The Best Strategy To Use For "GoBank vs Traditional Banks: What Makes Them Different?"

When it happens to banking, there are two principal possibilities offered: typical banks and on-line financial institutions. Each option has actually its personal pros and disadvantages, and making a decision which one to make use of inevitably happens down to individual inclination. One of the most well-known internet banking options is GoBank. In this write-up, we will definitely discover the distinctions between GoBank and conventional banking companies.

What is GoBank?

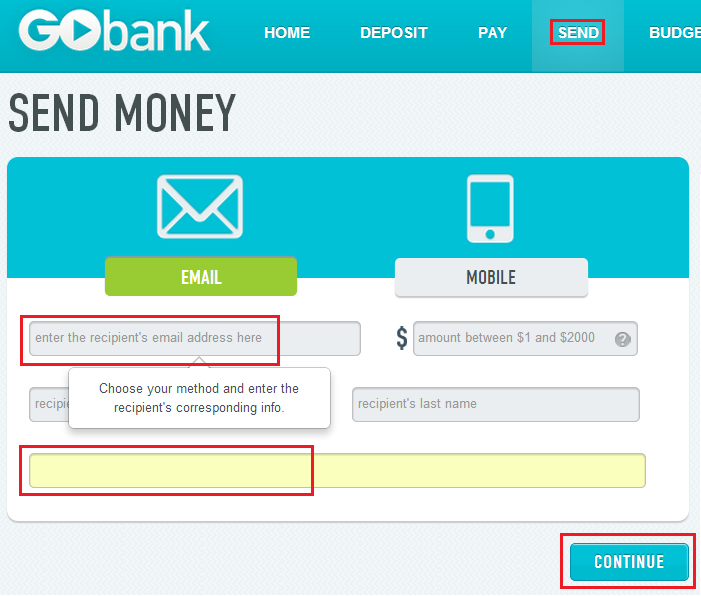

GoBank is an online-only bank that was launched by Green Dot Corporation in January 2013. It is a mobile-first banking company that offers a array of financial companies such as checking profiles, savings accounts, debit memory cards, and bill payments. The bank does not possess any kind of bodily divisions and all transactions are conducted via its mobile app or website.

GoBank vs. Traditional Banks

1. Ease

One of the largest perks of GoBank over standard financial institutions is ease. Along with GoBank, consumers can perform all their banking tasks coming from the convenience of their residence or anywhere else they have accessibility to the net. They don't need to have to go to a division physically or hang around in collection for long durations of opportunity only to transfer loan or spend expenses.

On the various other hand, conventional financial institutions normally call for customers to go to a branch in person if they wish to open up an account, down payment funds or take out cash money. For individuals who live far away coming from divisions or lead occupied lives along with little free of charge opportunity during the course of company hours, this can easily be extremely inconvenient.

2. Fees

An additional considerable distinction between GoBank and traditional banking companies is expenses. GoBank has no month-to-month servicing fees for its inspection profile and no over-limit fees either (up to $200). Nevertheless, certain purchases such as ATM drawbacks from out-of-network equipments may accumulate fees.

Conventional banks commonly charge month-to-month upkeep fees for their examination accounts and may additionally ask for added expenses for making use of out-of-network ATMs or overdrawing an profile equilibrium.

3. Interest fees

Interest costs are one more location where GoBank varies coming from typical financial institutions dramatically - especially when it comes to cost savings profiles. GoBank's financial savings account gives an annual percentage yield (APY) of up to 1.00%, which is higher than most traditional financial institutions supply.

Traditional banks generally offer lower APYs on their financial savings accounts, which implies a lot less interest gotten on the balance.

4. Customer assistance

When it comes to client support, GoBank and traditional banks vary in phrases of schedule and availability. GoBank just delivers consumer assistance by means of its website or mobile application, and there is actually no phone number to call for help.

Traditional financial institutions generally possess a consumer solution hotline that consumers can easily call 24/7 if they need aid. They also possess branches where consumers can speak along with banking company representatives in person if required.

5. The Latest Info Found Here is a essential problem when it comes to banking, and both GoBank and standard banks take this problem truly. However, online-only banking companies like GoBank might be more vulnerable to cyber-attacks matched up to traditional financial institutions that have physical security measures in spot.

GoBank has carried out a number of security step such as multi-factor authentication, security process, and fraud keeping an eye on bodies to safeguard versus unapproved get access to or deceptive activities.

Standard banking companies also utilize identical surveillance measures along along with bodily security step such as surveillance cams and security protections at their branches.

Final thought

In conclusion, both GoBank and standard banks possess their very own one-of-a-kind staminas and weaknesses when it happens to banking services. For individuals who value benefit above all else - particularly those who lead busy lives or live far away from a division - online-only banking options like GoBank might be the suitable option. Having said that, those who require more personalized customer support or choose face-to-face interactions might like a a lot more conventional financial institution option instead. Ultimately, the choice between these two possibilities will depend on private inclinations and necessities.