Tezos has some missing holes

ibankerI work in finance. Specifically I work at an investment bank. And more specifically I used to work in Morgan Stanley although I don't think I ever met Arthur Breitman there.

As a hobby I invest in cryptocurrencies and recently attended a Tezos meetup and it sounded interesting enough for me to invest in. I started asking around and looking up the founders history, and found someone named L.M. Goodman. Goodman is the author of the Tezos white paper and position paper who later left the project and handed it over to Arthur and his wife.

The pinned tweet from @l_m_goodman made last year says:

From now on, @ArthurB (my ideological doppelganger) will be leading development of #tezos.

But Arthur and his wife later told a reporter they came up with the L.M. Goodman pen name in order to poke fun at Leah McGrath Goodman, the reporter who claimed that one particular Satoshi Nakomoto was the real Satoshi Nakomoto. So L.M. Goodman was actually Arthur and Kathleen all along.

I would guess that the real reason why Arthur actually used the Goodman name was probably to create unique intellectual property without having to disclose it to Morgan Stanley, while employed at Morgan Stanley. I trade securities and am not a labor lawyer, but bank contracts are usually written such that employees and contractors like Arthur need to disclose projects that are related to their day job. And Arthur apparently worked on financial algorithms for trading systems. And Tezos, through its affiliate company, Dynamic Ledger Solutions (DLS), was originally pitched as trading system.

What is that?

DLS, my sources at other banks and companies who have seen the pitch, tried to raise money as one of those banker blockchains like Digital Asset or Paxos, but for OTC markets of some kind a year ago. Maybe Morgan Stanley probably could make the case that they have a claim to the DLS intellectual property assuming Arthur worked on it while employed at Morgan Stanley.

The founders seem to have good backgrounds but if you look at their history, you will find a couple other holes.

For example, Kathleen does not appear to stay at a company for more than a year. In media interviews this year she markets herself as an alumnus of the Wall Street Journal or Bridgewater. But according to her LinkedIn, she worked at each for less than a year.

And Arthur moved out to California and worked at Google but that does not appear on his LinkedIn profile.

One of his speaker profiles with Strange Loop states that he worked at Google on the self-driving car, but this is not on his LinkedIn or the current Tezos pitch deck. In her interview with Ether Review, Kathleen says that Arthur worked at Google on the X project. If he really worked at Google, does Google or Waymo also have some intellectual property claim on DLS and Tezos?

Maybe they are as smart as they claim, maybe these jobs and activities are unimportant. But before you invest your money into their project remember that their pitch deck says that some insiders have helped fund them and we know one of them is Tim Draper. Another person rumored to be involved is Marc Andreessen.

Why let Silicon Valley insiders benefit from your investment when you can invest in other projects on top of existing blockchains like Ethereum or Cosmos not run by Silicon Valley?

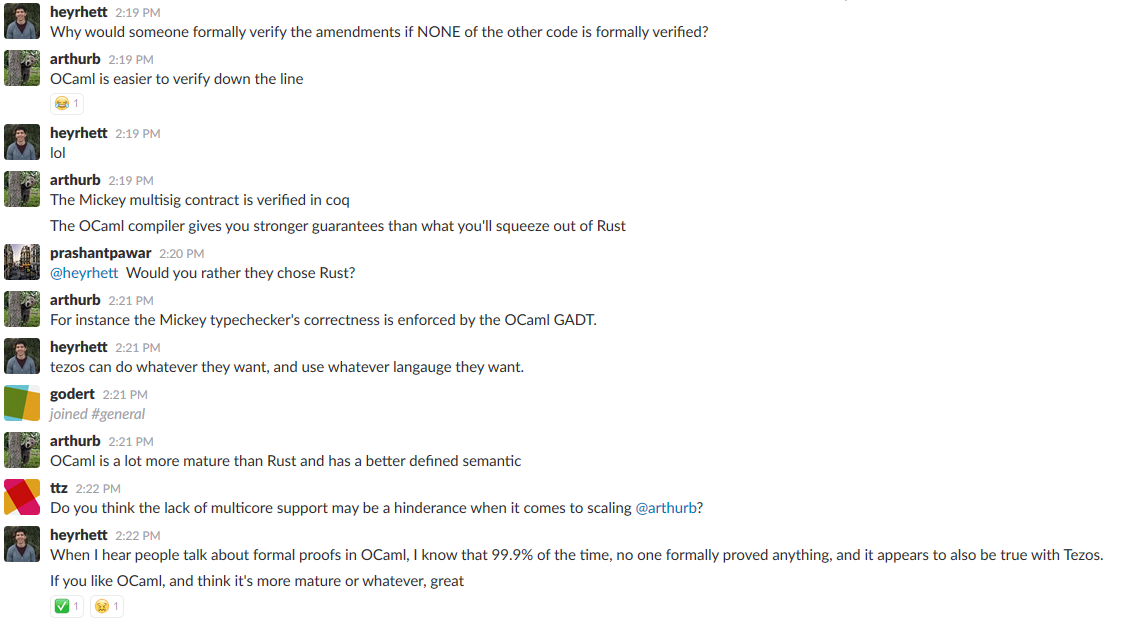

And lastly, they haven't actually formally verified their code even though they market their platform for being verified in the meetup I went to. But they admit that in their Slack room.

I like to invest in cryptocurrencies but I also like to know what I invest in. And these holes make me uncomfortable. I might still invest but only because of the hype and not because of the team.