The Definitive Guide for Jumbo Loan Details For Reno Home Buyers

A Biased View of Jumbo Loans in NC & SC - Jumbo Loan Mortgage Lender

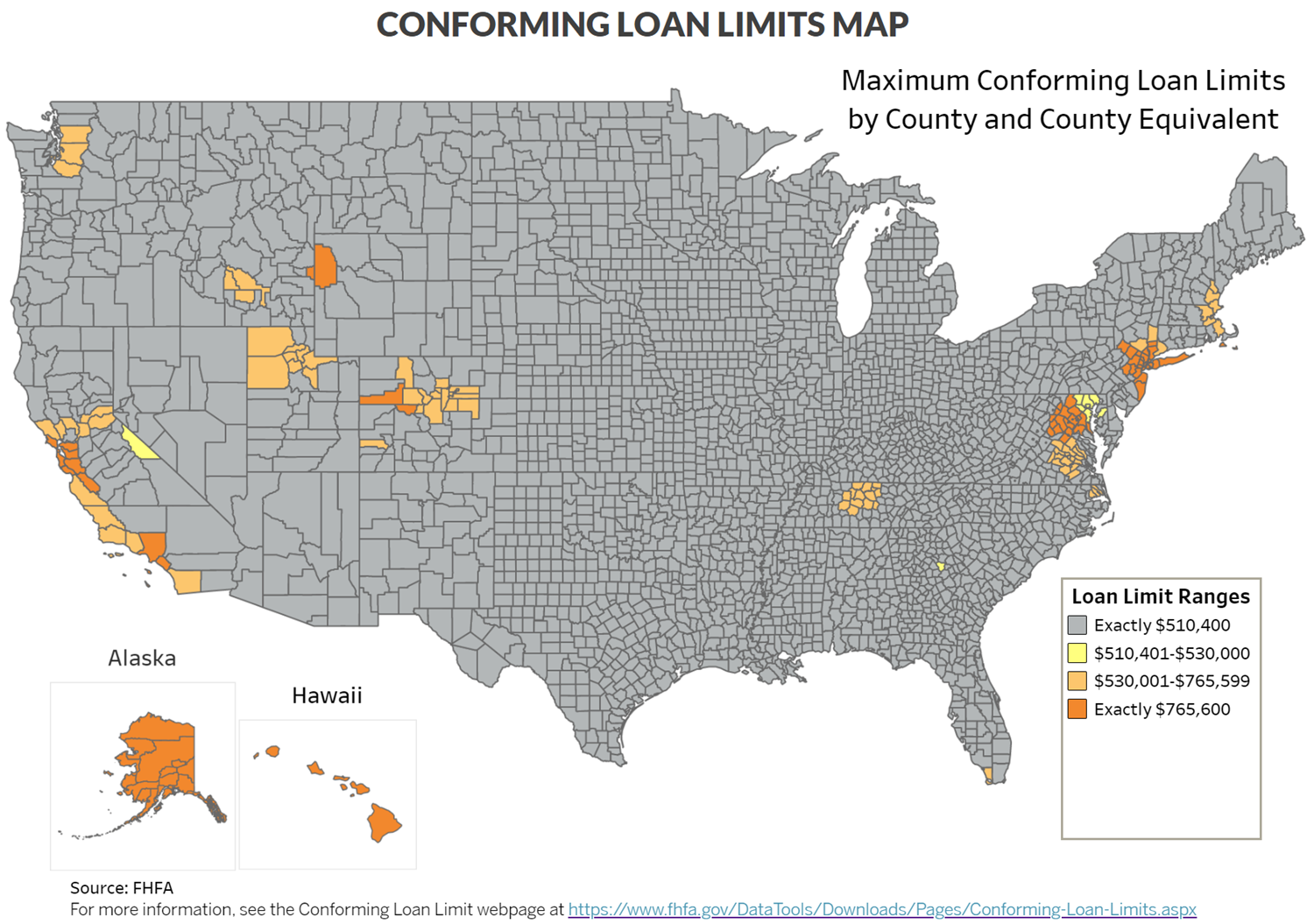

This remains in reaction to the signifiant (and unexpected) home-price gains that took place throughout 2020. Regardless of the coronavirus pandemic and economic recession, house worths in a lot of U.S. cities continue to climb in 2020. In many counties across the nation, the 2021 maximum adhering loan limit for a single-family home will be.

This marks the 5th year in a row that federal real estate officials have actually raised the standard, in order to keep up with increasing home values. However once again, this is simply the standard conforming loan limitation utilized for a lot of parts of the country. In higher-cost property markets, like San Francisco and New York City City, the limit for a single-family mortgage can be as high as $822,375.

Anything above these caps is thought about a jumbo home mortgage. What Is a Conforming Loan? A conforming mortgage is one that satisfies, or "adheres" to, certain standards set forth by Freddie Mac and Fannie Mae. Freddie and Fannie are the two government-sponsored business (GSEs) that purchase home loans, package and securitize them, and after that sell them to financiers through Wall Street and other channels.

Jumbo Loans for Larger Mortgage Amounts - Bank of America Fundamentals ExplainedThere are numerous requirements utilized to define a "adhering" home mortgage item. However the size of the loan is one of the most essential criteria, from a customer's perspective. five star mortgage jumbo loan and Fannie Mae will just buy loans up to a particular quantity. These optimal quantities, or limits, vary by county and are updated every year.

When a mortgage goes beyond the caps set by the Federal Real Estate Financing Agency, it is referred to as a "jumbo" home mortgage item, and it can not be offered to Fannie Mae or Freddie Mac. Jumbo loans are still widely available in the U.S., however the credentials criteria are generally more stringent for these items due to the higher level of risk included.

About Us - Sandstone Home Loans

About Us - Sandstone Home Loans Jumbo Loan Limits in 2021 - NerdWallet

Jumbo Loan Limits in 2021 - NerdWalletAs an outcome, eligibility requirements are frequently more rigid with these larger "non-conforming" loans. Lenders frequently need higher earnings, better credit, and bigger down payments for jumbo loans. Simply know that the specific requirements vary from one lending institution to the next. To discover the 2021 conforming loan limits for your county, just download the PDF file or Excel spreadsheet above.