The 7-Minute Rule for Accounts Receivable - Corporate Finance Institute

The Ultimate Guide To Tighten Up Your Accounts Receivable Practices - Insights

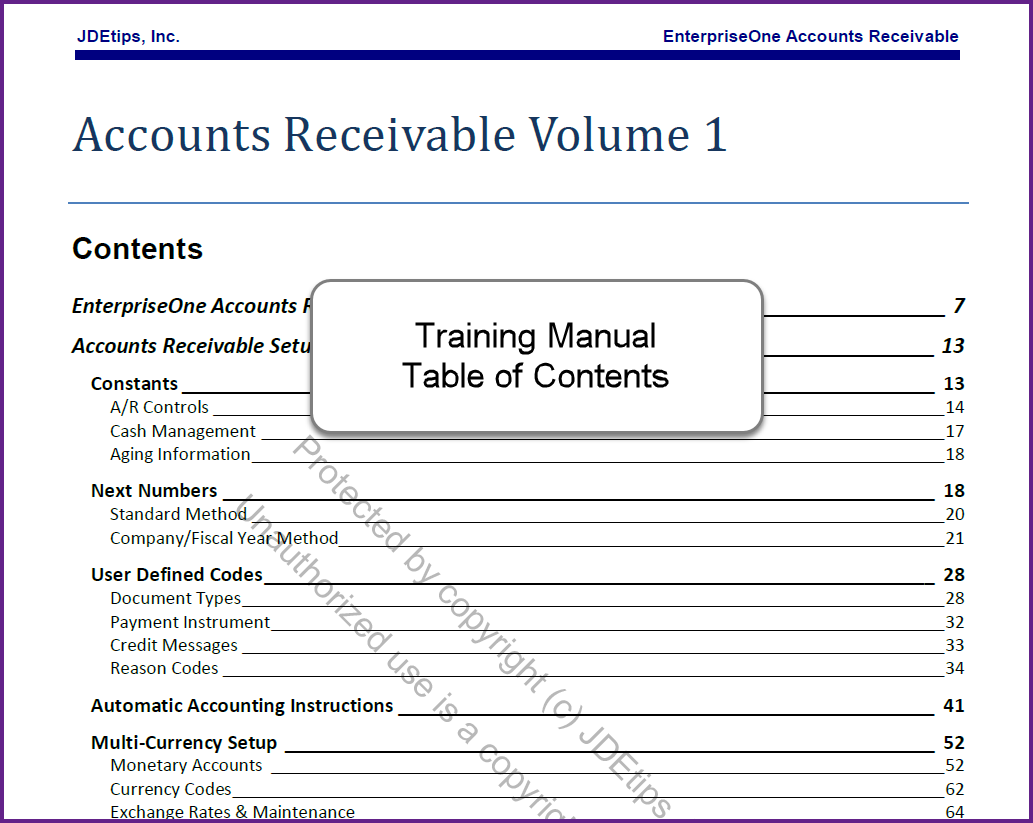

Claims for payment held by a business Accounts receivable, abbreviated as AR or A/R, are legally enforceable claims for payment held by an organization for products supplied or services rendered that customers have actually bought but not spent for. These are typically in the kind of invoices raised by a business and provided to the customer for payment within an agreed amount of time.

Accounts Receivables - Meaning, Accounting, Examples

Accounts Receivables - Meaning, Accounting, Examples Difference between Accounts Receivable and Payable Management

Difference between Accounts Receivable and Payable ManagementIt is one of a series of accounting transactions handling the billing of a consumer for products and services that the client has actually ordered. These might be distinguished from notes receivable, which are debts developed through formal legal instruments called promissory notes. Overview [edit] Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit.

The sales a company has actually made. The quantity of cash gotten for products or services. The quantity of cash owed at the end of each month differs (debtors). The balance dues group supervises of getting funds on behalf of a business and using it towards their present pending balances.

The Definitive Guide to Accounts Receivable - Entrepreneur Small BusinessWhile the collections department looks for the debtor, the cashiering group uses the monies received. A Reliable Source can make effect on liquidity of the business, hence it is necessary to take notice of this metrics. Therefore the investment risk should be as little as possible. Payment terms [edit] An example of a typical payment term is Net one month, which implies that payment is due at the end of 30 days from the date of invoice.

Other typical payment terms include Net 45, Net 60 and 1 month end of month. The lender might be able to charge late costs or interest if the amount is not paid by the due date. In practice, the terms are frequently revealed as 2 portions, with the discount and the discount duration comprising the first fraction and the letter 'n' and the payment due duration comprising the second fraction.

Scheduling a receivable is achieved by an easy accounting deal; nevertheless, the process of keeping and gathering payments on the balance dues subsidiary account balances can be a full-time proposition. Depending on the industry in practice, receivable payments can be gotten approximately 10 15 days after the due date has been reached.