Spread Forex

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Forex

Apply everything you’ve learnt on a real trading account with up to 1:777 leverage, negative balance protection and outstanding support.

Forex spread types - How many are there?

Although every spread type has one purpose of earning the broker some income they still come in different shapes and sizes. There are way too many to mention here, but the ones that are most important to know about are the following:

Bid/ask spread

Yield spread

Option adjusted spread

Negative spread

Z spread

However, we will still only talk about Bid/ask spreads, Yield spreads and negative spreads as the others are a bit more advanced.

Let’s get to know all of them one by one.

What is bid ask spread

When asking for what is the spread in Forex, people usually mean bid ask spreads, as they are the most common ones to find with Forex brokers because they are such an easy way to get payouts for them.

The difference between the bid and the ask price is pretty much what you are paying the broker to receive their service. Although 1 pip may sound really small for making a good income for a company, remember that spreads are calculated according to the size of the lot you are trading.

For a standard lot, 1 pip would be equal to $10, for a mini lot it would be $1 and etc. The more you trade, the more the broker makes through spreads.

The perfect way to calculate how much you are spending on spreads is to use the following formula:

(ask-bid) x lot size = payment size.

Yield spread

Yield spreads are also pretty much the same as bid and ask spreads, but they are usually calculated for different assets. For example, the most popular asset that yield spreads are associated with bonds and here’s how they calculate them.

If there are two bonds of equal size and value, the difference between their yields will result in a yield spread.

So, if one bond has a yield of 10% and another has a yield of 5%, this would mean that the yield spread is only 5%.

This can be used for Forex as well. For example, a high yield spread would be something like this. Imagine that EUR/USD has a yield curve of 20%, and EUR/GBP has 5%. Both of these currency pairs are considered major ones, so calculating the yield spread on them is available.

The yield spread here would be 15%, indicating that more people will start transferring to the EUR/USD pair to find more payouts.

Negative spreads

Negative spreads are only negative for the brokers themselves. Basically what a negative spread means is that you can trade without having to “pay” the broker anything from your trade orders.

In fact, the broker guarantees that you immediately get a payout if the spread is negative. But this is possible only when you make the correct call. If the currency pair starts falling, then no amount of negative spread will be there to save you.

The negative spread Forex usually happens with high-interest rate currencies. The broker is able to profit so much from the government for holding or trading their currency, that they are ready to pay their customers to use this currency pair as much as possible.

Fixed and floating spreads

This is not necessarily a “type” of spread for Forex trading simply because every single spread can be either fixed or floating. They’re like the types of the types of Forex spreads.

A fixed spread is when the broker guarantees that no matter what happens in the market, the spread will remain the same. So, if the spread on EUR/USD was 1 pip, it will stay that way no matter what.

A floating spread is based on market demand. Similar to the price and exchange rate of the currencies, the spread can change by growing or lowering. The market then adjusts it based on how many people continue to trade that currency pair.

Spreads vs Commission

The spread in Forex is considered one of the best options for both brokers and traders, but it doesn’t mean that there is no alternative method for it. That alternative method is the commission. It’s usually very different depending on the broker you are trading with, but it doesn’t mean spreads and commissions can’t be compared.

The main factor is probably the guarantee of spreads and the unpredictability of commissions. You see, when the spread is fixed, you as a trader are already aware of how much you will pay for the broker’s services. But when you are on commissions, they could change dramatically. For example, your trade can grow overnight making you pay a commission, it could reach a deadline making you pay a commission or you could accidentally close the trade too early and again pay a commission.

The logic is quite clear, bid ask spreads may be slightly more expensive when we first look at them, but in the long run, commissions are much more likely of costing you more.

How can spreads change?

Fixed spreads change very rarely, but floating ones are guaranteed to do so. The most common case when a spread change is when there’s a shift in the market.

Imagine a news piece where the government of the United States says that they are increasing interest rates significantly. It’s likely for Forex brokers to react to this news and lower the spreads on their USD currency pairs.

Why? Because they want to increase their volume of USD trades so that the interest rate bonuses are applied to them.

Other reasons for changing the definition of what is a good spread in Forex include market trends and recessions. If the market decides that a specific currency pair is a lot more important to trade, it’s likely for a Forex broker to increase the spreads on it. Why? Because since a lot of people are trading it, it might as well increase their income due to the demand. This corrects the market and people diversify into different currency pairs eventually.

And in terms of recessions, Forex brokers could simply choose one major currency pair and offer the best spreads possible on it.

Apply everything you’ve learnt on a real trading account with up to 1:777 leverage, negative balance protection and outstanding support.

© AXIORY is a trade name of Axiory Global Ltd. All rights reserved

Cookie Policy: The Axiory website uses cookies and by continuing using the website you consent to this.

Risk Warning: Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. Please read the full Privacy Policy.

There is a very simple definition for spread in Forex assets as well as other financial instruments. What is spread in Forex? It is basically the difference between buying and selling prices of the assets you are currently trading.

For example, let’s imagine a USD/JPY trade. In this pair’s case, we are buying JPY with USD, so we need to calculate accordingly. The market is requesting a price of 109.77 JPY per USD, so we buy. There’s another person trying to sell his USD and he is seeing a price of 109.79 JPY per USD. Once the trade goes through each trader gets the according amount and the spread comes in to be at 2 pips. So 109.79-109.77= 0.02.

But what is a spread in Forex trading? Why is there a gap between these prices? Well, it’s quite simple. The spread is usually an income source for the broker. Every broker has a “liquidity provider” who directs the trades to the market and helps both the broker and the trader make payouts.

Those liquidity providers have their own spread as well, so if the broker wants to have at least some income, they either have to charge commissions on the traders, or mark the spread up.

So, what are spreads in Forex? A spread, no matter what we call it, is the difference between buying and selling prices of currency pairs or other assets. The higher the spread, the less income a trader can expect from their trading activities.

Spreads are the most popular way for Forex brokers to generate income. Most of them have fixed spreads which guarantees them a steady income. The higher the spread, the more income the Forex broker makes.

The best spread on Forex pairs can be found with major currencies. Things such as USD, EUR, GBP, JPY and etc. As long as the pair is constructed with these pairs the spread is almost guaranteed to be extremely low.

This is even more relevant for EUR/USD, which is the most traded pair in the market.

There are two types of spreads. A fixed one and a floating one. The floating spread changes all the time based on market movements and trends. The fixed spread could change on very rare occasions such as monetary policy changes or recessions.

When trading Forex, either online or offline, you need to pay a certain set of commissions. Here's what is spread in Forex trading: It's one of the most popular commission charges used by brokers. When it comes to the spread meaning in Forex, it deprives from subtracting the bid price from the ask price and it all occurs during trading, so that you don't need to specifically pay anything. Usually, the bid price is always smaller than the ask price, which means the broker is buying a certain asset at a lower price from you, whereas it sells the same asset at a higher price - exactly what constitutes an FX spread.

Forex brokers don’t necessarily have their own storage of funds. They use things called liquidity providers. These liquidity providers are the ones that let you trade currencies and give you the funds for your leverage.

In case of a negative spread Forex pair, the liquidity provider is most likely trying to somehow acquire new retail clients or simply increase its volume for a quota. Forex brokers are often trying to not show you any negative spread options because it’s not profitable for them.

Not necessarily. They both have their advantages and disadvantages. For example, the fixed spread gives a guarantee that you will be charged only 1 pip per lot no matter what. A floating spread could possibly charge you 1.2 pips per lot or 0.8 pips per lot depending on how the market is performing.

There’s a risk factor with floating spreads, but it has a chance of being a bit more profitable for the trader. In most cases though, traders choose to go with fixed spreads so that they don’t have to do too much calculating.

If you look at what is Forex spread with Major or even Minor currencies, you'll see that they have some of the lowest commission charges in the market. For example, the EUR/USD currency pair will come with very tight spread trading opportuntities because it's the most popular and widely-used currency pair and there are tons of liquidity providers, as well as traders, that drive the prices low. So, the most widely-traded currencies will come with good spreads in Forex meaning they'll be more convenient to trade in the market.

There’s such a thing called a pip spread definition in Forex. It’s usually different depending on the service provider you are using as it’s up to them to decide how to price their pips. But let’s consider that a standard lot pip is worth $10.

If you spread it to 2 pips, this means that you will have to pay $20 per 1 standard lot trader. A mini lot would cost $2, a micro lot would be $0.2 and a nano lot would be $0.02.

Yes. Some traders that have a much larger account would usually get better deals on their spreads.

For example, if the regular account has a spread of 3 pips on EUR/USD, a higher level account would have 1 pip spread. This is an advantage for the broker because they keep the high-level trader. What is spread in Forex but a way to generate income for the brokers?

It’s very hard to reach a high-level account status though as it needs lots of trading volume. So whoever has that better spread condition definitely earned it.

At Axiory Global Ltd. we try to bring trading back to the client. A professional trading environment with fast executions and highly secured internal procedures, these are foundations on which we build and which we take seriously. But for us, it’s not enough.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Axiory Global Ltd. will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

THIRD PARTY LINKS: Links to third-party sites are provided for your convenience. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as ours. Axiory Global Ltd neither endorses nor guarantees offerings of the third party providers, nor is Axiory Global Ltd responsible for the security, content or availability of third-party sites, their partners or advertisers.

The content on this website is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Axiory Global Ltd. has taken reasonable measures to ensure the accuracy of the information on the website, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the website, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website.

Axiory Global Ltd. is not under the supervision of the JFSA, it is not involved with any acts considered to be offering financial products and solicitation for financial services, and this website is not aimed at residents in Japan.

Restrictions to accessing our services might apply to individuals being national of, or resident in, the following countries:

Albania, Barbados, Botswana, Cambodia, Ghana, Jamaica, Mauritius, Myanmar, Nicaragua, Pakistan, Panama, Syria, Uganda, Yemen, Zimbabwe.

We do not provide our service to the inhabitants of United States of America, Canada, EU countries, Islamic Republic of Iran, Indonesia, North Korea, Belize. You need to be 18 years old or legal age as determined by the laws of the country where you live in order to become our client.

The website is owned by AXIORY group of companies. The group includes PT International Limited, registration number 9668659, Enterprise House, 5 Roundwood Lane, Harpenden, Herts, England, AL5 3BW, London (operates the website) and Axiory Global Limited, registration number 127 090, registered address No.1 Corner of Hutson Street and Marine Parade, Belize City, Belize, authorized by International Financial Services Commission of Belize, licence number 000122/15.

What is a Spread in Forex Trading? - BabyPips.com

What is spread in Forex and what does it actually do?

What is Spread in Forex ? | Learn Forex | CMC Markets

Forex Spread Explanation in Details | FreshForex

What Does a Forex Spread Tell Traders?

Home

Learn

Learn forex trading

What is spread in forex

Fill in our short form and start trading

Explore our intuitive trading platform

Trade the markets risk-free

Australia

English

简体中文

Österreich

Canada

English

简体中文

France

Deutschland

Ireland

Italia

New Zealand

English

简体中文

Norge

Polska

Singapore

English

简体中文

España

Sverige

United Kingdom

International

English

简体中文

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Products

What you can trade

Forex

Indices

Commodities

Shares

Treasuries

Trading platforms

Next Generation

Charting features

Trading tools

News & insight

Order execution

Mobile trading apps

iPhone

iPad

Android

News & Analysis

Our market analysts

Learn

Trading guides

Learn forex trading

Learn CFD trading

Support

Help topics

Getting started FAQs

Account applications FAQs

Funding and withdrawals FAQs

Platform FAQs

Product FAQs

Charges FAQs

Complaints FAQs

Security FAQs

Glossary

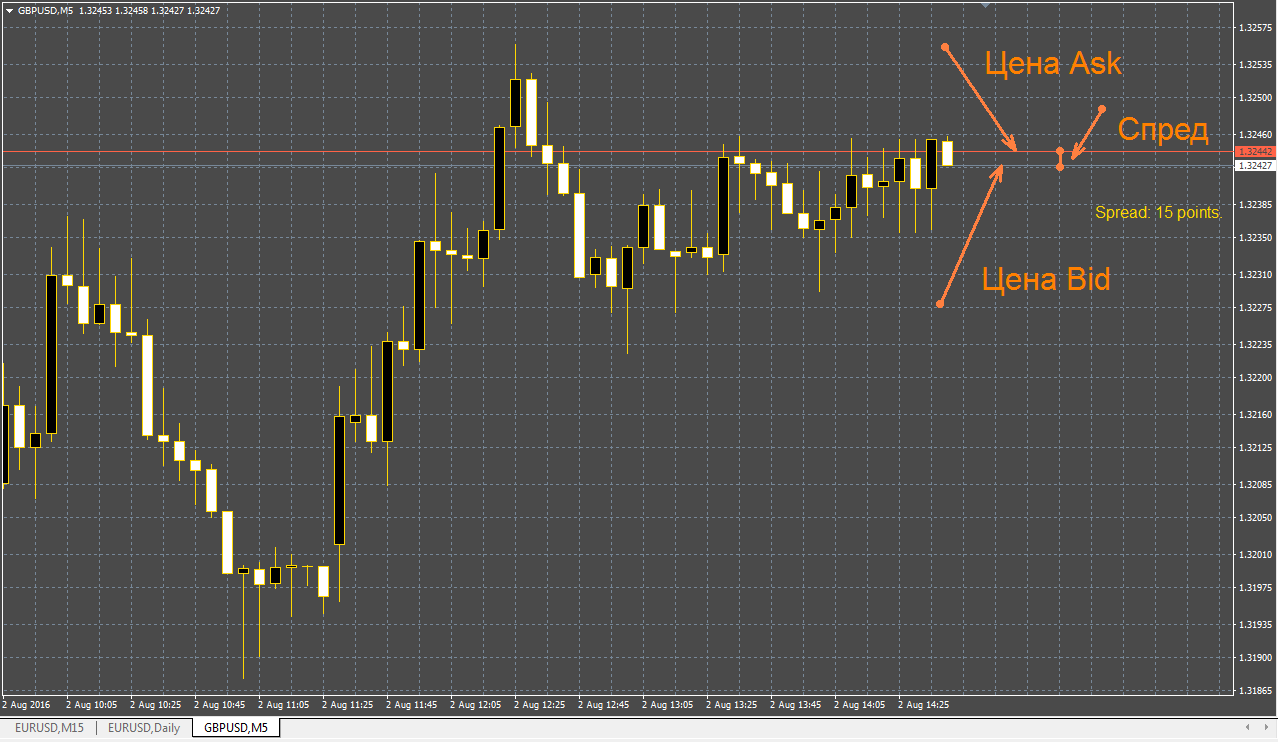

In forex trading , the spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair.

There are always two prices given in a currency pair , the bid and the ask price . The bid price is the price at which you can sell the base currency, whereas the ask price is the price you would use to buy the base currency.

The base currency is shown on the left of the currency pair, and the variable, quote or counter currency, on the right. The pairing tells you how much of the variable currency equals one unit of the base currency.

The buy price quoted will always be higher than the sell price quoted, with the underlying market price being somewhere in-between.

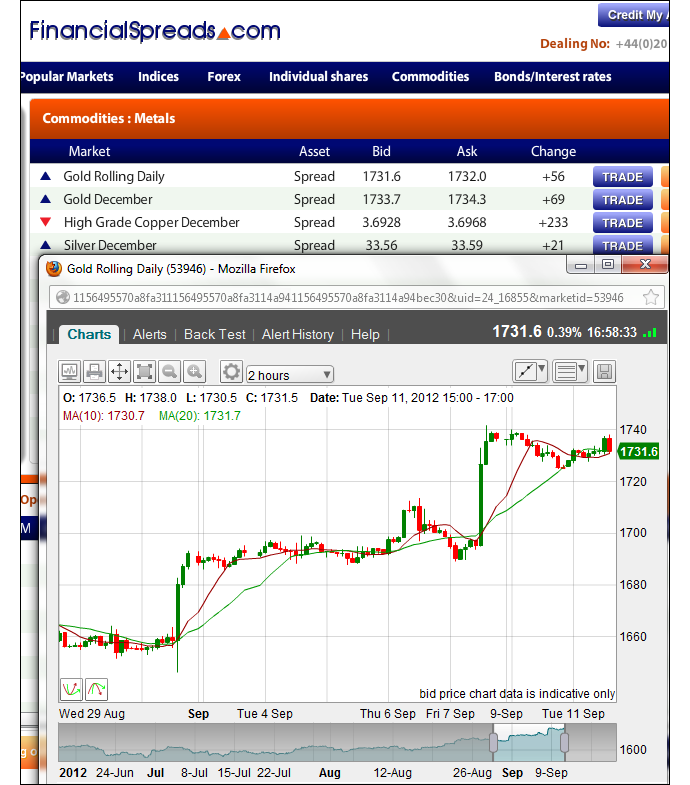

Most forex currency pairs are traded without commission, but the spread is one cost that applies to any trade that you place. Rather than charging a commission, all leveraged trading providers will incorporate a spread into the cost of placing a trade, as they factor in a higher ask price relative to the bid price. The size of the spread can be influenced by different factors, such as which currency pair you are trading and how volatile it is, the size of your trade and which provider you are using.

Some of the major forex pairs include:

The spread is measured in pips , which is a small unit of movement in the price of a currency pair, and the last decimal point on the price quote (equal to 0.0001). This is true for the majority of currency pairs, aside from the Japanese yen where the pip is the second decimal point (0.01).

When there is a wider spread, it means there is a greater difference between the two prices, so there is usually low liquidity and high volatility. A lower spread on the other hand indicates low volatility and high liquidity. Thus, there will be a smaller spread cost incurred when trading a currency pair with a tighter spread. To start trading on the most popular forex pairs in the market, we have provided some suggestions here.

When trading, the spread can either be variable or fixed. Indices , for example, have fixed spreads. The spread for forex pairs is variable, so when the bid and ask prices of the currency pair change, the spread changes too.

Some of the benefits and drawbacks of these two types of spreads are outlined below:

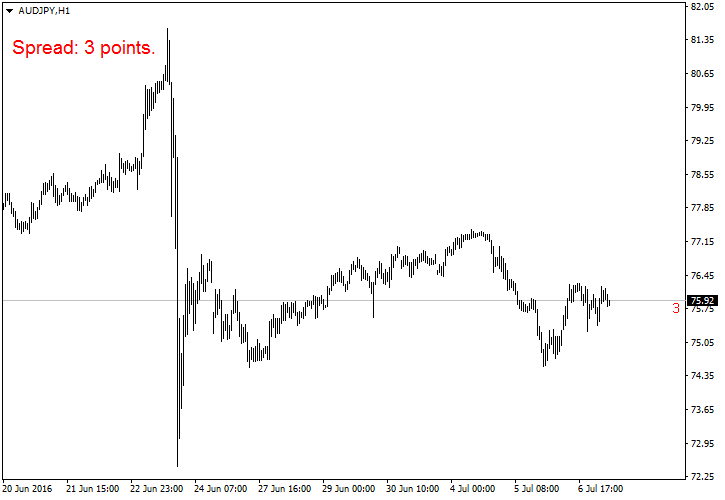

The spread is calculated using the last large numbers of the buy and sell price, within a price quote. The last large number in the image below is a 3 and a 4. When trading forex, or any other asset via a CFD or spread betting account, you pay the entire spread upfront. This compares to the commission paid when trading share CFDs, which is paid both when entering or exiting a trade. The tighter the spread, the better value you get as a trader.

For example: The bid price is 1.26739 and the ask price is 1.26749 for the GBP/USD currency pair.

If you subtract 1.26739 from 1.26749, that equals 0.0001. As the spread is based on the last large number in the price quote, it equates to a spread of 1.0.

The spread indicator is typically displayed as a curve on a graph to show the direction of the spread as it relates to bid and ask price. This helps visualise the spread in the forex pair over time, with the most liquid pairs having tighter spreads and the more exotic pairs having wider spreads.

Factors which can influence the forex spread include market volatility, which can cause fluctuation. Major economic news, for example, can cause a currency pair to strengthen or weaken – thus affecting the spread. If the market is volatile, currency pairs can incur gapping, or the currency pair becomes less liquid, so the spread will widen.

Keeping an eye on an economic calendar can help prepare you for the possibility of wider spreads. By staying informed as to what events might cause currency pairs to become less liquid, you can make an educated prediction as to whether their volatility might increase, and thus whether you might see a greater spread. However, breaking news or unexpected economic data can be difficult to prepare for.

There will also be a lower spread for currency pairs traded in high volumes, such as the major pairs containing the USD. These pairs have higher liquidity but can still be at risk of widening spreads if there is economic volatility.

During the major market trading sessions , like London, New York and Sydney sessions, there are likely to be lower spreads. In particular, when there is an overlap, such as when the London session is ending and the New York session is beginning, the spread can be narrower still. The spread is also influenced by the general supply and demand of currencies – if there is a high demand for the euro, the value will increase.

If the forex spread widens dramatically, you run the risk of receiving a margin call , and worst case, being liquidated. A margin call notification occurs when your account value drops below 100% of your margin level, signalling you’re at risk of no longer covering the trading requirement. If you reach 50% below the margin level, all your positions may be liquidated.

It’s therefore important to gauge how much leverage you’re trading with and the size of your position. Forex pairs are usually traded in larger amounts than shares, so it’s important to remain aware of your account balance.

A forex spread is the difference between the bid price and the ask price of a currency pair, and is usually measured in pips. Knowing what factors cause the spread to widen is crucial when trading forex. Major currency pairs are traded in high volumes so have a smaller spread, whereas exotic pairs will have a wider spread. See our guide on risk management when trading.

We offer competitive spreads on a range of currency pairs, including major pairs such as EUR/USD and GBP/USD. Discover forex trading with our award-winning trading platform .

Disclaimer CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

Experience our powerful online platform with pattern recognition scanner, price alerts and module linking.

Access our full range of markets, trading tools and features.

Try trading with virtual funds in a risk-free environment.

Try CFD trading with virtual funds in a risk-free environment.

Access our full range of products, trading tools and features.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under registration number 154814. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License .

Can get a tighter spread than fixed

More appropriate for novice traders

More appropriate for experienced traders

A volatile market won't effect the spread

Spread can widen rapidly if there is high volatility

Naughty America Incest

Japan Lingeries

Outdoor Design

Voyeur Pee Video

Naked 720