The Chapter 53 - Article 21 - North Carolina General Assembly Statements

The Only Guide for The Best Reverse Mortgage Lenders of 2021 - Caring.com

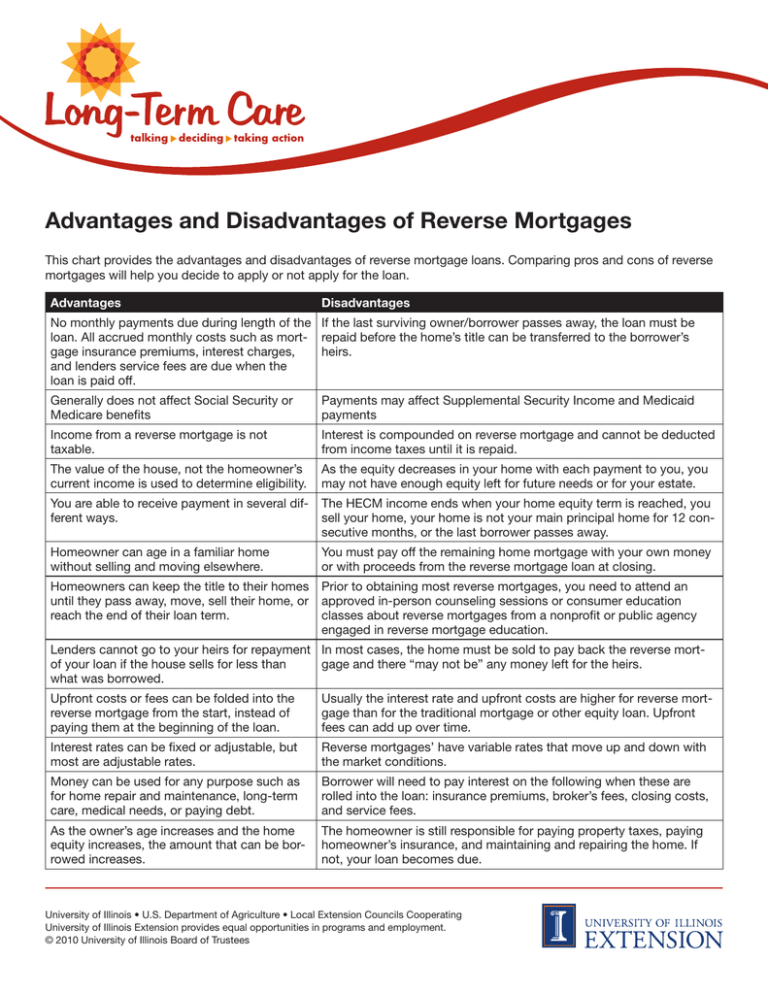

The counselor also must explain the possible options to a HECM like government and non-profit programs, or a single-purpose or exclusive reverse home mortgage. Did you see this? ought to be able to help you compare the expenses of various types of reverse mortgages and tell you how different payment choices, charges, and other costs affect the overall cost of the loan gradually.

Counseling companies generally charge a charge for their services, typically around $125. This fee can be paid from the loan earnings, and you can not be turned away if you can't pay for the cost. With a HECM, there generally is no particular income requirement. Nevertheless, lending institutions need to conduct a monetary evaluation when choosing whether to approve and close your loan.

Based on the outcomes, the loan provider could require funds to be set aside from the loan continues to pay things like residential or commercial property taxes, property owner's insurance, and flood insurance coverage (if applicable). If this is not required, you still might agree that your lender will pay these items. If you have a "set-aside" or you consent to have the loan provider make these payments, those amounts will be subtracted from the quantity you get in loan profits.

What is a Reverse Mortgage Loan? Everything You Need to Know About It

What is a Reverse Mortgage Loan? Everything You Need to Know About ItThe smart Trick of For Senior Taxpayers - Internal Revenue Service That Nobody is Talking About

The HECM lets you pick among numerous payment alternatives: a single disbursement alternative this is only available with a set rate loan, and normally provides less cash than other HECM options. a "term" choice fixed regular monthly cash advances for a particular time. a "tenure" alternative fixed monthly cash loan for as long as you live in your home.

This alternative restricts the quantity of interest troubled your loan, due to the fact that you owe interest on the credit that you are utilizing. a mix of monthly payments and a line of credit. You may be able to alter your payment choice for a small charge. HECMs typically give you larger loan advances at a lower total cost than exclusive loans do.

Reverse Mortgages Los Angeles, CA - Pacshores Mortgage 310-478-5005

Reverse Mortgages Los Angeles, CA - Pacshores Mortgage 310-478-5005Taxes and insurance coverage still must be paid on the loan, and your home needs to be kept. With HECMs, there is a limitation on how much you can take out the very first year. Your lender will compute just how much you can borrow, based upon your age, the rates of interest, the worth of your home, and your monetary assessment.