Spread Bond

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Bond

From Wikipedia, the free encyclopedia

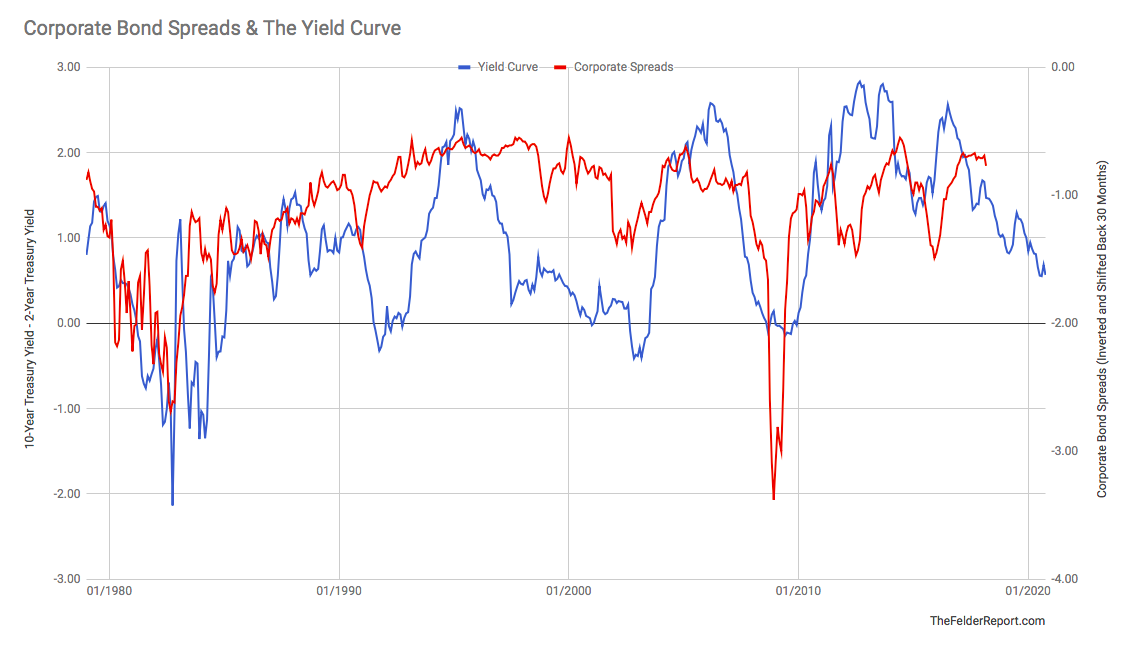

^ Macro Musings Blog. 26 November 2008. What Corporate Bond Yield Spreads Tell Us

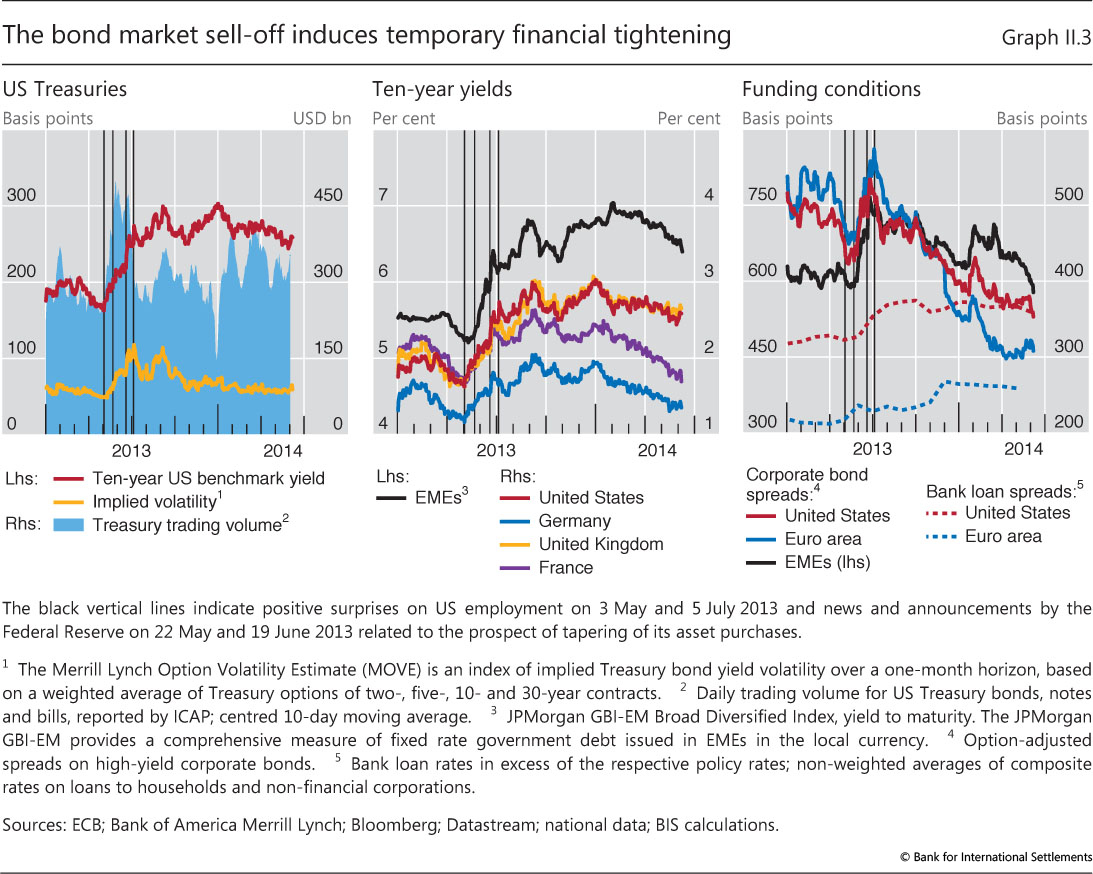

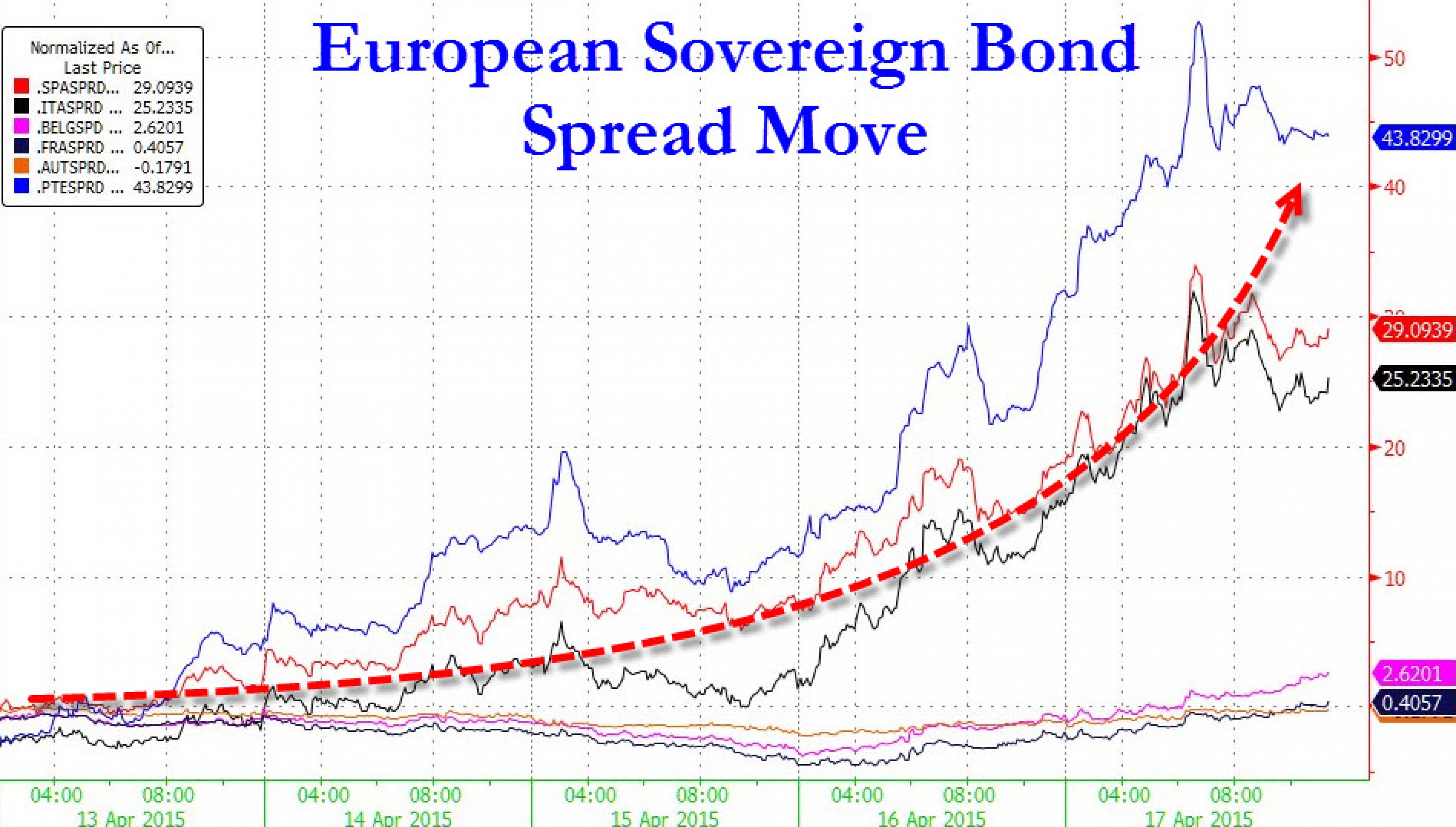

In finance , the yield spread or credit spread is the difference between the quoted rates of return on two different investments , usually of different credit qualities but similar maturities. It is often an indication of the risk premium for one investment product over another. The phrase is a compound of yield and spread .

The "yield spread of X over Y" is generally the annualized percentage yield to maturity (YTM) of financial instrument X minus the YTM of financial instrument Y.

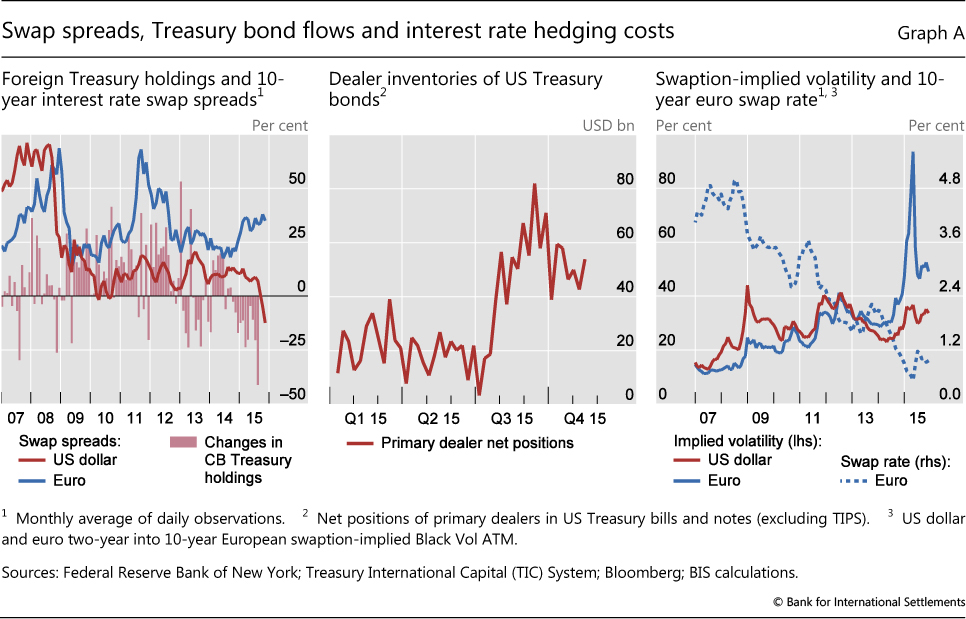

There are several measures of yield spread relative to a benchmark yield curve , including interpolated spread ( I-spread ), zero-volatility spread ( Z-spread ), and option-adjusted spread (OAS).

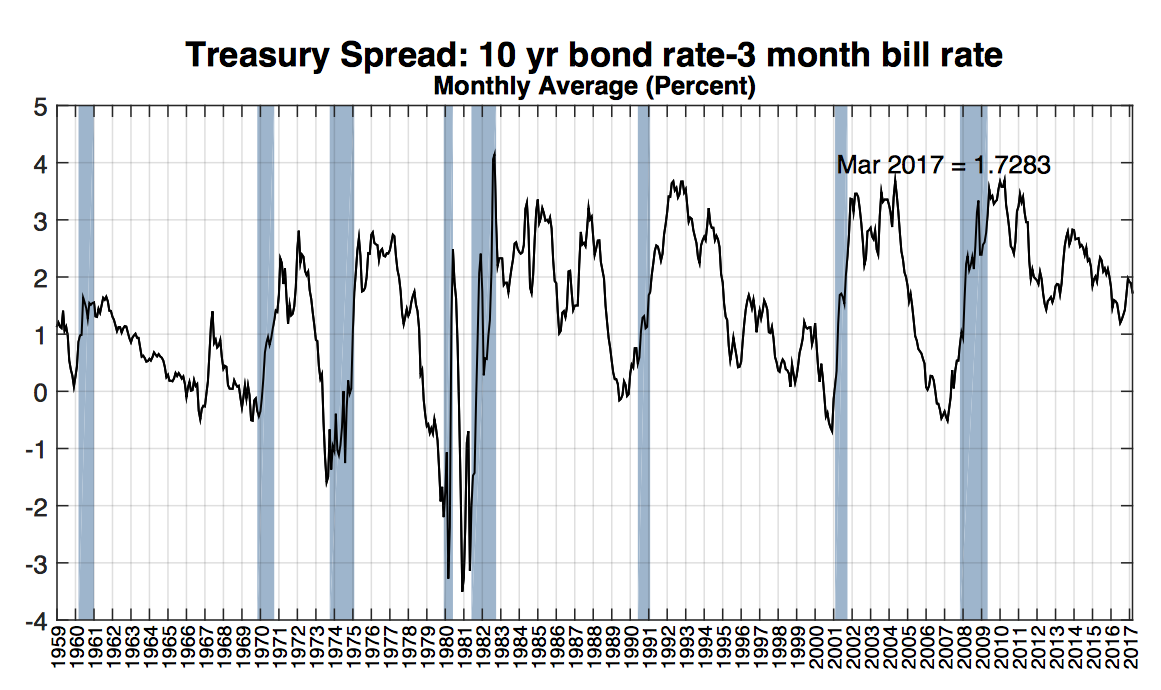

It is also possible to define a yield spread between two different maturities of otherwise comparable bonds. For example, if a certain bond with a 10-year maturity yields 8% and a comparable bond from the same issuer with a 5-year maturity yields 5%, then the term premium between them may be quoted as 8% – 5% = 3%.

Yield spread analysis involves comparing the yield, maturity, liquidity and creditworthiness of two instruments, or of one security relative to a benchmark, and tracking how particular patterns vary over time.

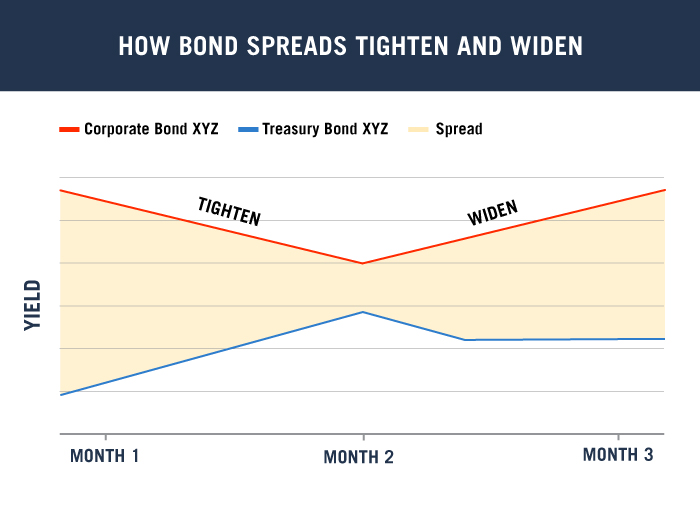

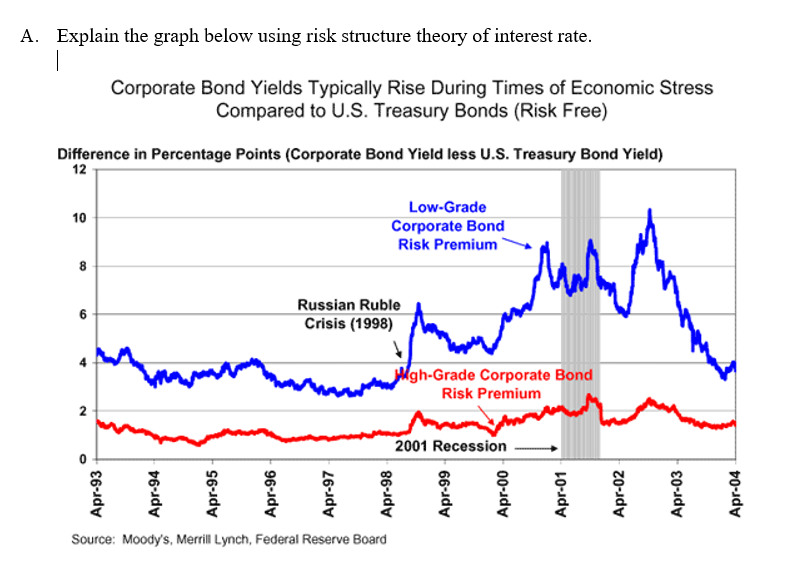

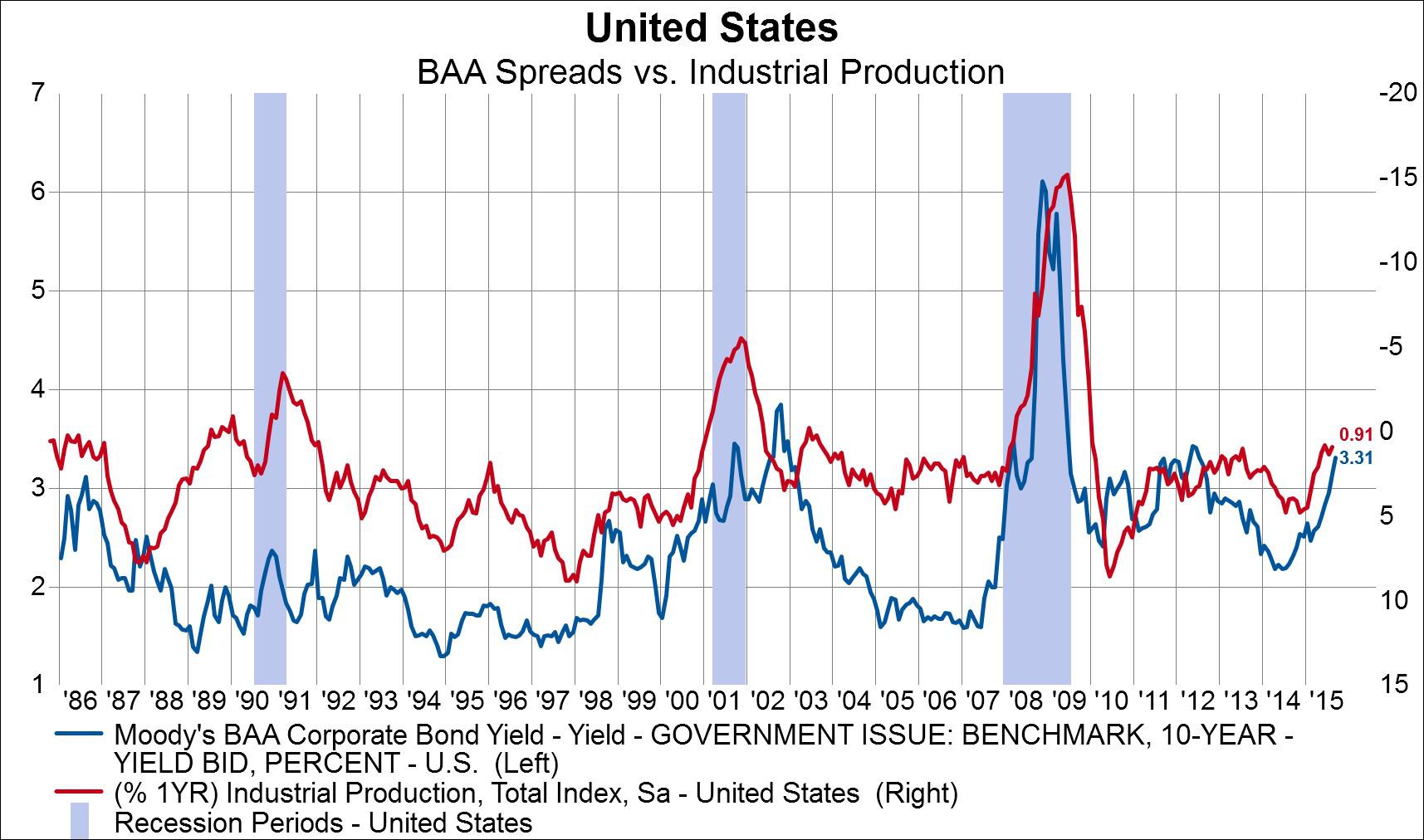

When yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring more risk of default on the lower-grade bonds. For example, if a risk-free 10-year Treasury note is currently yielding 5% while junk bonds with the same duration are averaging 7%, then the spread between Treasuries and junk bonds is 2%. If that spread widens to 4% (increasing the junk bond yield to 9%), then the market is forecasting a greater risk of default, probably because of weaker economic prospects for the borrowers. A narrowing of yield spreads (between bonds of different risk ratings) implies that the market is factoring in less risk, probably due to an improving economic outlook.

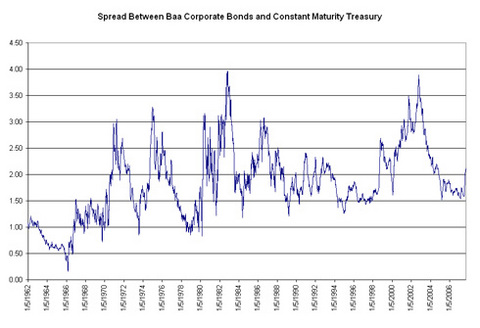

The TED spread is one commonly-quoted credit spread. The difference between Baa-rated ten-year corporate bonds and ten-year Treasuries is another commonly-quoted credit spread. [1]

Yield spread can also be an indicator of profitability for a lender providing a loan to an individual borrower. For consumer loans, particularly home mortgages , an important yield spread is the difference between the interest rate actually paid by the borrower on a particular loan and the (lower) interest rate that the borrower's credit would allow that borrower to pay. For example, if a borrower's credit is good enough to qualify for a loan at 5% interest rate but accepts a loan at 6%, then the extra 1% yield spread (with the same credit risk) translates into additional profit for the lender. As a business strategy, lenders typically offer yield spread premiums to brokers who identify borrowers willing to pay higher yield spreads.

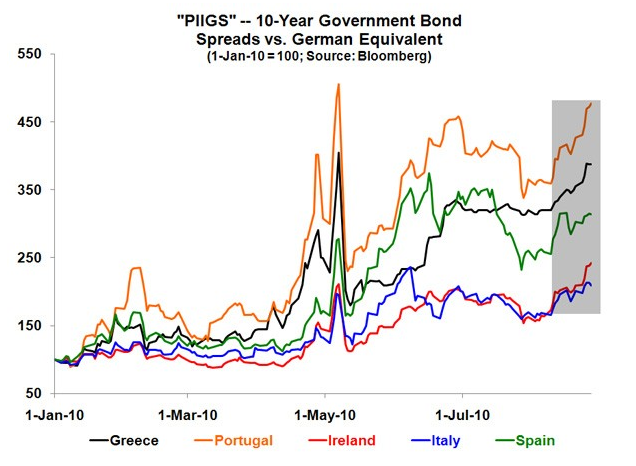

Italy 10 Year vs Germany 10 Year Spread Bond Yield - Investing.com

Yield spread - Wikipedia

High-Yield Bond Spread Definition

Bond spread - Fixed income

How to Calculate Bond Spread : 11 Steps (with Pictures) - wikiHow

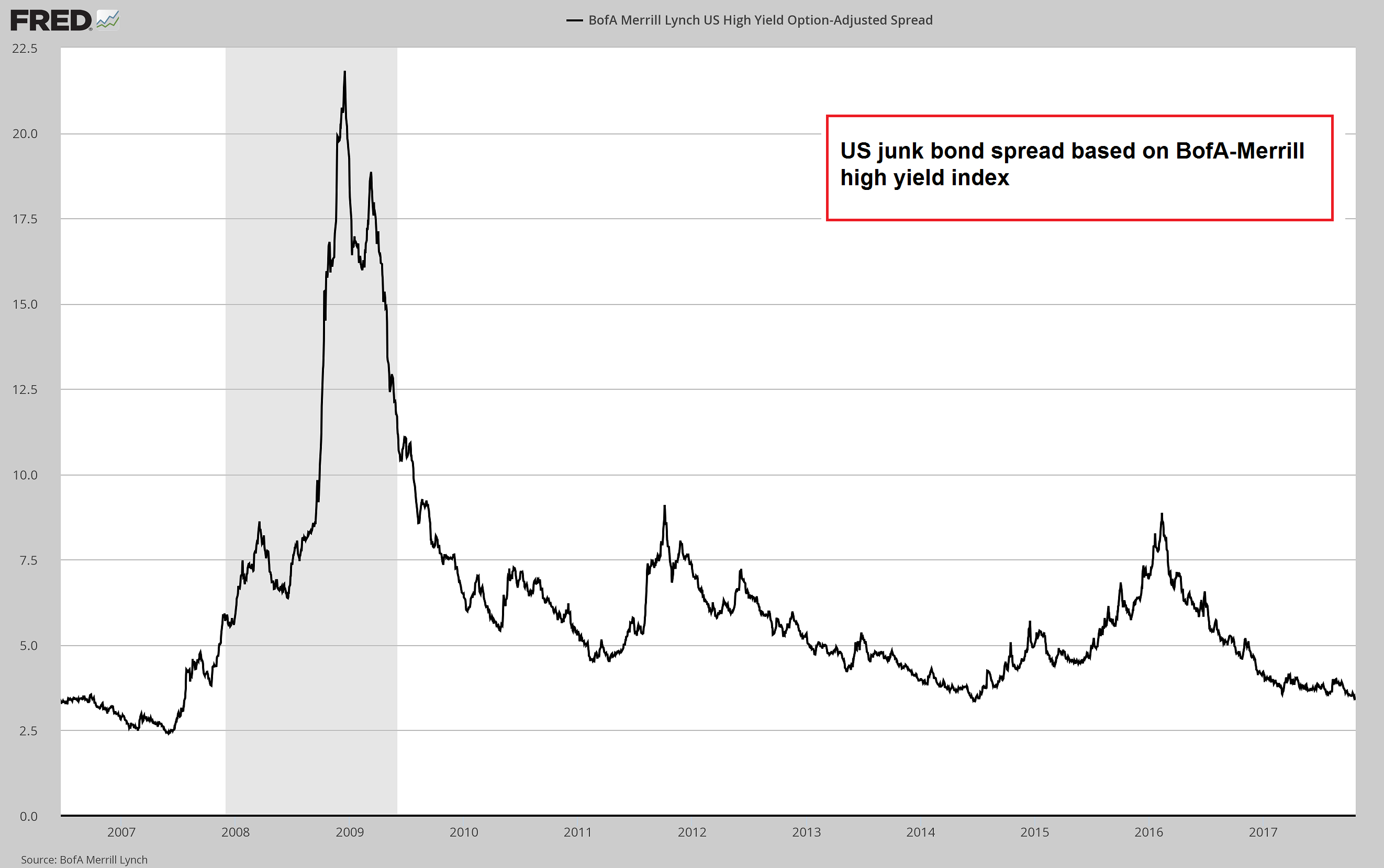

A high-yield bond spread, also known as a credit spread, is the difference in the yield on high-yield bonds and a benchmark bond measure, such as investment-grade or Treasury bonds. High-yield bonds offer higher yields due to default risk. The higher the default risk the higher the interest paid on these bonds. High-yield bond spreads are used to evaluate credit markets, where rising spreads can signal weakening macroeconomic conditions.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

A yield spread is the net difference between two interest bearing instruments, expressed in terms of percent or basis points (bps).

Junk bonds are debt securities rated poorly by credit agencies, making them higher risk (and higher yielding) than investment grade debt.

A default premium is the additional amount a borrower must pay to compensate a lender for assuming default risk.

A high-yield, or "junk" bond has a lower credit rating and thus pays a higher yield due to having more risk than higher rated bonds.

The TED spread is the difference between the interest rate on short-term U.S. government debt and that of interbank loans.

B1/B+ is the highest quality credit rating for non-investment grade bonds.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

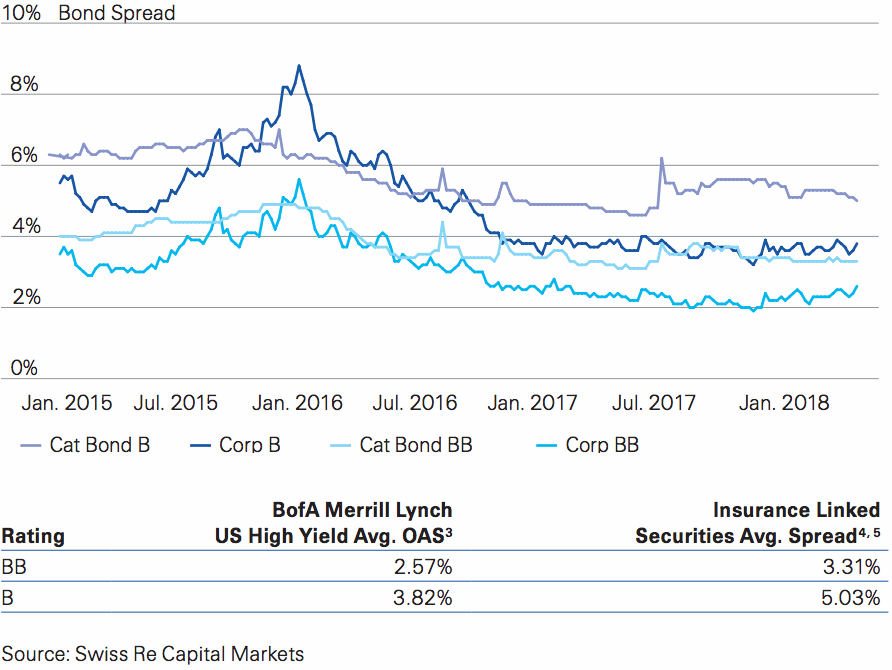

A high-yield bond spread is the percentage difference in current yields of various classes of high-yield bonds compared against investment-grade corporate bonds, Treasury bonds, or another benchmark bond measure. Spreads are often expressed as a difference in percentage points or basis points . The high-yield bond spread is also referred to as credit spread.

A high-yield bond, also known as a junk bond, is a type of bond that offers a high rate of interest because of its high risk of default . A high-yield bond has a lower credit rating than government bonds or investment-grade corporate bonds, but the higher interest income or yield draws investors to it. The high-yield sector has a low correlation to other fixed income sectors and has less sensitivity to interest rate , making it a good investment asset for portfolio diversification.

The greater the default risk of a junk bond, the higher the interest rate will be. One measure that investors use to assess the level of risk inherent in a high-yield bond is the high-yield bond spread. The high-yield bond spread is the difference between the yield for low-grade bonds and the yield for stable high-grade bonds or government bonds of similar maturity.

As the spread increases, the perceived risk of investing in a junk bond also increases, and hence, the potential for earning a higher return on these bonds increases. The higher yield bond spread is, therefore, a risk premium . Investors will take on the higher risk prevalent in these bonds in return for a premium or higher earnings.

High-yield bonds are typically evaluated on the difference between their yield and the yield on the U.S. Treasury bond . A company with weak financial health will have a relatively high spread relative to the Treasury bond. This is in contrast to a financially sound company, which will have a low spread relative to the US Treasury bond. If Treasuries are yielding 2.5% and low-grade bonds are yielding 6.5%, the credit spread is 4%. Since spreads are expressed as basis points, the spread, in this case, is 400 basis points.

High-yield bond spreads that are wider than the historical average suggests greater credit and default risk for junk bonds.

High-yield spreads are used by investors and market analysts to evaluate the overall credit markets. The change in the perceived credit risk of a company results in credit spread risk. For example, if lower oil prices in the economy negatively affect a wide range of companies, the high-yield spread or credit spread will be expected to widen, with yields rising and prices falling.

If the general market’s risk tolerance is low and investors navigate towards stable investments, the spread will increase. Higher spreads indicate a higher default risk in junk bonds and can be a reflection of the overall corporate economy (and therefore credit quality) and/or a broader weakening of macroeconomic conditions.

The high-yield bond spread is most useful in a historical context, as investors want to know how wide the spread is today compared to the average spreads in the past. If the spread is too narrow today, many savvy investors will avoid buying into junk bonds. High-yield investments are attractive vehicles for investors if the spread is wider than the historical average.

Netherlands Public Sex

Small Dog Missionary Fucking

Homemade Mature Nude

Young Slender Girl In Double Penetration

Family Double Penetration

.1566418097341.png)