Spread Definition

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Definition

1 a : to open or expand over a larger area

spread out the map

b : to stretch out : extend spread its wings for flight

2 a : to distribute over an area

spread fertilizer

b : to distribute over a period or among a group

spread the work over a few weeks

c : to apply on a surface

spread butter on bread

d (1) : to cover or overlay something with

spread the cloth on the table

(2) archaic : to cover completely

e (1) : to prepare or furnish for dining : set spread the table

(2) : serve spread the afternoon tea

3 a : to make widely known

spread the news

b : to extend the range or incidence of

spread a disease

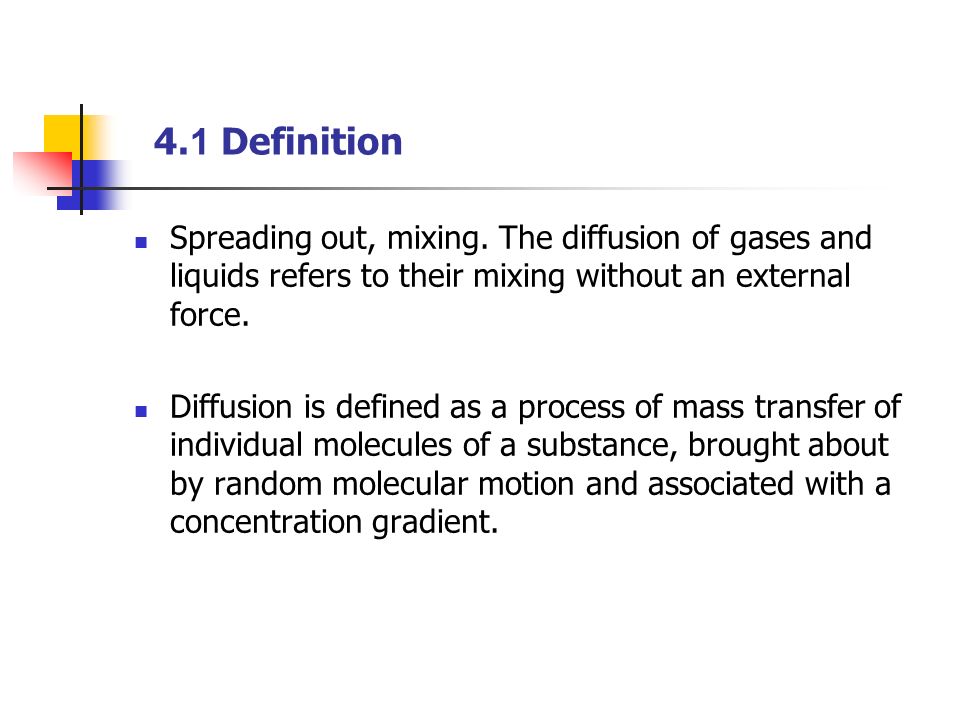

c : diffuse , emit flowers spreading their fragrance

4 : to push apart by weight or force

1 a : to become dispersed, distributed, or scattered

b : to become known or disseminated

panic spread rapidly

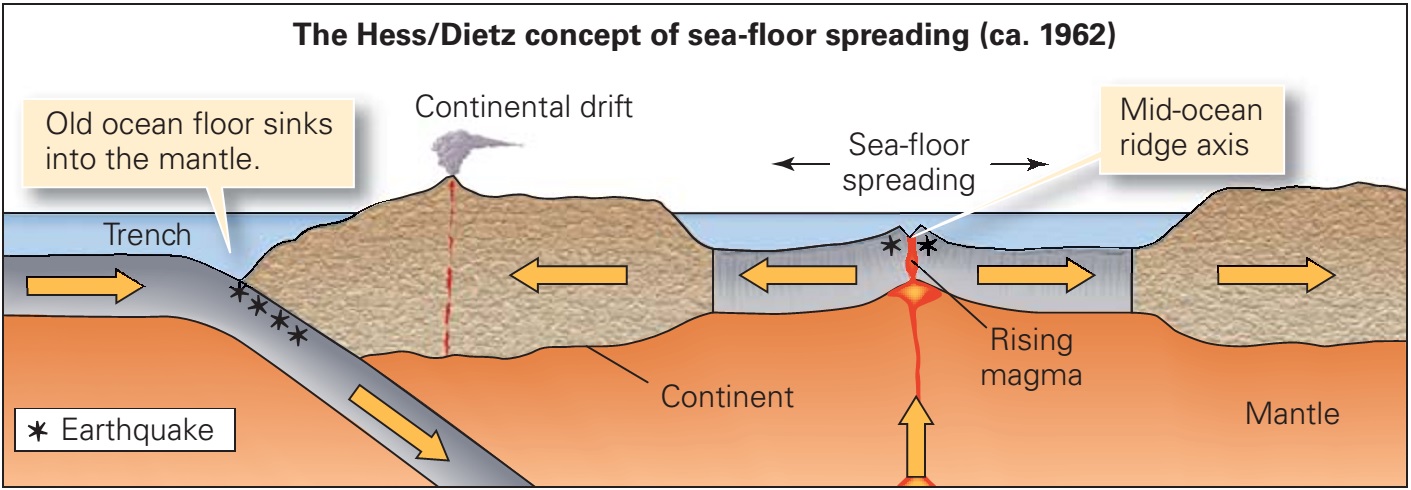

2 : to grow in length or breadth : expand

3 : to move apart (as from pressure or weight) : separate

1 a : the act or process of spreading

b (1) : a ranch or homestead especially in the western U.S.

(2) Western US : a herd of animals

c (1) : a prominent display in a periodical

(2) : two facing pages (as of a newspaper) usually with matter running across the fold also : the matter occupying these pages

3 : something spread on or over a surface: such as

a : a food to be spread (as on bread or crackers)

a cheese spread

c : a cloth cover for a table or bed

4 : distance between two points : gap

5 : a commodities market transaction in which a participant hedges with simultaneous long and short options in different commodities or different delivery dates in the same commodity

spreadability \ ˌspre-də-ˈbi-lə-tē \ noun

spreadable \ ˈspre-də-bəl \ adjective

: to open, arrange, or place (something) over a large area

: to place (things) over a large area

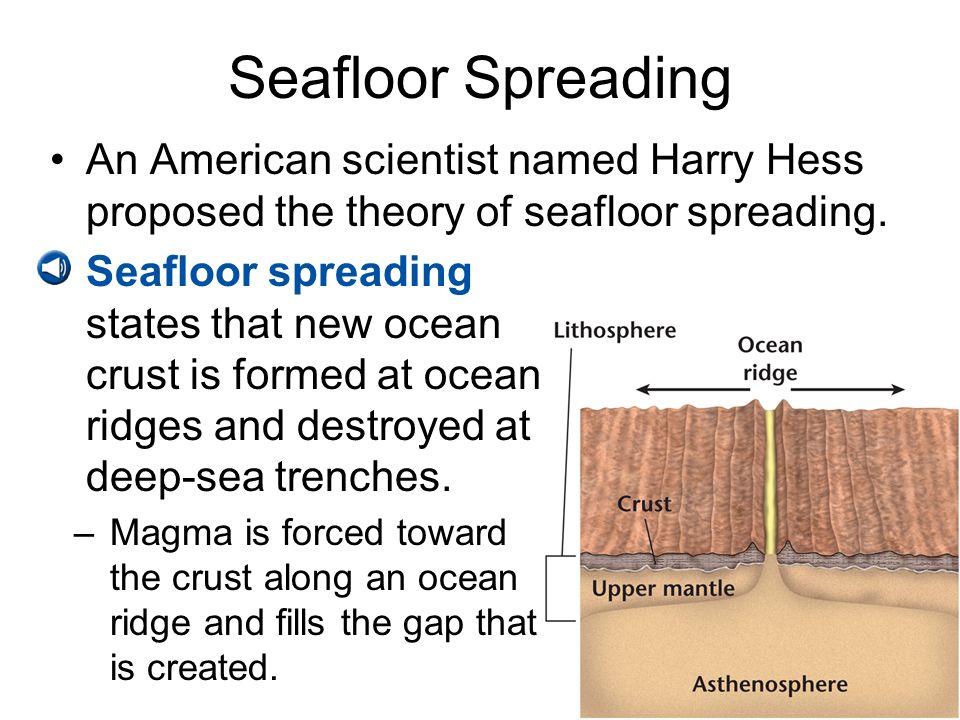

: to become larger or to affect a larger area : to move into more places

: growth or increase that causes something to cover a larger area, affect a larger number of people, etc.

: a soft food that is spread on bread, crackers, etc.

: the total distance between the two outer edges of something

1 : to stretch out : extend I spread my arms wide.

2 : to pass or cause to pass from person to person

The news spread rapidly. Flies can spread disease.

3 : to open or arrange over a larger area

The captain spread out a map.

4 : to increase in size or occurrence

The fire keeps spreading . Cell phone use spread quickly.

5 : to scatter or be scattered

spread fertilizer

6 : to give out over a period of time or among a group

The boss spread work to make it last.

7 : to put or have a layer of on a surface

He spread butter on bread.

8 : to cover something with

Mom spread a cloth on the table.

9 : to stretch or move apart

I spread my fingers open.

10 : to prepare for a meal : set The table was spread for dinner.

1 : the act or process of increasing in size, amount, or occurrence

the spread of education

2 : the distance between two points that are farthest to each side

the spread of a bird's wings

3 : a noticeable display in a magazine or newspaper

4 : a food to be put over the surface of bread or crackers

cheese spread

6 : a cloth cover for a table or bed

1 a : the difference between any two prices for similar articles

the spread between the list price and the market price of an article

b : the difference between the highest and lowest prices of a product or security for a given period

c : the difference between bid and asked prices (as of a stock)

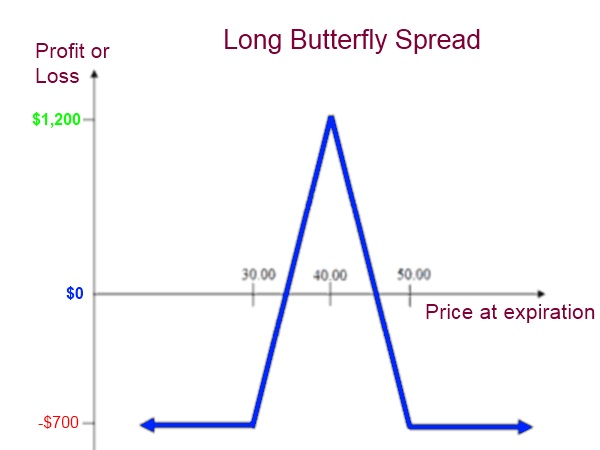

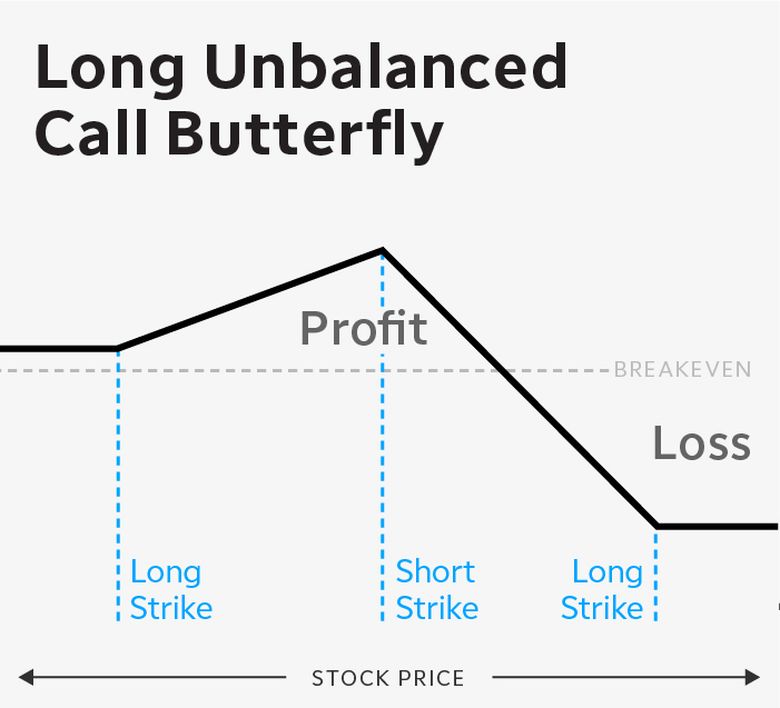

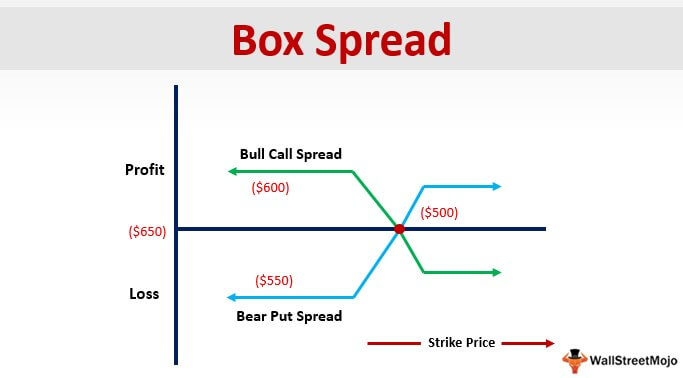

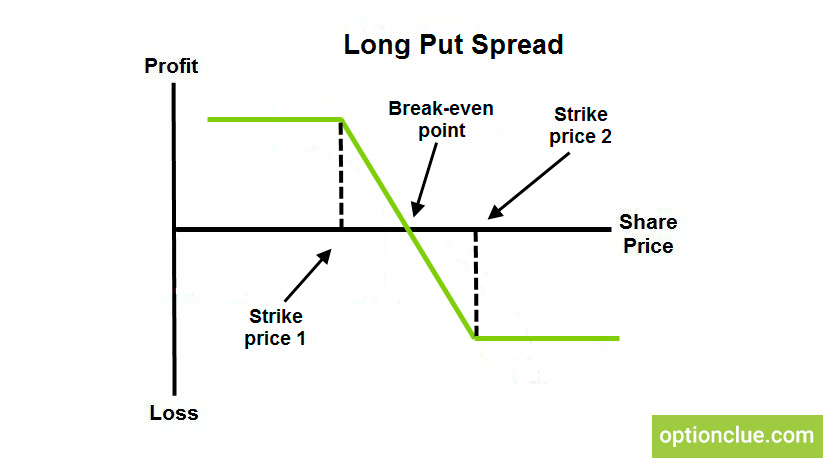

2 a : a simultaneous put option and call option in which the put price and the call price differ so that no profit is made unless the price falls below or rises above the put or call price respectively by more than enough to cover the cost of the option also : the difference between the put price and call price

b : a transaction in which a participant hedges with simultaneous long and short options in different commodities or different delivery dates in the same commodity

3 : an arbitrage transaction operated by buying and selling simultaneously in two markets when there is an abnormal difference in price between the two markets also : the difference in price

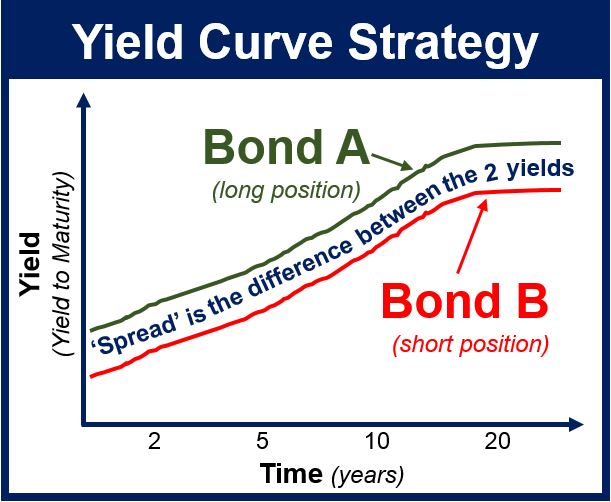

4 : the difference between the yields on investments in fixed-income securities equal in quality but with different maturity dates or with the same maturity dates but unequal quality

Love words? Need even more definitions?

To save this word, you'll need to log in.

Definition of spread (Entry 2 of 2)

These example sentences are selected automatically from various online news sources to reflect current usage of the word 'spread.' Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Send us feedback .

13th century, in the meaning defined at transitive sense 1a

1565, in the meaning defined at sense 1a

Middle English spreden , from Old English -sprǣdan ; akin to Old High German spreiten to spread

From the Editors at Merriam-Webster

“Spread.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/spread. Accessed 3 Feb. 2021.

English Language Learners Definition of spread (Entry 2 of 2)

Kids Definition of spread (Entry 2 of 2)

More from Merriam-Webster on spread

What made you want to look up spread ? Please tell us where you read or heard it (including the quote, if possible).

Test your visual vocabulary with our 10-question challenge!

A daily challenge for crossword fanatics.

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Learn a new word every day. Delivered to your inbox!

© 2021 Merriam-Webster, Incorporated

Spread definition and meaning | Collins English Dictionary

Spread | Definition of Spread by Merriam-Webster

Spread Definition

Spread - definition of spread by The Free Dictionary

Spread | Definition of Spread by Oxford Dictionary on Lexico.com also...

In finance, a spread refers to the difference between two prices, rates or yields One of the most common types is the bid-ask spread, which refers to the gap between the bid (from buyers) and the ask (from sellers) prices of a security or asset Spread can also refer to the difference in a trading position – the gap between a short position (that is, selling) in one futures contract or currency and a long position (that is, buying) in another

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market.

A yield spread is the net difference between two interest bearing instruments, expressed in terms of percent or basis points (bps).

An intermarket spread involves purchasing long futures in one market and selling short futures of a related commodity with the same expiration.

Slippage refers to the discrepancy between the expected price of a trade and the price at which the trade is executed.

The London Interbank Bid Rate is the average interest rate at which major London banks bid for eurocurrency deposits from other banks in the interbank market.

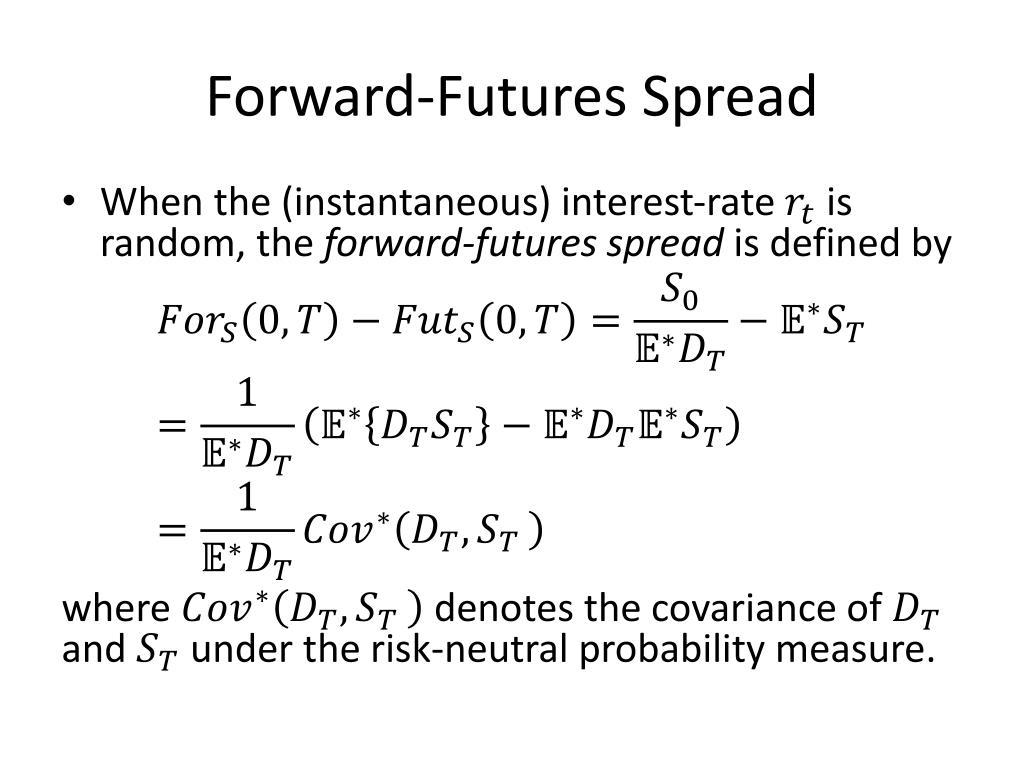

A futures spread is an arbitrage technique in which a trader takes two positions on a commodity to capitalize on a discrepancy in price.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

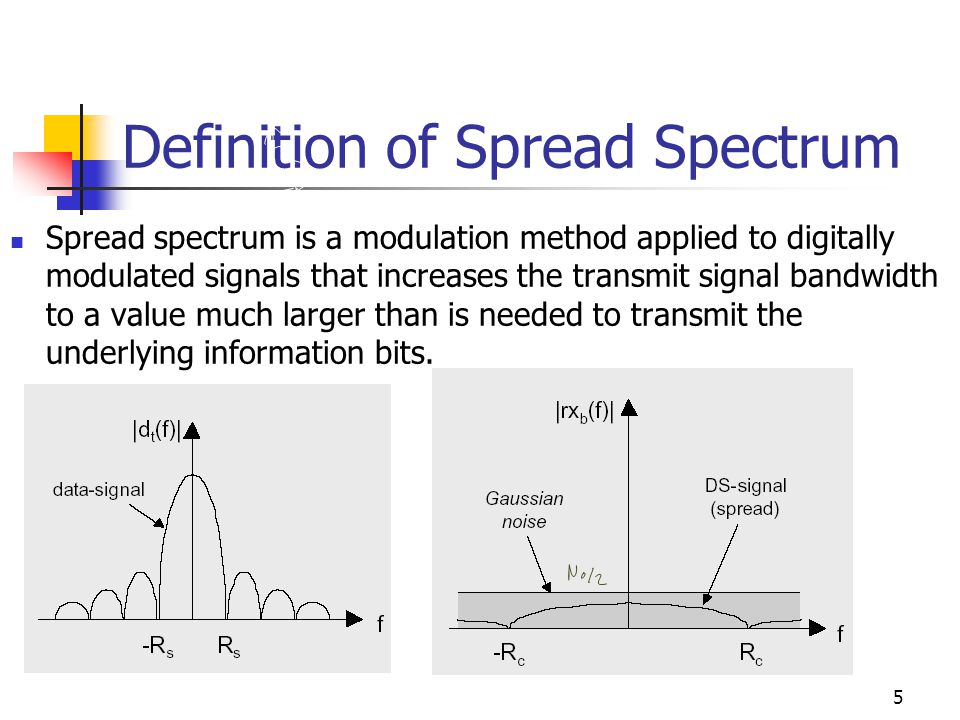

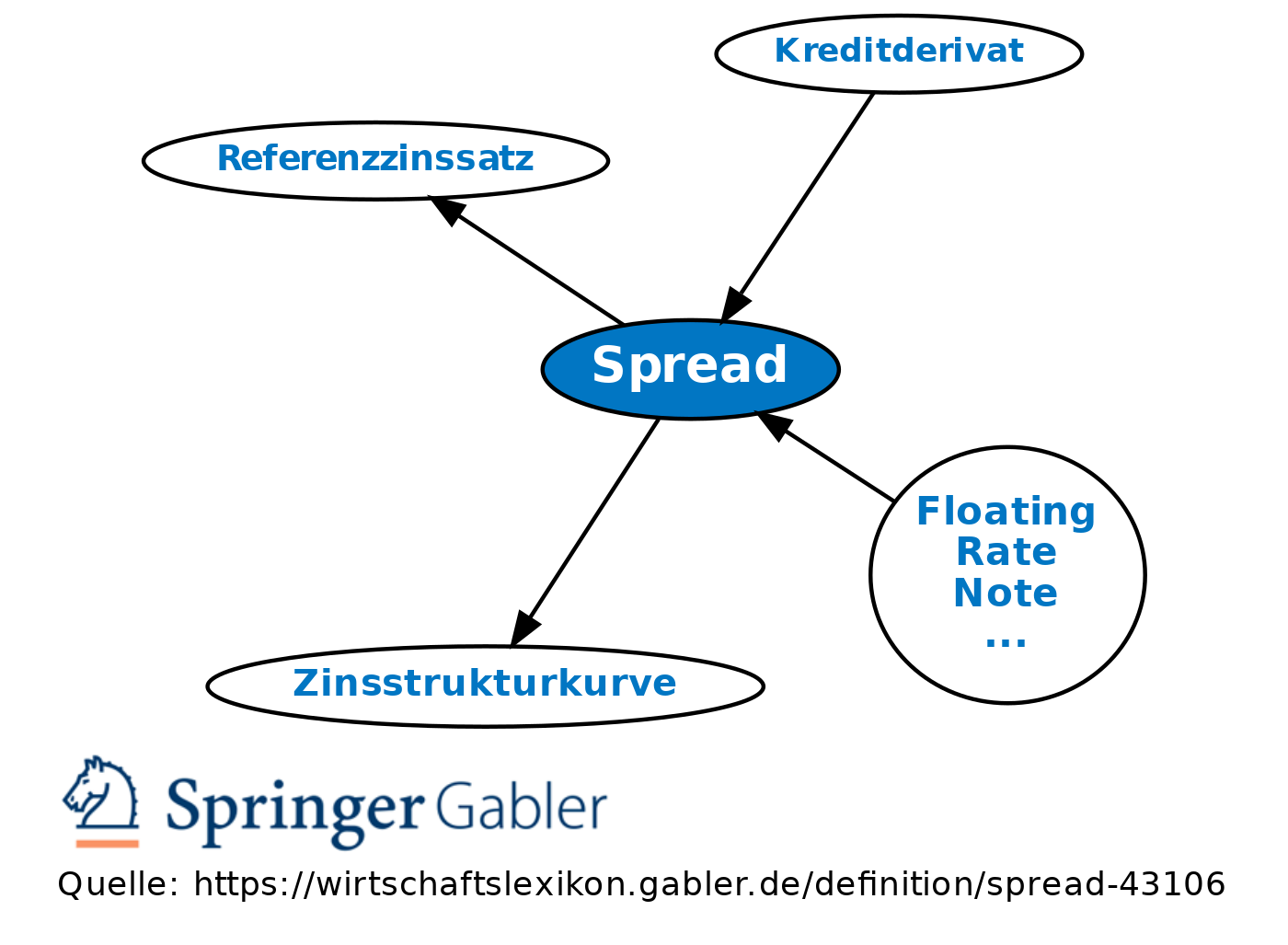

A spread can have several meanings in finance. Basically, however, they all refer to the difference between two prices, rates or yields .

In one of the most common definitions, the spread is the gap between the bid and the ask prices of a security or asset, like a stock, bond or commodity. This is known as a bid-ask spread.

Spread can also refer to the difference in a trading position – the gap between a short position (that is, selling) in one futures contract or currency and a long position (that is, buying) in another. This is officially known as a spread trade.

In underwriting , the spread can mean the difference between the amount paid to the issuer of a security and the price paid by the investor for that security—that is, the cost an underwriter pays to buy an issue, compared to the price at which the underwriter sells it to the public.

In lending, the spread can also refer to the price a borrower pays above a benchmark yield to get a loan. If the prime interest rate is 3%, for example and a borrower gets a mortgage charging a 5% rate, the spread is 2%.

The bid-ask spread is also known as the bid-offer spread and buy-sell. This sort of asset spread is influenced by a number of factors:

For securities like futures contracts , options, currency pairs and stocks, the bid-offer spread is the difference between the prices given for an immediate order – the ask – and an immediate sale – the bid. For a stock option , the spread would be the difference between the strike price and the market value .

One of the uses of the bid-ask spread is to measure the liquidity of the market and the size of the transaction cost of the stock. For example, on Jan. 8, 2019 the bid price for Alphabet Inc., Google's parent company, was $1,073.60 and the ask price was $1,074.41. The spread is 80 cents, or $.80. This indicates that Alphabet is a highly liquid stock, with considerable trading volume.

The spread trade is also called the relative value trade. Spread trades are the act of purchasing one security and selling another related security as a unit. Usually, spread trades are done with options or futures contracts. These trades are executed to produce an overall net trade with a positive value called the spread.

Spreads are priced as a unit or as pairs in future exchanges to ensure the simultaneous buying and selling of a security. Doing so eliminates execution risk wherein one part of the pair executes but another part fails.

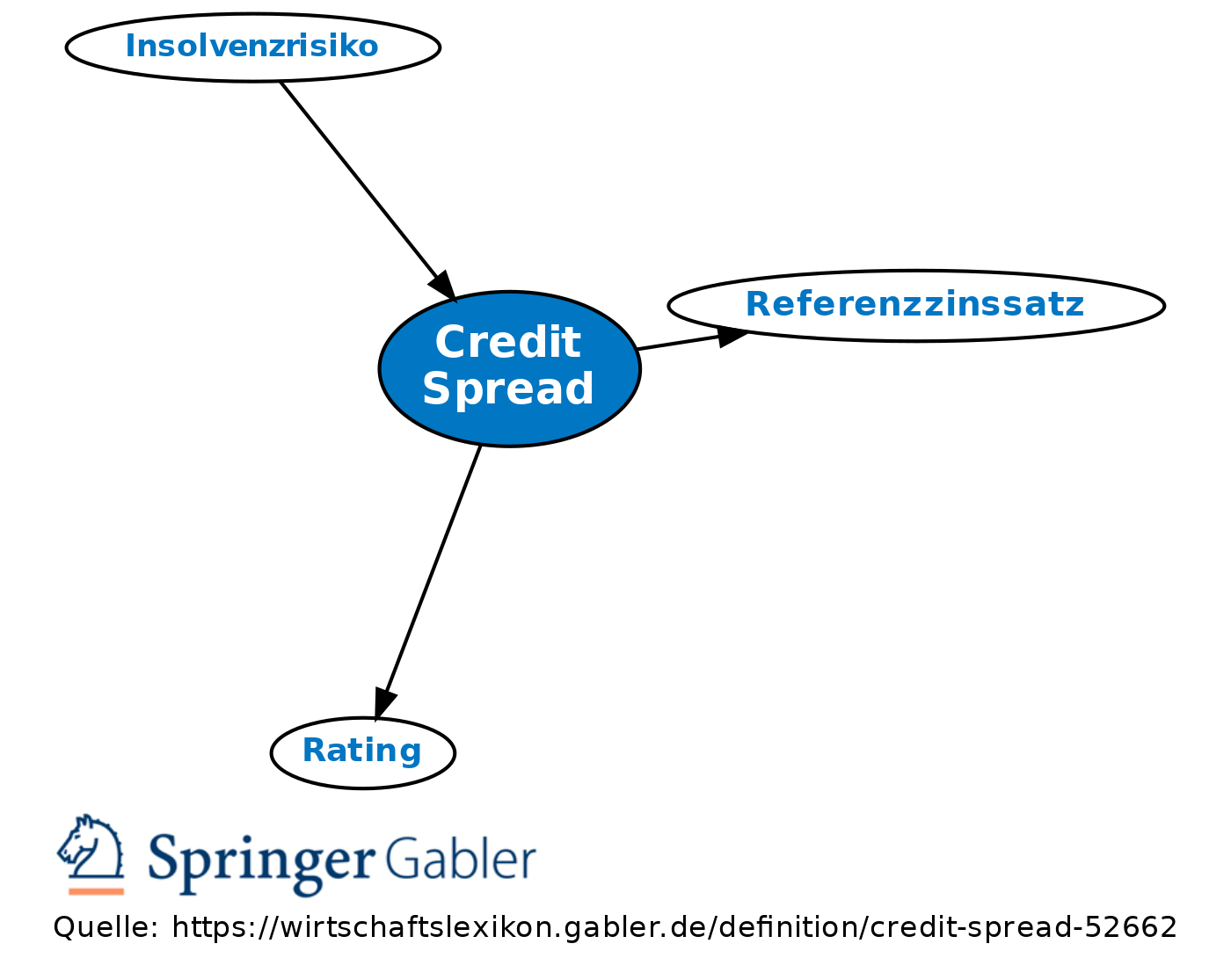

The yield spread is also called the credit spread . The yield spread shows the difference between the quoted rates of return between two different investment vehicles. These vehicles usually differ regarding credit quality .

Some analysts refer to the yield spread as the “yield spread of X over Y.” This is usually the yearly percentage return on investment of one financial instrument minus the annual percentage return on investment of another.

To discount a security’s price and match it to the current market price, the yield spread must be added to a benchmark yield curve . This adjusted price is called option-adjusted spread . This is usually used for mortgage-backed securities (MBS), bonds, interest rate derivatives and options.

For securities with cash flows that are separate from future interest rate movements, the option-adjusted spread becomes the same as the Z-spread.

The Z-spread is also called the Z SPRD, yield curve spread and zero-volatility spread . The Z-spread is used for mortgage-backed securities. It is the spread that results from zero-coupon treasury yield curves which are needed for discounting pre-determined cash flow schedule to reach its current market price. This kind of spread is also used in credit default swaps (CDS) to measure credit spread.

Advanced Trading Strategies & Instruments

Https Youjizz Sex Hayvonlarga Siktirgan Qizlar Html

Hot School Girls Fucked

Don T Be Nasty

Porn Masturbate Fingers

Hugo Boss Private Accord

/dotdash_Final_Bear_Call_Spread_Apr_2020-01-876ed1191c524f8dbbea367e3d1bb3b9.jpg)