Swap Spread

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Swap Spread

The difference between the swap rate and the yield on the government bond with a similar maturity

We and selected partners, use cookies or similar technologies as specified in the cookie policy . With respect to advertising, we and selected third parties , may use precise geolocation data and actively scan device characteristics for identification in order to store and/or access information on a device and process personal data (e.g. browsing data, IP addresses, usage data or unique identifiers) for the following purposes: personalised ads and content, ad and content measurement, and audience insights; develop and improve products . You can freely give, deny, or withdraw your consent at any time by accessing the advertising preferences panel . You can consent to the use of such technologies by closing this notice.

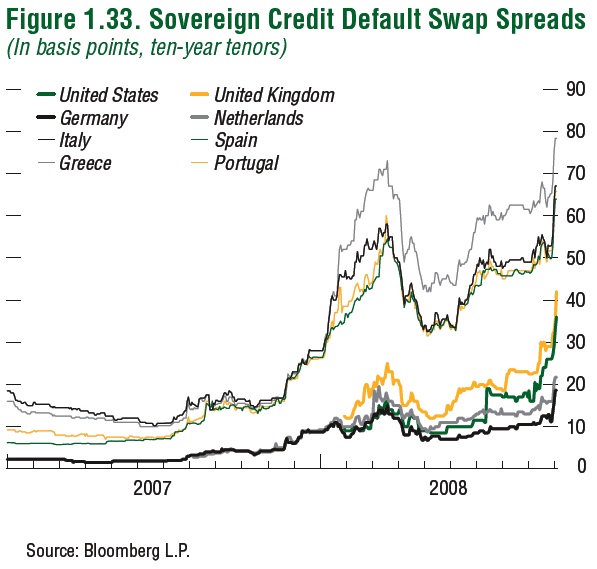

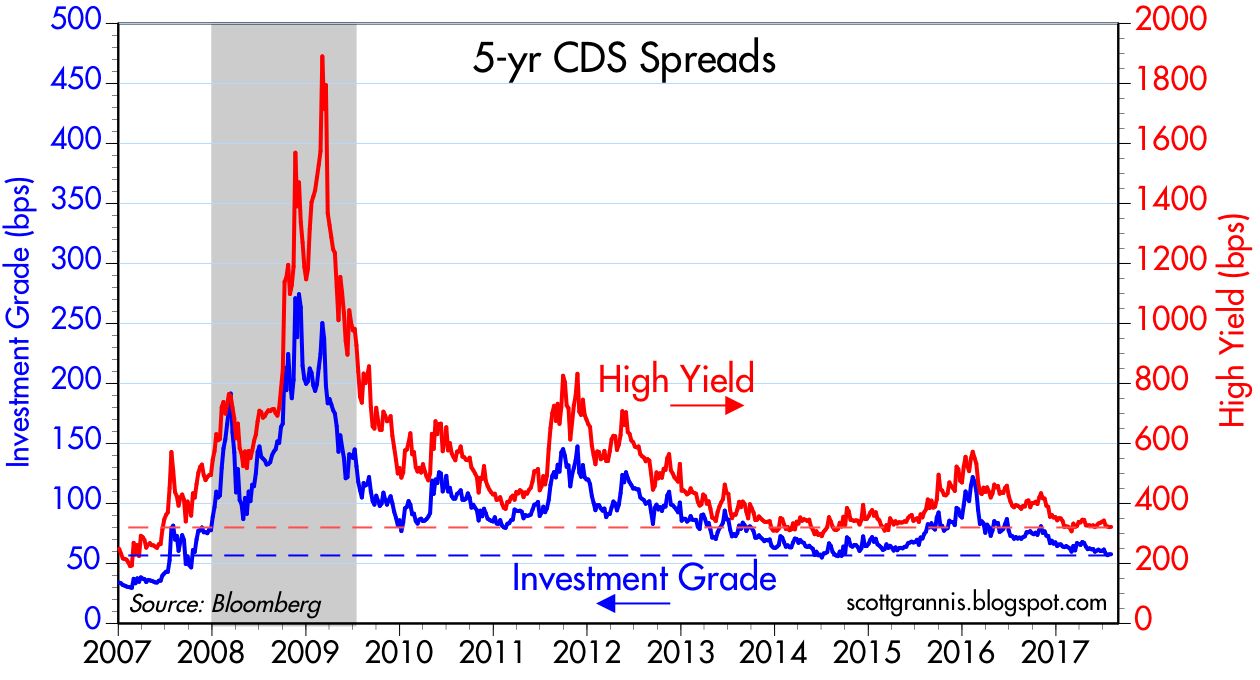

The swap spread is the difference between the swap rate (the rate of the fixed leg of a swap) and the yield on the government bond with a similar maturity. Since government bonds (e.g., US Treasury securities Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument that is issued by the US Treasury with maturity periods ranging from a few days up to 52 weeks (one year). They are considered among the safest investments since they are backed by the full faith and credit of the United States Government. ) are considered risk-free securities, swap spreads typically reflect the risk levels perceived by the parties involved in a swap agreement. Swaps are frequently quoted as the swap spread (another option is the swap rate).

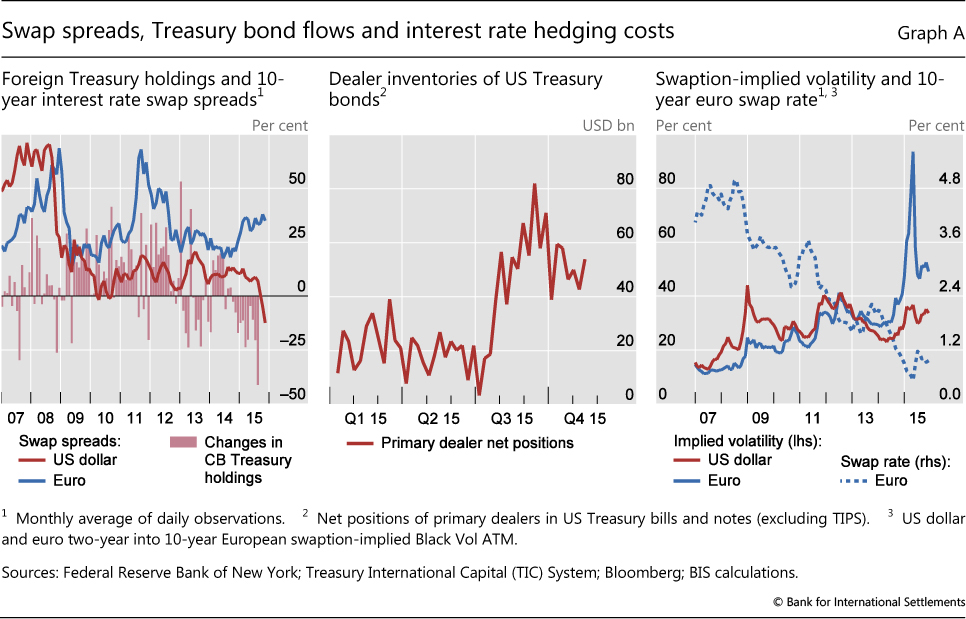

The swap spreads of interest rate swaps Interest Rate Swap An interest rate swap is a derivative contract through which two counterparties agree to exchange one stream of future interest payments for another are considered typical indicators of market risk and a measure of the risk aversion prevalent in the market. Swap spreads are commonly used by economists in assessing current market conditions .

Large positive swap spreads generally indicate that a greater number of market participants are willing to swap their risk exposures. As the number of counterparties willing to hedge their risk exposures increase, the larger the amounts of money that parties are keen to spend to enter swap agreements. Such a trend generally reveals strong risk aversion among the market participants, Key Players in the Capital Markets In this article, we provide a general overview of the key players and their respective roles in the capital markets. The capital markets consist of two types of markets: primary and secondary. This guide will provide an overview of all the major companies and careers across the capital markets. which can be caused by a high level of systematic risk in the market.

Additionally, large spreads may signify reduced liquidity in the market. This is generally caused by the greater portion of capital employed in the swap deals.

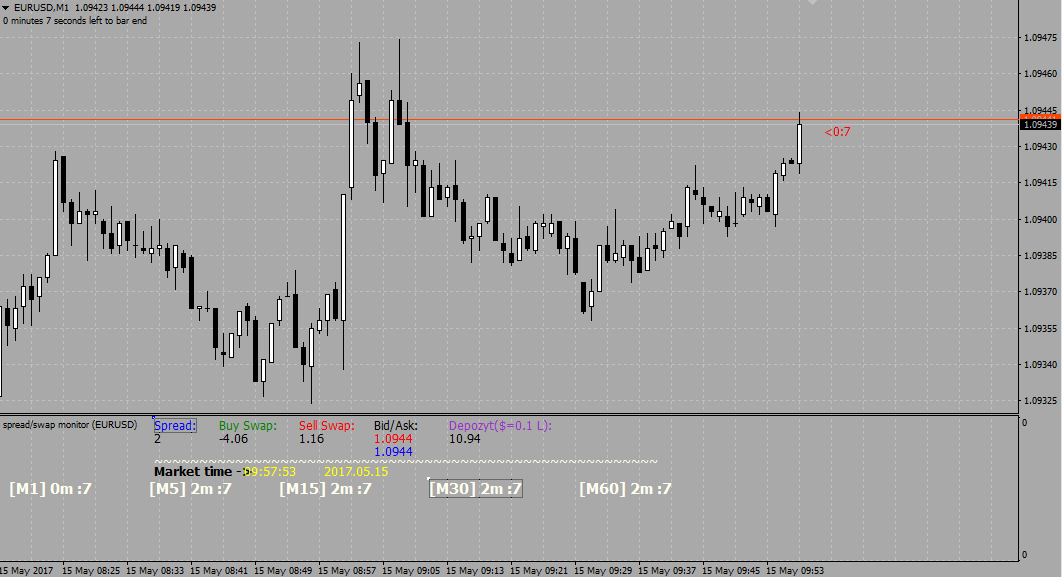

ABC Corp. enters into an interest rate swap agreement with XYZ Corp. It is a 3-year interest rate swap in which ABC Corp. (the payer) must pay a 3% fixed interest rate, while XYZ Corp. (the receiver) must pay the floating interest rate that equals 1-year LIBOR LIBOR LIBOR, which is an acronym of London Interbank Offer Rate, refers to the interest rate that UK banks charge other financial institutions for . The current 3-year yield on the default-free government bond is 1.5%.

In order to calculate the spread of the swap, we need to determine its swap rate. According to the definition, the swap rate is the fixed rate of the swap. Thus, the swap rate of the swap contract between ABC Corp. and XYZ Corp. is 3%, which represents the swap’s fixed rate.

Therefore, the swap spread, which is the difference between the swap rate and the yield on a government bond with a similar maturity, is calculated using the following formula:

CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)™ FMVA® Certification Join 350,600+ students who work for companies like Amazon, J.P. Morgan, and Ferrari certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

Get world-class financial training with CFI’s online certified financial analyst training program FMVA® Certification Join 350,600+ students who work for companies like Amazon, J.P. Morgan, and Ferrari !

Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Learn financial modeling and valuation in Excel the easy way , with step-by-step training.

Swap spread - Wikipedia

Swap Spread - Definition, Market Risk, and Example

Swap spread — Wikipedia Republished // WIKI 2

What is Swap spread | Capital.com

Swap Spreads For Dummies? | Seeking Alpha

This page was last edited on 18 March 2020, at 18:57

Basis of this page is in Wikipedia . Text is available under the CC BY-SA 3.0 Unported License . Non-text media are available under their specified licenses. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc. WIKI 2 is an independent company and has no affiliation with Wikimedia Foundation.

To install click the Add extension button. That's it.

The source code for the WIKI 2 extension is being checked by specialists of the Mozilla Foundation, Google, and Apple. You could also do it yourself at any point in time.

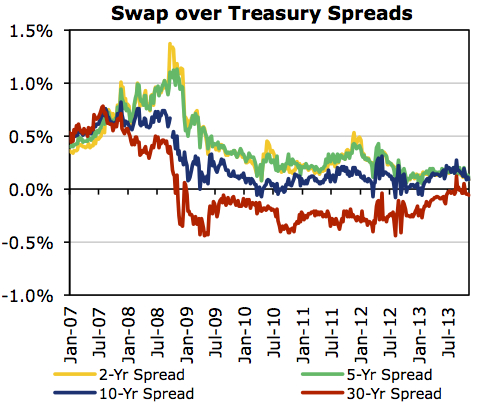

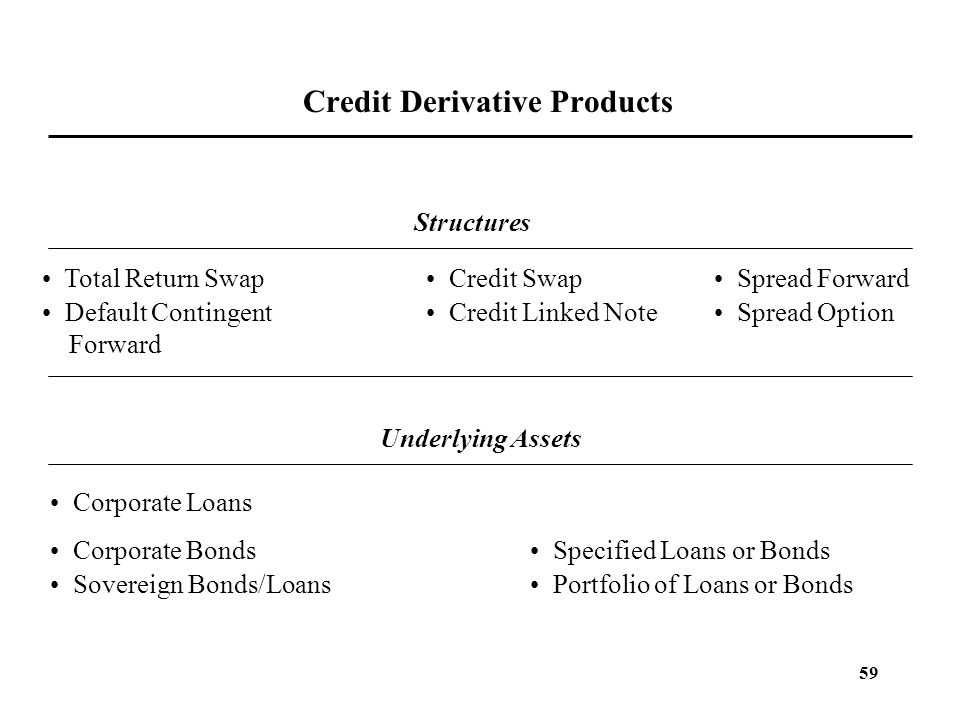

Swap spreads are the difference between the swap rate (a fixed interest rate) and a corresponding government bond yield with the same maturity ( Treasury securities in the case of the United States). [1] [2]

For example, if the current market rate for a 5-year swap is 1.35 percent and the current yield on the 5-year Treasury note is 1.33 percent, the 5-year swap spread would be 0.02 percentage points, or 2 basis points. [3] [4]

Often, fixed income prices will be quoted in "SWAPS +", wherein the swap rate is added to a given number of basis points. The swap rate there is simply the yield on an equal-maturity Treasury plus the swap spread.

Swap spread became a popular indication of credit spread in Europe during the 1990s.

Sex Oral Ru

Candid Hd Nudists Hd Forum

Solo Video Girls 18

Photo Playboy Lingerie

Ahegao Overwatch