The Current Market Situation

BTCLet's take a look at the current situation in the cryptocurrency market and, of course, focus on Bitcoin.

From January 24, 21 to the current moment, a fairly wide range can be identified where the lower support border will be the 30k area and the upper resistance area will be the 67k area.

Until the price has updated the local minimum of September 21 (marked with a black tick), despite a fairly aggressive decline, Bitcoin looks not bad in terms of growth.

But if Bitcoin updates this minimum, we will in fact get a flat situation where there is no clearly defined direction or trend. This will further complicate the situation and open the way to 30k per Bitcoin..

A very strong demand area awaits us in the 30k area because below we do not have any liquidity zones where the price could linger (this gap is circled in red), so the next stop will be the 14k area (it is highlighted in gray)

If you look at the situation locally from the historical high, then Bitcoin is in a downtrend and looks frankly weak.

As a result, the current moment is the most suitable for the bulls to somehow show themselves, otherwise, we will have a cascade of sales ...

A scenario that did not justify itself ...

December 21, when Bitcoin locally entered a downtrend. We were betting on altcoins since BTC began to lose its dominance and everything went to the fact that it would be below 40%.

As a rule, at the moment when Bitcoin loses its dominance, altcoins have a good chance for growth, and we wanted to use this window for performance from altcoins. But in the end, we got a very strange picture when Bitcoin was losing dominance, but altcoins were falling even more aggressively than Bitcoin. This significantly spoiled our statistics and now we are not in the most comfortable position.

Why?

Because now there are two understandable locations for Bitcoin where you can try to buy it - this is the current one and 30k.

But how altcoins will behave is a question. The liquidity from the order books simply evaporates and interesting patterns break without much effort.

Plus, the events in Kazakhstan and the FRS rate are not conducive to growth.

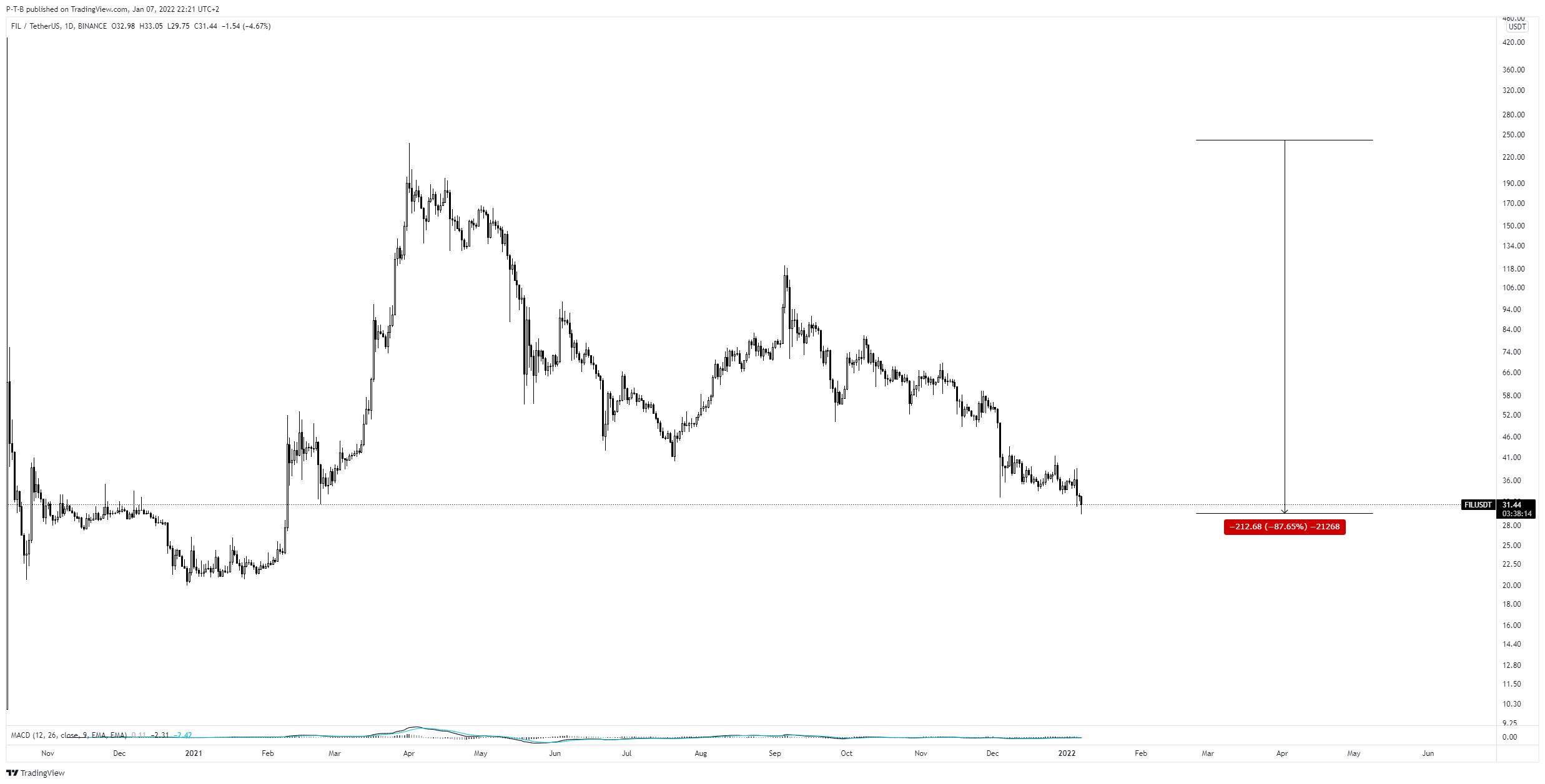

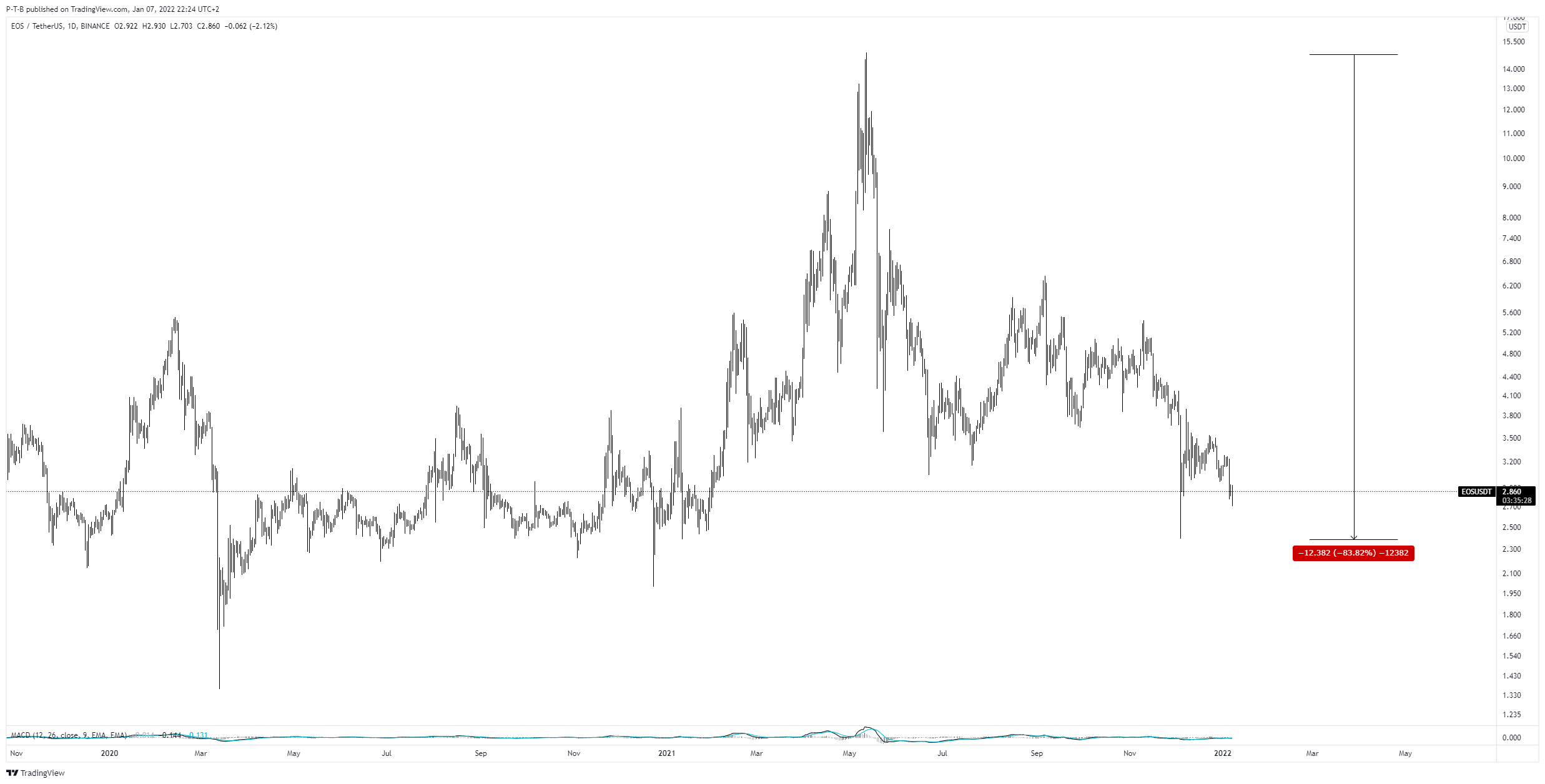

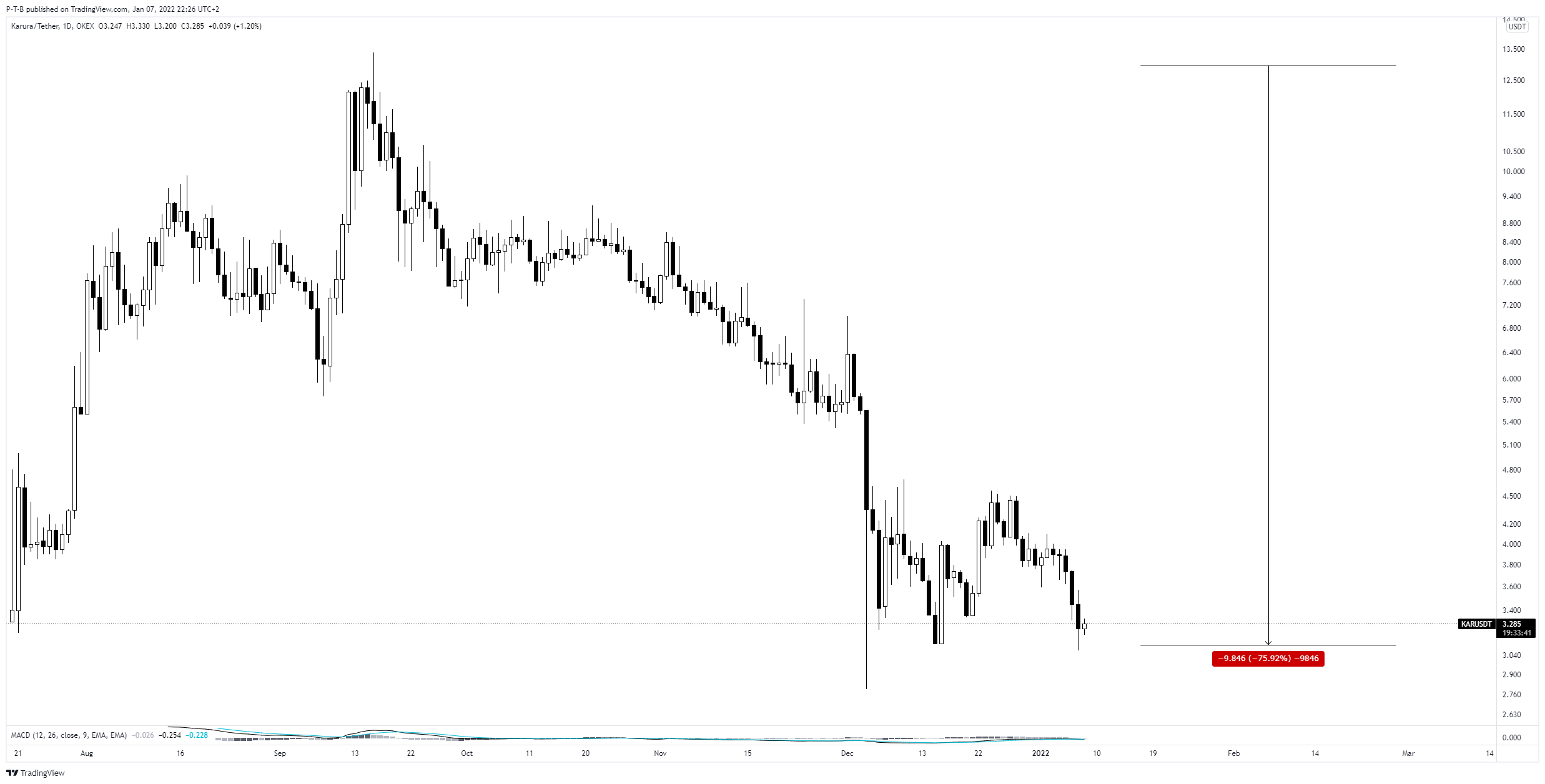

One might think that it is time to take short positions, but the fact is that if you look at the big picture, many altcoins have already lost almost 90% of their historical highs ...

FIL

Another example EOS

KAR

The situation is very difficult, but we will most likely get out of it with minimal losses if we observe risk management. We will also keep you updated on the reviews of individual coins here https://safetrading.today/ideas/

Once we have already done one maneuver in a similar situation, and for those who listened to the rather difficult phase of the market turned into some profit, perhaps this time we will recommend doing something similar (we will write about this separately)

Now the main thing is to control the risks.