Spreads Futures

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spreads Futures

Table of Contents

Hide

Still Have Questions?

Contact Support

support@earn2trade.com

Disclaimer

Terms of Use

Affiliates

Trading guides, webinars and stories

The trading world is full of various strategies and methods for making a potential profit. Arbitrage trading is one of the most efficient, yet at the same time, also one of the most complicated strategies. Many traders prefer Futures spread trading as an arbitrage strategy. They consider it one of the safer ways to try and profit from the commodity market. In this guide, we will help you find out more about the most popular futures spread trading strategies and how to use them. We will also examine different futures spread trading examples along with their pros and cons. Let’s go!

Futures spread is a trading technique where you open a long and a short position simultaneously to take advantage of a price discrepancy.

The idea behind futures spread trading strategies is to reduce the risk. At the same time, it allows you to capitalize on the pricing inefficiencies for one or several instruments. You can use spreads for a variety of asset classes. In this article, we will focus on using it with futures trading and commodities, in particular.

A while ago, due to the market’s structure, spread trading strategies were available only to institutional and large-scale traders. However, today, they are gaining popularity among retail traders, as well. This is thanks to technological development and a reduction in the margin requirements. Furthermore, these futures spreads are gaining popularity among retail traders, as well.

The objective of futures spread trading strategies is to capture the difference between the price of the contract that is being sold and the one that is bought. This usually works when trading futures with different expiration dates. One example of a futures spread is when you go long and short on a soybeans futures contract (ZS) at the same time. You can also apply it to different types of assets like soybean and corn, for example.

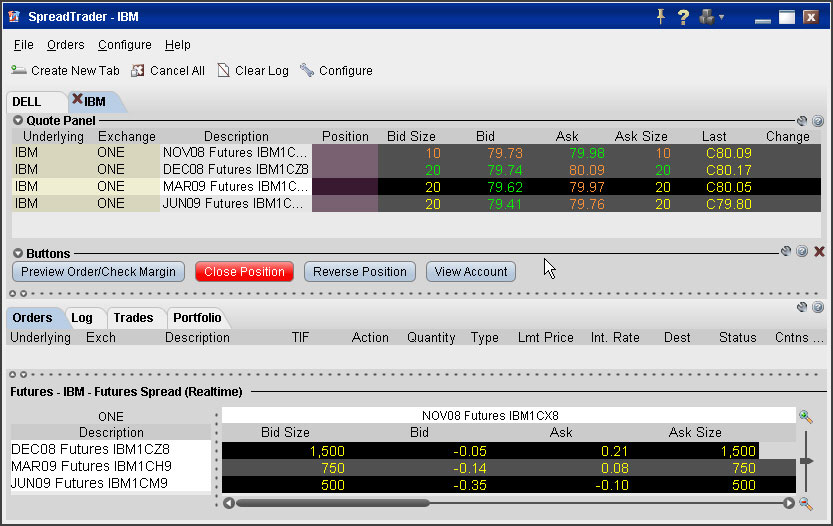

The buy and sell positions that the trader opens at the same time are acknowledged as a single position, called a “unit trade”. The buy and the sell sides of the unit trade are called “legs”.

The goal of the trader placing the unit trade is to see the long side of the spread increase compared to the short one. That way, the spread between their positions guarantees they capture a more significant profit.

Depending on the trader’s preferences about the type of commodity they want to focus on, its state, and the exact strategy of how to trade it, they can choose from three types of futures spreads. These are inter-commodity, intra-commodity, and commodity product spreads.

Aside from these, although rarely, you can also hear experts talk about bull and bear futures spreads. Now let us take a look at the difference between the two. With bull futures spreads, the trader goes long on the front month and shorts the deferred one. Meanwhile, in bear futures spreads, he goes long on the deferred month and shorts the front month.

Now back to the main types. The common categories are typically inter-commodity, intra-commodity, and product spreads. Let’s find out how are they different from each other:

An inter-commodity futures spread is the type where contracts on various commodities with the same month are utilized. For example, when you simultaneously open positions to buy corn futures (ZC) and sell wheat futures (ZW), both of which expire in September.

For those interested in inter-commodity futures spreads, it is essential to be aware of the specifics and the price drivers of the instruments they intend to trade. This means having expertise in trading various futures contracts, which usually isn’t typical for beginners in the field.

Intra-commodity futures spread trading is used when the trader buys and sells the same commodity but with different months. For example, the trader may buy an April soybean futures contract and sell an October soybean futures contract. In this case, the “legs” of the trade spread are between different months, rather than other instruments.

This type of futures spreads is also known as “calendar spreads”.

Calendar spreads are considered easier to trade since the trader only needs to specialize in a single commodity. By learning all about different price factors like seasonality, supply, and demand, weather conditions, etc., they can ensure they have the fundamentals to trade that particular commodity.

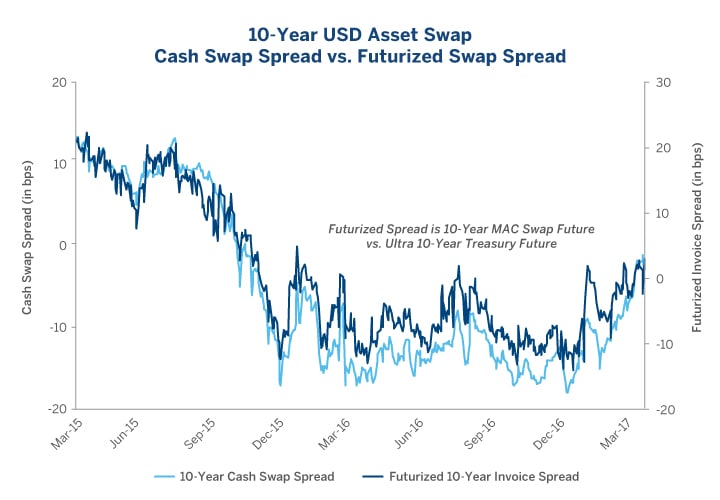

The commodity product spreads reflect the difference in the commodity’s price in its raw form and as a finished product.

Commodity product spreads are a frequent choice for traders interested in the oil and agriculture industries. Traders usually enjoy this type of commodity product spread and trade them by going long on the raw material and shorting the finished product related to it. That way, the profit basically replicates the profit margin of the company that handles the whole process.

Bear in mind that this type of futures spread is usually more of an exotic instrument.

Margin requirements are a crucial thing that any trader interested in futures spread trading should be aware of. They indicate the level of volatility and risk associated with the underlying commodity or the relationship between the traded assets (if more than one).

Futures spreads margins are lower than those of traditional futures contracts since they bear less volatility and hedge against systemic risk. In the case of an unexpected event like a terrorist attack, a stock market crash, a war breaking out, or the default of a country, for example, both legs of the unit trade should be affected equally. That way, the trader won’t incur any losses.

Assume that Joe wants to trade corn and wheat futures spreads. Let’s say that the margin for corn futures is set at $2,000, while the one for wheat is currently at $1,000. Instead of posting $3,000 to trade the spread on the two contracts, Joe can receive a 75% margin credit. This means the initial margin will equal just $750.

What this comes to show is the massive difference in terms of the margin requirement when trading single contracts outright as opposed to trading them as a spread. Often, depending on the instrument, the futures spread margin can be as low as just 10% of the value of the margin requirement for a single contract.

Before trading, it is essential to check with your brokerage service provider to determine the current margin requirements you should comply with when trading futures spreads.

Depending on their type, there are a variety of widely-used futures spreads. Such pairs include:

The list goes on and on. The idea here is that traders shape their preferences depending on the type of spread they trade, the specifics of the underlying asset, and what factors might affect the spread.

In the case of crude oil or natural gas, traders base their analysis mostly on the seasonality effect. For example, during the winter, the need for heating and energy consumption increases, which drives the demand for natural gas. During the summer, on the other hand, the demand for petroleum goes up as the traffic increases. The consequence is a positive effect on the price of crude oil.

It is the same case with crops. Depending on the harvesting period, the weather conditions, the supply and demand figures, whether farmers’ lean towards one or the other seed, and other similar factors, traders may shift their preferences for particular commodities. These are some of the factors relevant to those willing to trade the Soybean – Corn spread, for example.

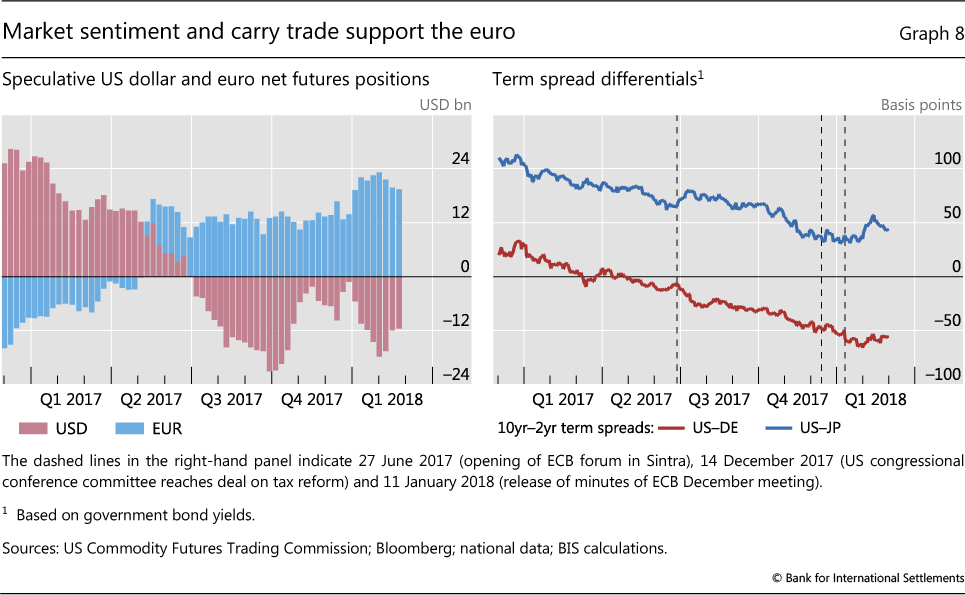

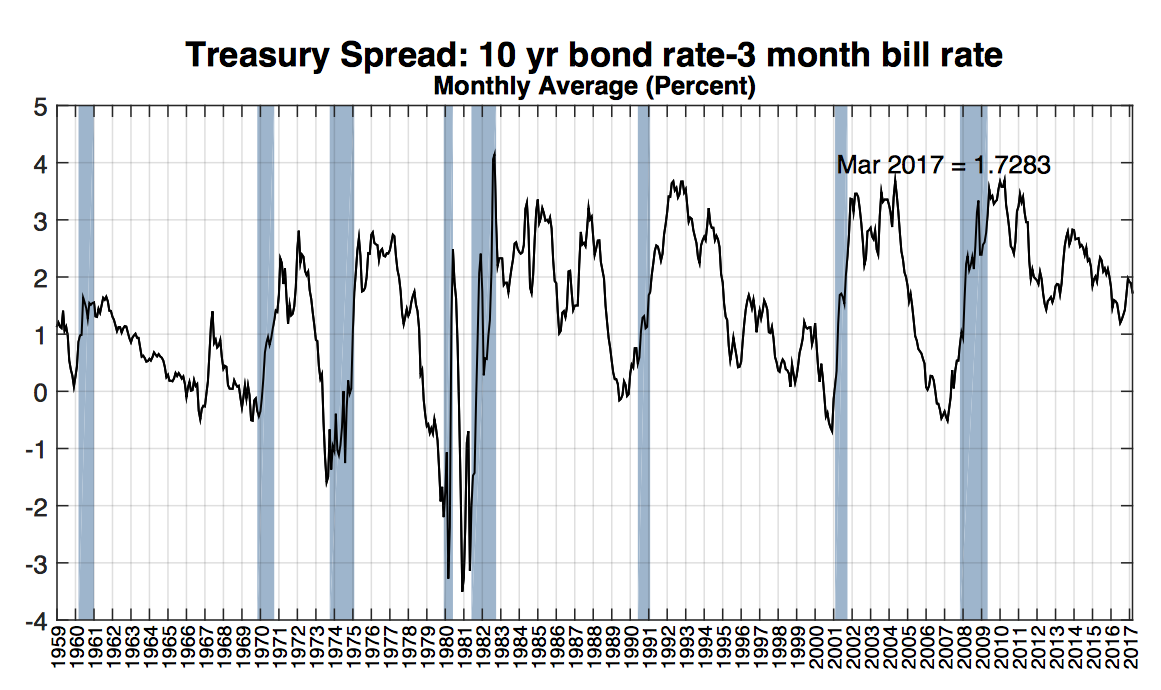

In the case of futures spreads based on financial instruments, the most widely considered factors include interest rate changes, national policies, global economic and political landscape, etc.

In the end, no matter what spread you are trading, make sure to put your primary focus on the relationship between both legs of the spread, rather than the overall direction of the market. If the spread is good enough, you will be making money in downwards markets as well.

Although less risky than buying and selling single futures contracts, trading futures spreads still requires substantial expertise and attention to detail. In the cases where inter-commodity futures spreads are traded, for example, the trader should be aware of the specifics of different instruments.

The first step to becoming a successful futures spreads trader is to get familiar with the primary factors and characteristics of the different commodities or instruments that you are willing to trade. Here are some of those factors:

First and foremost, consider the time of the year. You need to know how it may affect the price of the instruments you are willing to trade. Seasonal factors are among the detrimental ones for the instruments’ price. It is a real risk whether you are buying or selling single futures contracts or trading futures spreads.

The reason is that seasonality determines supply and demand. Some commodities like natural gas, for example, may be in higher demand during the winter, while others like crude oil during the summer. On the other hand, a warm winter can reduce the demand for gas and heating oil, thus decreasing their price.

The case is similar when it comes to trading grains futures, the prices of which depend on the harvest period’s results. Weather conditions also have a direct effect on these. If we take corn, for example, we can say that it has the largest supply in the fall, which may decrease its price during that particular period. The majority of the grains usually hit their highest price in the late spring and early summer, when they are most vulnerable to extreme weather conditions. That is why, depending on the year and the weather forecasts, you can expect a so-called “weather premium” to affect the price of the grains.

The easiest way to overcome the seasonality effect is to analyze the spreads’ performance over the years and see over which time periods they perform the best.

It is essential to not only focus on the specific characteristics of the commodity but also to keep an eye on the macro factors that may affect your spreads. These include trade wars, embargos, global political instabilities, interest rates policy, financial and economic crises, region-specific developments, etc.

This is crucial for all types of futures spreads, but most importantly, inter-commodity and product spreads. In the case of intra-commodity spreads, although there would be some difference, the overall effect should equally affect both legs of the trade. For example, if you are trading April and August crude oil and some instability in the Middle-East region arises, then the spread between the buy and the sell order should remain the same.

Financial and commodity markets are very dynamic. Things change from day to day and, if you want to succeed as a futures trader, you should keep track of the news and updates regarding the industries you are interested in.

The best way to do that is by accompanying your morning coffee with an official industry analysis or report. Good places to start, depending on the futures spread contracts you are interested in trading are:

Of course, there are plenty of other sources, but you get the idea. Stay on top of the most recent news to increase your profit potential.

There are a variety of futures spreads trading strategies that you can use. Here, we will go through some of the most basic and the most popular ones. We will also learn how to apply them in practice. Remember not to just blindly follow these strategies. Use your own best judgment when trying them.

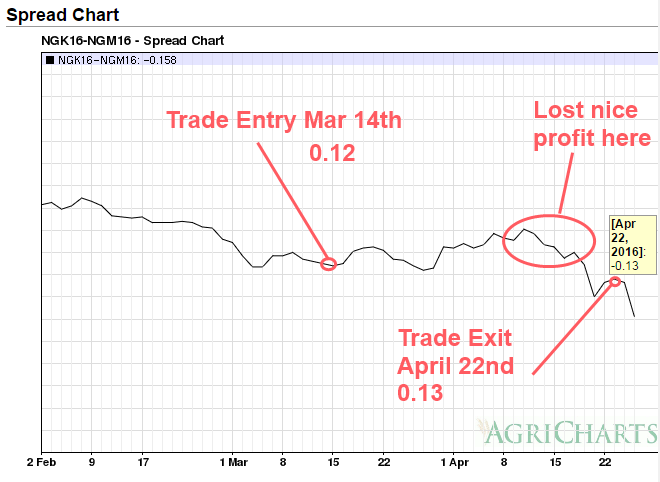

This intra-market spreads strategy requires buying and selling a single contract but with different expiration months. The goal here is to benefit from short-term price increases.

Here is how this works in practice. Let’s assume that you have an interest in trading the soybeans futures (ZS) in a spread strategy. To do that, you can:

The end goal here is to see the spread narrow. During bull markets, this happens when you go long on nearer contracts and short the far-term ones as they are slower to react to price changes.

Understandably, the bear-market alternative of the strategy mentioned above works the opposite way. You should expect the price of the nearer month contract to fall faster and farther than the price of the deferred one during bear markets. This strategy aims to take advantage of widening spreads.

Let’s say that you have an interest in creating a unit trade by buying an August (front month) wheat futures contract for $5.25 per bushel and selling an October (deferred month) wheat contract for $5.65 per bushel. The way to calculate the spread is by subtracting the deferred month from the front one ($5.25 – $5.65 = -$0.4). In this case, it is 40 cents. As the front number trades lower than the deferred one, the spread is quoted as negative.

To calculate the profit/loss of the trade, you should multiply the spread by the price change. For example, a 10 cents price change will result in $400 profits/loss.

Assume that it is the end of the year, and you are bullish on the soybeans forecasts for next year. Front months usually outperform latter months. Because of that, you buy a March soybeans future for 875.0 and sell a September contract for 883.0. In that case, the spread is calculated as follows: 875.0 – 883.0 = -8. If your forecast turns accurate and the spread has narrowed from -8 to -5 by March, then your profit equals 3 cents. Since one contract is for the delivery of 5 000 bushels, your total profit is $150.

Let’s also take a look at an example of an inter-commodity spread. Let’s say that you have an interest in trading corn and wheat. Your analysis reveals that the demand for corn will exceed the one for wheat. Here we will ignore the price of the contracts and whether they will go up or down. Your only goal here is to see the price of corn advance farther over the one of wheat. If the market sells off, you will hope for the corn to retain its price better than the one of wheat.

At first sight, futures spread trading may seem like the safest strategy ever to exist. However, the truth is that, aside from the abundance of advantages, it also has some drawbacks. The list of the former, in particular, can be quite long. To elaborate on both, we will focus on the main pros and cons of trading futures spreads:

Aside from reducing the risk significantly, futures spreads also provide a variety of ways to make profits. Although controlled and without as much leverage as single contracts, futures spreads are considered a much more balanced instrument.

Futures spreads trading makes it easier to predict how the different contracts (legs of the trade) will react to particular events. During both bear and bull markets, the closer contract’s price is usually more affected than the one of the longer-term contract.

Since futures spreads trading bears less risk, over time, it has led to a major decrease in the margin requirements. That way, the trader gets way better ROI than when trading single futures contracts.

A typical stock or futures broker may require you to deposit $5,000 or more to be eligible to trade. With futures spreads, however, things are quite different. Depending on the service provider’s requirements, often you can open an account with just $50.

Futures spread trading eliminates systemic risk, which is the most unpredictable and problematic event for beginners and professional traders. This makes them a much better place for newbies to make their first steps, without the fear of losing significant capital.

The major drawback of futures spreads trading is that each trade consists of two legs, buying and selling an instrument. This basically doubles the trading fees. If you do not take them into account initially when building your strategy, they may eat up a big chunk of your profits.

Often, futures spreads are less liquid than trading other instruments or even single futures contracts. This may turn out to be a problem for traders who rely on or have to get in and out of positions quickly.

Like any other type of trading activity, the main risk here comes from trading excessively large positions. Even so, you should not take it lightly. Traders who don’t adhere to some basic risk management principles may lose a big part of their portfolio. Especially if they fail to predict the spread’s change correctly.

There is also the risk of locking yourself in a trade due to a lack of liquidity. The relatively lower trading volume in futures spreads may make you struggle to close your position. Especially if, you combine it with situations where traders buy and sell more exotic futures. Your profit may decrease notably if you fall into that trap.

Although not particularly a risk, it is worth mentioning the need to keep an eye on where you place your entry and exit points. It is imperative to adhere to a clear risk management strategy. That way, you will make sure to avoid situations where emotions take over. It will help you avoid throwing your plan in the bin in pursuit of higher profits. As you know, this usually doesn’t end well.

Hi! We do have an article about it. Check it out here https://blog.earn2trade.com/stock-futures-indices/ . Make sure to follow us on our Facebook , Instagram, Twitter and Youtube to stay updated

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment

Learn What is The Simple Moving Average (SMA) and How it Works

What is The Daily Loss Limit Rule in Funded Programs?

What is The Maintain Consistency Rule and Why is It Important?

Futures Spread Definition

Futures Spread Trading - Guide on How to Trade Spreads in Futures

Futures Spreads | SpreadCharts.com

Commodity Futures Spreads and Spread Charts

Futures Calendar Spread by FuturesTradingpedia.com

Trusted by more than 10,000 users. We're authorized market data distributor.

Access the charts without restrictions and annoying advertising

Unlimited access to the app, advanced features, trading signals powered by AI and premium research videos

SpreadCharts is a cloud app with responsive design, so it can run on any PC, tablet or smartphone.

SpreadCharts offers the widest range of tools for analyzing commodity futures and spreads, which gives you a unique insight into the market. If you want to outsmart other traders, you have to use SpreadCharts!

83 futures markets means that there are more than 200 thousand possible spread combinations. So how to choose the right one? You need a complex platform in which you can analyze seasonality, COT or term structure, all in one place. You need SpreadCharts. And if you are still on edge about a particular market, our detailed market research can help you.

You’re probably familiar with various seasonal signals. They are quite common in many tools, and we used to have them too. Such signals are, however, backward-looking only as they ignore the current data. Using just seasonality is not a good idea as it can often fail. We decided to do better and developed trading signals powered by artificial intelligence. This intelligent model takes other types of data into account, not just seasonality. It makes predictions in real-time, continually learns on the new data, and adapts to the everchanging market environment.

It pays off to be a contrarian. The sentiment data is necessary to identify the crowded side of the trade. And the best sentiment data in commodities and futures is the Commitment of Traders (COT). It shows you not what people think about the market, but what they actually do with their money. We have COT data for all available commodities and financial futures. As a result, you can see what the big players are doing so that you can manage your positions accordingly.

Unvaluable free service provided by https://t.co/IB9PYHdtl8 to futures spread traders thanks to @halapav and his team. Bravo!

I just checked your site today, it could be great help. I normally don't trade commodities; but software architect in me! Thanks for sharing information & charts.

https://t.co/ps8OOQ73Lg This is a pretty good spread web site

thanks.. fyi.. i love your website.. #spreadcharts

If you haven't tried @SpreadChartsCom , it's free to try and quite good. All futures, no equities, but average or YoY seasonality on any contract or contract spread. If you use average charts, be sure to read the blog post about it. https://t.co/oXQCFzbLpq pic.twitter.com/LBxbDd5O2y

Seasonality alone is no longer sufficient in today's financial markets. We offer much more. And all of it comes packed in a user-friendly environment.

These intelligent signals take other types of data into account, not just seasonality. They can make predictions in real-time, continually learn on the new data, and adapt to the everchanging market environment.

World-class research of the best opportunities in the markets from people with a successful track record in the hedge fund industry.

Although seasonality in no longer enough today, it is still important. That's why it is integrated into SpreadCharts too. The app offers not only normalized averages, but also variance estimates, stacked seasonality charts and seasonality by month.

Our great endeavor was to make Volume and Open Interest analysis clear up to 4 different futures contracts at the same time. This makes it easy to see the liquidity flow between particular contract months.

We have developed our own Commitment of Traders data processing methodology. Thus, it is possible to display the continuous series of COT data from 1986 onwards. In addition to the classic net positions, the app also includes traders positioning and concentration ratios.

The charts are built entirely in HTML5, so using them is quick. You can also edit them and interact with them in many different ways. Moreover, the app works on tablets and smartphones.

This is a really unique thing, and you will not find it anywhere else in the world. Our full carry models for grains can help you better estimate the risk and improve timing of your trades.

We have futures data for tens of markets available from the 1950s onwards. Thus, you analysis can be really long-term and thorough.

We have decades of historical data, for some commodities since the 1950s. Although you can browse this data in the app, it's difficult to make sense of tens of thousands data points. That's where advanced machine learning skills come into play. Our powerful data analytics and AI models will help you recognize the key information and save time. And as you know, time is money.

You can run the SpreadCharts app anywhere and anytime. Our software is ready to use on both PC and tablet. Thanks to our advanced technology, you’ll stay up-to-date even when traveling.

We provide data for 83 commodities and financial futures

More than 10,000 people from 68 countries trust us

Our trading software is up and running for more than 10 years

Use the free version of the SpreadCharts app to access charts and manage your watchlist...or become a premium subscriber and unlock advanced features, get access to the trading signals powered by artificial intelligence and premium research. The premium membership will help you identify the best opportunities, so that you won't miss anything.

We plan to widen the scope of our data offerings in the future. And we...

You all saw the selloff in gold over the last few days. It has done...

We have launched another major update of the SpreadCharts app today. We bring you an...

On October 18th, we sent an email alerting all of you about the chain of...

It all started out of the need for a tool to help us in our own trading. There was nothing suitable on the market, so we started to develop a solution ourselves. Although the app was originally intended for our own needs, we decided to make it available to other traders for free. The enthusiasm is still there, we keep developing SpreadCharts, making it even smarter and more powerful tool. Today, the app is used not only by traders, but also by producers and processors of physical commodities like farmers, grain elevators, oil drillers, wood logging companies and even dairy companies.

We’re the right choice for commodity markets analytics

All information on this website is for educational purposes only and is not intended to provide financial advice. There is a risk of loss in futures trading.

Private Bitches

White Wife Black Cock Slut Is Slave

Mommy Pee

Legs Nylon Sperm

Public Sex 1080