The Significance of Insurance Coverage: Securing Your Resources and Monetary Security

Whether you are a homeowner, a driver, or even an organization proprietor, insurance is actually vital for shielding your assets and also ensuring your monetary stability. In this article, our experts are going to look into the relevance of insurance coverage and also why it is essential to have the best insurance policy protection.

The Basics of Insurance:

Insurance is a deal between an individual or business as well as an insurance company. The specific or organization pays for a premium, as well as the insurance provider agrees to cover reductions in the unlikely event of an unpredicted celebration. There are actually different sorts of insurance policy, including life insurance policy, health insurance, automobile insurance coverage, property owner's insurance, as well as business insurance coverage. Each kind of insurance policy supplies protection for specific dangers as well as activities.

Safeguarding Your Assets:

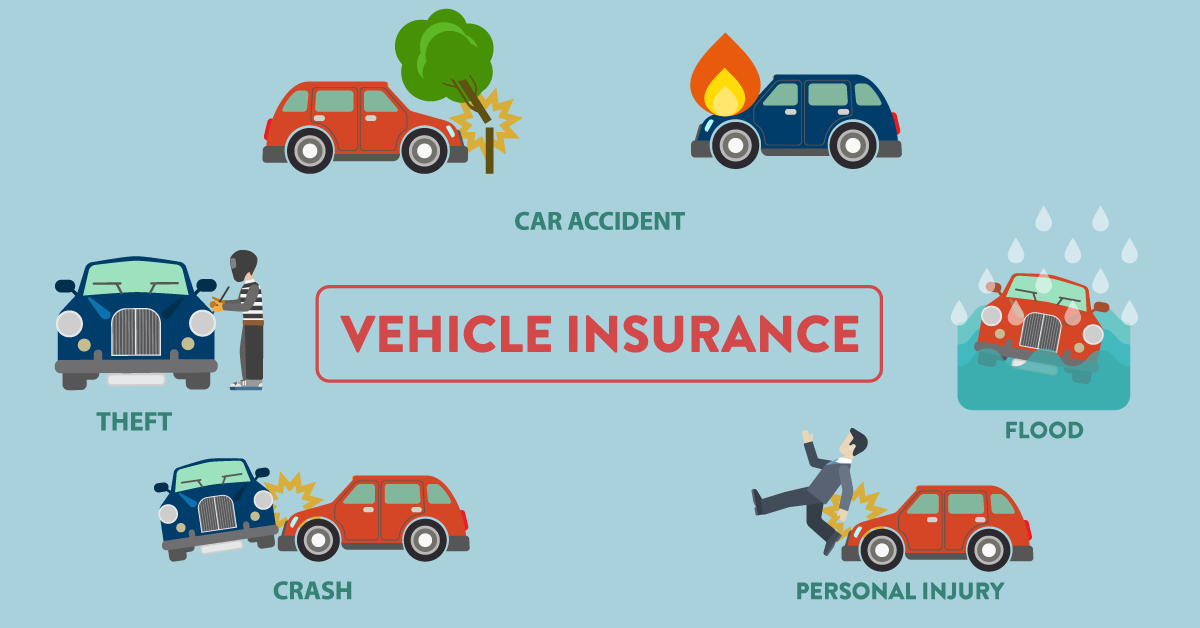

Insurance policy may safeguard your assets from monetary reduction. For example, if you own a home, house owner's insurance can easily safeguard you from the cost of repair work or rebuilding in the event of damages coming from fire, flood, or various other all-natural catastrophes. If you are entailed in a mishap or your cars and truck is actually stolen, automobile insurance may shield you coming from financial loss. Business insurance can easily defend your service coming from legal actions or various other monetary losses.

Financial Stability:

Insurance may likewise assist preserve your monetary security. Without insurance, an unpredicted celebration might bring about notable financial loss, putting your assets and also economic stability in danger. Insurance coverage may provide a safeguard, guaranteeing that you are actually defended in the event of an unforeseen celebration. As an example, life insurance can deliver financial support to your really loved ones in the unlikely event of your fatality, ensuring that they are actually certainly not overwhelmed with monetary hardship.

Finding the Right Insurance Coverage:

It is actually essential to possess the right insurance policy coverage to guard yourself and your resources fully. There are a lot of factors to look at when selecting insurance policy protection, including the level of protection needed, the expense of the costs, and also the credibility and reputation of the insurer. It is necessary to analysis as well as review various insurance policy alternatives to discover the greatest protection for your requirements.

Working with an Insurance Agent:

Dealing with an insurance coverage broker can be practical in locating the right insurance policy protection. An insurance agent may supply experienced tips and aid you navigate the complex world of insurance coverage. They can additionally aid you understand the different kinds of insurance coverage as well as the risks connected with each form of insurance policy.

Whether you are actually a home owner, a motorist, or even a business proprietor, insurance is essential for safeguarding your possessions as well as ensuring your monetary security. Through understanding the various types of insurance policy and functioning along with an insurance coverage broker, you may discover the best insurance coverage to satisfy your demands.

Read the spectacular news about business insurance at https://www.vingle.net/posts/5531729 and be the first to comment and discuss it with your friends!

In this post, our company will certainly discover the value of insurance and why it is actually important to have the correct insurance policy coverage.

There are various types of insurance, including daily life insurance, wellness insurance policy, cars and truck insurance, individual's insurance, as well as organization insurance policy. There are several aspects to take into consideration when deciding on insurance policy coverage, consisting of the amount of coverage needed, the expense of the premium, and also the credibility of the insurance coverage company. Functioning along with an insurance agent can be valuable in discovering the ideal insurance policy coverage. By understanding the various styles of insurance as well as functioning along with an insurance policy broker, you can easily find the best insurance policy coverage to meet your demands.