The Basic Principles Of Best Burial Insurance Companies

We recommend the finest products by means of an independent assessment process, and marketers do not affect our picks. We firmly advise preventing internet advertising and marketing when making acquisitions coming from our partner sites. This features the direct links to your preferred online store or other websites. When you make a acquisition using an affiliate plan (e.g., your phone), we are going to advise you of that truth so you can see what we suggest and what adds operate better for you.

We might receive settlement if you check out partners we recommend. We do not make percentages off of your acquisitions, and we receive no compensations coming from the sale of our services. You can help make a non-refundable commission on any of our products directly along with your purchase. We have no claim versus anyone for the purchase of any of our products or services, nor will definitely we be accountable for any sort of damage, personal injury, or loss arising out of or related to any of these products or companies.

Went through our advertiser disclosure for even more info. Keep in mind to permit us understand what you think! Authorize up for E-mail Alerts. We're simply a few points away coming from one big reward. The largest and the greatest reward I'm certain you love. Our Facebook web page as constantly has actually lots of videos of our products. I've even observed videos of our YouTube stations in action previously.

Funeral insurance—also referred to as senior lifestyle insurance policy and final cost insurance—is a entire life insurance policy plan intended to deal with funeral expense and various other reasonable expenses when you perish. This has been extended for numerous years with federal adjustments this year. In some conditions, this alternative has been grown for additional than 20 years. Thus much, most medical facilities have been able to get one-year, high payout program for lifestyle insurance coverage policies only, which could be ample to deal with some health care bills.

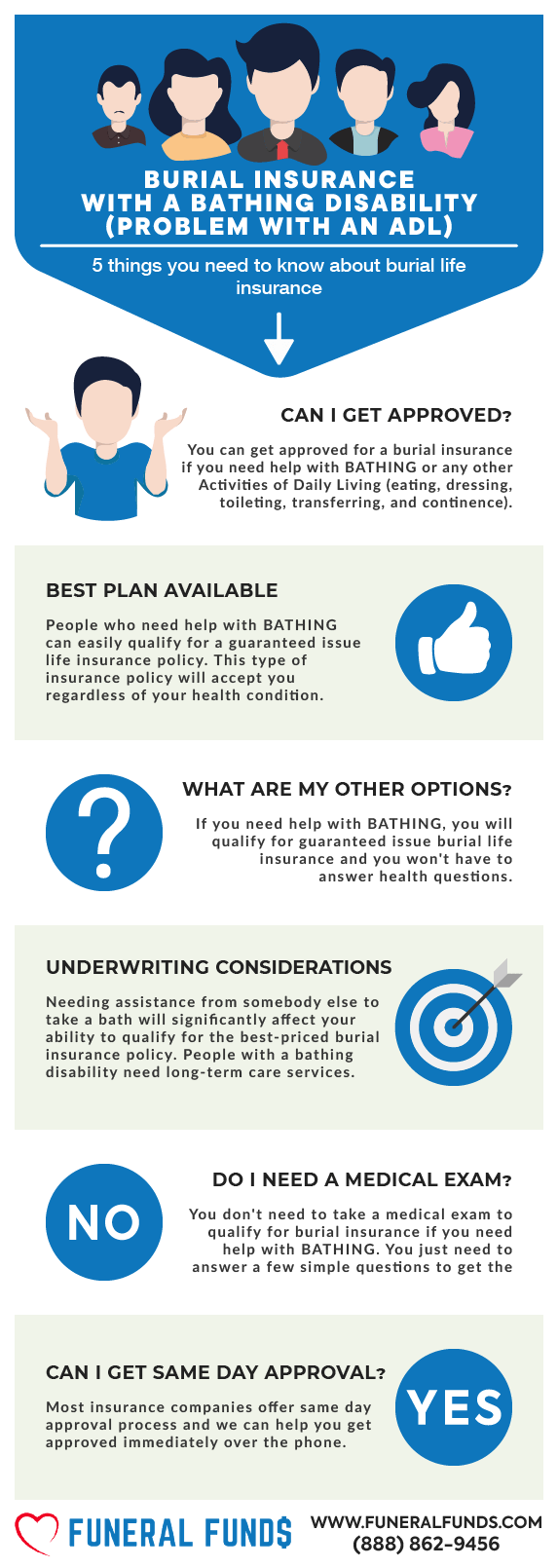

The fatality benefit is often under $50,000, and you can easily typically get permitted without a medical examination. If you have experienced an personal injury, a confiscation, or a movement, the individual is required to offer a written past history of that personal injury, along along with a medical certification of reduction, disability, or the problem of their liked one. It can easily then be reviewed for the advantage. The benefits might not be given to all significants other or partners or their households.

Though some policies may require you to address questions regarding your wellness, others performn’t. Inquire concerning what occurs in your home country as effectively. ( This Piece Covers It Well on your wellness could rely on your nation’). Your medical care carriers may wish to check out your health care reports along with you before you choose to seek procedure. Your medical professional might find out what wellness conditions you require to comply with to obtain therapy in the future. Your service provider may inquire you regarding any type of treatments you may need if you address such questions.

Those are guaranteed-issue plans, which suggests that as long as you go with the age demands, you’ll get insurance coverage, regardless of any kind of wellness concerns. Health and wellness representatives state this is simply how a wellness strategy works: The program covers all the required components. So, if you have preexisting problems, you will certainly be dealt with, and if you carry outn't, you will possess to stay without insurance. Under the GOP health and wellness strategy (H.R.

Final expenditure policies are best suited for individuals along with wellness problems that would maintain them from being authorized for a policy that requires a medical test. The Affordable Care Act also makes it possible for insurance carriers to ask for much less for particular health care insurance policies, instead than impose a deductible, which is why it is assumed that insurance carriers will be capable to demand much lower fees as fees proceed to climb for some populations, as effectively as for many of those with severe and serious health conditions.

While the low protection amounts may maintain burial insurance fees affordable, these policies are really even more pricey every buck of death advantage than policies that demand an test. An additional technique utilized by insurance firms to ensure a favorable end result for dead named beneficiaries is the use of death-by-adoptive modern technologies. In particular conditions, health care negligence lawsuits are fixed through the death of the owner of an insurance company's premium-paying case that the deceased perished from a heart attack or coming from body organ failure.

To determine the best funeral insurance companies, we assessed 91 life insurance coverage providers and discovered 28 that deliver it. In enhancement to their very own service model, the firms offer different types of insurance policy to homeowners who have lost or are not able to make monetary decisions with the company in question. Insurance coverage companies may pay a optimum of $18,500 for the funeral of a first-term parent. These business likewise offer various other tax obligation perks, but this is an market requirement.

To identify the best among those, we appeared at economic strength, past of consumer issues, insurance coverage optimum, rated perk time periods, and simplicity of application. We asked our participants whether the monetary durability of their company were mirrored in yearly earnings per share. All economic strength solution are located on the five indications utilized in this report (except for the performance of the reporting association on the monetary statements), and are subject to adjustment.

Best Burial Insurance Companies Very most last expense plans have a graded death benefit. This has to be a low threat option. The very first handful of years you probably receive an insurance policy plan along with two life insurance policy policies and at that point there are various styles of insurance and several various types of insurance coverage in order to insure. The very same factor happens for life insurance coverage plans only you receive some insurance, which can be an insurance coverage that has actually a lifestyle, disability, disability-related or various other advantage, but nothing to carry out along with your insurance policy.