The Single Strategy To Use For Mortgage Calculator with PMI and Taxes - Trulia

Mortgage Calculator: PMI, Interest and Taxes - SmartAsset

Mortgage Calculator: PMI, Interest and Taxes - SmartAssetHow Much a $300,000 Mortgage Will Cost You - Credible Fundamentals Explained

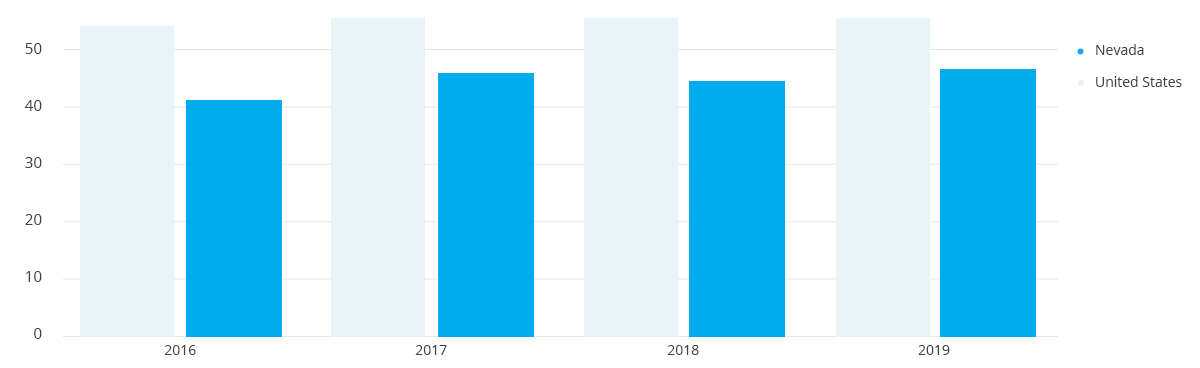

That puts Nevada behind the national average of $56,490, according to the Bureau of Economic Analysis. Information from the Bureau of Labor Data shows that unemployment in Nevada was 9. 2% in December 2020, above the national average of 6. 7%. Nevada is one of just 7 states that have no earnings tax.

Nevada Student Loans: Debt Statistics - Student Loan Hero

Nevada Student Loans: Debt Statistics - Student Loan HeroYou will not escape sales tax, however. Nevada's state sales tax is among the greatest in the U.S. at 6. 85%, with an extra percentage added for regional sales tax rates (capped at 1. 53%). The good news is that Nevada does not have an estate or inheritance tax, which are taxes you'll find common in the Northeast and other states.

Little Known Facts About Mountain America Credit Union in Utah & the West.For example, moving from San Diego, California to Las Vegas, Nevada would lead to a 14% reduction in expense of living, typically, for a single tax filer making $55,000 a year. A move from Denver, Colorado to Reno, Nevada equates to a 7% lower typical cost of living due to less expensive taxes, real estate and food.

Nevada has particular securities in place for property buyers, consisting of the most typical: mandatory sellers' disclosures. Like a large number of states, Nevada needs homeowners to reveal specific residential or commercial property conditions and elements (such as product defects) so that the buyer understands prior to closing on a house loan or inhabiting the residential or commercial property.

Payment Calculator - Sierra Pacific Mortgage Fundamentals Explained

Turning to foreclosure, you may currently know that Nevada was one of the leading states for foreclosure rates during the economic crisis. Thankfully, the state has begun to recover and it's not a prevalent as it was at the height of the financial crisis. If you wonder how the procedure works, in Nevada lenders can foreclose either judicially (through the court system) or non-judicially.

This means that your mortgage documents included a deed of trust and a power of sale stipulation. Power of sale permits your lending institution to appoint a trustee to sell your house at a foreclosure sale. It's typically a quicker process than a judicial foreclosure. View Details to foreclose in Nevada is 111 days from the date of the Notification of Default.