Term Spread

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Term Spread

Word / Article

Starts with

Ends with

Text

For webmasters:

Free content

Linking

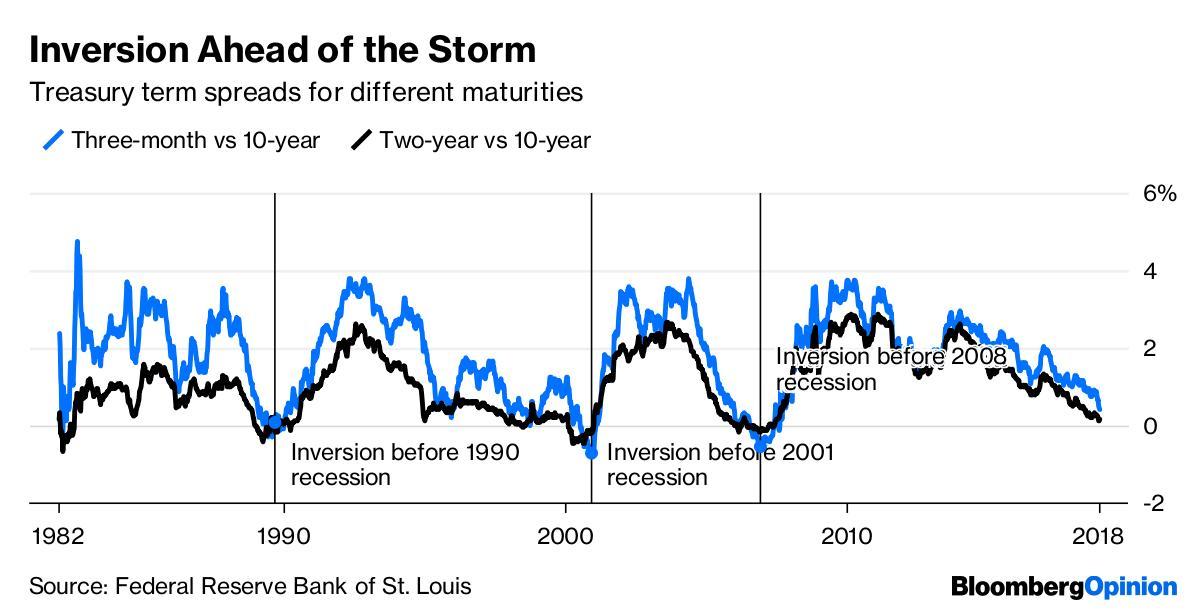

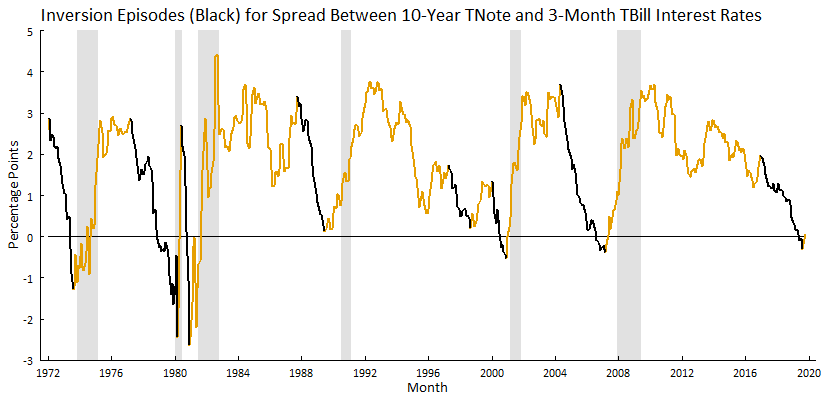

Lookup box

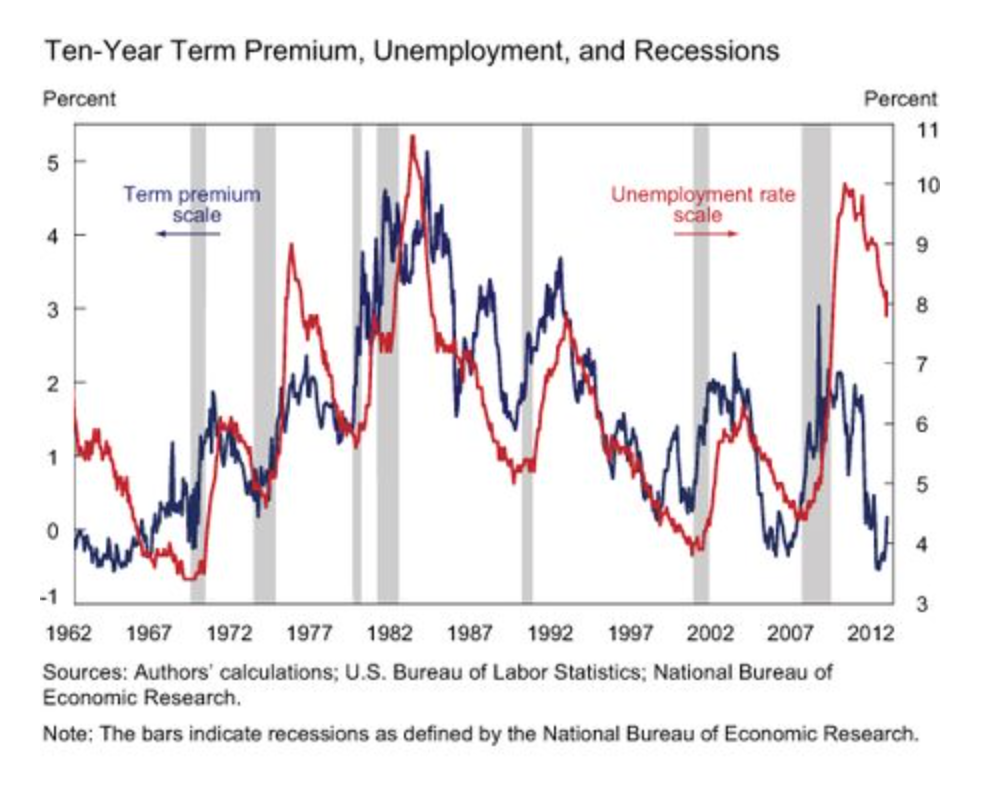

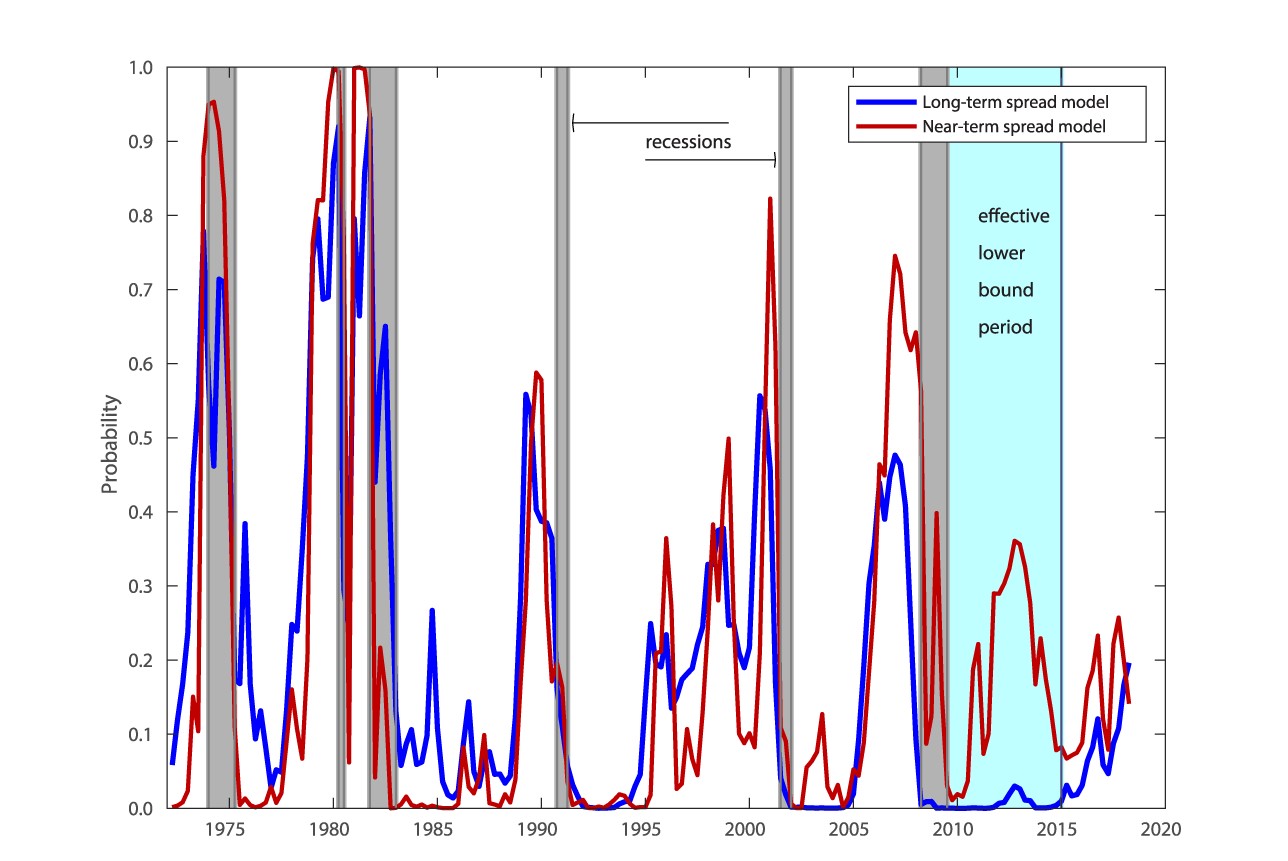

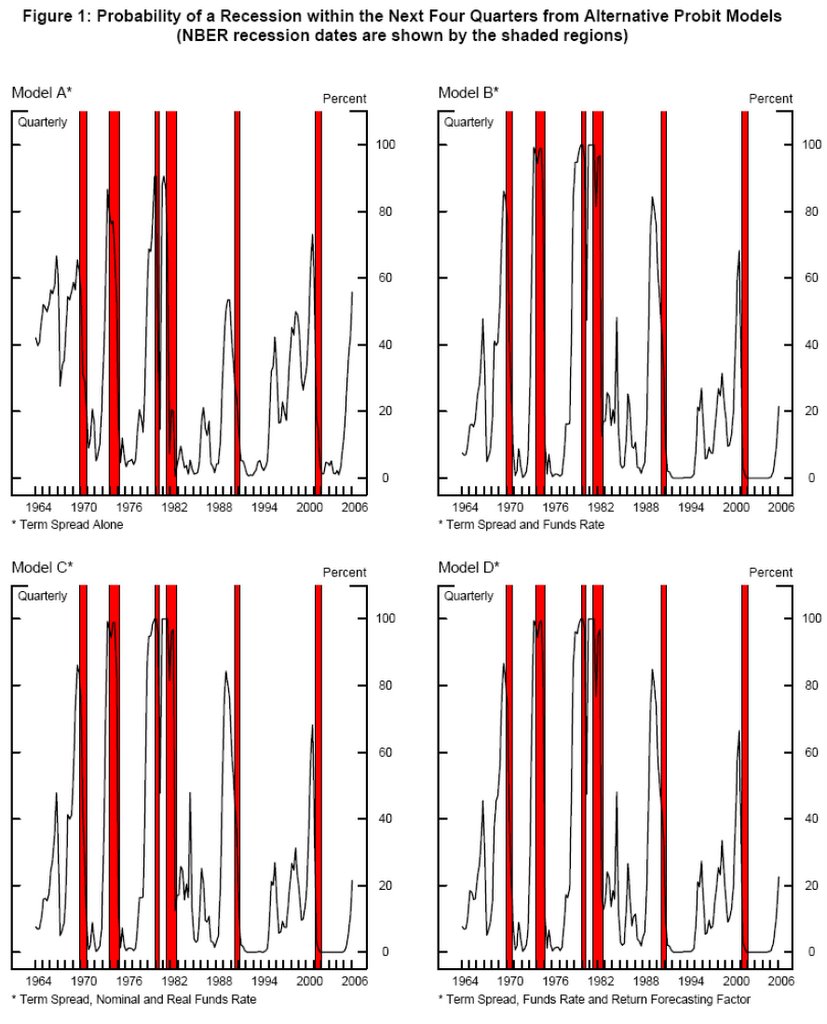

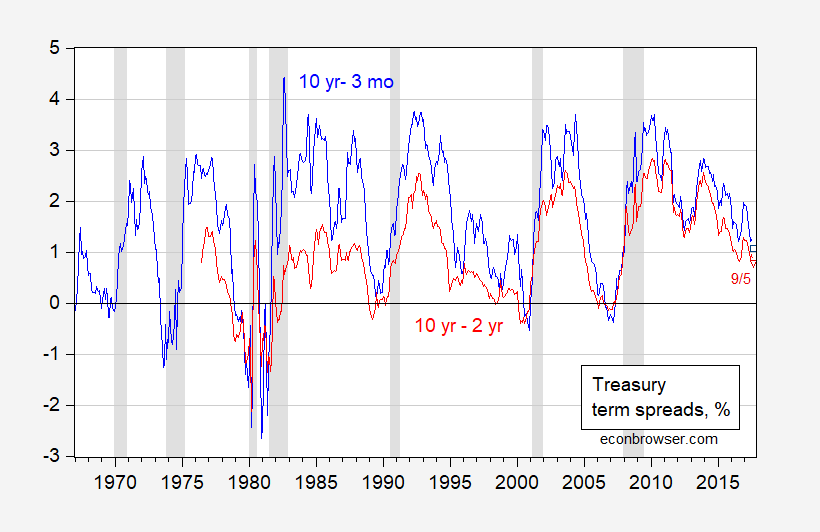

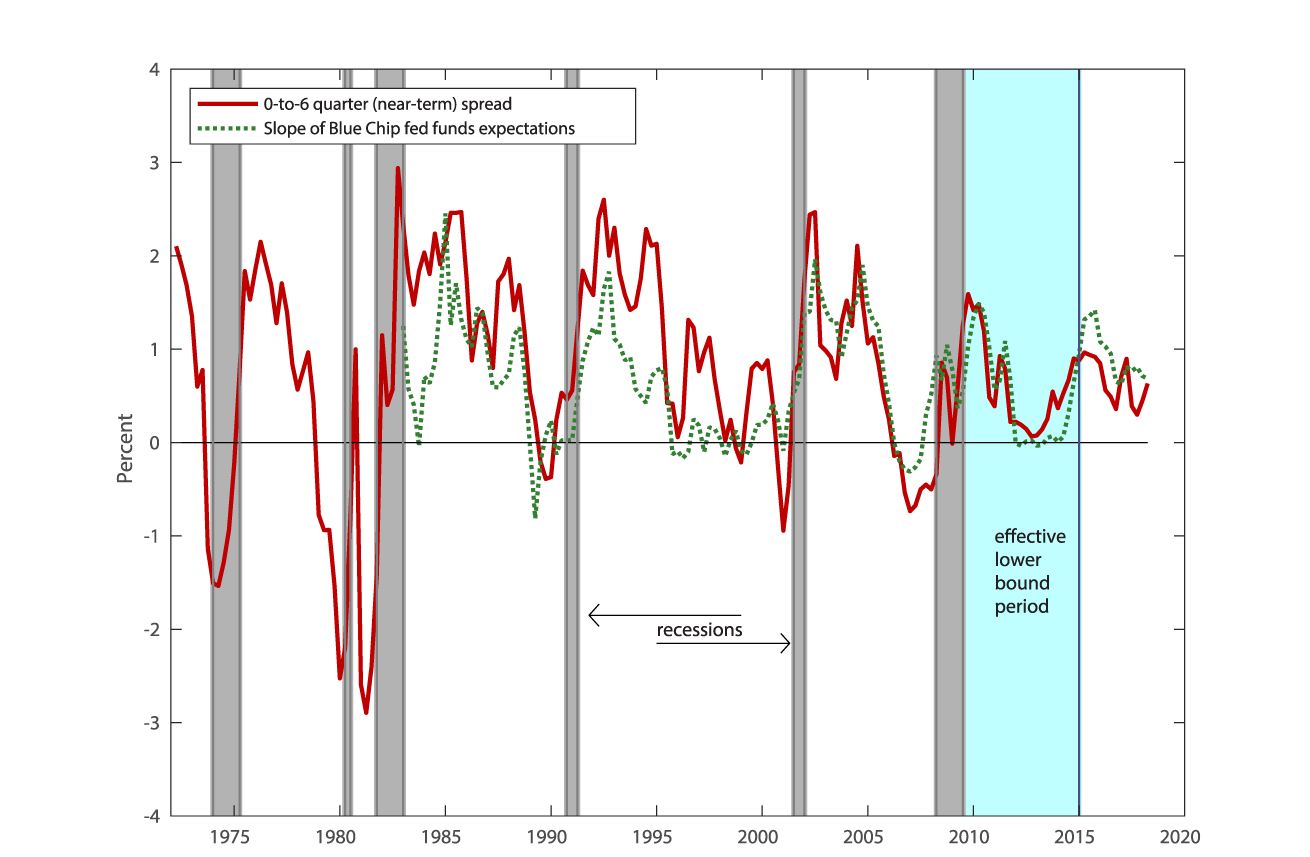

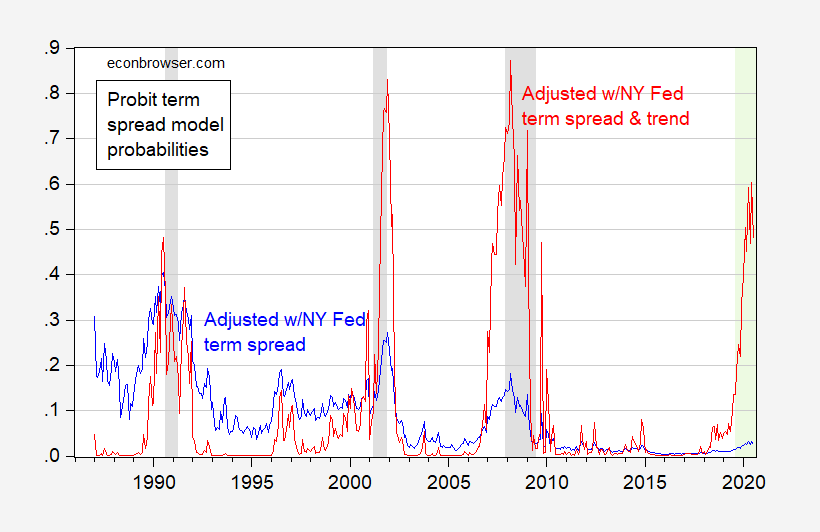

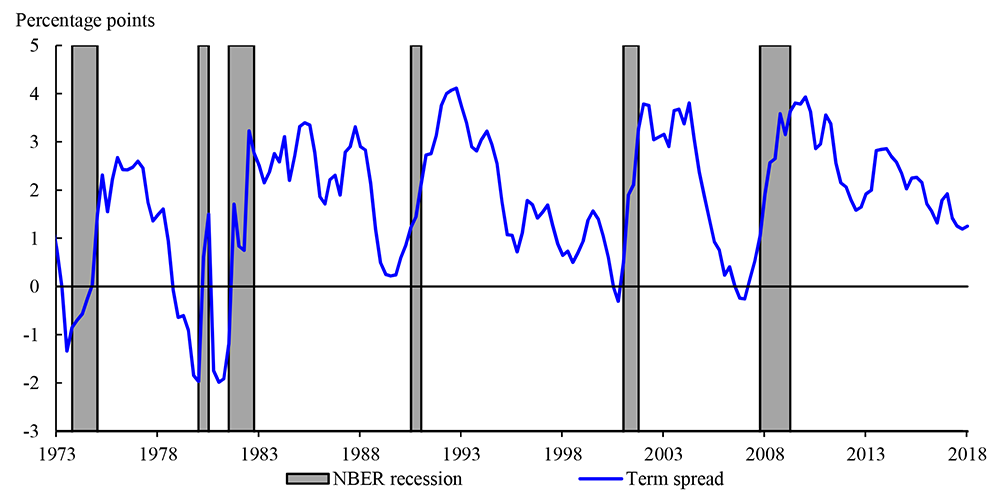

The graphic depiction of the relationship between the yield on bonds of the same credit quality but different maturities . Related: Term structure of interest rates . Harvey (1991) finds that the inversions of the yield curve (short-term rates greater than long term rates) have preceded the last five US recessions . The yield curve can accurately forecast the turning points of the business cycle.

Copyright © 2012, Campbell R. Harvey . All Rights Reserved.

A representation on a chart of the yields on bonds with identical credit ratings but different maturities . On the yield curve, the maturities are represented on the x-axis, and the yield is represented on the y-axis. That is, if the yield curve trends upward, it indicates that interest rates for long-term debt securities are higher than short-term debt securities; this is called a normal yield curve . A negative yield curve indicates that interest rates for short-term debt securities are higher, and a flat yield curve indicates that they are roughly the same. Yield curves are most commonly plotted with U.S. Treasuries with different maturities; this is used to predict future trends in interest rates .

Farlex Financial Dictionary. © 2012 Farlex, Inc. All Rights Reserved

At any particular time, the relation between bond yields and maturity lengths. The yield curve usually has a positive slope because yields on long-term bonds generally exceed yields on short-term bonds. The shape of a yield curve is influenced by a number of factors including the relative riskiness between long-term and short-term securities and by investors' expectations as to the level of future interest rates. Also called term structure of interest rates . See also expectations hypothesis , flat yield curve , negative yield curve , positive yield curve , riding the yield curve .

Case Study Long-term interest rates are generally higher than short-term rates, resulting in a yield curve that slopes upward. An upward-sloping yield curve was in place in fall 2001 when six-month Treasury bills were yielding 2% at the same time that 30-year Treasury bonds were selling to yield slightly over 5%. Despite the relatively steep slope of the curve, many bond traders were convinced the slope would grow even steeper. That is, they believed short-term interest rates would continue to fall at the same time long-term rates remained steady or moved upward. The Federal Reserve was actively pursuing an easy money policy to stimulate a weakening economy. The September 11 terrorist attacks on the World Trade Center and Pentagon accelerated the economic decline with major corporate layoffs, reductions in industrial output, and increased business bankruptcies. The attack also made it likely that the U.S. Treasury would increase spending, thereby borrowing more and selling more Treasury bonds. The increased borrowing would result in higher long-term interest rates and reduced prices for Treasury bonds. At least, that was the theory. In this environment many bond traders decided to take an investment position that allowed them to profit from a steeper yield curve. Traders took a bullish position (bought) in short-term Treasuries they thought would increase in price, and at the same time they assumed a bearish position (sold) in long-term Treasuries they thought would decline in price. This investment strategy came tumbling down on October 31, when the U.S. Treasury made a surprise announcement that it would quit selling 30-year bonds. The announcement caused a major price increase in these bonds that in a two-day period reduced yields from 5.25% to about 4.8%. What seemed a sure thing among sophisticated investors turned into a nightmare as a bearish bet on long-term Treasuries went bad for a reason none of the participants had foreseen.

Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor by David L. Scott. Copyright © 2003 by Houghton Mifflin Company. Published by Houghton Mifflin Company. All rights reserved. All rights reserved.

Dictionary of Financial Terms. Copyright © 2008 Lightbulb Press, Inc. All Rights Reserved.

Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005

References in periodicals archive

?

Site:

Follow:

Rss

Share:

Mobile Apps

Apple

Android

Kindle

Windows

Windows Phone

For surfers:

Free toolbar & extensions

Word of the Day

Bookmark

Word Finder

Help

For webmasters:

Free content

Linking

Lookup box

Terms of Use

Privacy policy

Feedback

Advertise with Us

Copyright © 2003-2021 Farlex, Inc

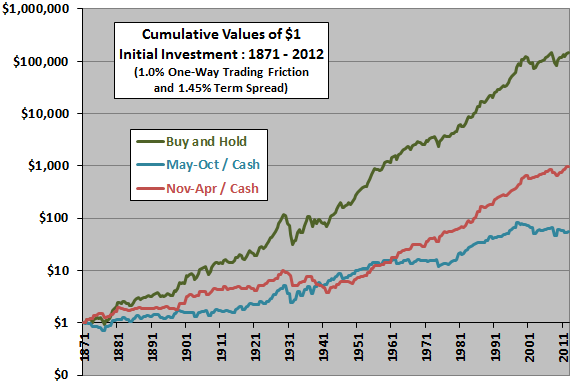

A yield curve shows the relationship between the yields on short-term and long-term bonds of the same investment quality.

Since long-term yields are characteristically higher than short-term yields, a yield curve that confirms that expectation is described as positive. In contrast, a negative yield curve occurs when short-term yields are higher.

A flat or level yield curve occurs when the yields are substantially the same on bonds with varying terms.

A negative yield curve has generally been considered a warning sign that the economy is slowing and that a recession is likely.

All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

Understanding Term Spreads or Interest Rate Spreads

Term spreads financial definition of Term spreads

Spread Definition

Term Spread Trade Definition | Forexpedia by BabyPips.com

(PDF) Liquidity, Term Spreads and Monetary Policy

In finance, a spread refers to the difference between two prices, rates or yields One of the most common types is the bid-ask spread, which refers to the gap between the bid (from buyers) and the ask (from sellers) prices of a security or asset Spread can also refer to the difference in a trading position – the gap between a short position (that is, selling) in one futures contract or currency and a long position (that is, buying) in another

A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market.

A yield spread is the net difference between two interest bearing instruments, expressed in terms of percent or basis points (bps).

An intermarket spread involves purchasing long futures in one market and selling short futures of a related commodity with the same expiration.

Slippage refers to the discrepancy between the expected price of a trade and the price at which the trade is executed.

The London Interbank Bid Rate is the average interest rate at which major London banks bid for eurocurrency deposits from other banks in the interbank market.

A futures spread is an arbitrage technique in which a trader takes two positions on a commodity to capitalize on a discrepancy in price.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

A spread can have several meanings in finance. Basically, however, they all refer to the difference between two prices, rates or yields .

In one of the most common definitions, the spread is the gap between the bid and the ask prices of a security or asset, like a stock, bond or commodity. This is known as a bid-ask spread.

Spread can also refer to the difference in a trading position – the gap between a short position (that is, selling) in one futures contract or currency and a long position (that is, buying) in another. This is officially known as a spread trade.

In underwriting , the spread can mean the difference between the amount paid to the issuer of a security and the price paid by the investor for that security—that is, the cost an underwriter pays to buy an issue, compared to the price at which the underwriter sells it to the public.

In lending, the spread can also refer to the price a borrower pays above a benchmark yield to get a loan. If the prime interest rate is 3%, for example and a borrower gets a mortgage charging a 5% rate, the spread is 2%.

The bid-ask spread is also known as the bid-offer spread and buy-sell. This sort of asset spread is influenced by a number of factors:

For securities like futures contracts , options, currency pairs and stocks, the bid-offer spread is the difference between the prices given for an immediate order – the ask – and an immediate sale – the bid. For a stock option , the spread would be the difference between the strike price and the market value .

One of the uses of the bid-ask spread is to measure the liquidity of the market and the size of the transaction cost of the stock. For example, on Jan. 8, 2019 the bid price for Alphabet Inc., Google's parent company, was $1,073.60 and the ask price was $1,074.41. The spread is 80 cents, or $.80. This indicates that Alphabet is a highly liquid stock, with considerable trading volume.

The spread trade is also called the relative value trade. Spread trades are the act of purchasing one security and selling another related security as a unit. Usually, spread trades are done with options or futures contracts. These trades are executed to produce an overall net trade with a positive value called the spread.

Spreads are priced as a unit or as pairs in future exchanges to ensure the simultaneous buying and selling of a security. Doing so eliminates execution risk wherein one part of the pair executes but another part fails.

The yield spread is also called the credit spread . The yield spread shows the difference between the quoted rates of return between two different investment vehicles. These vehicles usually differ regarding credit quality .

Some analysts refer to the yield spread as the “yield spread of X over Y.” This is usually the yearly percentage return on investment of one financial instrument minus the annual percentage return on investment of another.

To discount a security’s price and match it to the current market price, the yield spread must be added to a benchmark yield curve . This adjusted price is called option-adjusted spread . This is usually used for mortgage-backed securities (MBS), bonds, interest rate derivatives and options.

For securities with cash flows that are separate from future interest rate movements, the option-adjusted spread becomes the same as the Z-spread.

The Z-spread is also called the Z SPRD, yield curve spread and zero-volatility spread . The Z-spread is used for mortgage-backed securities. It is the spread that results from zero-coupon treasury yield curves which are needed for discounting pre-determined cash flow schedule to reach its current market price. This kind of spread is also used in credit default swaps (CDS) to measure credit spread.

Advanced Trading Strategies & Instruments

Chaturbate Private Video

Lesbian Pee Video

Nasty Orgy

Hyperline Ftp4 C5e Solid Outdoor

Cute But Deadly Overwatch

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)