Startup funding: types, benefits, and drawbacks

Maria SparkInvestments are the engine of any business. The startup can be well-developed and planned, however, if it lacks funds, it won`t take off. Therefore, every entrepreneur has to decide what way they are going to raise investments to make their ideas happen. Let us tell you what methods you can use.

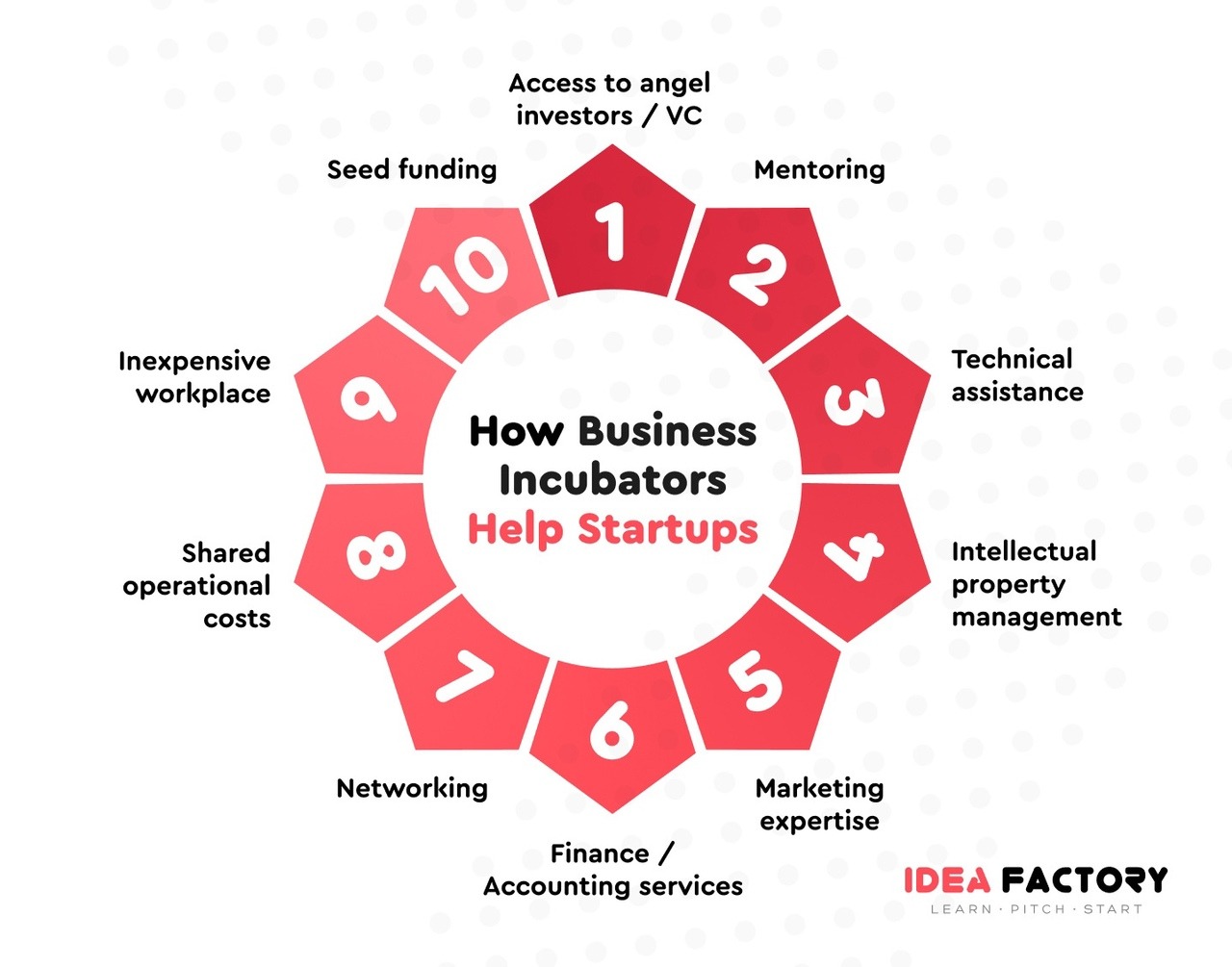

Startup incubators and accelerators

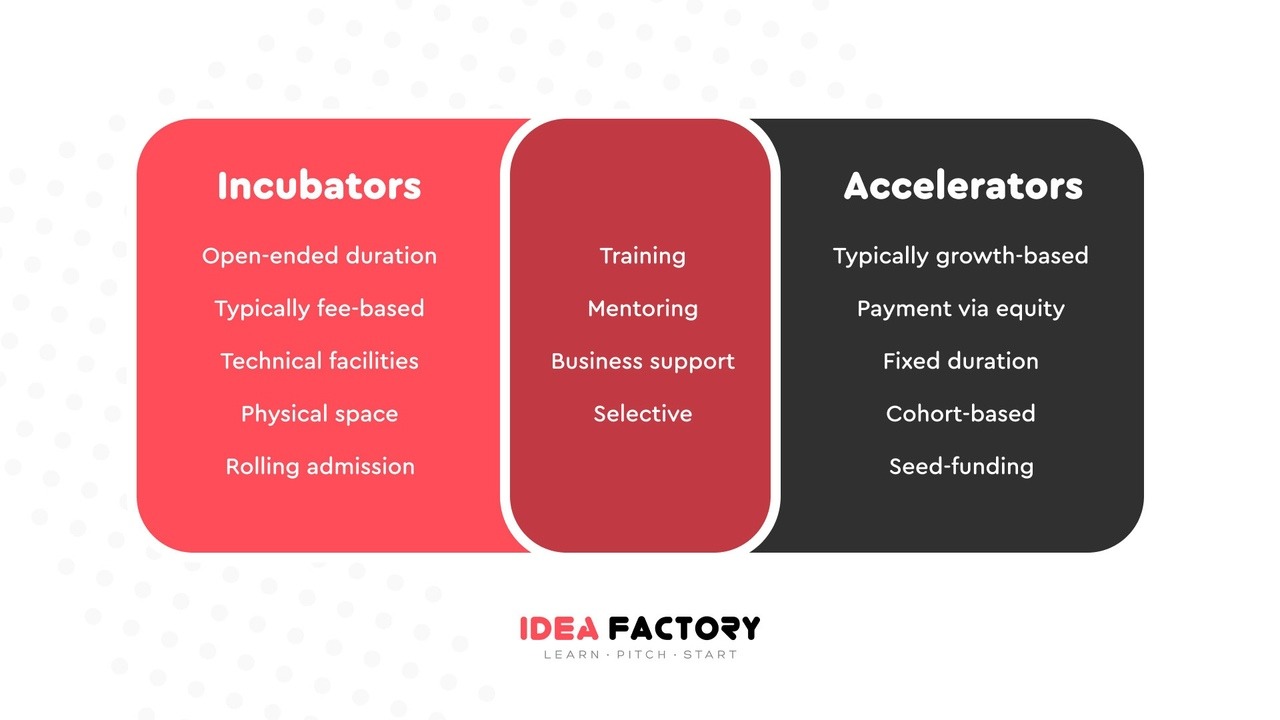

Being at an early stage, you can consider incubator and accelerator programs as a great option for fundraising. These programs help hundreds of startups every year across the globe. Although incubators and accelerators can be used interchangeably, there are several fundamental differences between them.

Incubators are like parents who help their child raise a business, provide tools for development, train and build a strong network. Unlike incubators that allow startups to develop gradually, accelerators help you make a giant leap within a limited time. Besides, accelerators are famous for their prominent trainers. For example, Y Combinator invites only the greatest entrepreneurs and company heads who share their extensive experience with founders.

Advantages

Potential for growth

The ultimate goal of the accelerator program is to scale the business up. Dedicated working hours, specialist training and investment opportunities allow your company to thrive.

Valuable feedback

Accelerators offer individual meetings with program consultants. They have experience in raising startups, attracting investors and entering global markets.

Opportunities for establishing contacts

Companies work together with other startups within coworking and workshops. You get unique access to successful entrepreneurs through mentoring and accelerator graduates.

Seed investments

Participants often receive funding from the program. They also offer investors at the end of the program.

Prestige

The accelerator is a badge of honor for investors. Participation in the best program shows that your team possesses high skills, drives and preparation.

Disadvantages

Loss of capital

Most accelerators require some share from startups in their program. Therefore, if you don`t want to split your ownership, you`d rather choose another way of fundraising.

Commitment to rapid growth

For some companies, slow growth leads to long-term success. Rapid scaling is not a suitable option for many startups.

Distractions

Mandatory meetings and social events can interfere with the work on the development of a startup. Fortunately, not every accelerator provides a long list of necessary sessions you have to attend.

Advice

- Present a workable product to convince a startup accelerator/incubator take you to the program;

- Elaborate on its prospects, what you expect the product to be in the future and how much profit it is likely to bring;

- Make sure your product is problem-solving as you may further introduce it to investors.

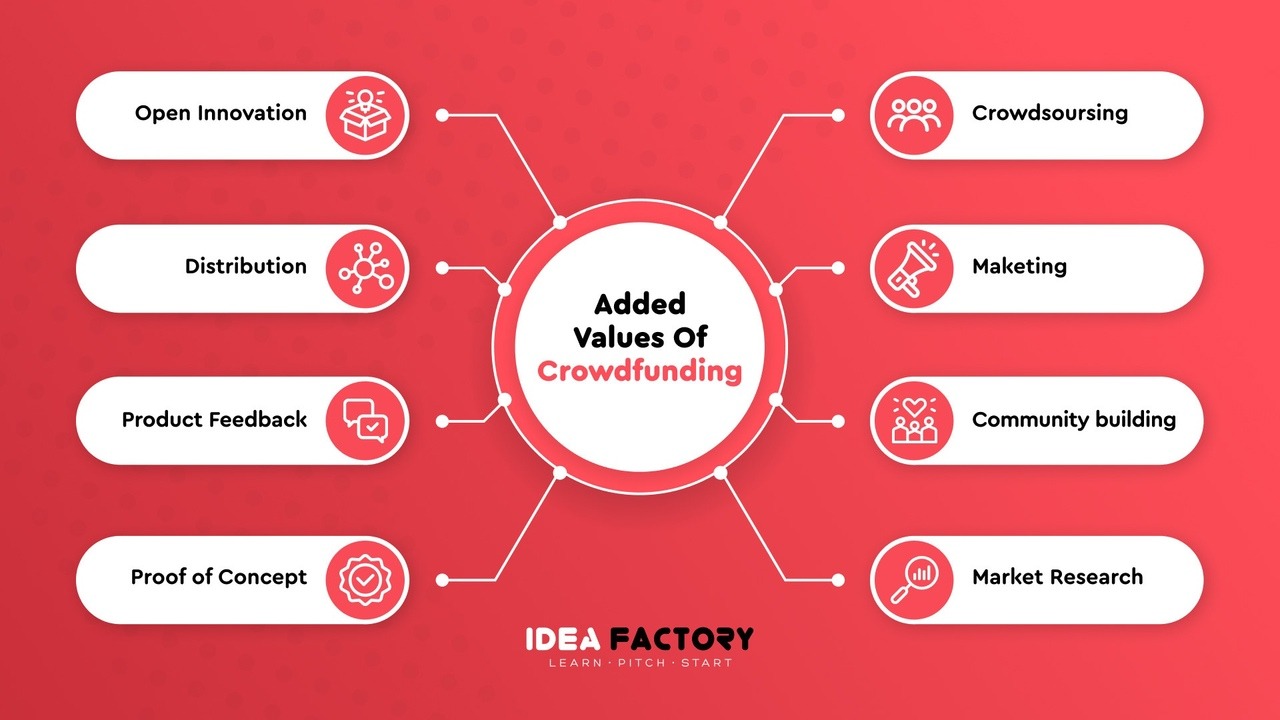

Crowdfunding

Crowdfunding is one of the modern tools to get your startup funded. This is raising investment from many people simultaneously. How does it work? You post a comprehensive description of your project on a crowdfunding platform. It`s necessary to mention the goals of your startup, profit plans, how much funding it needs and for what purposes. Then, users get acquainted with the information about your startup and donate money as long as they like the idea.

Advantages

Marketing opportunities

Crowdfunding platforms expose your project to millions of users. You can attract many viewers and investors to your startup if the idea is really great. This will help you further promote your project and reach target audience.

Access to stakeholders and customers

This method eliminates the difficulties associated with reaching investors or brokers, and enables ordinary entrepreneurs to represent their interests as other, more experienced participants. It has great potential to raise venture capital investments as the business develops.

Drawbacks

Competition

The fierce competition on crowdfunding platforms can be a true challenge. If another entrepreneur presents a similar idea more successfully, you will have to put much effort in order to outpace them. If your project is not as attractive as your competitors`, there is a chance that your business idea will be ignored or rejected.

Compliance with legal obligations

When establishing project on a crowdfunding platform, it is important to consider all regulatory requirements. This issue is especially relevant for debt and equity crowdfunding. The chosen platform must have the necessary regulatory authority, be open and informative, and attractive for potential investors. Non-compliance with the requirements may result in sanctions.

Changes

When creating crowdfunding campaigns, it is likely that a small number of stakeholders can substantially grow. In the meantime, there can be an increase in administration costs, not to mention the requirements of potential investors who intend to get a financial return.

Advice

- Examine your target audience and find out what they are interested in to make valuable rewards for them;

- Prepare a lot of materials for publications, the press, journalists in advance to successfully promote your campaign;

- The first impression is the most important. So ensure everything is perfect before launching the crowdfunding campaign.

VC firms

These are professionally managed funds that invest in startups with huge potential. Venture capital provides expertise, mentoring, and serves as a startup booster. Many entrepreneurs seek to get there not only to raise funds but also to evaluate their business in terms of sustainability and scalability. Venture investments may be appropriate for the small businesses that have passed early stages and already generate income. With a well-developed exit strategy, you can gain up to millions of dollars, which they offer for quick investments, networking and growth of your company.

Advantages

Strong sustainability

Venture capitalists effectively monitor the progress of the company they have invested in, thus ensuring the sustainability and growth of their investments.

High and quick return

Its level can significantly exceed the amount of investments during the first few years. On average, investors stay in the project for about five years.

New ideas

VC mentors can help you in terms of the startup concept and identify its strengths and weaknesses, which will allow you to improve the overall idea.

Drawbacks

High risks

According to statistics, 75% of venture projects do not return money to investors. 20% of startups fail within the first year, 30% — within two, 50% — over the next five years.

A long wait

Some projects take off quickly, but individual enterprises need time to develop which sometimes takes a while.

Risks of losing investors

Venture capitalists will remain loyal to your business until they get their capital and profits back. This usually happens within three to five years.

Advice

- Your product should strongly stand out among others so that VC firms believe in it and want to give their support;

- If your product can grant further returns on their investments, you substantially increase your chances to get funded.

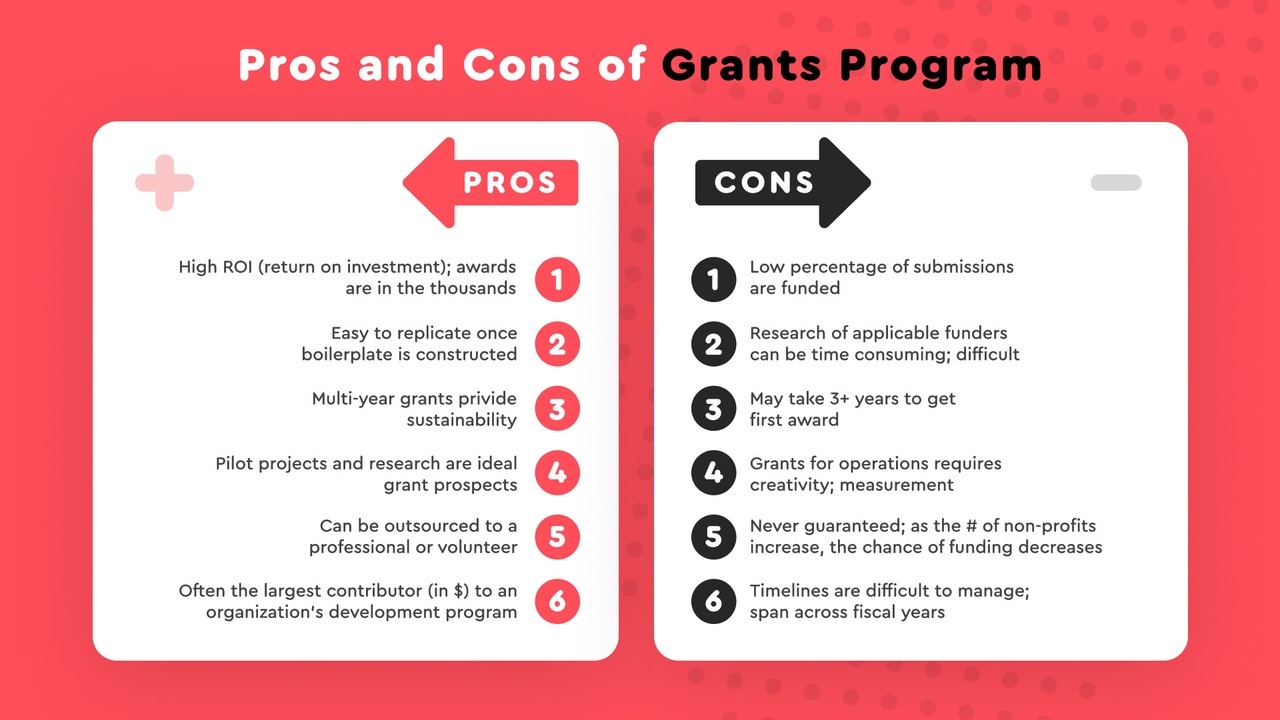

Govt grants/programs

Government programs that offer seed capital are a great a source of funding for your idea. You have to submit a plan that can be accepted by the grant committee. Afterwards, your plan is thoroughly reviewed and if approved, you will be provided with the funds necessary to launch your business.

Advantages

Great funds

In some countries, the government can give you large funds, which enables you to sufficient capital to run your startup. As long as they have a developed startup ecosystem, you have a chance to get considerable investments.

Increased loyalty

Having governmental support, you are likely to enhance your reputation and attract more investors in the future.

Drawbacks

Low percentage of submissions are funded

Depending on the country the amount of funds can vary. So, if the state budget is not big enough, you may be rejected or receive little investment.

Takes much time

The process of examining, approving and providing funds can take a long time due to government bureaucracy. Some countries lack necessary institutions for optimizing the fundraising for new projects.

Advice

- In order to apply for govt grants, you should develop a holistic plan for your startup. It has to include a clear development strategy that is likely to raise investments;

- There can be strict policies about the number of employees your company should have. So get acquainted with all the terms and requirements beforehand.

Business angels

They invest their own capital in exchange for a share in your business. Alternatively, they can acquire a large block of shares to have a decisive voice for making financial and managerial decisions. In other words, a business angel is a private investor chasing promising startups. Such investors help project at the earliest stages and can gather in whole groups to study a business proposal.

Advantages

Large cash sums

Business angels are ready to offer capital at early stages of your startup development while other investors may abstain. They are willing to risk a business idea to make a big profit. Therefore, you can raise much funds within a short time.

Mentorship

Business angels are typically wealthy people who possess an extensive experience in entrepreneurship. Thus, you may not only attract investments but also take advantage of their expertise.

Drawbacks

Disharmony

Investors may have interests, plans, and values different from yours. This might prevent you from reaching a single vision of your startup development.

Changes

If a new stakeholder joins your business, you will need to make respective adjustments to the workflow. Probably, it will require additional reporting and increase in the document flow.

Advice

- Don`t chase after investors, let them come to you instead. So create such a credible product that it will attract business angels.

- Keep your guard up. Sometimes, investors can turn out mere scammers or fools. Pay attention to their experience and see if they are trustworthy.

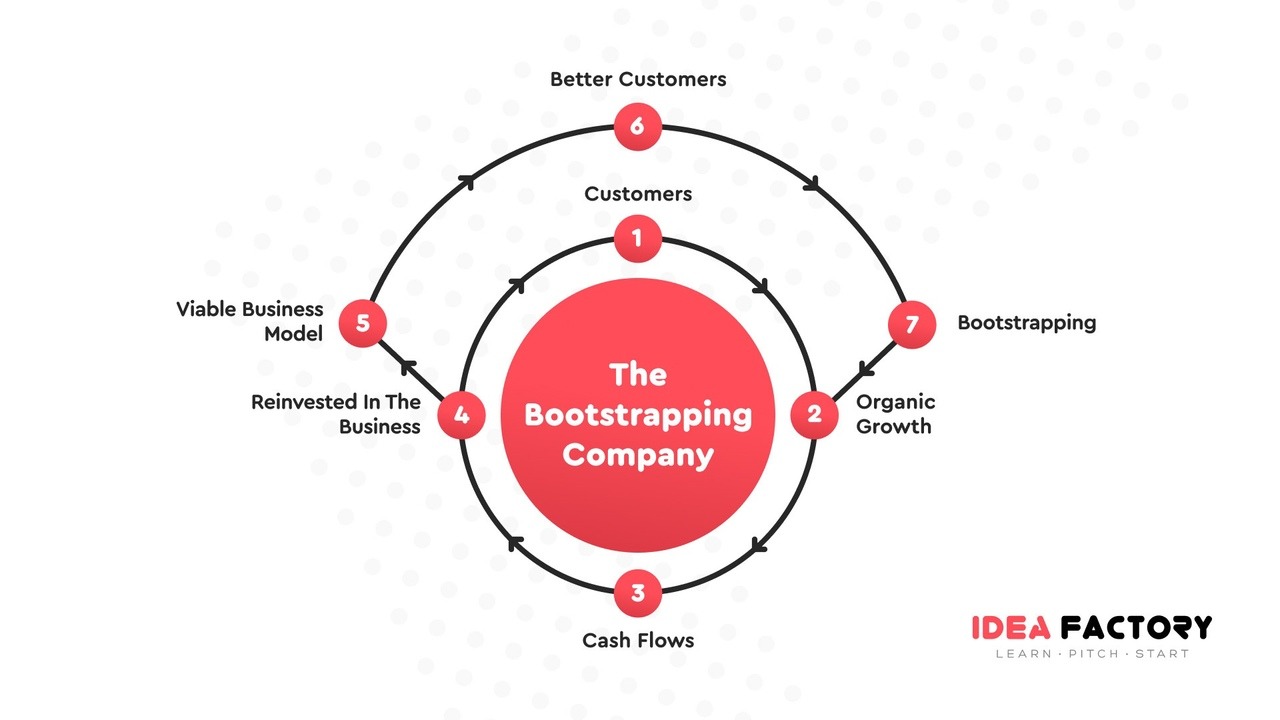

Bootstrapping

If you don`t want to rely on investors or borrow money from someone else, bootstrapping is what you need. This is the process of establishing a company from scratch with only your own savings. Bootstrappers don`t attract external funds and use only their own budget. Looking for investors may take ages and there is no guarantee you will eventually find them. In order to get the business started, you have to fund it on your own.

Advantages

Cost-saving

Basically, it is cheaper and more efficient than attracting external funds. Investing only your own money can help you fuel your business forces to launch a workable startup, and reduce the amount of unnecessary costs.

Ownership

Bootstrapping allows you to maintain full control over your company: venture investors, angels and other external sponsors most often not only demand a share of your company but also actual control over it. Bootstrapping will make it easier to get funds in the future. Once you are ready to look for external funds, investors will be impressed by the fact that you managed to establish a startup on your own.

Self-development

Though bootstrapping is a real challenge, it allows you to develop your talents and do things that at first seemed impossible. It also gives entrepreneurs the opportunity to become even more professional, making them more powerful than if they had a lifeline in the form of external investments.

Drawbacks

Shortage of capital

It can prevent founders from getting enough investments. In some cases, it is very difficult or even impossible for startups to grow and scale up only by bootstrapping. Venture capitalists and business angels can provide a tangible amount of investment, which is sometimes necessary to achieve the main goals of a new business.

High risks

It is significantly more risky in terms of financial losses and legal consequences as bootstrappers invest their own money. The problem of losing big sums of money is more serious, compared with investments from someone else's capital. Bootstrapping also can make you feel more stressed.

Advice

- Develop a product that is likely to bring profit in a short-term. Otherwise, you can easily run out of money for further developing. Create a reliable strategy that will help you avoid unnecessary costs.

- Pay attention to the cash flow and its reasonable use. Build connections with banks until your startup becomes creditworthy.

Conclusion

Each startup is unique therefore you should choose the fundraising method that is align with it. If you are ready to share your business or capital with other investors, you should look for VC firms or accelerators. However, in case you are intended to develop the startup on your own in a long run, give preference to crowdfunding or bootstrapping. All in all, whatever method you choose, the success still depends on your qualities and abilities. Even the most experiences mentors and investors can make mistakes but if you know what your startup actually needs, you won`t lose.