The Single Strategy To Use For Student Accounts Receivable

Why High Accounts Receivable Can Be Bad Business - PNC Insights

Why High Accounts Receivable Can Be Bad Business - PNC InsightsThe Best Strategy To Use For Accounts receivable - Order to Cash Knowledge Center

Given that billing is done to claim the advances numerous times, this location of collectible is not reflected in accounts receivables. Ideally, since Answers Shown Here happens within an equally agreed-upon term, it is the responsibility of the accounts department to periodically take out the declaration revealing advance collectible and ought to be provided to sales & marketing for collection of advances.

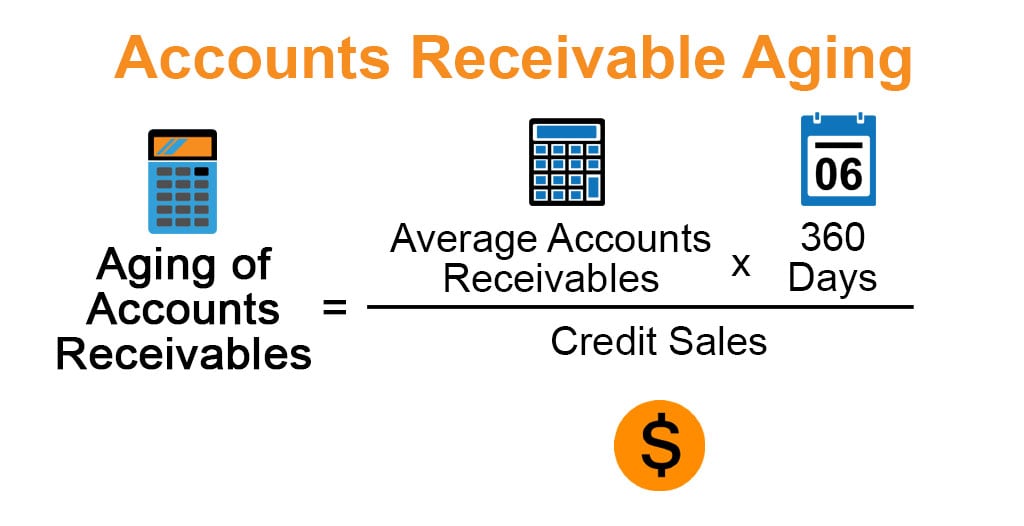

Accounts Receivable Age Analysis [edit] An Accountants Receivable Age Analysis, also referred to as the Debtors Book is divided in classifications for existing, thirty days, 60 days, 90 days or longer. The analysis or report is typically referred to as an Aged Trial Balance. Clients are normally noted in alphabetic order or by the amount outstanding, or according to the business chart of accounts.

Accounts Receivable Questions That Cry For Quick Answers - Recoupera

Accounts Receivable Questions That Cry For Quick Answers - RecouperaAccounting [edit] On a business's balance sheet, receivable are the money owed to that company by entities beyond the company. Balance due are categorized as present properties assuming that they are due within one calendar year or . To tape-record a journal entry for a sale on account, one must debit a receivable and credit a revenue account.

Some Known Details About What are accounts receivable - BDC.caThe ending balance on the trial balance sheet for receivables is usually a debit. Enterprise which have ended up being too big to carry out such jobs by hand (or small ones that might however choose not to do them by hand) will typically use accounting software application on a computer to perform this task.

The first method is the allowance approach, which develops a contra-asset account, allowance for skeptical accounts, or uncollectable bill provision, that has the impact of reducing the balance for receivables. The quantity of the bad debt arrangement can be computed in two ways, either (1) by reviewing each private debt and deciding whether it is skeptical (a particular arrangement); or (2) by providing for a fixed portion (e.

2%) of overall debtors (a general arrangement). The change in the bad financial obligation provision from year to year is posted to the bad debt expense account in the earnings statement. The allowance approach can be determined using either the earnings declaration technique, which is based upon a portion of net credit sales; the balance sheet approach, which is based upon an aging schedule in which debts of a certain age are classified by threat, or a mix of both.