The 20-Second Trick For BOA expands down-payment assistance program for home

Down Payment Assistance & Homeownership Education - An Overview

GSFA understands just how much you wish to own a house, and understands the biggest difficulty you might deal with when acquiring a house is coming up with the funds for the associated down payment and/or closing costs. Today, this is an obstacle faced by the bulk of homebuyers, not just newbie property buyers.

Homebuyer Workshop: Down payment assistance (Free) - Calendar List - National City, CA

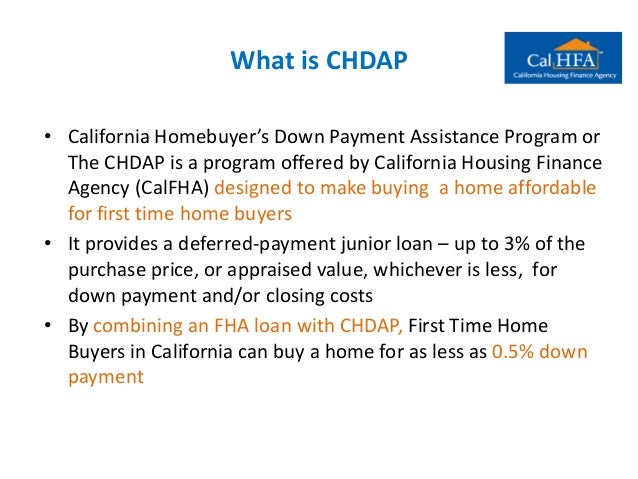

Homebuyer Workshop: Down payment assistance (Free) - Calendar List - National City, CA California Homebuyer's Downpayment Assistance Program - Mortgage Market Talk

California Homebuyer's Downpayment Assistance Program - Mortgage Market TalkHomeownership Programs Financial help programs for homebuyers and homeowners, sponsored and/or handled by NHF Shortcuts According to the 2018 Barriers to Accessing Homeownership report by the Urban Institute, 68 percent of U.S. tenants see the inability to save for a down payment as one of the leading barriers to homeownership.

NHF Deposit Assistance Among the most significant challenges for homebuyers is developing the funds to cover the down payment requirements and/or closing costs connected with a mortgage. To bridge that gap, NHF provides deposit and/or closing expense assistance (DPA), as much as 5% of the mortgage amount.

About First Time Homebuyers - Housing Programs - City of TurlockIt is offered in most U.S. States and qualifying standards are flexible. NHF DPA highlights( 1 ): NHF DPA is provided as a Gift or a forgivable 2nd Home mortgage There is no requirement that a debtor be a novice homebuyer to certify FICO rating requirements and allowable debt-to-income ratios are versatile NHF DPA programs includes generous earnings limitations; greater than might be anticipated FHA, VA, USDA and Traditional Mortgage funding is readily available NHF DPA is offered for both purchase and refinance of a main home Sponsored by NHF and offered nationally through Participating Lenders Other Financial Support Programs Managed by NHF GSFA Platinum and Open, Doors Programs The GSFA DPA Programs offer deposit and/or closing cost support up to 7% of the loan amount, particularly for customers acquiring or refinancing a main home in the state of California.

California First Time Home Buyer Programs

California First Time Home Buyer ProgramsCheck out the GSFA site to read more. Check For Updates With the GSFA Energy Performance Funding programs, qualified property and commercial home owners in California can fund a variety of energy performance measures in simple and budget friendly ways. The Programs are sponsored by GSFA in partnerships with Pacific Gas and Electric Business, California Energy Commission, 5 Star Bank and Ygrene Energy Fund.