The 6-Second Trick For What Is Yield Farming? DeFi Basics Explained - Shrimpy Blog

A Beginner's Guide to Yield Farming

A Beginner's Guide to Yield FarmingThe Basic Principles Of Top Yield Farming Pools by Value Locked - Coingecko

What Is Yield Farming? De, Fi is the talking point of the cryptocurrency industry in 2020, and yield farming is financiers' go-to approach of getting involved in the pattern. Coin, Market, Cap provides a beginner's guide to yield farming and how much is at stake by offering your hard-earned coins to De, Fi platforms in return for monetary rewards.

De, Fi Yield Farming Explained For Beginners Yield farming is a new way of making cash with cryptocurrency that has become a significant phenomenon this year. From Check Here For More in the summertime of 2020, yield farming one of the primary financial investment techniques connected with the decentralized financing (De, Fi) motion has built a big community and produced dizzying amounts of worth in a matter of months.

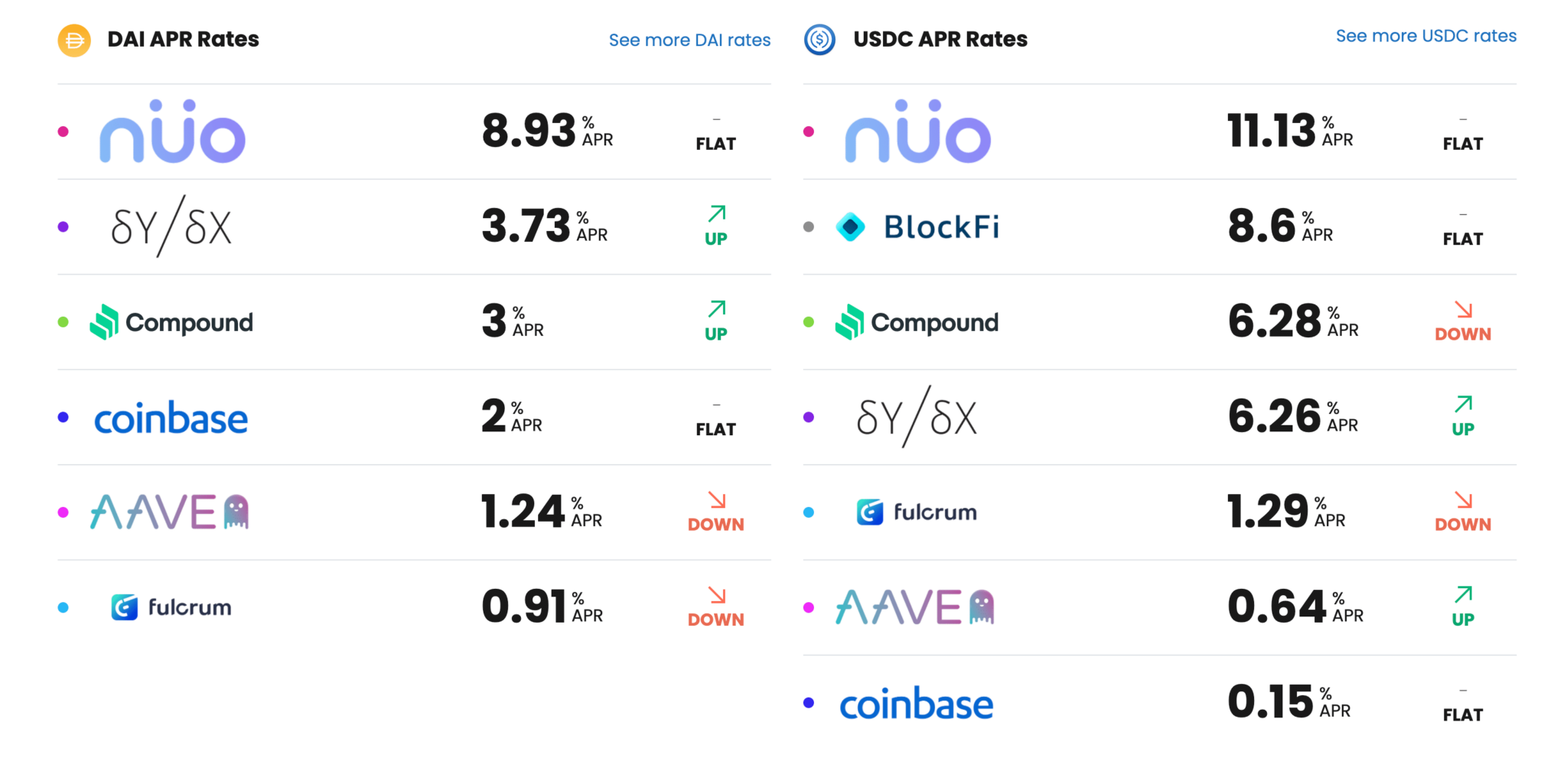

The 45-Second Trick For Yield Farming in the DEX - DeFi and Liquidity Mining - OracleDe, Fi enables anyone to engage in all sorts of financial activities which formerly required trusted intermediaries, ID confirmation and a lot of charges anonymously and for totally free. One example focuses on loans. Someone installs cryptocurrency for another to obtain, and the platform this takes place on benefits them for doing so.

The combination of these benefits, coupled with the reality that the cost of these internal tokens is free-floating, permits the prospective profitability of financing and even obtaining to be substantial. The practise of putting cryptocurrency to operate in in this manner, often in several capacities simultaneously, is what is called yield farming.

Edge - DeFi Vocab: Yield Farming & Liquidity Mining - Edge

Edge - DeFi Vocab: Yield Farming & Liquidity Mining - EdgeOur What is Yield Farming? Beginner's Guide - Decrypt Statements

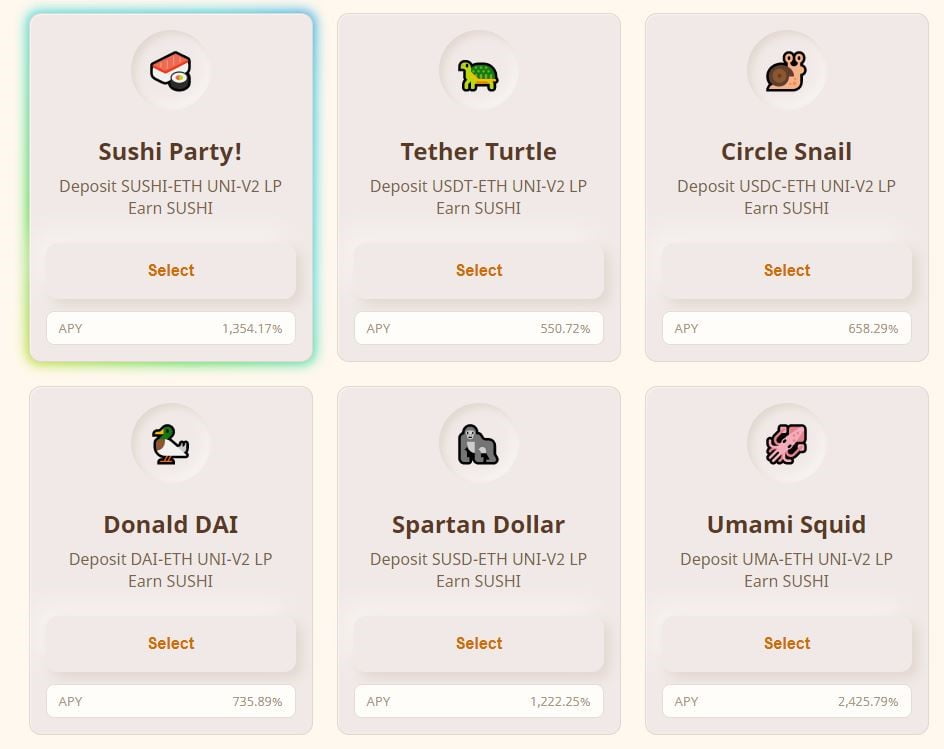

The ecosystem is fleshed out with automated trading markets computer systems managing "swimming pools" of tokens to make sure that there is liquidity for any provided trade that token holders want to make. Uniswap is among the best understood of these "automated liquidity protocols." Curve is an example of a decentralized exchange which concentrates on stablecoins such as Tether (USDT), and has its own token which borrowers and lenders can get as a benefit for involvement offering liquidity.

What Is Yield Farming? - CoinMarketCap

What Is Yield Farming? - CoinMarketCapThe yield farming design consists of intrinsic threat which differs depending on the tokens utilized. In the loan example, expense factors to consider include the initial cryptocurrency installed by a lending institution, the interest and the value of the internal governance token reward. Considered that all 3 are free-floating, the revenue (or loss) capacity for individuals is significant.