The Cheat Sheet for Spotting the Shitty ICO Projects and Dumb Blockchains

BQ2021Here's your quick cheat sheet to spot shitcoins if you are not the High Level crypto master. Don't forget to use it every time you make an emotional investment. Because no point in this list is designed to push you into investing in any of the magical crap.

ૐ Don't believe in anything and keep in mind that the industry is designed to wire the money from your pocket to this industry's best sharks.

ૐBeginners beware because there's a hunt going on and the target is your BTC

ૐ We think that its time to put an end to the massive amount of lies surrounding the roots of Bitcoin's success.

ૐ We don't quite see the authorities of this 'market' do something towards solving the ICO bullshit problem. And this industry's endless rules are something designed to blind newcomers and impose worship.

ૐ We also have no backers who restrict us from telling the truth about mainstream coins.

Test your favorite currency using the checklist below, and be sure that we honestly don't care whether one or another cryptocurrency will 'win'.

Does it have own blockchain? If not, 70% probability it's a shitcoin.

Many of the cryptocurrencies have developed a blockchain that works, sometimes having to survive 51% attacks, DDoS attacks, transaction spam, etc. However, there are plenty of shitcoins never having their blockchain. The blockchain technology is somewhat a key part of any such product. In large projects aimed at disruption, sophisticated blockchain did play a central role in marketing.

If the coin authors gathered millions of dollars during an ICO, yet they cannot afford a blockchain launch, this could be a clear sign of a shitcoin. Only the lazy coders could run their cryptocurrency on the Ethereum blockchain, adding to its popularity and decreasing its own.

Does it work on Ethereum's ERC-20, ERC-721, Waves, Omni, Namecoin?

If the coin has to use some other coin's blockchain ans is often referred to as ‘token’, there's a huge probability that it's a shitcoin.

Does it have a team of developers?

Ever tried googling the main names behind the project adding words like 'scam' or 'selective scamming'? Sometimes 'fraud' and 'investigation' are good words too.

There must be at least 1-5 active devs, and 15-20 who help clean up the code. If there are no devs and no activity in the GitHub branch, then the coin is shit. Don't think that many Twitter followers are a good metric to determine the coin's significance. It is rather a GitHub activity that acts as a good indicator that everything runs smoothly

Bitcoin Core has about five to ten active developers. Bitcoin Cash has two to five developers who contribute to different projects. Bitcoin Cash is a moderately risky community of experimentalists.

The industry keeps bloating with odd ICO fraudsters, venture investors and professional coders trying to obtain the power over any shitcoin with low hash power. There are much less of the developers working on Bitcoin Cash than on Bitcoin. However, Chaincode Labs and Blockstream will have the final word, according to Jeff Garzik. (<------Rare link)

A team of developers should have a broader team of coders surrounding the project. If you check GitHub or Twitter of some decent startup, you'll see that there are thousands of coders working there. If so, guess what? Such a project is supposed to be a good one. You don't have any iron guarantees, however.

Don't forget to google each name of each developer and find out the past of the primary developers. Sometimes, you can find out that the decent product that you want using is made by a former fraudster or a team of professional crooks.

Does the coin have notable followers? What do they do?

Sometimes, the authors of the shitcoins attract people like Steven Seagal to promote campaigns. The new traders look at famous people and assume that the offering is legit. Who would think that Steven will participate in a cheap fraud? However, this is exactly what has happened with the 'Bitcoiin' ICO promoted by Steven Seagal. Per the American Securities and Exchange Commission (SEC):

Does the coin have no limited monetary supply? Probably a shitcoin.

Ethereum doesn't have that, as well as a very big list of cryptocurrencies. In some way, this adds them no credibility, because dollar supply is unlimited too and the cryptocurrencies are supposed to be the tool of 'subverting the centralized power of monetary criminals'.

So, if the coin has unlimited monetary supply, except for the Tail Emission like in Monero, then its probably a bullshit coin.

Regarding Ethereum, it's up to you to decide whether they are going the right way. Just take note of the fact that Ethereum Classic fork had added a fixed cap on the supply sometime after the network split. This measure is to keep the deflation economics model within the currency's ecosystem.

The coin has its code open source and peer reviewed? If no, then its a bullshit coin.

No cryptocurrency has its code closed for the audit. The money isn't something that programmers are willing to lose because of the closed code. The code openness allows peer review, bug search campaigns, bounty hunts and increases people's trust.

There are a few closed source wallets for Bitcoins and altcoins, like the Exodus wallet, Atomic wallet or Jaxx. Considering the high number of Reddit stories of a theft from the user's of a closed source PC wallet, it's better to ensure that the software you use doesn't play games with you. Its a pity that this ecosystem's newbies are coming to the Wild West, where people are bound to their hunger to money, token splits, intrigues, and revolutionary and dangerous frameworks.

The coin's blockchain requires no investment in mining rigs?

Then its probably a shitcoin, except for cases where ASIC miners are banned by network mining algorithm. In Monero, Beam, MFCoin and similar currencies there are restrictions on using ASICS, so this metric doesn't work in all the cases.

The coin's developers tied with ICO scammers or Ponzi charlatans?

This could indicate a shitcoin. You need to make contact with the project's CEO or Support team and find out why they have contracts or affiliated with scammers. Sometimes, even good people support scammers, you need to be careful and not mix everyone in one category.

Does it use PoS or DPoS instead of PoW mining algo? Big probability its a shitcoin.

The majority of coins performed well in 2019 are PoW coins. The PoS coins were losing the price and the interest of the pubic, despite the price rise in Summer, and they usually gather unfavorable feedback. The users are arguing that the cryptocurrency has no room for them, or that staking is not as profitable and safe as mining. Both PoS and DPoS models have substantial flaws in organizing the decentralization of validator nodes.

The major portion of monetary supply in hands of origin company, banks or other institutions?

Maybe a shitcoin. But it depends. Sometimes a pretty honest company want's to establish a business. They need that monetary supply to be added to the market very slowly, like the XRP's initial escrow system or in the concept of Monero's Tail Emission. Sometimes, a private company picks to disclose real names, addresses, and all the information and then run their network. It mustn't attract the free time and resources of many people.

Requires at least 10-20 USD on a balance to enable payments?

A shitcoin. Some of the online wallets could ask you to store a minimum amount of the coin to be able to spend it, like Ripple’s XRP requires a minimum of 20 XRP for the wallet to be active. However, most of the coins should not demand storing/staking any minimums.

It was pumped by shady investors?

If big pockets, sports stars or Russian/Japanese/Chinese mafia are manipulating tokens and coins, or participating as advisors, promoters or speakers for Ponzi schemes/investment frauds/ICO's, then you should stay away from such people and their projects.

Does it use 95% of the stolen code?

A shitcoin.

No, any scalability/privacy improvements compared to BTC and BCH without sacrificing security and decentralization?

A shitcoin.

Highly dependable on a small circle of well-known developers who work in the same third party company?

Probably a shitcoin, but with exceptions like Beam.

It requires KYC to open a wallet? 110% Shitcoin

According to the law and common sense, you should check the companies you send money to.

Have you ever heard of the projects that require sending out personal data? In exchange for the opportunity to receive a $50 airdrop in some mid-level shitcoin, sites like Blockchain.com offer you to submit KYC information despite their 'cyberpunk' image in the old days.

The cryptocurrency industry grew on decentralization principles. It is strange when a company explicitly ask the customers to send out their ID data. In most of the cases, such 'startups' don't even provide guarantees within their User Agreement that they hold responsibility for data theft, breach or other kinds of interruption or leakage.

And yes, they will sell your data to other corporations, because its a ton of profit which is impossible to ignore. Maybe even you would not be resisting such a bait once the chance comes.

You can try out their service anytime you want, but if somebody steals the funds or your data, they have zero responsibility. Why gathering personal documents then? To make a clear message to the hackers, money laundering minds, corrupt politicians and drug traders that this particular currency (or another cryptocurrency-related service) is for law-abiding people. However, do you think such a strategy is effective?

The ICO rush is over but new variations of this same game appear at the horizon: IEO, STO and more. Let us now look into some of the reasons not to invest in ICO startups and ventures.

Many of the shitcoin/ICO startups have been gathering money for the products that they cannot create.

Here's a list of blockchain projects dedicated to Artificial Intelligence. Before you start thinking this is not entirely impossible, please consider this opinion by Alexander Nevzorov, famous Russian biologist, publicist and armed conflict reporter who survived in seven wars:

So, Artificial Intelligence on a blockchain? You know the answer.

Does it have troubles with the SEC, CFTC, or some Central Banks or regulators?

In most of the cases, if a startup has received a hit from the SEC or CFTC for not registering the ICO, the things are bad for the company's top management. During 2018-2020, we've seen an increasing billow of ICO CEO's going to jail or paying huge fees.

Chinese University claims 90% of altcoin code is stolen from other projects

According to the research made by the Xi'an Jiaotang University of China, 90% of altcoins have their code stolen from another project dedicated to crypto. The report mentions 488 cryptocurrencies, almost all of them are working thanks to open source code.

Among the number, only 38 cryptocurrencies appeared having more than 20% of the unique code. The study concludes that the cryptocurrency industry is having too many projects without goals and necessity proven.

76% of all the altcoin projects don't bring in any value

In March 2018, during MIT Bitcoin Expo, Christian Catalini said that more than half of all the ICO projects have a negative return rate.

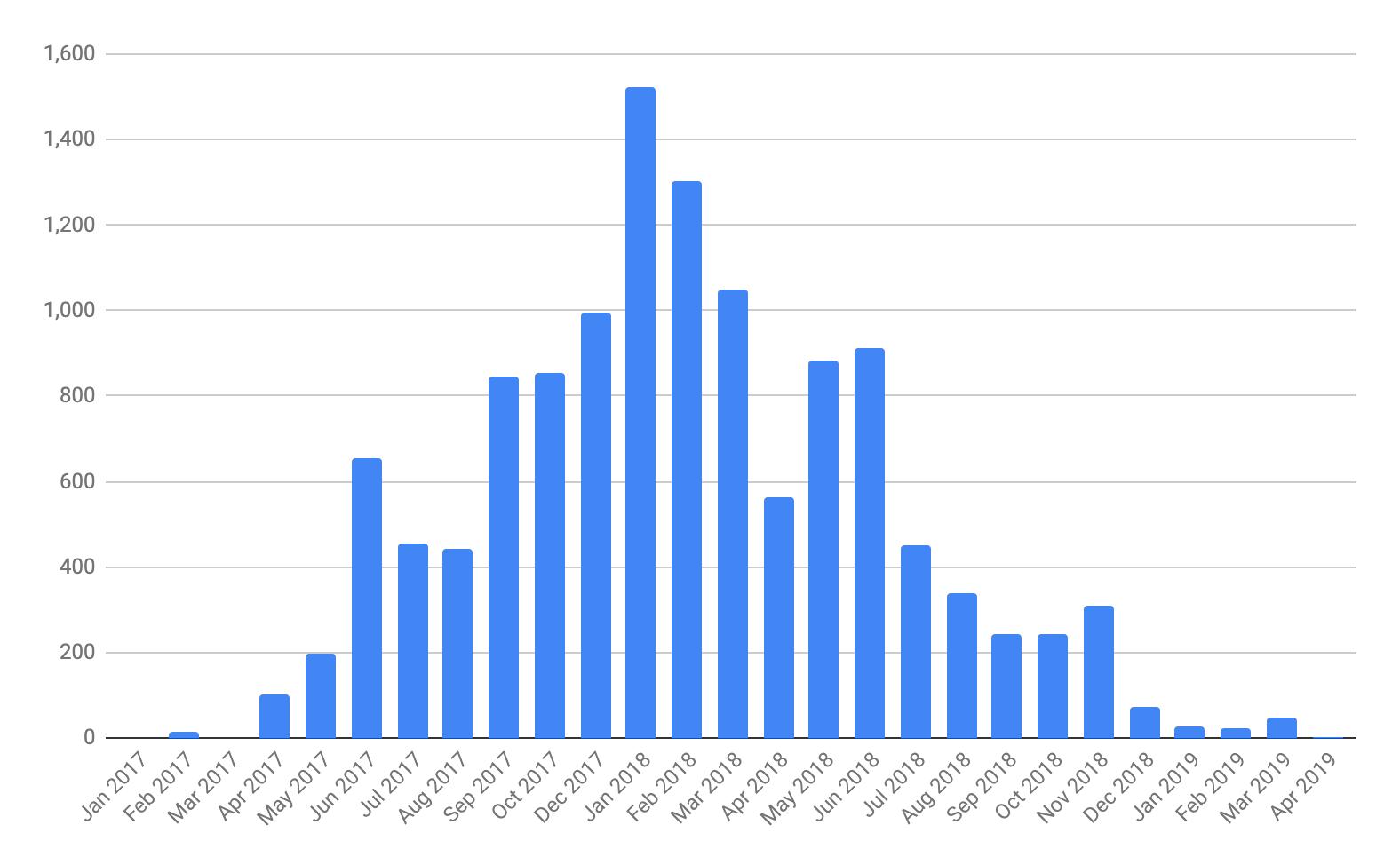

Also, take a look at this magnificent graph made by BitMex:

Blockchain has to have at least 5K nodes.

Bitcoin's blockchain has around 10K nodes that openly signal their loyalty. Also, it reportedly has over 50K nodes connected to the network via Tor, from unknown places. However, the shitcoins having their blockchain usually very easy to attack via selfish mining or a Ddos attack or even by the old good transaction spam. Remember – 150-400 nodes is not sufficient to be a decentralized network.

Without decentralization of the blockchain nodes, both the ability of cryptocurrency to work out ''a million TX's per second'' and to ''mine 5x more blocks'' do not matter. The faster the ICO/shitcoin gathers its funds via a public ICO sale, the more probability it's a scam. In general, you beware of anything that is done with huge speed – legitimate blockchain startups usually develop code for months or even years, before they present the result to the public.

A usual lending website with smiling corporate photos?

Almost all the ICO projects have the same lending pages. They have fancy pictures in the slider, inexistent juridical addresses, and the photos are in grey. The Team section fille with a ton of nerdy-looking people in expensive suits, always smiling to you as if there's no evil on Earth.

The founders may have their Instagram and Twitter full of photos of them on yachts or near the luxury sports cars.

The product description is usually fantastic: ICO coins seem to cure cancer, make sweet girls jump onto you without any reason, and the main quality of the offer is 90000% in profits in the first hour of trades.

What they keep silent about is their complete lack of fiduciary duties. Yeah, the ones that add obligations to compensate losses to investors in case of fraud.

~Subscribe to our super TG channel to win money know the truth about cryptocurrencies earlier than anyone.

~Discuss the piece on Bitcoin.com Forum.

Disclaimer: This article was offered to some news outlets. But as they hold Ethereum, they have made attempts to modify the content of the piece (cutting out at least 60% of valuable facts), so that Ethereum would look less shitty in it. I found that it's better to place the full, unedited (and improved) version of the piece in my personal blog.