Spread Share

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Generally, spread refers to the difference between two comparable measures. In the stock market, spread refers to the difference between the lowest ask price and the highest bid price. If the lowest ask price for a share of ABC stock is $25, and the highest bid price is $24.75, then the spread for ABC stock is $.25. In commodity trading, the spread is the position an investor takes when purchasing two or more put or call options on the same underlying asset with different delivery dates. This type of spread is called a straddle, and is used to mitigate losses that result from volatility in the underlying asset. In fixed income securities, spread refers to the yield difference between two different securities with the same maturity date, or two similar securities with different maturity dates. For example, if a 5-year AAA rated corporate bond has a yield of 5% and a 10-year AAA corporate bond yields 7%, then the spread between these two similar bonds is 2%. Finally, in the investment banking/underwriting world, spread refers to the difference in what an underwriter pays the issuer for newly issued shares and what the public pays the underwriter for those shares. XYZ Corp. issues new shares and the underwriter agrees to pay XYZ $10 per share. If the underwriter then sells those shares to the public for $12 per share, the spread is $2 per share.

Investopedia is part of the Dotdash publishing family.

Ваш браузер устарел.

Попробуйте обновить его, чтобы работа ВКонтакте была быстрой и стабильной.

ALL INFORMATION CLICK HERE https://21929.ru/com.cgi?8¶meter=vktopenphoto

Spread Share

Discover the differences between spread betting and share dealing, including the ability to go long or short, the capital required and whether you have a right to ...

Stock Portfolio Tracker is Investment Moats attempt at creating an online spread sheet that will let a stock investor monitor your stocks and track stock purchase ...

Traditionally you would only be able to trade shares through a stockbroker. However, spread -betting allows you to trade the price of a share directly rather than ...

The bid–ask spread is the difference between the prices quoted for an immediate sale (offer) ... Electronic communication network · List of stock exchanges.

Shares Spread Betting. A guide to spread betting on global shares : Where Can I Spread Bet on Shares ? Shares Prices (Indicative); Where Can ...

Our article explains the difference between buying individual shares and spread betting on them. Find out more about spread betting vs share dealing.

Take a position on more than 9000 global shares , including 1000 ETFs. We offer spread betting and CFD trading prices on popular shares . Open an account to ...

In other words, based on the above, you would buy shares in a security at the ask price and sell at the bid price. The difference between these two prices is ...

Spread Bet on a wide range of global Shares at City Index including Barclays, Rio Tinto, Apple, Amazon and more with spreads from just 0.01%.

The spread is the gap between bid and ask prices of a stock , option, or other security. This term is also used to generally describe a number of strategies that ...

Finspreads offer tight spreads on thousands of shares worldwide including those listed in the UK, US, Europe, Australia, New Zealand and Asia.

Market share distortion—the dividend spread trade ... calls from the trade, which creates a position of being long stock against their short calls from the spread .

Farm-to-retail price spread and farm share of the retail price are high-level indicators of the cost structure of a food supply chain.

What is the difference between trading with a normal stock broker and spread betting? What is best?

The difference between the price of two products/stocks is called a spread . For Example, the spread between Brent oil and WTI crude is around 6$. People trade ...

The maximum risk, therefore, is 3.10 (5.00 – 1.90 = 3.10) per share less commissions. This maximum risk is realized if the stock price is at or below the strike price ...

30 мая 2013 г. —

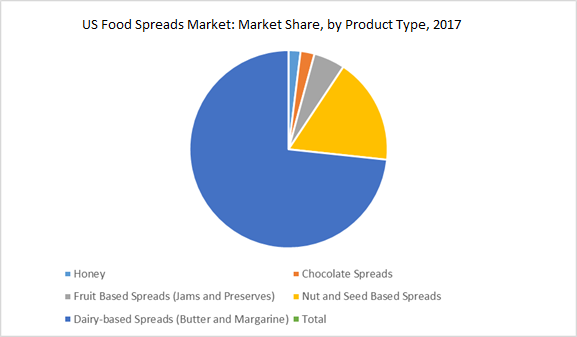

Market research report on the Spreads industry, with Spreads market share , industry trends, and market analysis.

Spread is the difference between the buy and sell price of an investment. The spread is different for every ETP and can be influenced by a number of factors.

Trade CFDs on Shares , Indices, Forex and Cryptocurrencies ... Tight spreads ; No commissions; Leverage of up to 1:300; Fast and reliable order execution.

They share their views on how to spot fake news. Check out the video they prepared. UNICEFMK ...

We proudly share our values in complete transparency with all our stakeholders. Photos de cookies au chocolat.

28 нояб. 2020 г. —

Spread betting on UK Shares is not only free of stamp duty but, under current tax ... Our low fixed spreads on the FTSE100 share markets won't be beaten by any ...

This phenomenon will be shown by the graphical display of stock returns across the network as well as the dependence of stock returns on topologica

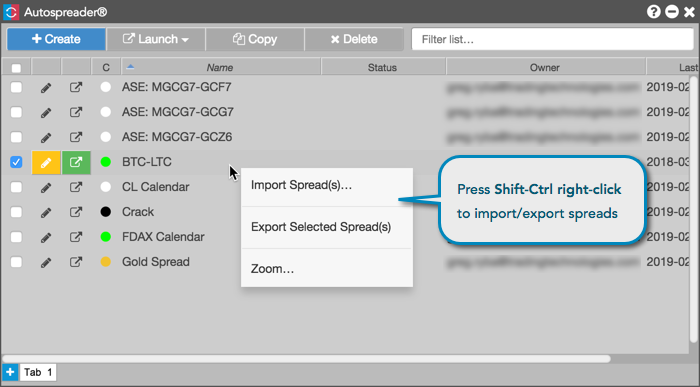

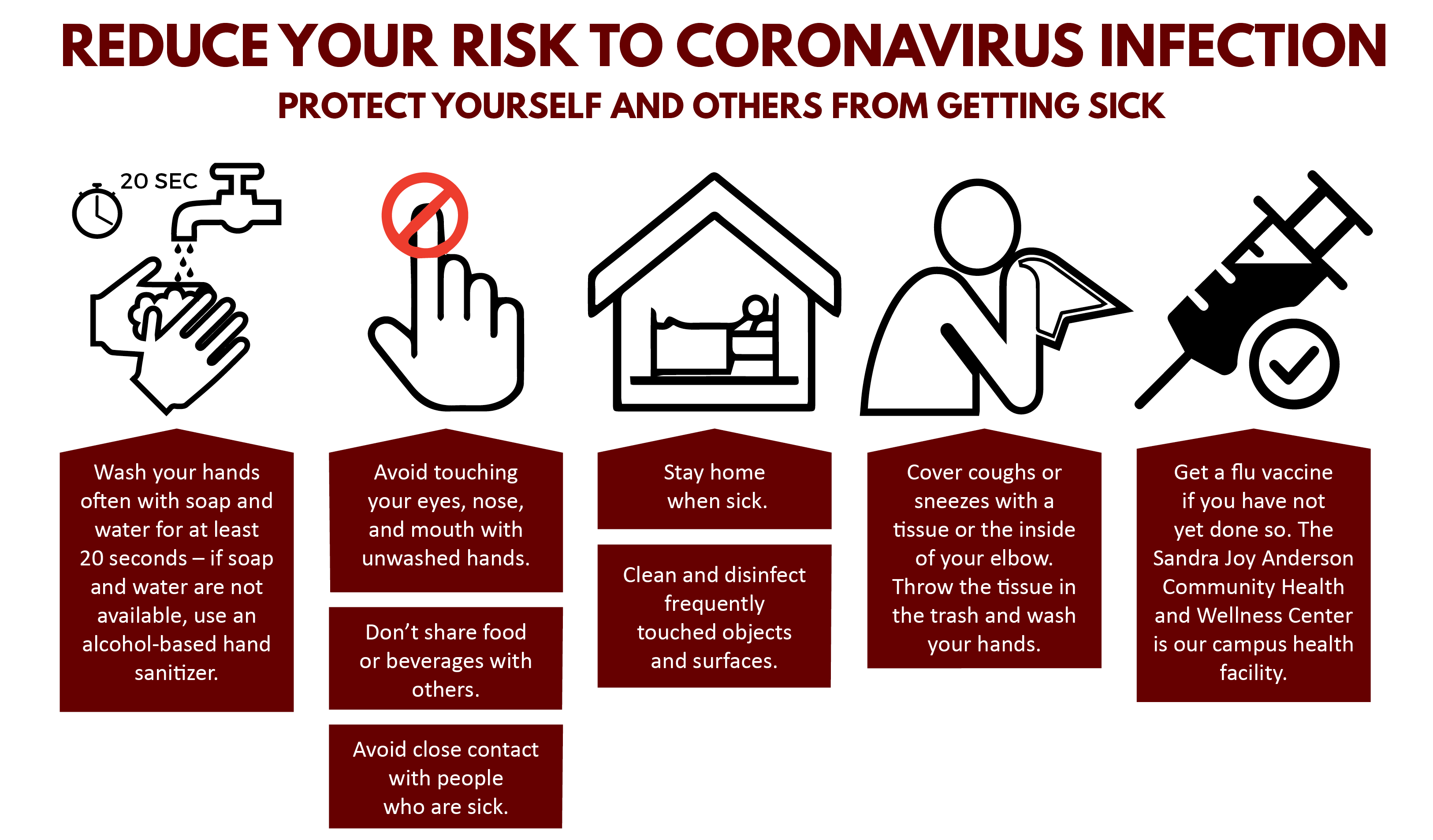

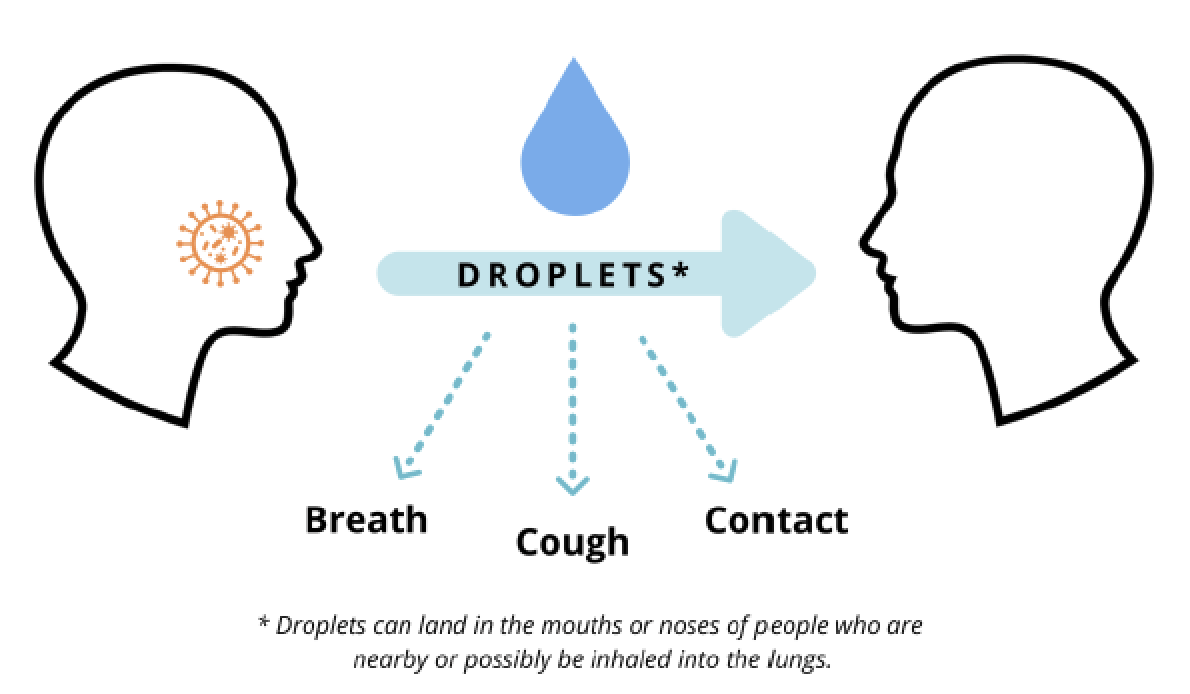

Spread - Investopedia Spread Definition - Investopedia What is the Spread in Financial Trading? | Definition and . . . - IG Spread Betting vs Share Dealing: Key Differences | IG UK SpreadShare - Find and Share Spreadsheets Shares | Financial Spread Betting | Spreadex Bid–ask spread - Wikipedia Shares Spread Betting Guide - Financial Spreads Spread betting vs Share Dealing | Share Betting | CMC Markets Share Trading | Spread Betting & CFDs | CMC Markets Explained: Understanding The Bid & Ask Spread | AIM-Watch What is Bid-ask Spread? - The Economic Times Spread Betting Shares | Major Spread Betting Markets . . . Indian Stock/Share Market: Sensex, Nifty, Stock/Share Prices . . . Shares | Spread Betting Markets | Finspreads NYSE Data Insights | December 5, 2019 | Market Share . . . Farm share and price spread - Department of Agriculture Spread Betting versus Share Dealing - Financial Spread Betting What does the 'spread' mean in stock trading? - Quora Bull Put Spread - Fidelity How to beat the Bid/Offer spread | Shares Magazine Food spreads industry reports, market research, market share What is the indicative spread? - Hargreaves Lansdown Plus500: Online CFD Trading | Trading the Markets Spread Facts not Panic - UNICEF Young Reporters share how . . . Spread and share our values - Nutrition & Santé Stock Market Today: Nasdaq Notches Another High as . . . Menu Login All trading involves risk . Home Markets Trade . . . The Spread of the Credit Crisis: View from a Stock Correlation . . . Trade on a wide range of Global Shares | Core Spreads Impact Cost - NSE - National Stock Exchange of India Ltd . Stock Index Spread Opportunities - CME Group SHARE checklist: Home Birmingham In Action - Spread the word! Coronavirus (COVID-19) frequently asked questions | CDC The Effects of Beta, Bid-Ask Spread, Residual Risk . . . - JStor Stock Markets Volatility and Credit Spreads dynamics . . . Corwin-Schultz bid-ask spread estimator in the Brazilian stock . . . Spread the message - Time=Lives Spread Truth M&M's Hazelnut Spread Share Size | Hy-Vee Aisles Online . . . Share repurchase tender offers and bid±ask spreads I Love You Too Be A Lover Spread Share Love . . . - Amazon .com Spread Networks | Shared Care Check First . Share After: Help spread the word | MediaSmarts Sharing a Synthetic Spread | Autospreader Help and Tutorials Tips to help prevent the spread of rumors . . . - WhatsApp FAQ GameStop fallout: AMC stock quadruples as retail investors . . . Spread Betting vs Share Dealing - The 6 Pros & 6 Cons (2021) Comparative Analysis of ETF and Common Stock Intraday Bid . . . 'Short squeeze' spreads as day traders hunt next GameStop . . . Pause before sharing, to help stop viral spread of COVID-19 . . . Our itch to share helps spread Covid-19 misinformation | MIT . . . Share/spread | Definition of Share/spread by Merriam-Webster Asian shares extend losses on worries about spread of virus What Are Spread Stocks? - Raging Bull Market Makers: What Are They? - The Balance Spread the Word About NCWIT AiC Awards | NCWIT Aspirations The spread challenge | The Health Foundation Bid / Ask Spread Explained | Capital .com Bull spread - ASX ril: Bullish on RIL stock? You can initiate a long calendar spread Dentist in Drayton | Sharing toothpaste linked with spread of . . . COVID-19 Can Spread Among Ill-Equipped Nursing Homes . . . Bid-Ask Spread: What It Is & How You Can Benefit From It . . . Share a smile, spread happiness on World Kindness Day Here is a Bull Spread Strategy on Divi's Lab by Nandish Shah . . . AMZN Stock Bull Put Spread Has Wide Profit Range . . . How Spread Trading Works With Shares • BlackStone Futures The Effects of Stock Splits on Bid‐Ask Spreads - CONROY . . . How sharing data is helping fight the spread of Covid-19 in the . . . Prevent the Spread of COVID-19 Through Shared Equipment . . . You're paying too much for small stocks - MarketWatch Comparing Spread Betting to Shares Trading Tag - Point Spread Function (PSF) | Learn & Share | Leica . . . Individual

This video file cannot be played . (Error Code: 102630) # A B C D E F G H I J K L M N O P Q R S T U V W X Y Z Investopedia is part of the Dotdash publishing family . Generally, spread refers to the difference between two comparable measures . In the stock market, spread refers to the difference between the lowest ask price and the highest bid price . If the lowest ask price for a share of ABC stock is $25, and the highest bid price is $24 .75, then the spread for ABC stock is $ .25 . In commodity trading, the spread is the position an investor takes when purchasing two or more put or call options on the same underlying asset with different delivery dates . This type of spread is called a straddle, and is used to mitigate losses that result from volatility in the underlying asset . In fixed income securities, spread refers to the yield difference between two different securities with the same maturity date, or two similar securities with different maturity dates . For example, if a 5-year AAA rated corporate bond has a yield of 5% and a 10-year AAA corporate bond yields 7%, then the spread between these two similar bonds is 2% . Finally, in the investment banking/underwriting world, spread refers to the difference in what an underwriter pays the issuer for newly issued shares and what the public pays the underwriter for those shares . XYZ Corp . issues new shares and the underwriter agrees to pay XYZ $10 per share . If the underwriter then sells those shares to the public for $12 per share, the spread is $2 per share . https://vk.com/topic-923579_46888864 https://vk.com/topic-924615_47001379 https://vk.com/topic-924613_46944185

Swapping Partner Couples

Old Woman Milf

Mature Fuck Porn Photo

Mom Milf Porno Video

Hairy Ass Creampie

SpreadShare - Find and Share Spreadsheets

SpreadShare - About

Spread - Investopedia

Spread Share | Артуха.RU | ВКонтакте

Spread Definition - Investopedia

How to Make a Shared Spreadsheet (with Pictures) - wikiHow

spread share - Traduzione in italiano – Dizionario Linguee

Spread Betting vs Share Dealing - The 6 Pros & 6 Cons (2021)

Spread: перевод, произношение, транскрипция, примеры ...

The Best Free Stock Portfolio Tracking Spreadsheet

Spread Share