Spread Builder

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Builder

TWS Strategy Builder | Interactive Brokers LLC | Spread Pricing

Spread builder | Cryptocurrency statistical arbitrage - Part 7 - YouTube

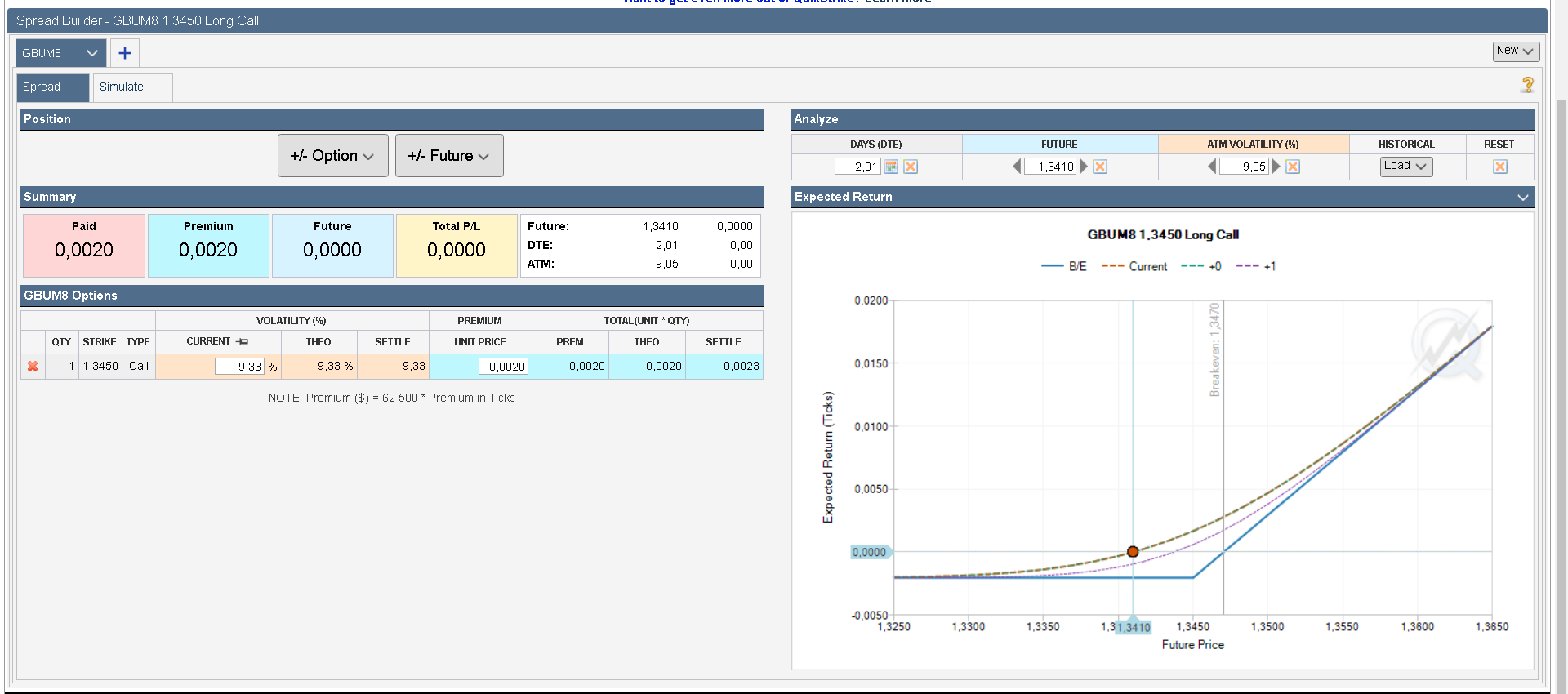

Strategy Simulator User Guide - CME Group | Build a Strategy

Powerful options analysis platform with an extensive set of tools.

Spread Builder | MERCEDES GL&GLK-The Best, only for Rich People | ВКонтакте

26 Feb 2018

By

CME Group

Topics: General Education

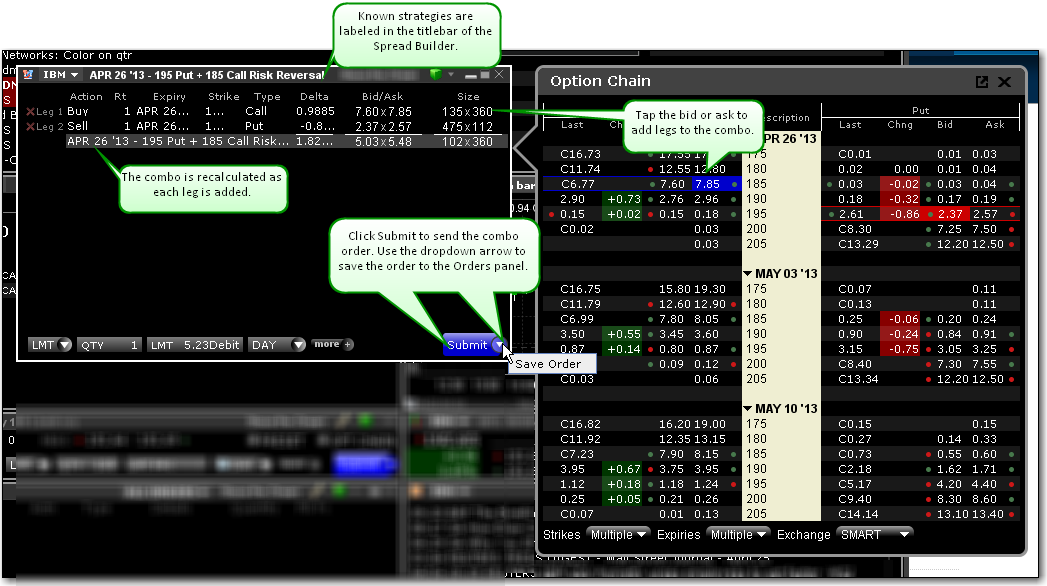

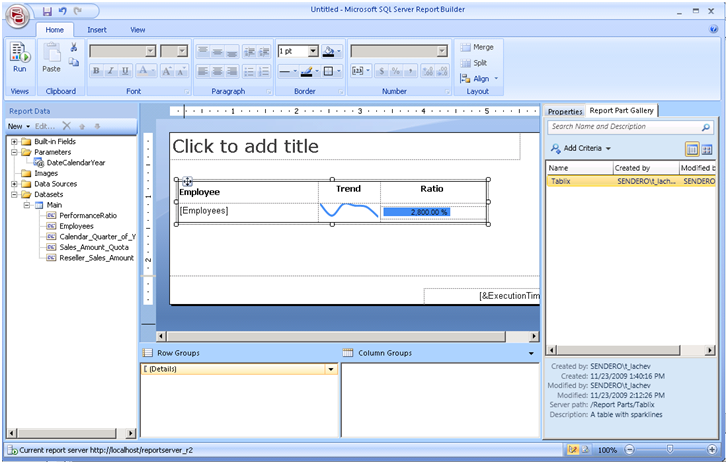

3. Select the Contract Expiration (expirations will vary by product)

5. Click the dropdown arrow to add the desired instrument

5. Select Option from the Spread Builder screen

6. Select the desired strike prices

Call arrows on the left. Put arrows on the right

Use up arrows to add to the position

Use down arrow to subtract from the position

5. Select Future from the Spread Builder screen

6. Enter the Quantity and Futures price

Positive quantity indicates Long position

Negative quantity indicates Short position

5. Select Physical from the Spread Builder screen

6. Enter the Quantity and Physical price

Positive quantity indicates Long position

Negative quantity indicates Short position

Clear Physical will close the dialog box

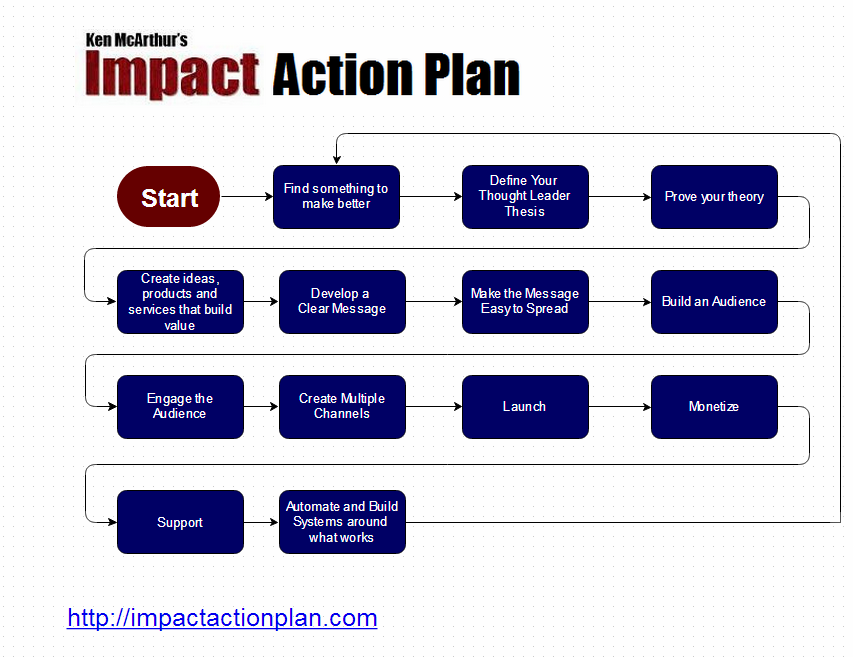

1. Add an additional strategy to analyze. If more than one strategy is built. Simulate All tab will be available, allowing comparison between the strategies.

2. Adjust chart settings – specifically view profit and loss in ticks or dollar terms

3. Run the strategy through hypothetical, monte carlo underlying scenarios.

4. Add additional instruments to the current strategy.

5. Allows user to view strategy summary, profit and loss charting, analyze and manually adjust days til expiration (DTE), Future price, ATM (at the money) Volatility, Historical market conditions, Reset.

7. Start Over – clears current strategy

9. View strategy values in terms of Theoretical Value, Delta, Gamma, Vega or Theta

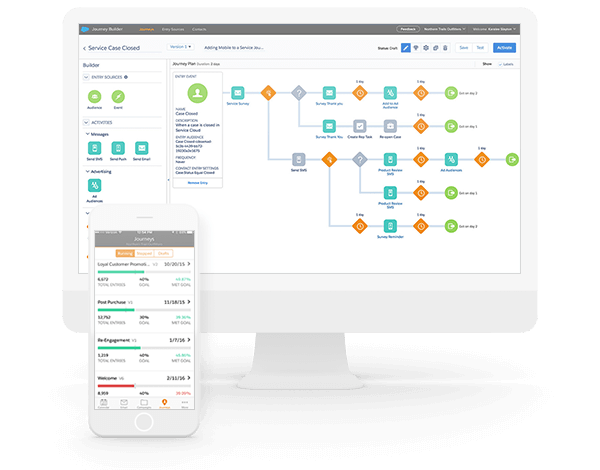

3. Select to run position through one of the hypothetical, Monte-Carlo scenarios. These scenarios are simulations targeted to follow a price path. Simulation does not affect the

4. Profit/Loss of the strategy(ies) is charted

5. Summary of the strategy(ies) performance along with Profit/Loss is displayed

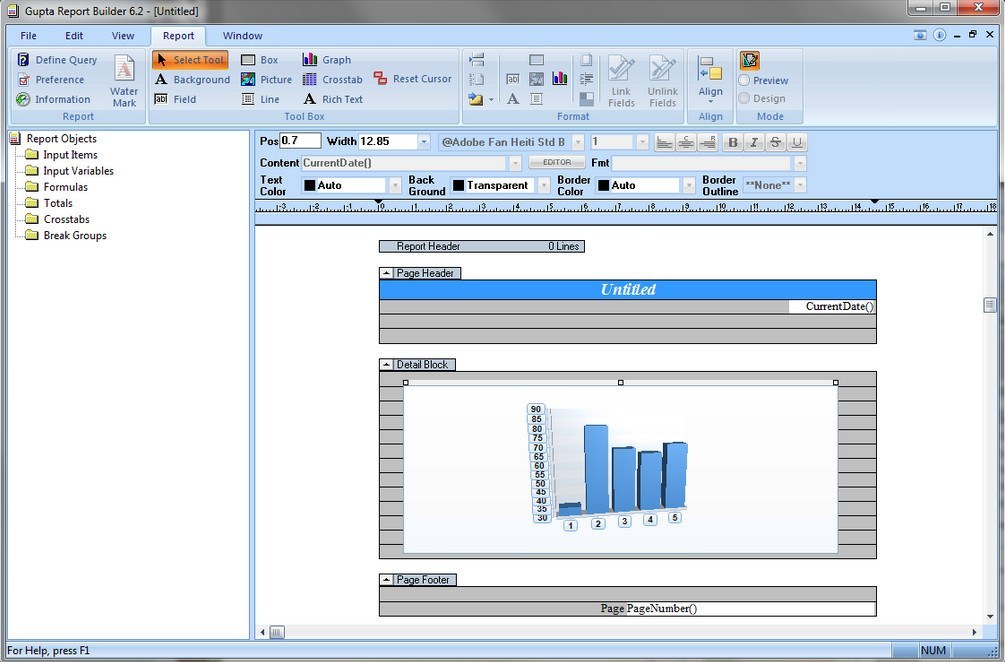

This screen allows you to build a spread using any combination of options, futures, or physical positions.

Option – allows users to enter an option position

Future – allows users to enter a futures position

Physical – allows users to enter an existing cash position and build option and future hedges around the cash position

a. Up Fast – simulates a fast upward underlying move

b. Up Slow – simulates a slow upward underlying move

c. Flat – simulates a relatively unchanged underlying move

d. Down Slow – simulates a slow downward underlying move

e. Down Fast – simulates a slow downward underlying move

As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.

CME Group is the world's leading and most diverse derivatives marketplace. The company is comprised of four Designated Contract Markets (DCMs).

Further information on each exchange's rules and product listings can be found by clicking on the links to CME , CBOT , NYMEX and COMEX .

© 2021 CME Group Inc. All rights reserved.

Anonymous Private

Sex 4k Film Full Movie Softcore

Nude Heaven Nudist Models

Bending Ass

Furry Oral Porn