Spread Charts

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Charts

Открыть Страницу «SpreadCharts.com» на Facebook

We plan to widen the scope of our data offerings in the future. And we...

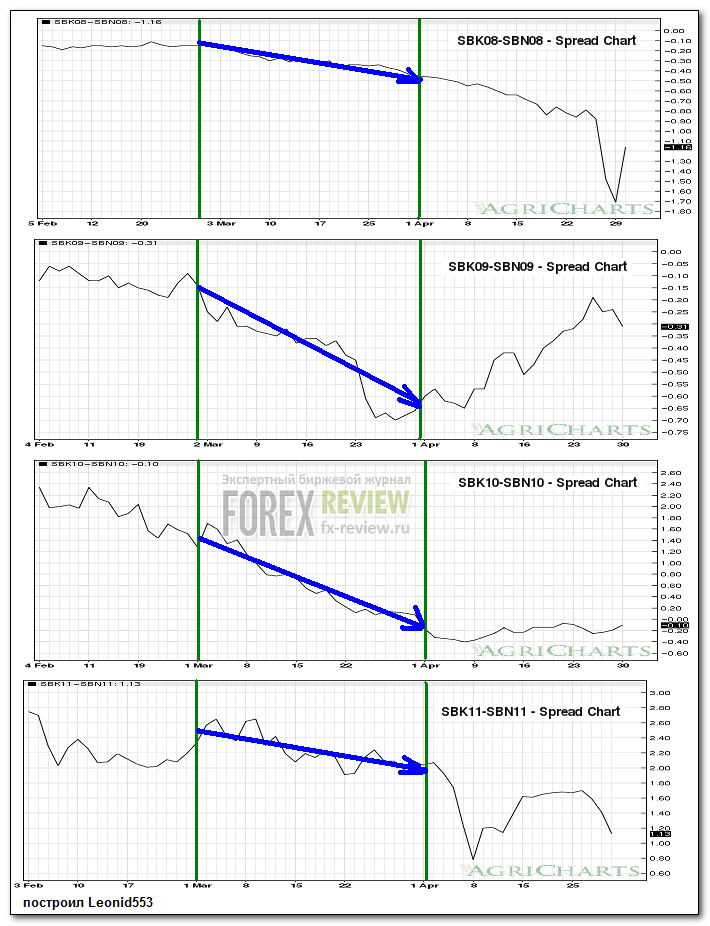

“(1/7) One of our premium users suggested us to analyze bull spreads in grains. And it is truly looking as an asymmetrical opportunity, especially the near spreads. #OATT #ZC_F $CORN #ZS_F $SOYB”

All information on this website is for educational purposes only and is not intended to provide financial advice. There is a risk of loss in futures trading.

We have launched another major update of the SpreadCharts app today. We bring you an...

Radim Hranický Novinky jsou super, ale nevyváží omezení, které jste přidali do free verze. Maximum 3 otevřených tabů bych ještě chápal, ale omezení watchlistu na 10 položek jste teda přehnali. Chápu, že je to vaše aplikace a udělat to můžete, ale nechápu proč bych měl platit za analýzy, nebo signály které nepotřebuju jen abych měl ve watchlistu více, než 10 položek. Za mě palec dolů. :(

All information on this website is for educational purposes only and is not intended to provide financial advice. There is a risk of loss in futures trading.

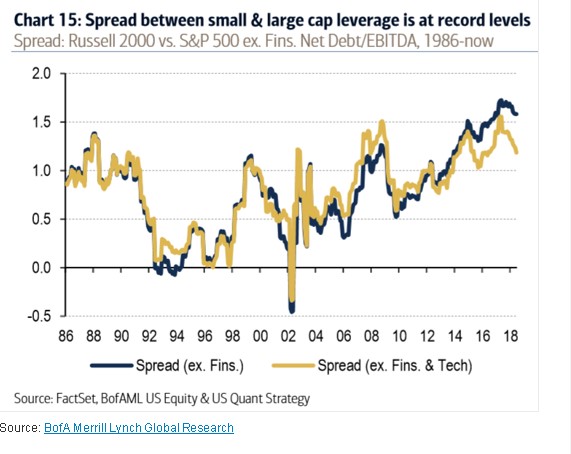

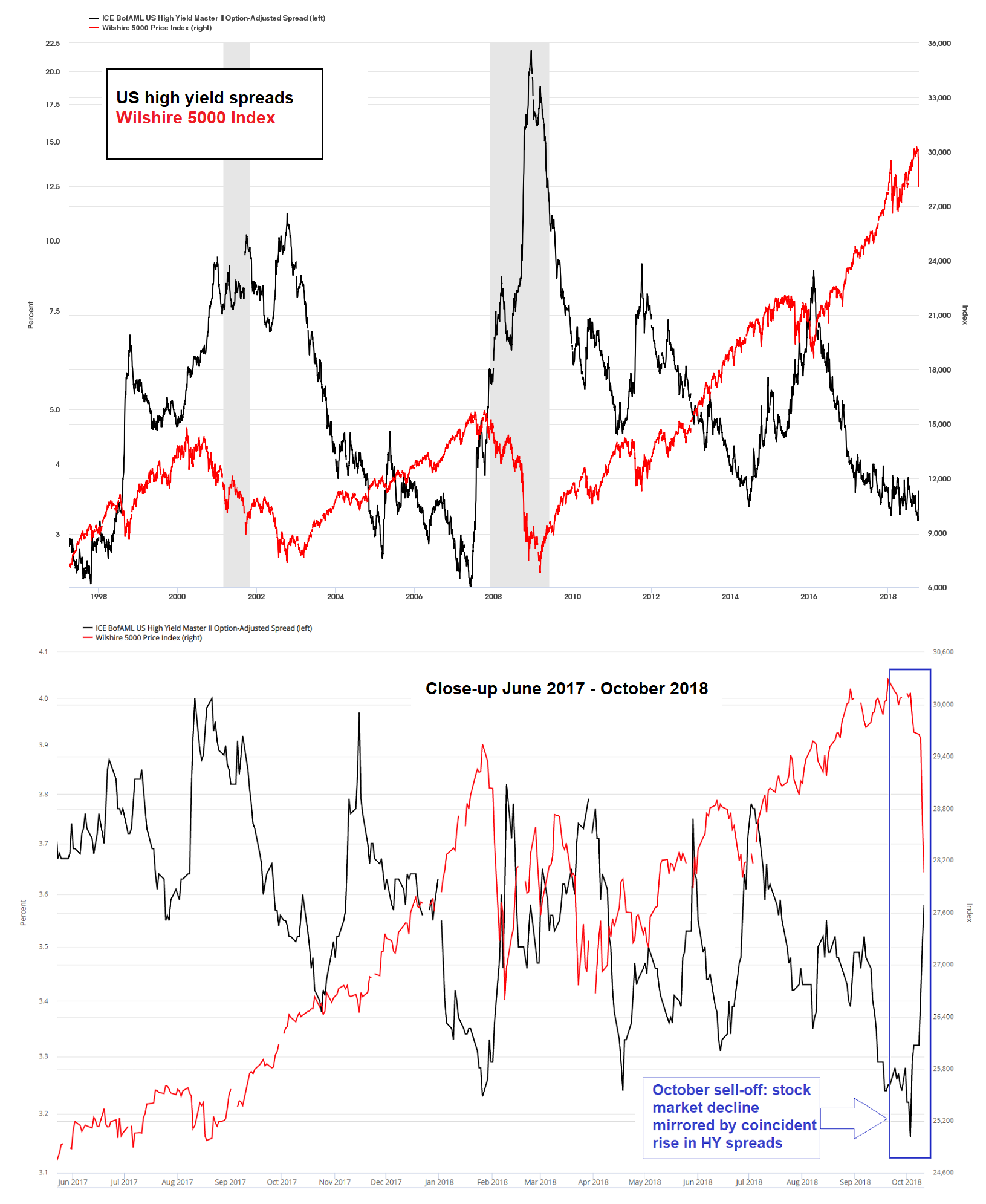

Volatility spiked, and stocks sold off last week. Is this the start of a major selloff we were anticipating?

Maybe. But don't be fixated on the short-term price action too much. For example, Friday's market internals were rather bullish. Only the breadth was truly bad. Maybe it will lead to a bounce on the stock market next week. But this observation is based just on a single data point (Friday), which means it's not very reliable.

It will be a breakout on the dollar that wil … l trigger the unwind of many overcrowded trades out there. And it has not happened yet. The dollar may consolidate here for a few more weeks before making a move higher.

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

We remain very selective with regard to the opportunities worth a closer look.

Today we like spreads on 🍰 Sugar 🍰 , 🛢️ Brent 🛢️ and 🌱 KC Wheat 🌱 .

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

Watch grains, especially 🌽 Corn 🌽 and 🌱 Soybeans 🌱 . Btw the the 🐄 cattle 🐄 end its spreads we've been positive about for quite some time is finally moving.

We added Canola futures data into the SpreadCharts app.

The markets are following our New Year's forecast perfectly so far. While we told you to expect a large selloff in the medium term, the high-frequency data pointed to further upside in the short term.

What about now? Are the markets ready to fall in a panic selloff? Well, no, at least not according to our data. Just don't forget any short-term prediction is inherently uncertain. Nonetheless, stocks will probably push even higher. The risk is, however, extreme and is rising ev … ery day.

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

Many important strong signals on energy like 🛢️ Brent 🛢️ or ⛽ ULSD ⛽ and 🌱 Soybean complex 🌱 .

You all saw the selloff in gold and silver over the last few days.

It has done some technical damage, and many have started to question the uptrend’s sustainability, at least in the short term.

We decided to make a comprehensive analysis that can help you filter out the noise and point the key details that might decide the gold’s short-term direction.

Check our analysis of the asymmetrical opportunity on near bull spreads in grains (thread):

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

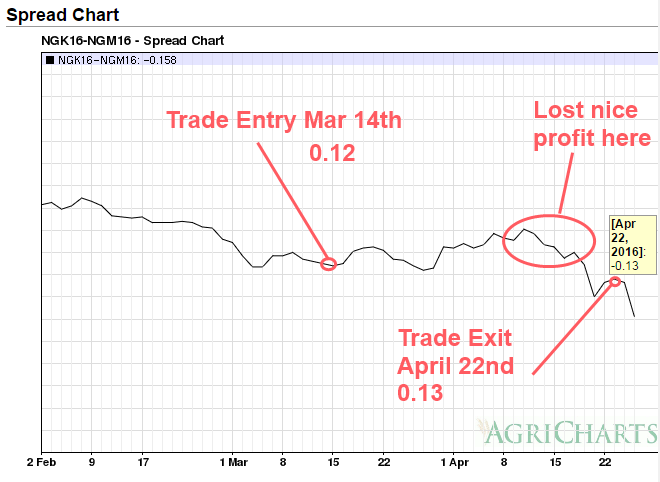

We like the signal on 🐄 Cattle 🐄 and maybe the risky signal on 🍫 Cocoa 🍫 . Don't forget to check the valid signal on 🪙 Gold 🪙 and follow the weak signal on 🔥 NatGas 🔥 .

New trading signals on SpreadCharts will be published somewhat later today as we forgot to change the year in the input COT data and have to generate the signals again with the latest Commitments of Traders data.

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

Signals on 🪙 Gold 🪙 and 🍫 Cocoa 🍫 definitely have our attention. We also like the price action on ⛽ ICE Gasoil ⛽ , both the underlying and the spreads.

What to expect from the markets in 2021?

What are the emerging major trends and how to profit from them?

...these are just some of the questions we answered in our special video analysis in the Research section of the SpreadCharts app.

Commitments of Traders data won't be published today. Its release has been postponed to Monday's close due to New Year’s Day in the US.

New trading signals on SpreadCharts, normally scheduled to be computed during the weekend, will instead be generated after the release of the COT data (Tuesday). Existing signals, however, will be updated normally.

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

We like the spreads in 🐷 Hogs 🐷 , 🛢️ Brent Crude oil 🛢️ and 🍫 Cocoa 🍫 . There is also a new valid signal on 🪙 Gold 🪙

Commitments of Traders data won't be published today. Its release has been postponed to Monday's close due to Christmas Day in the US.

New trading signals on SpreadCharts, normally scheduled to be computed during the weekend, will instead be generated after the release of the COT data (Tuesday). Existing signals, however, will be updated normally.

Another major update of the SpreadCharts app is here! We bring you entirely new watchlist and many improvements focused on a better mobile experience.

SpreadCharts app will undergo maintenance on Tuesday, December 22nd, 2020. You can look forward to amazing new features.

The app will be unavailable for a few tens of minutes under the perfect scenario. However, if we encounter any problems, it can take us some time to resolve them. Therefore, brace for more downtime through the day, just as a precaution.

📈 New trading signals 📈 have been added to https://app.spreadcharts.com

We continue to like the spreads in 🐷 Hogs 🐷 and 🐄 Cattle 🐄 , especially in our intermarket strategy (check our research). The risky spread in 🍫 Cocoa 🍫 is also doing great. We're also watching 🍰 Sugar 🍰 which might become a great opportunity (just not quite there yet).

We've been long-term bullish on coffee. It first caught our attention at the end of 2018 when we predicted it would break out of the massive falling wedge.

This eventually happened in 2019, and the subsequent price action has also been supportive. Ultimately, we expect the price to double or maybe even triple from the current levels.

On the other hand, there is some uncertainty in the short term. For example, the dollar is heavily oversold, and any bounce there can put commod … ities under pressure for some time.

Электронный адрес или номер телефона

Spread Charts — TradingView

SpreadCharts.com - Posts | Facebook

How to Create Spread Charts on Thinkorswim - YouTube

Commodity Futures Spread Charts

Futures Spread Overview

Women Pee Voyeur

Lopez Ass

Standing Public Sex

Private Boarding Schools

Femdom Slave Licking Sperm Vk