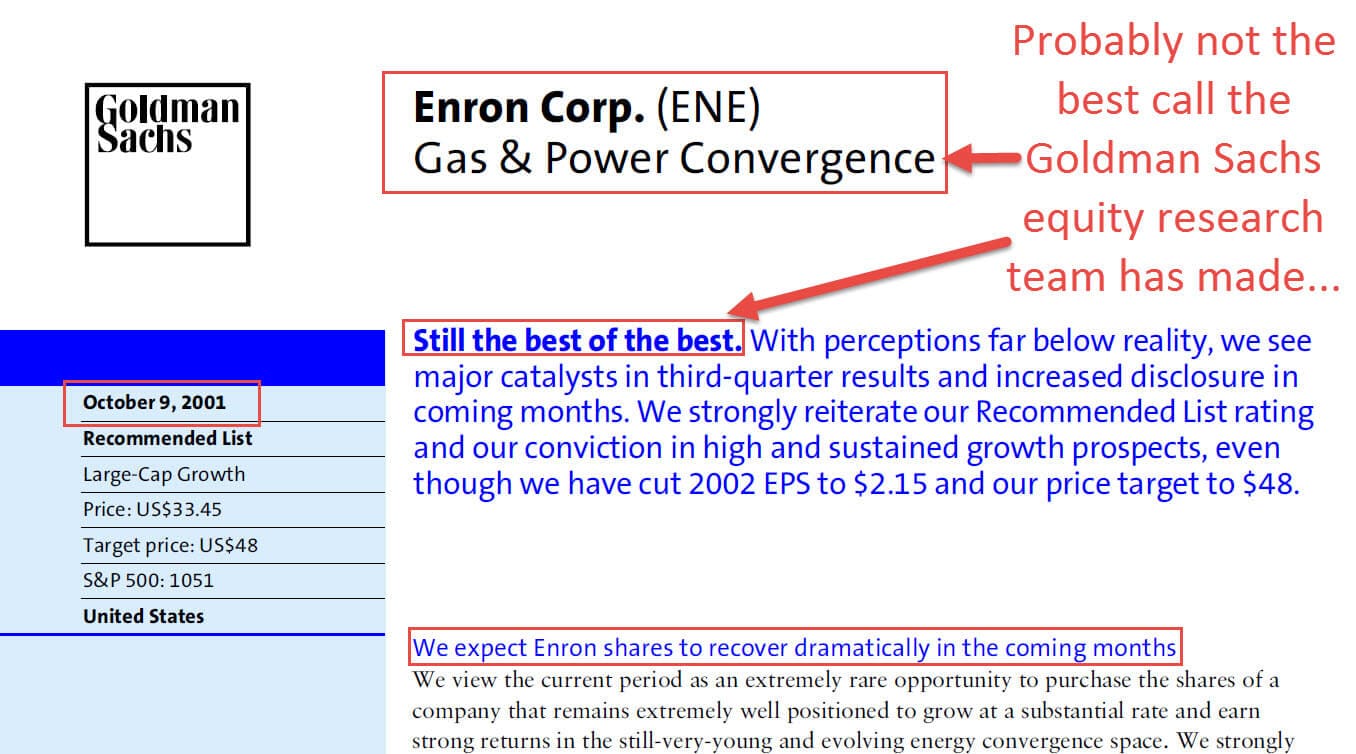

Equity analysis specialists play a crucial role in the investment landscape, providing insights that can profoundly affect the decision-making process for clients. Their skills lies in evaluating financial fundamentals, economic trends, and key indicators to assess the potential success of shares. By deciphering data sets and identifying patterns, these analysts help investors grasp the actual value of stocks, leading them through the often tumultuous financial environment.

Additionally, these professionals utilize a variety of models and analytical tools to project forward-looking performance. They take into account different factors such as profit growth, market competition, and regulatory changes, which can all impact equity prices. By conducting comprehensive equity analysis, specialists supply investors with personalized advice, allowing them to make wise choices that match their investment objectives. This essential information can often be the difference between a sound investment and a poor decision.

In addition to their analytical skills, equity analysts often provide regular training and information to investors. They disseminate their findings through reports, online seminars, and conversations, ensuring that investors are kept updated of market developments and current prospects. This ongoing interaction fosters a more profound understanding of the stock market and enables investors to manage their portfolios more effectively, making equity analysis specialists crucial allies in the search for financial prosperity.

Benefits for Investors

A major benefits of engaging financial analysis professionals is their ability to provide thorough market insights that are frequently overlooked by the typical investor. These experts carefully analyze multiple factors, including company reports, market patterns, and economic signals, to create a thorough understanding of a company's potential. By utilizing their expertise, investors can make more informed decisions that align with the investor's financial goals and risk tolerance.

Additionally, equity analysis specialists typically employ complex valuation techniques to assess the genuine worth of a stock. This analytical approach goes beyond superficial information, allowing investors to identify discounted or overpriced stocks with increased accuracy. By understanding these valuations, investors can capitalize on opportunities that may lead to substantial returns, enhancing their overall portfolio performance.

To sum up, collaborating with equity analysis specialists can foster confidence in investment strategies. With expert guidance, investors can enhance their approaches and develop a clearer-cut perspective on market dynamics. This assurance not only aids in navigating volatile markets but also promotes a disciplined investment philosophy that is based on analysis rather than speculation. As a result, having these specialists on your side can be a critical factor in achieving prolonged investment success.