Submission Id

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

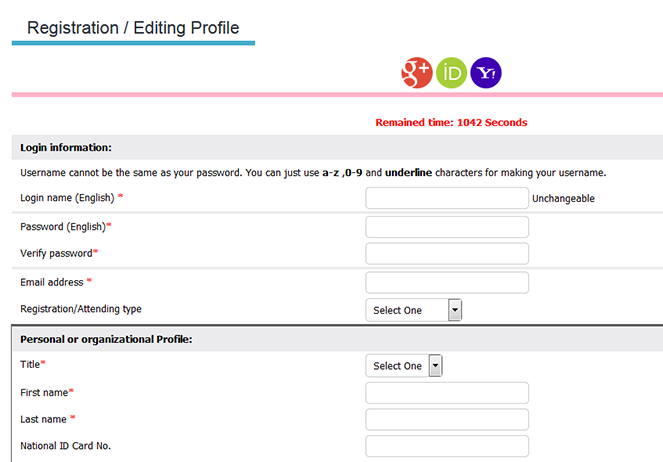

What is a Submission ID (SID), where do I find it, and how can I create a report showing SIDs?

The submission ID is a 20-character string that identifies a MeF e-file submission. It is created when you transmit your return to the IRS or to a state DOR through Drake. When the return is accepted and the acknowledgement processed, the SID becomes part of your local EF database.

Yes, however, the SID is not available before a return is accepted. Beginning in Drake15, the full SID is displayed on Forms 8878, 8879 and 9325, after an acceptance acknowledgement is processed. On Form 9325, the DCN also is displayed if the transmission is for a 4868. In a business return, the SID is displayed on the EF_ACK page.

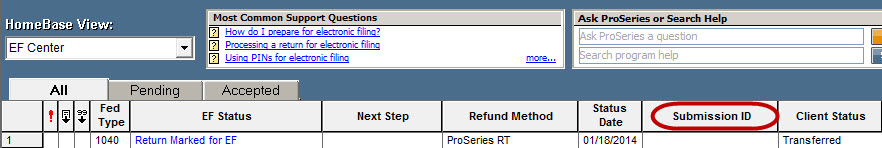

Where else can I find the SID for a return?

You can find the submission ID for a return -

Federal acceptance and rejection acknowledgements for the same return, and for extensions, have different submission IDs. Look for the ID associated with the return transmission that was accepted.

A submission ID looks like "11111120140358a56rfn".

"Submission ID - A globally unique 20 digit number assigned to electronically filed tax returns with the following format: (EFIN + ccyyddd + 7-digit alphanumeric sequence number)."

("Ccyyddd", a Julian date format, refers to the century, the year, and the day of the year. See Related Links below for a Julian Date Calendar.)

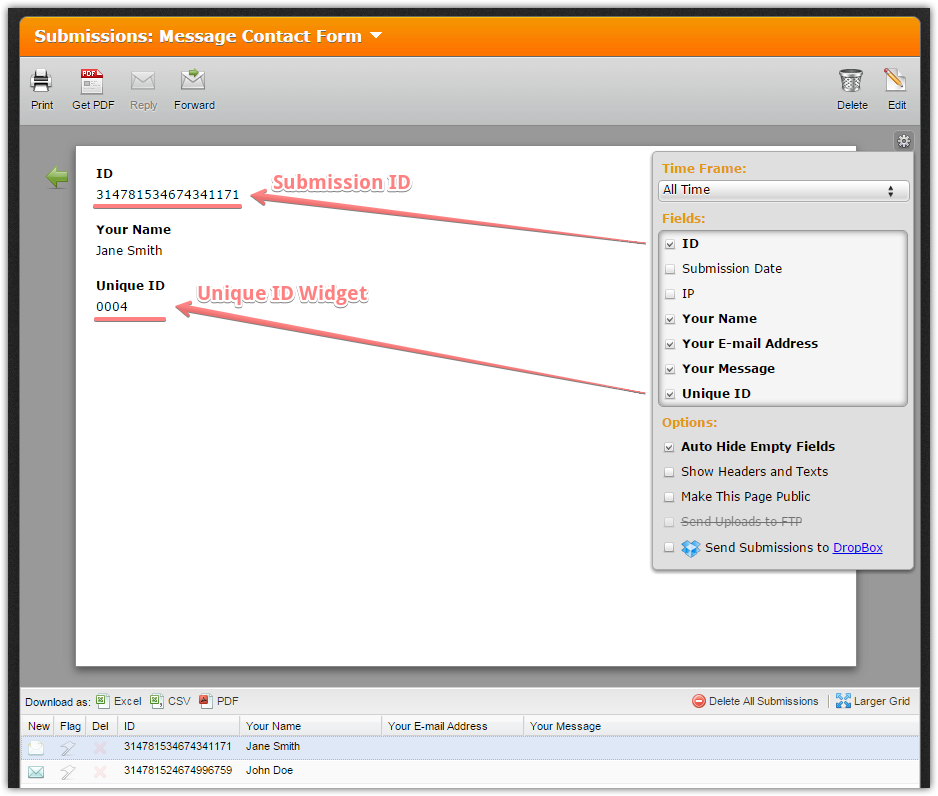

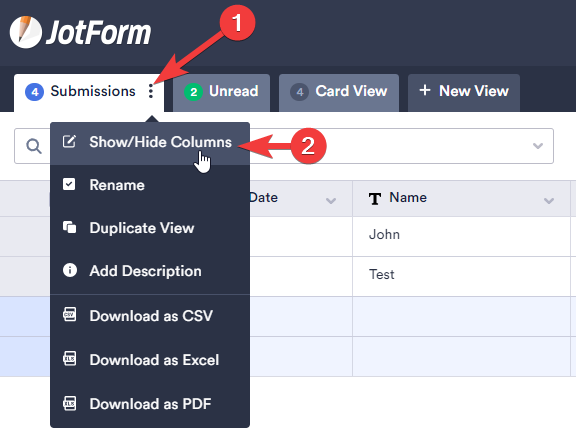

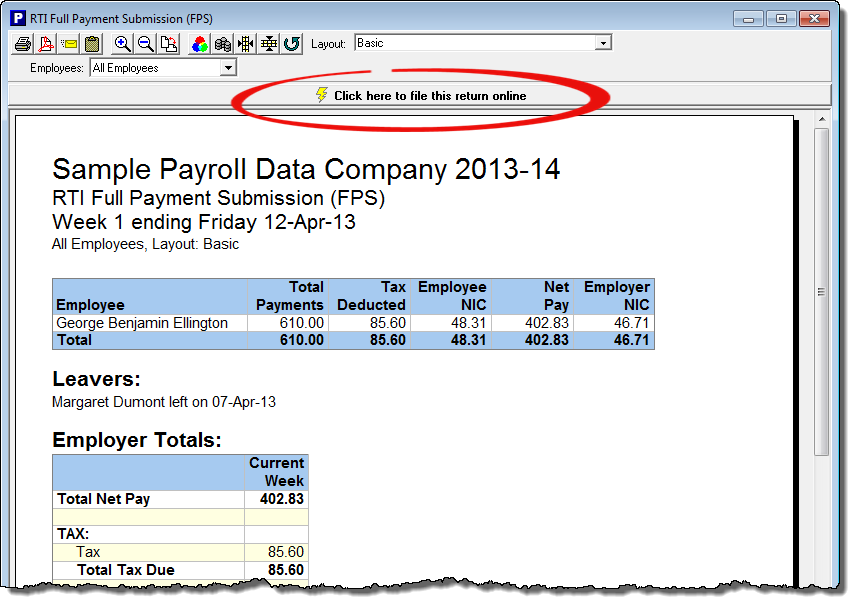

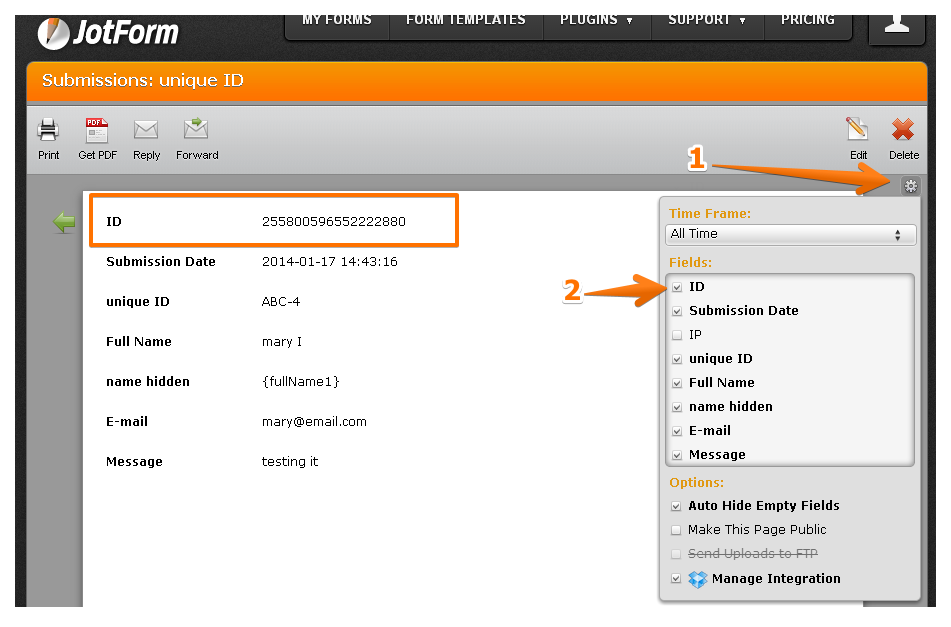

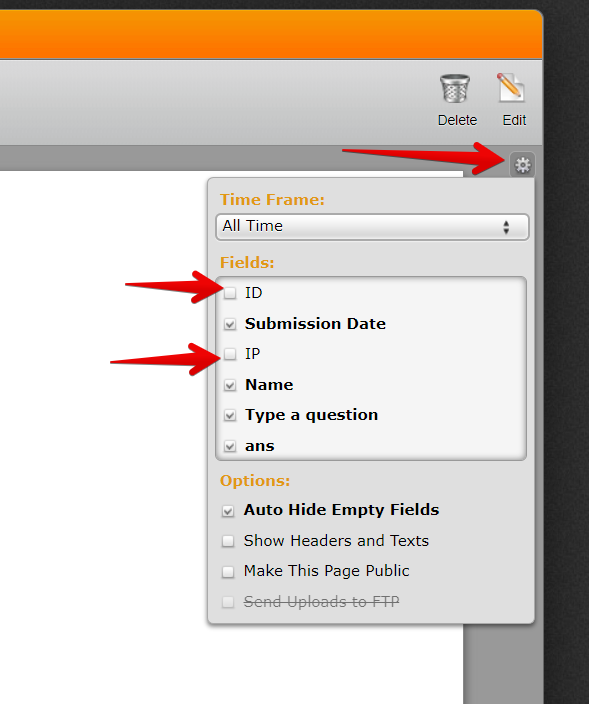

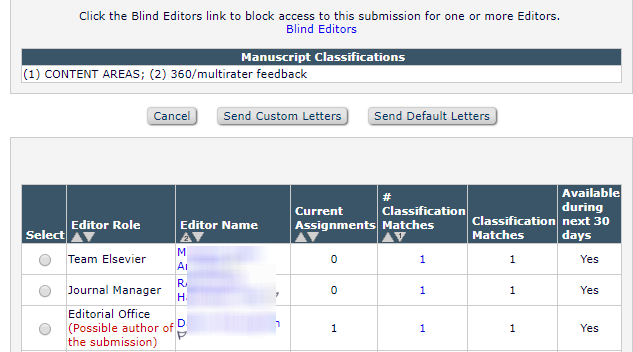

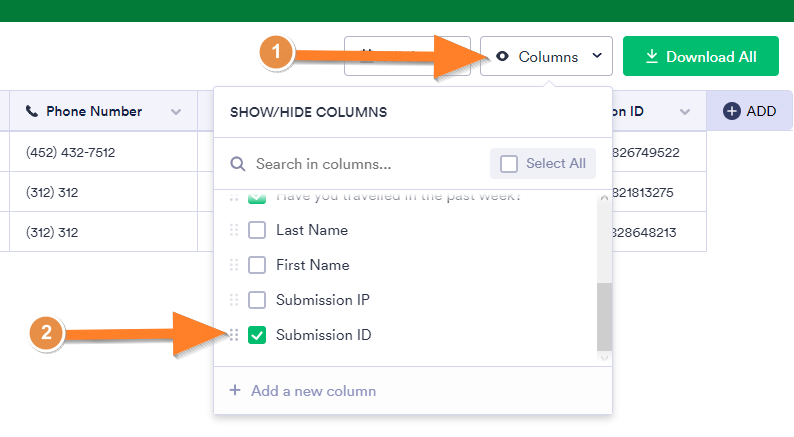

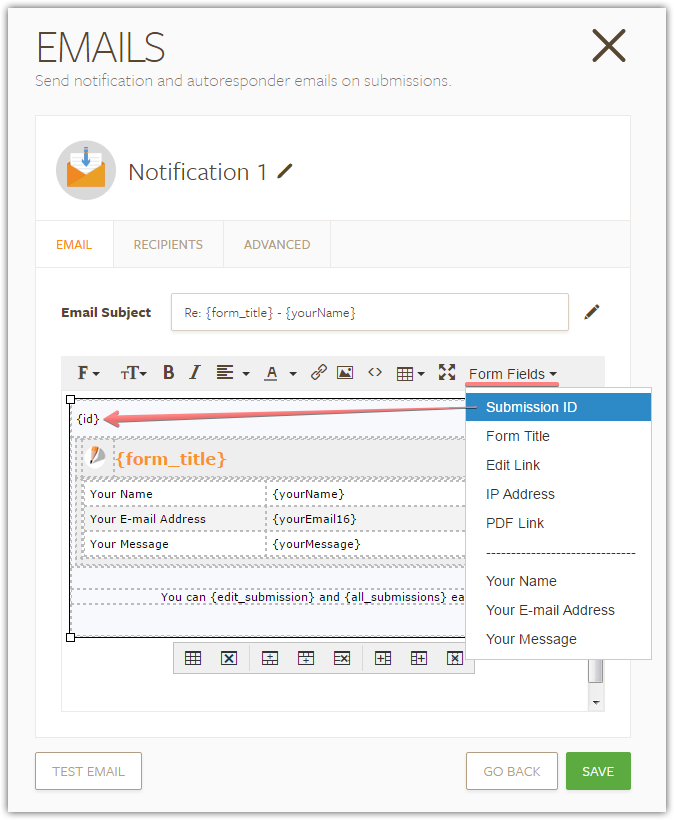

The outline below shows how you can set up a report that displays the Submission ID for accepted returns.

Note: The DCN is no longer used by the IRS and is only printed on the 9325 when transmitting a 4868. You can still add it to a report, if needed.

Cookie Settings

Privacy Policy | Terms of Service

© Copyright 2020 Drake Software. All rights reserved.

Drake’s sites, products and services are intended solely for businesses and not individuals. Drake does not target individuals with its professional products and services. When you visit our website, we store cookies on your browser to collect information. The information collected might relate to you, your preferences or your device, and is mostly used to make the site work as you expect it to and to provide a more personalized web experience. However, we provide you, as a visitor on our Sites, the ability to manage your internet cookie settings, which may impact your experience of the site and the services we are able to offer. Click on the different category headings to find out more and change our default settings according to your preference. You cannot opt-out of our First Party Strictly Necessary Cookies as they are deployed in order to ensure the proper functioning of our website (such as prompting the cookie banner and remembering your settings, to log into your account, to redirect you when you log out, etc.).

These cookies are necessary for the website to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. You can set your browser to block or alert you about these cookies, but some parts of the site will not then work. These cookies do not store any personally identifiable information.

Drake’s sites, products and services are intended solely for businesses and not individuals. Drake does not target individuals with its professional products and services. We provide you, as a visitor on our Sites, the ability to manage your cookie settings. The cookies we use collect information for analytics and help personalize your experience with targeted ads. You may opt out of cookies by using this toggle switch. If you opt out, we will not be able to offer you personalized ads and will not use your data for stats, social media, quality assurance, or together with our partners, for marketing. If you have enabled privacy controls on your browser (such as a plugin), we will attempt to take that as a valid request to opt-out. Therefore, we would not be able to track your activity through the web. This may affect our ability to personalize ads according to your preferences.

These cookies may be set through our site by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant adverts on other sites. They do not store directly personal information, but are based on uniquely identifying your browser and internet device. If you do not allow these cookies, you will experience less targeted advertising.

Austin Bartenhagen October 21, 2020 19:00

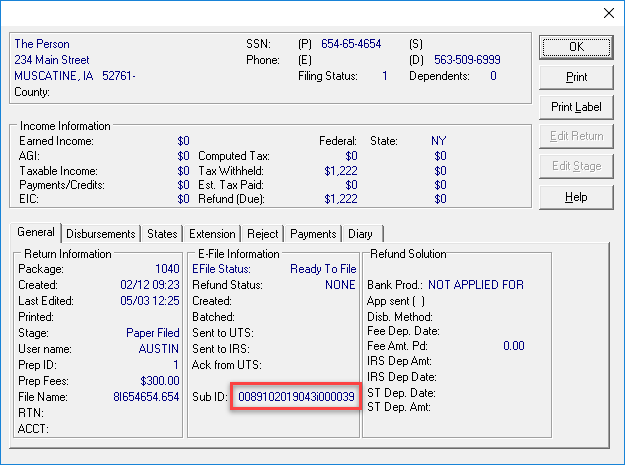

The submission ID is a 20-character string that identifies a MeF e-file submission. It is created when you transmit your return to the IRS or to a state DOR through UltimateTax. When the return is accepted and the acknowledgement processed, it will appear in the Return Status window when in a return. (F7)

An example is shown below using the following number: 070743-2010-073-0000001

State returns will have a different Submission ID than the Federal return for the same taxpayer.

Russian Penis

Dancing Penis

Big Shemale Tube

Incest Mother's Ass

Porn Actors Old

Submission ID (SID) - Drake Software

What is a Submission ID? – UltimateTax Solution Center

How to pass Submission ID along with the form submissino ...

How do I find a return's Submission Identification ...

Find and manage your hardware submission - Windows drivers ...

Submission ID - Modernized e-File - TaxAct

Hardware submissions - Windows drivers | Microsoft Docs

Submission ID - Microsoft Community

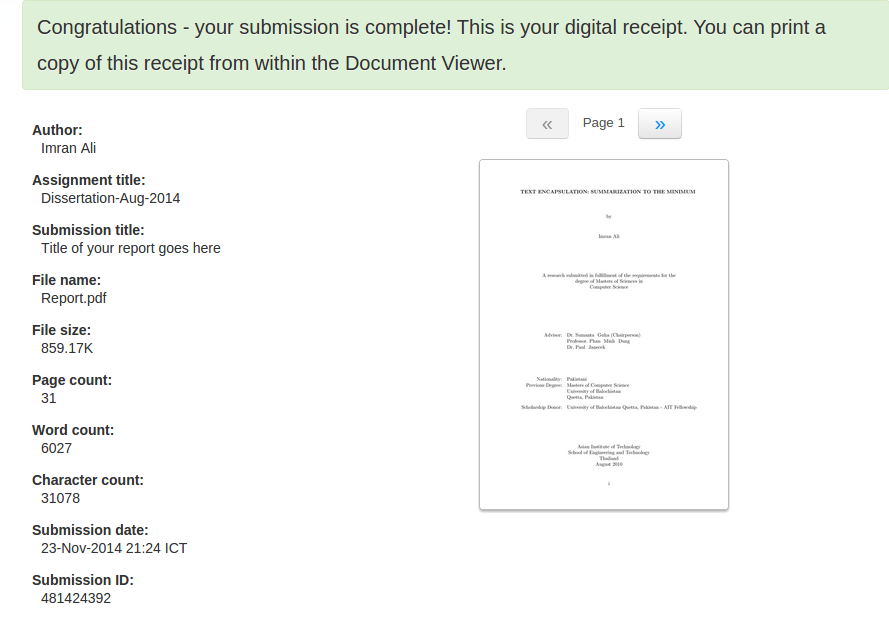

Viewing submission information - Turnitin

Submission Id