The 2-Minute Rule for Workers Compensation Insurance Quote

Top 25 Workers' Compensation Insurers

Top 25 Workers' Compensation InsurersSome Known Incorrect Statements About Texas Mutual: Workers' Compensation Insurance

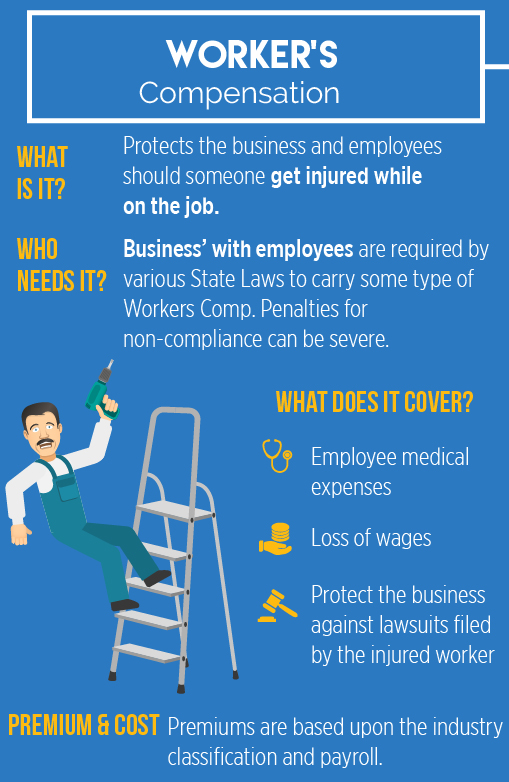

Workers' compensation insurance coverage usually isn't optional. While Autumn Insurance differ by state,. Even when not needed by law, this policy supplies crucial defense against medical expenditures and worker suits associated with work environment injuries. You can depend on employees' compensation if you or an employee requires medical care or time off due to an office injury or if an injured staff member sues you for stopping working to avoid a mishap.

And the majority of states levy costly charges for noncompliance. Small companies find workers' comp important for 3 reasons: Most states require employees' comp protection. It covers medical expenses and partial lost wages due to a work injury. Many policies also cover the expense of worker suits related to a work injury.

Does a Small Business Need to Provide Workers' Compensation Insurance?

Does a Small Business Need to Provide Workers' Compensation Insurance?Many small businesses can't afford to pay medical expenses out of pocket, whether it's treatment for carpal tunnel syndrome or a broken leg. Without employees' compensation coverage, both you and your workers are left in a challenging scenario. Does workers' compensation secure versus employee suits? In many states, yes. Most workers' payment policies include company's liability insurance to secure your company if an injured worker submits a claim versus you for not preventing a workplace mishap.

Top Guidelines Of Arkansas Workers' Compensation InsuranceIn these states, workers' compensation policies are bought from monopolistic state funds, which do not use this protection. Insurer sell stop space coverage to safeguard you from employee claims. Does workers' payment aid cover fatal mishaps? Yes, many employees' payment policies include survivor benefit. These assist a departed worker's loved ones pay funeral service and burial expenses after a deadly office mishap.

Does employees' compensation cover staff members who contract COVID-19? It usually depends on where an employee contracted COVID-19 (the coronavirus). Workers' comp insurance coverage secures employees from on-the-job injuries and diseases. If a staff member agreements the coronavirus while working, then this policy needs to provide protection. For example, a nurse caring for sick clients or a grocery shop worker who deals straight with the general public would both have a stronger claim than an office worker.

Your state's laws might possibly assist cover costs associated with COVID-19. If you believe you may be qualified for a claim, contact your insurance agency's claims department. How much does employees' settlement insurance expense? This is based upon the typical cost of workers' comp insurance. 30% of Insureon's little organization customers pay less than $35 each month for this policy.