The Only Guide for Texas Small Business Health Insurance & Group Medical Plans

6 Simple Techniques For Molina Texas Health Insurance Marketplace Plans

Owner can count as an employee. Owner name on business license need to draw wages from the company. Private Strategies: Eligibility is subject to medical underwriting. If you are rejected protection for a medical condition, you might be eligible for AHIP, or PCIP. COBRA: Guaranteed coverage available for workers who work for services with 20 or more workers.

Amy Wynn - Irving, TX Small Business Health Insurance - HealthMarkets Licensed Agent

Amy Wynn - Irving, TX Small Business Health Insurance - HealthMarkets Licensed Agent Brian McKittrick - Director Of Sales And Business Development at Insurance of Texas - Insurance of Texas - LinkedIn

Brian McKittrick - Director Of Sales And Business Development at Insurance of Texas - Insurance of Texas - LinkedInHIPAA: Must have had 18 months of continuous protection and totally exhausted Cobra or state extension coverage. Must not have actually lost protection due to fraud or non-payment of premiums. You have 63 days to register. HIPAA: Should qualify for Medicaid and have access to Employer-Sponsored Insurance or Cobra. Texas Health Insurance Coverage Month-to-month Expense: Group Plans: Costs depend on employer contribution and the + 20% of the Insurance provider's Index rate.

3 Simple Techniques For Group Health Insurance Plans - Healthcare Consultants, Inc.

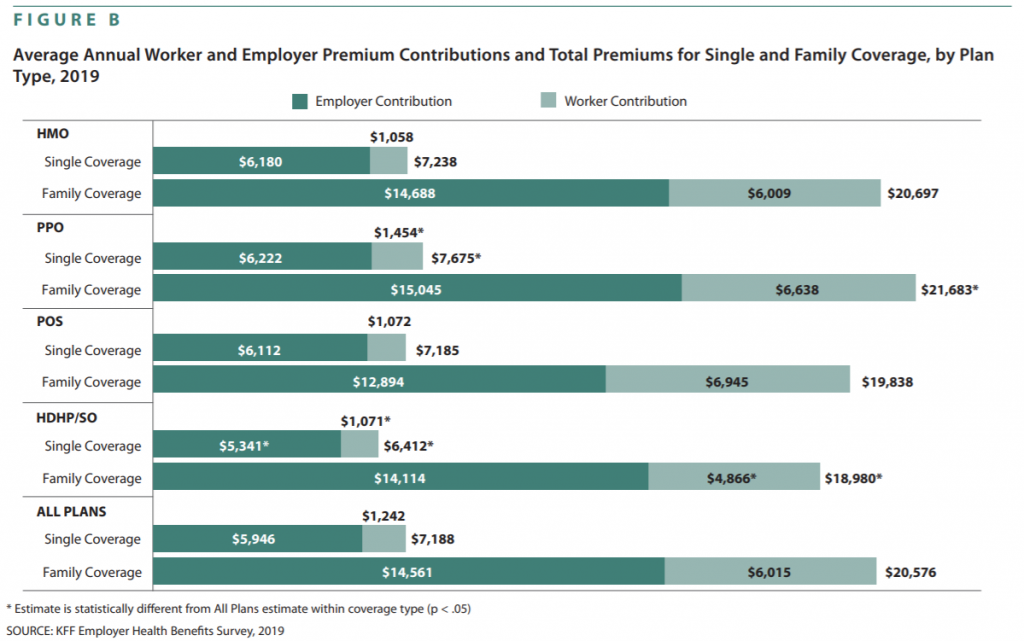

There are no rate caps. COBRA: Costs vary in between 102% to 150% of group health rates. HIPAA: Premiums will depend upon strategy selected. HIPAA: Compensates Another Point of View -sponsored insurance coverage premium quantity by check monthly. Pays the insurer directly for individuals on COBRA or eligible small companies. * Source: Texas: Average "Single" Premium per Enrolled Staff Member for Employer-Based Health Insurance Coverage, 2011 * Texas % Texas $ United States % United States $ Worker Contribution 19% $999 21% $1,090 Company Contribution 81% $4,199 79% $4,132 Total 100% $5,198 100% $5,222 Texas: Average "Family" Premium per Enrolled Employee for Employer-Based Medical Insurance, 2011 * Texas % Texas $ United States % US $ Worker Contribution 29% $4,318 26% $3,962 Employer Contribution 71% $10,585 74% $11,060 Overall 100% $14,903 100% $15,022 Texas: Typical "Employee-Plus-One" Premium per Enrolled Staff Member for Employer-Based Medical Insurance, 2011 * Texas % Texas $ United States % United States $ Worker Contribution 29% $3,009 27% $2,736 Employer Contribution 71% $7,210 73% $7,593 Overall 100% $10,219 100% $10,329 Texas: Average Per Individual Monthly Premiums in the Individual Market, 2010 * Texas $ US $ State Average Premium NA $215 * Source: statehealthfacts.

Small Business Texas Health Insurance - Merchant Maverick

Small Business Texas Health Insurance - Merchant MaverickHere's why: Business environment doubts, Employer-sponsored health insurance expenses increase each year, and New fees and charges work next year, and most companies do not fully understand how this will affect their financials. It is time for employers to analyze the specifics of health care reform, and begin believing strategically vs.