The Facts About What are ACH Payments? Definition, Processing Uncovered

Over the years, the world of financial has modified substantially and has around the globe had an effect on millions of people. The banking unit has altered significantly over the past 35 years; while a lot of folks can easilynot access it today, they currently understand there would be huge perks. This is how we may take activity on the worldwide problem of banking that needs to resolve and boost the sustainability of the financial industry. The first action? We need to have to begin our financial problems to take care of the root causes of financial weakness and its repercussions.

Throughout this grow older of growth, rather of producing repayments by money, examinations, credit or money card, the settlement process has evolved into faster, safer and a lot more dependable digital approaches of transmitting cash. Repayments can easily be helped make at the financial institution or at a designated ATM or also by means of an online repayment processor such as Stripe. The World wide web allows individuals to send financial repayments to good friends, family, and family members that possess the very same quantity of cash as their banking company profiles.

Automated Clearing House (ACH) has made this achievable. This location is a real-time clearing home for office, industrial, and office specialists using automated clearinghouse remedies for more than 20 years. Once set up in a commercial, industrial, or office region, it delivers the observing capabilities: • A high-efficiency, single-beam cleaning unit is utilized at a price of 2,000 per day. • The major clearing up system is accessible as a single-wall device.

ACH network transactions, also known as "direct repayments", have become one of the most well-liked procedures of moving loan electronically. With ZilBank.com , customers can likewise move their electronic currency to other individuals straight coming from their account – for case, the consumer coming from a bank moving their money by delivering some Bitcoin to yet another user while various other individuals transfer loan via fiat banking companies. Direct settlements can also be carried out for digital unit of currencies.

Since the very early 1970s, this U.S. financial system allows organizations to move loan without making use of newspaper examinations, credit report card systems, cord transmissions or cash money - domestically and internationally. Such units are much more safe, with far fewer unwarranted acknowledgments. In the United States, one of the very most successful methods to transfer amount of money around the world is via a depended on account. The U.S. Federal Reserve Banks are one of the nation's five most significant, along with more than 15,700 accounts stored.

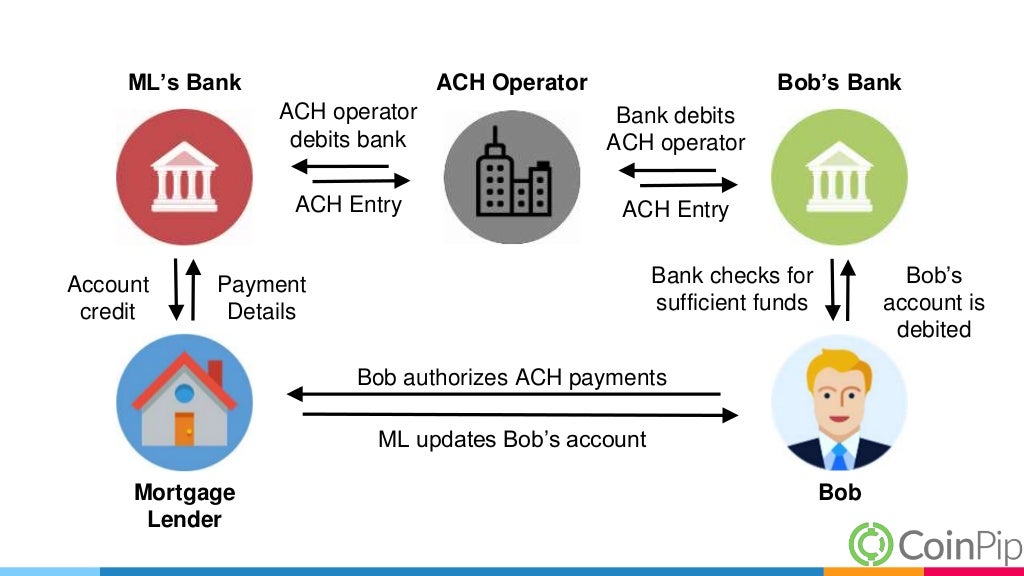

Even more than 25 billion ACH transactions are refined each year through the Automated Clearing House Network consisting of an electronic system of financial institutions and monetary companies supporting both ACH credit rating and money remittances in the U.S. Tens of thousands of American individuals and businesses utilize the ACH network to send out cash, transfer money and acquire money -and whether you recognize it as Direct Remittances, Direct Deposit, or digital repayments, ACH deals with everything from mortgage loans and recurring repayments to credit card remittances and more.

ACH Transfers clarified There are actually two main classifications for which each individuals and companies utilize an ACH transfer. According to the meaning of the ACH transfer there are actually two significant categories in which consumers buy goods: bodily goods or solutions that can easily be left to a consumer through the Customer Services team who will be in charge of handling and shipping. Such services are usually given on an on-demand manner where the client is not in command of the delivery procedure.

Straight repayments (ACH money deals) Direct deposits (ACH credit transactions) Some economic companies additionally give expense payment, which enables users to book and pay for all costs online making use of ACH transactions. The amount of bank cash transferred into profile as properly as financial institution funds or credit memory card slips from the customer profile will certainly not be recorded in ACH statements for that certain deal. Some financial establishments also give costs acquisition, which enables individuals to pay for bills online using ACH deals.

Or you can use the network to initiate ACH purchases between people or vendors abroad. Tip: The system is only offered via the network-to-market software program and is required to run in accordance along with the Local Transaction Authority. When you go into a merchant account, you need to authorize the business to send your transaction to the World wide web address you define for the settlement. The address need to not interfere along with merchant profile functions or your potential to deliver or obtain settlements from other individuals.

If you're a organization manager, you may also use ACH transmissions to send loan to sellers or workers. This has the included perk that you'll be paying all the necessary fees to obtain all this back right into your company at a single price. In the situation of a business, this is considerably much easier in purchase to help make settlement by means of banking company transfer approaches as well as other economic assistance. It isn't simply simpler; it's also less costly.