The 3-Minute Rule for Refinance Mortgage Easily - Home Refinance Options

Facts About Mortgage Refinance Calculator - Should I Refinance - Discover Uncovered

If you're not pleased with your credit history or the rates you're being priced quote, work on enhancing your credit initially, then attempt to re-finance again once you have actually improved it. 2. Figure out the length of time it will take you to break even One of the most important elements in refinancing is determining your break-even timeline.

If you're not preparing to remain in your present house for more than a couple of years, the cost savings you get from a lower rate may not outweigh those expenses before you move. Bankrate's refinance calculator can assist you find out this timeline. 3. Compare lenders It's just as crucial to shop around when you refinance as it is when you're getting your purchase mortgage.

Take a look at Bankrate's lender evaluates to assist make your choice. 4. Get your documents in order Once you have actually determined your lender, learn what paperwork you need and submit your application. This Piece Covers It Well gather all the needed documents, the faster the loan provider will be able to process your loan.

Refinancing (Meaning, Types)- How does Refinancing Loans Work?

Refinancing (Meaning, Types)- How does Refinancing Loans Work? Cash-Out Refinance - Mortgage Refinance - U.SBank

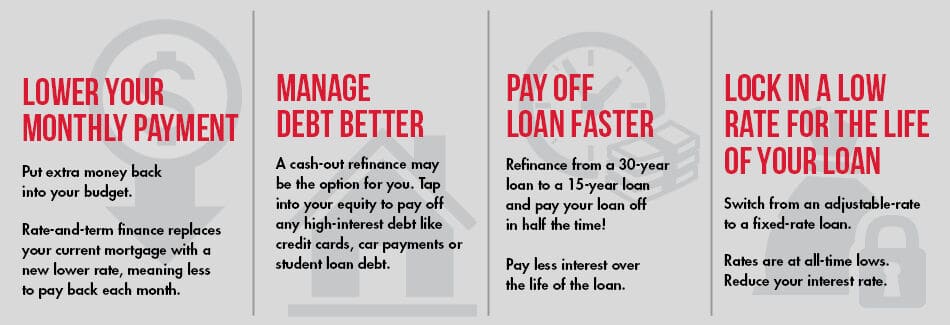

Cash-Out Refinance - Mortgage Refinance - U.SBankBe client Refinancing isn't rather as tough as looking for a house, but it still spends some time. While your loan is in procedure, do not open new charge account or make other large purchases until the new mortgage closes. Doing so can hinder your application. Refinancing can be a clever move, whether it assists you achieve more breathing space in your regular monthly budget plan by securing a lower rate or tap your home equity to fund a house restoration or other project through a cash-out offer.

About ROD: Why should I refinance? - Secretary of theIf your home's worth has actually risen, you may be able to end personal home loan insurance (PMI), which will also lower your month-to-month costs. PMI needs to end instantly as soon as you get to a minimum of 20 percent equity owned totally free and clear, however it's normally a good time to think about a refinance once that occurs, too.

It can make your regular monthly payments more pricey, but home improvements increase your equity value a lot more. Cons Re-financing expenses money. Closing expenses can amount to 2 percent to 5 percent of the amount of the mortgage, which is why it's so essential to make certain you'll recoup those costs prior to you move.