Spread Betting Uk Taxation

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

РекламаСтаньте специалистом по ставкам на спорт. Узнайте, что влияет на коэффициенты. · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated.

www.independentinvestor.com/spread-betting/how …

Do you have to pay tax on spread betting in UK?

Do you have to pay tax on spread betting in UK?

Spread betting, index betting and binary options are not regulated by the UK Gambling Commission but instead fall under the umbrella of the Financial Conduct Authority (FCA). Despite this you do not need to pay the 18% UK Capital Gains Tax or stamp duty on winnings from Spread Betting.

www.onlinebetting.org.uk/betting-guides/g…

Can a spread bet be carried on a trade?

Can a spread bet be carried on a trade?

The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker organising the spread bet is taxable on their profits. The section on betting and gambling contains the following further guidance:

www.gov.uk/hmrc-internal-manuals/busin…

Is the bookmaker involved in spread betting taxable?

Is the bookmaker involved in spread betting taxable?

They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker organising the spread bet is taxable on their profits. The section on betting and gambling contains the following further guidance: spread betting - BIM22020.

www.gov.uk/hmrc-internal-manuals/busin…

Do you have to pay tax on spread trading?

Do you have to pay tax on spread trading?

Answer: Financial spread trading is only available in the UK and Ireland, in other countries you would need to use other trading instruments such as futures or shares and these products are subject to tax. Question: Doesn’t HRMC lose money?

www.independentinvestor.com/spread-bett…

https://www.independentinvestor.com/spread-betting/how-spread-betting-is-taxed

Ориентировочное время чтения: 6 мин

Tax on Trading Activities

Tax on Spread Betting Activities

Questions & Answers

Conclusion

One of the key advantages of spread bettingis that it is taxed accordingly to considerably more favourable rules than other forms of trading. Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated. Because spread betting is based on asset prices, rather than trading in the ass…

https://www.shiftingshares.com/spread-betting-tax

25.03.2021 · The spread betting UK tax law. Spread betting is classed as a gambling activity by UK tax law. This is why all spread bet profits are tax-free and exempt from CGT. Spread betting is a form of leverage and based on the speculation of asset exposure and prices rather than actual ownership of the assets the spread bet is derived from, and so spread bets …

https://www.cityindex.co.uk/market-analysis/tax-advantages-of-spread-betting

18.03.2021 · Is spread betting taxable? No, spread betting is not taxable in the UK. Spread bets are free from both Stamp Duty and Capital Gains Tax (CGT), which means you don’t have to report any profits or losses to HMRC. Tax laws will vary in other jurisdictions outside of the UK …

https://www.intertrader.com/en/spread-betting/spread-betting-tax-benefits

Profits from spread betting are not subject to UK Capital Gains Tax or stamp duty Tax treatment depends on your individual circumstances and may change in the future We must emphasise that spread betting is only tax-free under current UK tax law, which may change, and that ultimately your tax …

https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim22015

The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker...

https://www.quantumbooks.com/.../finance/spread-betting-strategies-and-taxation-in-the-uk

Taxation on spread betting in the UK It is a well-known fact that spread betting is considered illegal in the United States but in the UK it is regulated by the FCA. According to a piece of information in an article by Forbes , for many it is surprising why the UK does not levy any taxes on the profits earned in spread betting.

https://www.onlinebetting.org.uk/betting-guides/gambling-and-betting-tax-in-the-uk.html

Do I pay tax on Spread Betting? Spread betting, index betting and binary options are not regulated by the UK Gambling Commission but instead fall under the umbrella of the Financial Conduct Authority (FCA). …

https://www.economywatch.com/uk/spread-betting

Spread Betting UK Tax As we briefly covered earlier, spread betting profits in the UK are completely exempt from taxation. Not only does this include stamp duty (0.5%) – but capital gains tax (10-20% depending on your tax …

https://www.financial-spread-betting.com/Tax-free.html

A: Unfortunately the answer is likely to be 'No' - UK corporate entities that participate in derivative transactions like options/spread bets/CFDs/futures are subject to special tax laws. Derivative rules stipulate that any spread betting profits made under the name of a company are taxed as income so corporation tax …

РекламаСтаньте специалистом по ставкам на спорт. Узнайте, что влияет на коэффициенты. · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

How Is Financial Spread Betting Taxed?

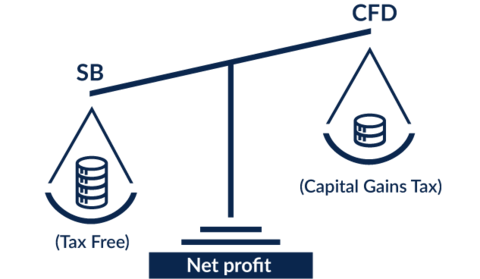

The image of spread betting as a gambling activity is carried on through the way in which spread betting gains are taxed in the UK, and for the purposes of tax, it remains quite a useful association. Remember – spread betting isn’t really gambling insofar as you can legitimately predict the outcome with logic and reason (rather than relying solely on chance or an individual performance), but as far as the UK tax authorities are concerned it’s a straightforward wager. Tax treatment might seem like an ancillary issue, but it’s actually extremely important, and can make the difference between a profitable trade and an unprofitable one, and the favourable tax treatment of spread betting ultimately leaves more of your earnings untaxed.

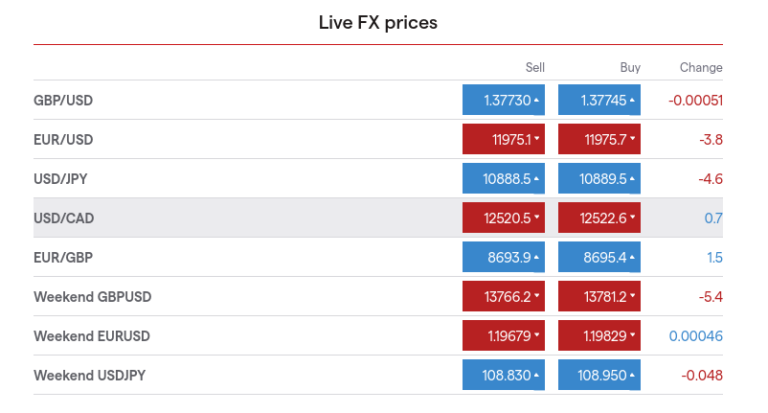

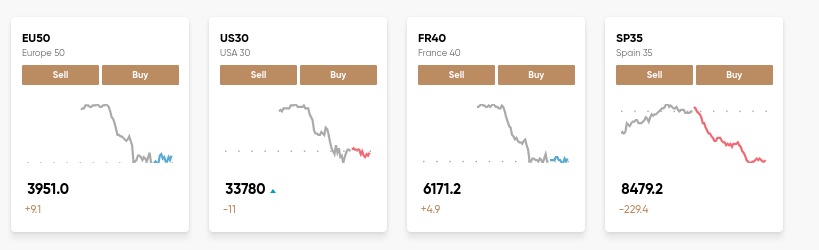

To start examining the way in which spread betting is taxed, let’s look at how traditional share transactions are taxed as a basis for comparison. Bear in mind, it is possible to spread bet on the performance of individual stocks where offered by your broker, thus it is plausible that you could invest in exactly the same trade in the share and spread betting markets with entirely different results.

A share transaction sees the transfer of ownership in a share, an asset. For starters, shares in the UK are liability to the payment of Stamp Duty, a form of tax that is applied on the total value of a transaction, expressed as a minimal percentage – for example, Stamp Duty for shares sat at 0.5% of transaction size. Particularly for leveraged transactions, this can be a significant tax liability to pay on each and every transaction over the threshold value. Without going too far into the intricacies of Stamp Duty and how it is calculated, this liability can be instantly removed from the equation when dealing with spread betting.

In order to realise a profit on a share transaction, you generally have to resell your shares, and this speculation with the intention to resell tends to be the core reason for most share purchases. This is where the most considerable tax burden comes into play – at the point of disposal. Capital Gains Tax is paid by UK individuals on any gains made on the disposal of capital. Effectively, CGT performs the same function as income tax on capital profits, and is charged at different rates depending on your level of capital and income. Not only is CGT expensive, but it is also highly complicated, and can be a significant administrative burden for traders, not to mention its financial impact.

In spread betting, no assets are changing hands. No transaction is taking place. No assets are being sold. It’s merely an intangible bet, or agreement between the trader and the broker, and it is taxed as a pure gambling activity – that means at a rate of 0%. The exception to the rule is where spread betting forms the core of your day to day income, at which point you will be liable to income tax on your earnings as with any other trade, business or job. However, as a starting point this can save a substantial proportion of your profits from the hands of the taxman, leaving more cash in your pocket at the end of the day.

Assume the rate of CGT is 20% and Stamp Duty is charged at 0.5%, (with all other reliefs and allowances exempted for simplicity’s sake). Buy 1000 £1 shares in Company X which you sell for £1.05 would yield a profit of £50, less 20.5%, which leaves £39.75 in profit. With a spread betting transaction on the same shares, you would be more considerably leveraged, earning a 500% return, which in turn would be tax free.

The significant savings afforded by the more preferable taxation of spread betting gains are one of the major pull factors for traders, and particularly when combined with the leverage effect of spread betting, can have a dramatic impact on the profitability of your trading activities.

Question: Are spread bets tax deductible?

Answer: Spread bet profits are tax-free and you get to keep all your profits but you can’t offset those losses against other capital gains. Let’s look at the example below.

Let’s look at the following scenario: you want to sell some equities and make a nice profit of £50,000 but at the same time you had a £50,000 investment in shares of another company which just went bust. In this case, you can offset your capital losses against capital gains, thus you have £0 net capital gain and you pay £0 in CGT.

Same scenario but this time you spread bet on shares: As financial spread betting is tax free, you can’t offset your losses against capital gains and thus you’d still have to pay Capital Gains Tax on the £50,000 profit you make from the sale of equities, even though you actually made no profit from these two transactions.

Question: Is financial spread betting really tax free?

Answer: Yes, this type of trading involves no taxes and you don’t need to report any profits or losses to the HMRC, just like with any other gambling activity.

Question: Is there any tax in the EU or Australia?

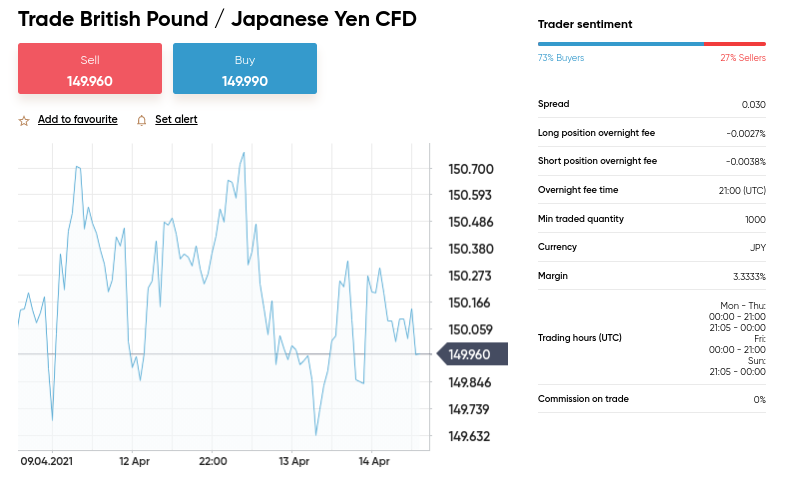

Answer: Financial spread trading is only available in the UK and Ireland, in other countries you would need to use other trading instruments such as futures or shares and these products are subject to tax.

Answer: Unfortunately, more than 70% of traders lose money and since spread bet traders can’t offset those losses against capital gains, the taxman in the UK actually benefits from this regime. Also, as spread betting falls under the gambling regime, the taxman collects more tax from your provider.

One of the key advantages of spread betting is that it is taxed accordingly to considerably more favourable rules than other forms of trading. Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated. Because spread betting is based on asset prices, rather than trading in the assets themselves, it is also exempt from stamp duty, which when added to the CGT saving makes spread betting an even more attractive investment style.

Independent Investor is a news and educational portal covering latest events in the world of trading and investment. Our team of dedicated writers work hard to bring the facts to our readers on a daily basis. Information on this website is for informative purposes only. Financial spread betting, forex and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs, forex, and spread betting. You should consider whether you can afford to take the high risk of losing your money. Independent Investor offers an unbiased and independent broker comparison service, but we may receive compensation from listed brokers.

We use cookies to ensure we give you the best experience on our website. By clicking the OK button you agree to the use of cookies as per our Privacy Policy. OK

Imgchili Net Little Sandra Naked Foam

My Wife And My Mother In Law

Adult Movie Lesbian

Xvideos Com Black Mother Creampie

Lesbian Real Cum

How Spread Betting Is Taxed - Independent Investor

Spread Betting Tax in the UK: The 2021 Guide - Shifting Shares

Tax Advantages of Spread Betting | Spread Betting Tax UK

Spread Betting Tax Benefits - Intertrader

BIM22015 - Business Income Manual - HMRC internal ... - GOV.UK

Spread Betting Strategies and Taxation in the UK

Tax on Betting and Gambling in the UK – Do you pay tax on ...

Spread Betting UK | What Is Spread Betting? Full 2021 Guide

So is Spread Betting really tax-free?

Spread Betting Uk Taxation