Spread Betting Vs Forex Trading

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Vs Forex Trading

Home

Blog

Spread Betting vs Forex Trading: What’s the Difference?

Spread Betting vs Forex Trading: What’s the Difference?

It's fast, easy and 100% free!

Ready to find your broker?

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

Foreign exchange is a vital part of today’s interconnected global economy. Companies require foreign exchange for paying for goods in another currency and dealing with international employees. People require it whenever they are travelling abroad, paying for their child’s education or paying mortgage for real estate overseas. This guide is designed to help investors and individuals understand the basic differences between spread betting and forex.

Traditional forex trading in simple terms is selling a particular currency and getting another currency in exchange, as per the existing exchange rate between those two currencies. For example, a trader will sell GBP£ 100 to get approximately US$ 140 at a rate of 1GBP=1.4USD. If the price of the held currency rises, in this case USD, the trader can make a profit by selling the USD. The difference between the buying and selling rate is the trader’s profit. There is no universal exchange, so most of the transactions are made over the counter, where individual buy and sell transactions are matched. Once a deal is finalised, known as a spot deal, there is an exchange of the currencies between the two parties.

Spread betting is different from the traditional forex trading in various ways. In spread betting, there is no actual exchange of the currency or purchase of the financial instrument that is being traded. Spread betting involves taking a position based on anticipating whether the price of a financial instrument will increase or decrease in the future. This form of betting means an investor will win or lose money based on the marginal variation of a particular outcome and the expected value spread quoted by the spread betting brokerage. Besides foreign exchange, spread betting can be conducted on a wide range of financial instruments, including interest rates, individual share prices, indices, price of commodities etc. Depending on how a trader expects the market to move, he/she can either put in a ‘Long Buy’ (anticipating a rise in price) or a ‘Short Sell’ (anticipating a fall in price). Spread betting is further illustrated by these examples:

Case 1: The trader expects the price of the financial product to rise. The trader assumes that the GBP to USD exchange rate will increase, assuming the exchange rate is 1GBP=1.14USD. The trader places a bet of £20 for every 0.1-point rise in the exchange rate. (long position). With this, there will be two possible outcomes:

Case 2: The trader expects the price of the financial product to fall. The trader assumes that the GBP to USD exchange rate will decrease, assuming the exchange rate is 1GBP=1.14USD. The trader places a bet for £20 for every 0.1-point fall in the exchange rate. (short position). There will be two possible outcomes:

The profit or the loss with respect to spread betting depends on two things.

Investors should be aware of the pros and cons of both investments before making any financial decisions:

Traders and individuals that want to trade forex, binary options and spread betting will benefit from working with a long established and trusted broker like ETX Capital. If you would like more information on ETX Capital, read our full review of ETX Capital here.

If you would like to see the best spread brokers available, read our comparison of spread betting brokers .

Other key firms dealing with binary options, spread betting and forex include ZuluTrade , AxiTrader and Spread Co .

Traders and individuals should keep in mind that their capital is at risk when they make any investments.

BrokerNotes Ltd is an Appointed Representative of Resolution Compliance Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN: 574048). BrokerNotes Ltd is registered in England and Wales. Company No. 10464674. Registered office: Thames Wing, Howbery Park, Wallingford, OX10 8BA, UK.

Copyright © 2014-2021 BrokerNotes Ltd

Disclaimer: BrokerNotes.co is for informational purposes only. This website does not provide investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Rates and terms set on third-party websites are subject to change without notice. Please note that BrokerNotes.co has financial relationships with some of the merchants mentioned here and may be compensated if consumers choose to utilise some of the links located throughout the content on this site.

Spread Betting vs CFD Trading : Key Differences | IG UK

Spread Betting vs Forex Trading : What's the Difference?

Spread Betting vs CFD Trading | Admiral Markets (United Kingdom)

Spread Betting Vs Forex - What is the difference? | Vladimir RIbakov

Forex Trading vs . Spread Betting | Forex Factory

81% of retail accounts lose money when trading CFDs with this provider.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

81% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

expand_more

Reading time:

9 minutes

Why Us?

Financial Security

Scam warning

Contact Us

News

Careers

Press Centre

Account Types

Deposits & Withdrawals

Admiral Markets Pro

Professional Trading Terms

Demo Account

Stocks and ETFs CFDs

Islamic Forex Account

Trading Calculator

Fees

Documents & Policies

Trading App

Forex

Commodities

Indices

Shares

ETFs

Bonds

Contract Specifications

Margin Requirements

Volatility Protection

Invest.MT5

Admiral Markets Card

MetaTrader 5

MetaTrader 4

MetaTrader Supreme Edition

MetaTrader WebTrader

Premium Analytics

Fundamental Analysis

Technical Analysis

Forex Calendar

Trading Central

Trader`s Blog

Market Heat Map

Market Sentiment

Weekly Trading Podcast

Forex & CFD Webinars

FAQ

Trader`s Glossary

Forex & CFD Seminars

Risk Management

Articles & Tutorials

Zero to Hero

Forex 101

Trading Videos

E-books

Affiliate Program

Introducing Business Partner

White Label partnership

In this article, we explain the difference between spread betting and CFD (

Contracts for Difference ) trading, as well as some of the major factors you need to know about when choosing CFD or spread betting products. Whether you are trading Forex, Stocks or Indices, understanding the vehicles available to you to speculate on such markets is a critical step towards successful trading.

Before we look at the similarities and differences of spread betting vs CFD trading, it is important to first understand what spread betting is and what CFDs are. Let's take a look.

When spread betting, the trader is not actually buying or selling an asset. Instead, the trader is betting on where they think the price of a particular market will move to. The trader is given an option to place a bet size per point the market moves.

For example, if a spread better believes the currency pair GBPUSD will rise, they would enter a buy, or long, position. If the trader used a bet size of 10 GBP per point, then every one point move higher in the price of the GBPUSD would result in a 10 GBP profit. The trader would lose 10 GBP for every point the market moved in the opposite direction of their trade.

When trading with CFDs, the trader is trading a contract based on the price of the underlying market. Instead of a trader buying physical assets from their broker (such as currency or company shares), or betting on the market, they can simply enter a Contract For Difference with their broker instead. The contract is to exchange the difference in the value of an asset from the price of the contract when it is first opened, to the price when the contract is closed.

The value of a contract differs depending on the market you are trading. For example, using the same example from the spread betting explanation above, if a CFD trader bought 10 contracts, or 10 CFDs of GBPUSD, then every one point move higher in the price of GBPUSD would result in a 100 USD profit and every one point move lower would result in a 100 USD loss. This is because when trading currencies one CFD is equivalent to 100,000 units of currency.

Both spread betting and CFD trading allow traders to speculate on the price direction of a particular market using

leverage , thereby enabling traders to open positions with only a small deposit of the full trade size. Of course, the same also applies to losses. Traders risk losing their deposit faster when using leverage – so use it cautiously!

While there are many similarities there are also some core differences between these two types of trading, as the spread betting vs CFD trading table below shows:

Forex, Stocks, Indices, Commodities, Cryptocurrencies and more.

Forex, Stocks, Indices, Commodities, Cryptocurrencies and more.

Do you own the asset you are trading?

Yes. You could potentially profit from rising and falling markets.

Yes. You could potentially profit from rising and falling markets.

Only available to residents of the UK or Ireland.

No commission but typically higher spreads than CFDs.

Zero, or low commission, with lower spreads depending on account type.

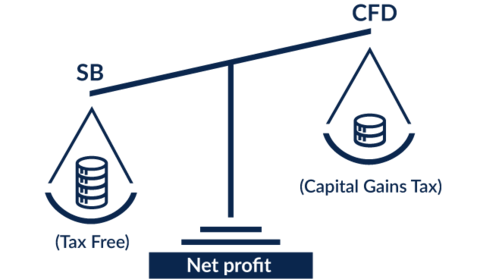

Profits are exempt from stamp duty and capital gains tax (CGT)*.

No stamp duty is payable but you do pay capital gains tax (CGT)*

Can losses be offset as a tax deduction?

What type of accounts are available?

* Tax laws depend on individual circumstances and are subject to change. Tax law may differ in jurisdictions outside of the UK.

The spread betting vs CFD table in the last section shows the main similarities and differences between the two trading vehicles. However, there are two particular differences between spread betting and CFDs that traders should be especially aware of.

For UK residents, spread betting is free from stamp duty and capital gains tax. For CFD trading no stamp duty is payable but you do have to pay capital gains tax. While some traders may be enticed by the lower levels of tax associated with spread betting there are some disadvantages when compared with CFD trading.

Spread bettors cannot offset any losses for tax purposes. CFD traders have the ability to offset any losses against future profits. For example, if you acquired a property and made a capital gain of £30,000 but then lost £10,000 on your CFD trading, it would result in a lower net capital gain of £20,000 which means you may end up paying less capital gains tax overall. This is a general example and does not take individual circumstances into account. You should consult a professional advisor regarding your specific tax situation.

As mentioned above, spread betting is only available to individual residents of the UK and Ireland.

Most spread betting providers have their own unique trading platforms whereas there are many more CFD brokers who use the world's most popular trading platform, MetaTrader.

A screenshot showing the Admiral Markets MetaTrader 5 platform with an open FTSE 100 trading ticket and Symbols window.

This is important as CFD trading via MetaTrader allows users to access advanced features such as:

In fact, you can see some of these features for yourself by downloading the Admiral Markets MetaTrader multi-asset class CFD trading platform completely FREE! Simply click on the banner below:

So which is better, CFD trading or spread betting? When choosing between CFDs and spread betting there are many things to take into consideration. While the tax situation may be the most obvious difference between the two, there are other considerations that could have a bigger impact on your overall profitability.

For example, spread betting and CFD trading allows for trading on the same markets, including Forex, Stocks, Indices, Commodities and Cryptocurrencies. However, CFD traders may have the option to trade directly with the broker's liquidity providers (typically tier-one banks and hedge funds) via

ECN (Electronic Communication Network) or STP (Straight Through Processing) technology. This enables traders to receive institutional-grade spreads and lower spreads mean lower costs, which could result in higher profits.

As spread betting involves betting on the view of prices either going up or down, it cannot offer the ability to trade with banks or hedge funds and receive institutional-grade spreads. As CFDs involve trading the underlying market price via contracts, traders can access the ability to trade directly with banks and hedge funds to receive lower spreads and lightning fast execution.

For example, with the Admiral Markets Zero.MT4 account, traders can trade currencies via STP technology and receive spreads from 0 pips plus commission, as well as trade on Spot Metal CFDs across the Admiral Markets MetaTrader platform for PC, Mac, Web, Android and iOS - meaning you could be trading directly with tier-one banks while on the move! To open an account, visit

Account Types .

If you feel ready to start trading, or this article has provided some extra insight to your existing trading knowledge, you may be pleased to know that Admiral Markets provides the ability to trade with Forex and CFDs on up to 80+ currencies, with the latest market updates and technical analysis provided for free! Click the banner below to open your live account today!

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Start trading today !

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. Charts for financial instruments in this article are for illustrative purposes. Past performance is not necessarily an indication of future performance.

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the

risks .

Risk warning: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using Admiral Markets UK Ltd, Admiral Markets Cyprus Ltd or Admiral Markets PTY Ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

Admiral Markets UK Ltd is registered in England and Wales under Companies House – registration number 08171762. Admiral Markets UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) – registration number 595450. The registered office for Admiral Markets UK Ltd is: 60 St. Martins Lane, Covent Garden, London, United Kingdom, WC2N 4JS.

Admiral Markets Cyprus Ltd is registered in Cyprus – with company registration number 310328 at the Department of the Registrar of Companies and Official Receiver. Admiral Markets Cyprus Ltd authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 201/13. The registered office for Admiral Markets Cyprus Ltd is: Dramas 2, 1st floor, 1077 Nicosia, Cyprus

Admiral Markets Pty Ltd Registered Office: Level 10,17 Castlereagh Street Sydney NSW 2000. Admiral Markets Pty Ltd (ABN 63 151 613 839) holds an Australian Financial Services Licence (AFSL) to carry on financial services business in Australia, limited to the financial services covered by its AFSL no. 410681.

Evil Angel Rocco Siffredi Porno

Zoo Porno Horse Sperm

Lifting And Carrying Lesbian

Peeing Girls Compilation 3

Sensual Porn Film