The Single Strategy To Use For "The Art of Checks Print: Exploring Designs and Patterns"

Examinations Print in Business: Managing Finances with Conventional Techniques

In today's technology-driven world, the use of typical techniques for handling finances may seem out-of-date. Having said that, there is still a area for examinations printing in organization when it comes to effectively dealing with economic deals. While digital settlements and internet financial have come to be considerably well-liked, examinations deliver a amount of safety and management that maynot be quickly replicated through various other procedures.

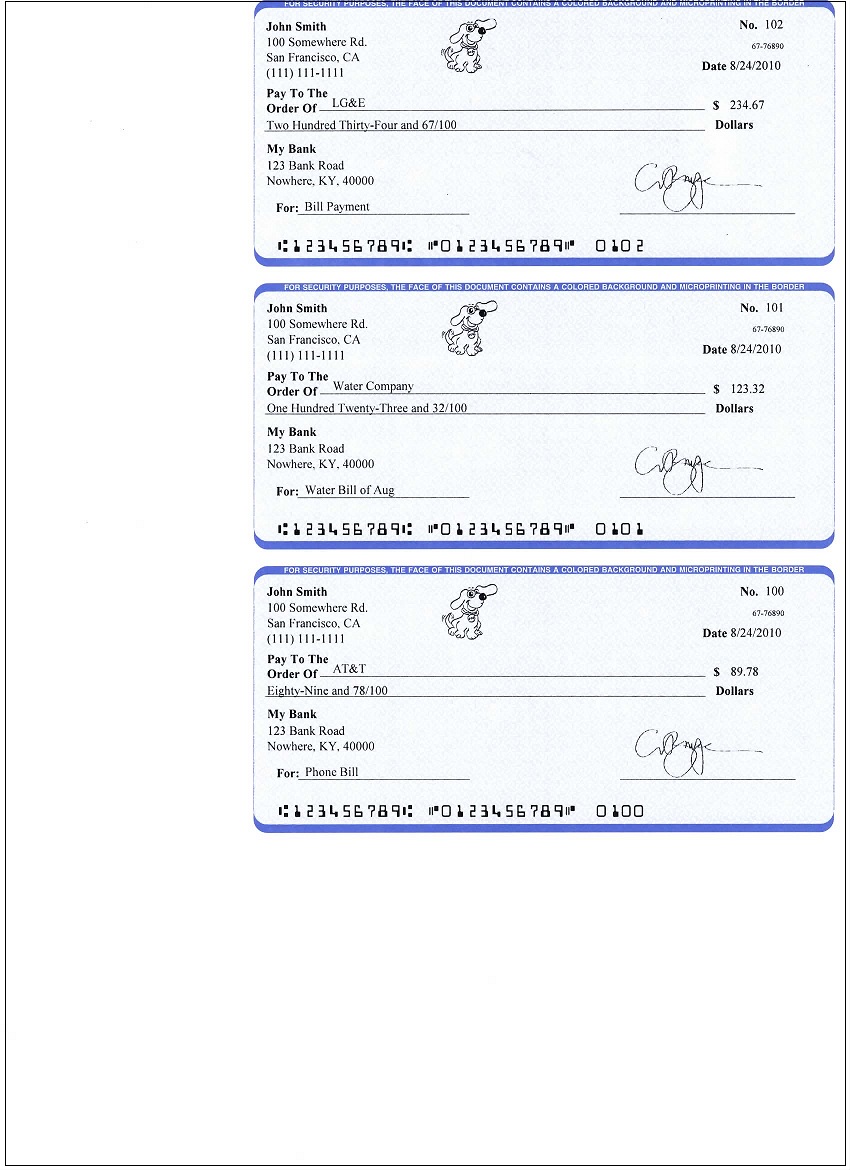

One of the main perks of making use of examinations in organization is the capacity to track and file purchases. Every opportunity a check is written, it generates a newspaper route that can be effortlessly referenced in case of any kind of inconsistencies or disputes. This level of documentation may be vital when it happens to auditing or reconciling accounts.

Also, inspections provide a feeling of surveillance for both the payer and the payee. When creating remittances through digital systems, there is actually consistently a danger of unwarranted access or deceitful tasks. Nevertheless, with examinations printing, physical belongings of the inspection ends up being crucial for any type of deal to develop. This adds an added coating of protection versus possible fraudsters.

In addition, examinations allow companies to maintain far better command over their money circulation. By writing inspections by hand, business managers and managers can easily very closely keep an eye on expenditures and make certain that funds are being designated suitably. In contrast, digital remittances typically occur instantaneously and may not give the exact same level of presence.

Inspections also supply flexibility when it comes to repayment conditions. While digital remittances are commonly quick, checks permit organizations to established particular remittance day depending on to their necessities and agreements along with sellers or distributors. This adaptability can easily be especially valuable when working with big investments or long-term contracts.

Yet another perk is that not all recipients allow digital types of payment such as credit rating memory cards or online transactions. Some individuals or companies still prefer obtaining repayment with typical techniques like inspections due to various explanations such as convenience of record-keeping or individual desire. Through possessing the option to issue physical examinations, organizations may fit these preferences without dealing with any kind of limits.

It is also worth noting that examinations may be extra cost-effective for certain companies. While electronic repayment systems might demand transaction fees or enforce other costs, examinations may be imprinted in-house at a low expense. For I Found This Interesting or those along with reduced deal quantities, this cost-saving conveniences can easily be notable.

Despite the several advantages of making use of checks in business, it is necessary to recognize that they do have some constraints. Examinations are bodily records that call for hands-on handling and processing, which can easily be time-consuming and vulnerable to inaccuracies. Also, the accessibility of funds need to have to be verified before a check can easily be released, which might trigger hold-ups in settlements.

In verdict, while digital remittance techniques have ended up being considerably rampant in today's service yard, there is actually still a spot for checks print when it comes to dealing with funds effectively. The capacity to track deals, offer protection and management over cash money flow, accommodate remittance choices, and offer cost-effectiveness are only a couple of explanations why organizations continue to rely on standard examination payments. However, it is crucial for services to examine the perks against the constraints and decide on the procedure that finest matches their specific demands and situations.

800 phrases