Tennessee Vs Mizzu Betting Spread

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Tennessee Vs Mizzu Betting Spread

Posted By Staff on January 23, 2021

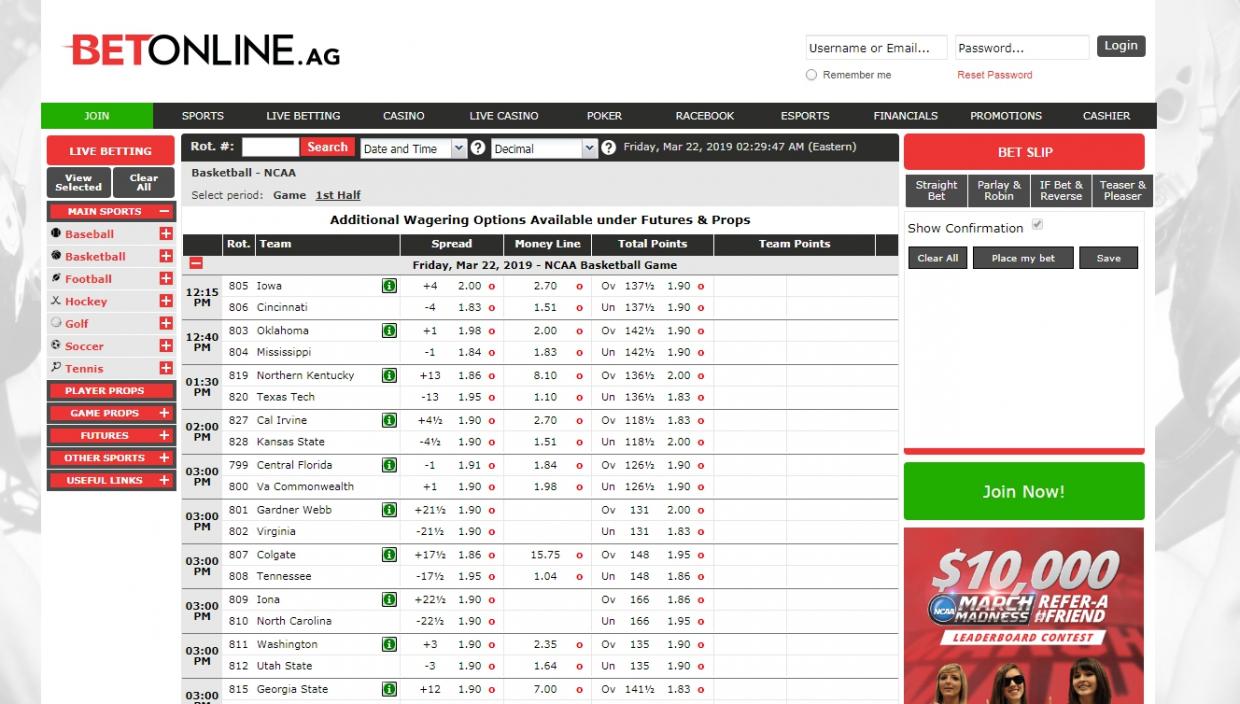

The No. 6 Tennessee Volunteers (10-2) host the No. 19 Missouri Tigers (9-2) in a matchup of SEC teams at Thompson-Boling Arena, tipping off at 8:30 PM ET on Saturday, January 23, 2021. The Tigers are 7-point underdogs in the game, the second matchup between the squads this season. The matchup’s over/under is set at 130.5.

The betting insights in this article reflect betting data from DraftKings as of January 23, 2021, 2:18 AM ET. See table below for current betting odds and CLICK HERE to bet at DraftKings Sportsbook .

Against the Spread (ATS) records are only reflective of games that had odds on them.

Against the Spread (ATS) records are only reflective of games that had odds on them.

Powered By Data Skrive using data from

Bet with your head, not over it. Call 1-800-GAMBLER if you have a gambling problem.

21+: TheLines.com and all content herein is intended for audiences 21 years and older.

Spread betting - Wikipedia

Tennessee vs Missouri: NCAA Basketball Betting Odds & Trends | 1/23/2021

Spread Betting vs CFD Trading: Key Differences | IG UK

2020 Gator Bowl odds, line, spread : Tennessee vs . Indiana picks, optimal...

What Is Spread Betting ? | A Stock Market Trade Versus a Spread Bet

No capital gains tax 1

No commission, just our spread

Easy to bet in the currency of your choice – greater control of currency exposure

Deal on rising and falling markets

Leveraged access to the markets

No stamp duty

24-hour dealing

Use prices based on the underlying market

Direct market access (DMA) on forex 2 and shares

Losses can be offset against profits for tax purposes

Deal on rising and falling markets

Leveraged access to the markets

No stamp duty

24-hour dealing

Use prices based on the underlying market

Derivative product differences in detail

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread bets and contracts for difference (CFDs) are both leveraged products – enabling you to open a position while putting up just a percentage of the capital. Though they share many benefits, there are key advantages unique to each.

Call 0800 195 3100 or email newaccounts.uk@ig.com to talk about opening a trading account. We’re here 24 hours a day, from 8am Saturday to 10pm Friday.

The key difference between spread betting and CFD trading is how they are taxed. Spread bets are free from capital gains tax, while profits from CFDs can be offset against losses for tax purposes. There’s no stamp duty to pay with either product because you don’t take ownership of the underlying assets when you trade.

Both enable you to go long or short, though there are technical differences in how they work:

All spread bets have a fixed expiry date, while CFDs don’t expire (with the exception of futures). Professional traders can get DMA on forex and shares with a CFD trading account. 2

Learn about the advantages of spread betting and CFD trading – and see how you can get started – with IG Academy’s online course.

If you’re experienced in the financial markets, both spread betting and CFD trading can bring variety and range to your portfolio. You can see a full comparison in the table below.

The below example takes a short position on the FTSE 100 – using the same deal size, it compares the process and outcome of a spread bet and a CFD trade if the market falls as predicted.

The profit and net loss for placing this trade via spread bet or CFD is the same.

However, while spread bets are tax-free and you keep all your profit, CFDs can be subject to capital gains tax, depending on individual circumstance.

Because CFDs are subject to tax, you can offset losses you make via CFD as a tax deduction.

* Please note that tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

The below example demonstrates the differences between a spread bet and CFD trade on a long GBP/USD position, showing the outcome if the market rises as expected.

Find more examples of spread betting and CFDs .

Daily funded bets (DFBs) are long-term bets on the cash price of an underlying instrument. DFBs have no expiry date, so we make a cash adjustment to your account to reflect funding charges.

This makes no difference to the price you deal at or your potential profit or loss: it simply makes it easier to track per point movements.

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade on the move with our natively designed, award-winning trading app

With 45 years' experience, we’re proud to offer a truly market-leading service

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade on the move with our natively designed, award-winning trading app

With 45 years' experience, we’re proud to offer a truly market-leading service

Log in to your account now to access today’s opportunity in a huge range of markets.

Browser-based desktop trading and native apps for all devices

We're clear about our charges, so you always know what fees you will incur

See how we've been changing the face of trading for more than 40 years

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 From 2 July 2018, regulatory interventions mean that certain products are unavailable to retail traders. As a result, we can only offer Forex Direct (forex DMA) to professional traders. To find out more about this, and to check whether you are eligible for a professional account, please see our professional account page.

3 Options are only available via spread betting accounts and professional CFD accounts.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

The placing of a bet that allows for a range of outcomes.

Trading a financial derivative – you deal on prices derived from the underlying market, not on the underlying market itself.

No expiry dates (excluding forwards).

You don’t pay capital gains tax or stamp duty. 1

You don’t pay stamp duty, but you do pay capital gains tax. However, losses can be offset as a tax deduction.

24-hour dealing on forex and major stock indices. During the underlying market hours for other markets. We also offer weekend trading on selected markets.

24-hour trading on forex and major stock indices. During the underlying market hours for other markets. We also offer weekend trading on selected markets.

Overnight funding on daily funded bets. Rollovers on forwards and futures.

Overnight funding on all markets, except futures. Rollovers on futures.

We profit primarily from spreads and funding, and hedge the majority of net client exposure. We accept a low level of risk, from which we can make a small profit or loss.

We profit primarily from commission, spreads and funding, and hedge the majority of net client exposure. We accept a low level of market risk, from which we can make a small profit or loss. The outcome of a client’s DMA 2 trade never has an impact on our profit or loss.

What kind of trading is it suitable for?

We make a dividend adjustment on equity and stock index spread bets.

We make a dividend adjustment on equity and stock index CFDs.

Yes, but CFDs can be more effective because of their tax-deductible benefits.

More than 17,000 markets, including: Forex Stock indices Shares ETFs and ETCs Metals Energies Spot metals Soft commodities Options 3 Interest rates Bonds Sectors Share forwards Forex forwards Daily stock index futures Stock index futures Daily oil futures

More than 17,000 markets, including: Forex Stock indices Shares DMA forex 2 DMA shares ETFs and ETCs Metals Energies Spot metals Soft commodities Options 3 Interest rates Bonds Sectors Stock index futures

You define the size of your deal by selecting the amount you want to bet per point of movement (£/pt). Profits and losses realised in currency you bet in.

You define the size of your deal by selecting the number of contracts or shares you want to trade. Each contract has a fixed value. Profits and losses realised in traded market’s base currency. GBP contracts available.

A spread on all markets. No commission. Funding adjustments (excluding futures and forwards).

A spread on all markets except shares. We charge a commission on share CFDs, but no spread. Funding adjustments (excluding futures).

Desktop dealing Mobile app (iPhone, Android) Tablet app (iPad) MetaTrader 4 ProRealTime

Desktop dealing Mobile app (iPhone, Android) Tablet app (iPad) L2 Dealer (DMA) 2 MetaTrader 4 ProRealTime

Introduction programme Interactive platform preview Demo account

Introduction programme Interactive platform preview Demo account

One contract. Each contract is worth £10 per point

£3100 Deal size x mid price x margin rate (5%)

£3100 Deal size x mid price x margin rate (currently 5%)

The market falls to 6150 by 10pm. This is the price our funding is calculated at. It continues to fall steadily until the next day, reaching 6120.

Overnight funding charge of £3.38 (One-month Libor (eg 0.4925%) minus 2.5% x value of deal x underlying level at 10pm) / 365 (-2.0075% x £10 x 6150) / 365

Overnight funding charge of £3.38 (One-month Libor (eg 0.4925%) minus 2.5% x value of deal x underlying level at 10pm) / 365 (-2.0075% x £10 x 6150) / 365

Overall market movement and profit/loss

6199.5 – 6120.5 = 79 Value of one point = £10 Gross profit = 79 x £10 = £790

6199.5 – 6120.5 = 79 Value of one point = £10 Gross profit = 79 x £10 = £790

1 pt spread: the underlying fell by 80 pts, but you benefited from a fall of 79. Funding deducted from cash balance: £3.38

1 pt spread: the underlying fell by 80 pts, but you benefited from a fall of 79. Funding deducted from cash balance: £3.38

If the underlying market rose to 6280 pts instead: 6280.5 – 6199.5 = 81 pts 81 x £10 + £3.44 (higher funding cost to account for higher market close at 10pm) £813.44 net loss

If the underlying market rose to 6280 pts instead: 6280.5 – 6199.5 = 81 pts 81 x £10 + £3.44 (higher funding cost to account for higher market close at 10pm) £813.44 net loss

Buy 1 contract at 1.55805 (1 contract = £100,000)

Notional value is $155,805 (or £100,000) and margin factor is 3.33%, so margin = $5188.3 (or £3330)

GBP/USD rallies overnight, and the position is held through 22:00 (London time)

Funding = amount per point x funding adjustment factor= $10 x 0.27 = $2.70 Where funding adjustment includes underlying tom-next rate and IG's charge for holding positions overnight which is no more than 0.0022% per day.

Funding = amount per point x funding adjustment factor = $10 x 0.05 = $0.50 Where funding adjustment includes underlying tom-next rate and IG's charge for holding positions overnight which is no more than 0.0022% per day.

$1145 15,695 – 15,580.5 = 114.5 Value per point = $10 114.5 x $10 = $1145

$1145 1.5695 – 1.55805 = 0.01145 Number of points = 0.01145 x 100000 = 114.5 114.5 x 10 = $1145

0.8 point IG spread (included) Funding cost = $2.70

0.8 point IG spread (included) Funding cost = $0.50

If the market dropped 114.5 points instead: $1145 + $2.70

Net loss = $1147.70

If the market dropped 114.5 points instead: $1145 + $0.50

Net loss = $1145.50

Russian Nudists

Sensual Ally

Chubby Outdoor Nude

Atk Spread

Sex Secretary Skachat

/cdn.vox-cdn.com/uploads/chorus_image/image/50894109/usa-today-9544890.0.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/56926643/usa_today_10317384.1506797466.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/66843064/usa_today_13874706.0.jpg)