The Best Guide To The Pros and Cons of Using ACH vs Wire Transfer for Business Payments

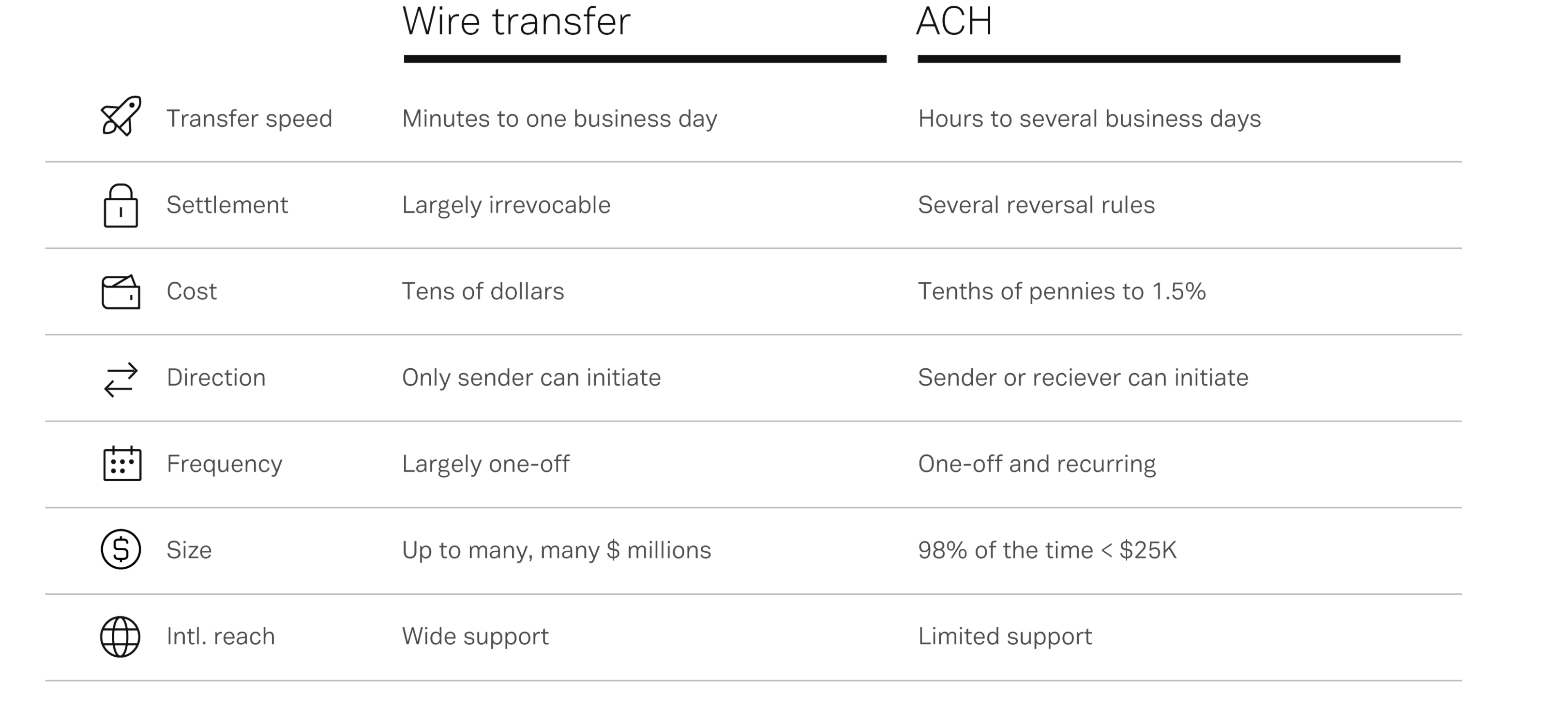

ACH and cord move are two common procedures of transferring funds between bank profiles. While they might appear similar, there are actually substantial differences between the two that can impact the rate, price, and safety of the transfer. Understanding these variations may assist you select the absolute best approach for your demands.

ACH stand up for Automated Clearing House. It is an electronic system that processes monetary transactions in sets. ACH transactions are usually made use of for recurring remittances such as pay-roll deposits, bill remittances, and straight down payments. ACH moves are started through the recipient of funds and demand consent coming from the sender.

Cord transmission, on the other hand, is a real-time strategy of moving funds between banking companies. Wire transactions are usually utilized for important or high-value transactions such as international remittances or actual real estate transactions. Cord transfers require verification coming from both celebrations involved in the deal.

One of the primary distinctions between ACH and wire transmission is rate. ACH moves normally take 2-3 business times to accomplish, while cord transactions can often be completed on the same day or within a couple of hours. This produces cable transactions a far better option for immediate deals or conditions where opportunity is essential.

Price is another essential difference between ACH and wire transmission. ACH moves are commonly much cheaper than wire transmissions because they are processed in sets and do not demand real-time confirmation. Some financial institutions may also deliver free of cost ACH transmissions to their customers as a perk of their account solutions.

Cord moves, on the other palm, can be expensive due to their real-time attributes and added protection action required for high-value purchases. Banking companies might charge a level charge or a percentage-based fee for wire transfer solutions depending on various aspects such as destination country, money substitution costs etc.

Safety is additionally an vital point to consider when choosing between ACH and wire transfer strategies. Each strategies utilize file encryption innovation to safeguard vulnerable financial information during transmission but there are substantial distinctions in terms of fraud defense action applied through banking companies.

Cable transfers have a greater degree of surveillance as they need proof from both the email sender and recipient of funds. Financial institutions may also use additional protection action such as PIN codes or biometric authentication to confirm the identity of the gatherings involved in the transaction. This helps make wire transmissions a better choice for high-value transactions or scenarios where fraud protection is crucial.

ACH transactions, on the various other palm, are more susceptible to fraudulence as they only require permission coming from one gathering included in the purchase. Key Reference can easily produce them an eye-catching target for scammers who may try to swipe delicate financial relevant information or trigger unwarranted transactions.

In final thought, both ACH and cable transmission methods possess their own benefits and setbacks relying on your specific requirements. If you need to have to move funds swiftly and firmly for immediate or high-value purchases, cord transmissions might be a better option despite their much higher price. For reoccuring payments or scenarios where time is not crucial, ACH transmissions can easily be a much more cost-effective option but with reduced safety and security step in spot. Understanding these distinctions are going to help you produce an informed decision about which technique is ideal for your needs.