Spread Betting Uk Shares

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

By clicking 'Continue' you are agreeing to have read our privacy policy.

Spread Betting Shares UK – Beginner’s Guide

13, April 2021 | Last Updated: 22, June 2021

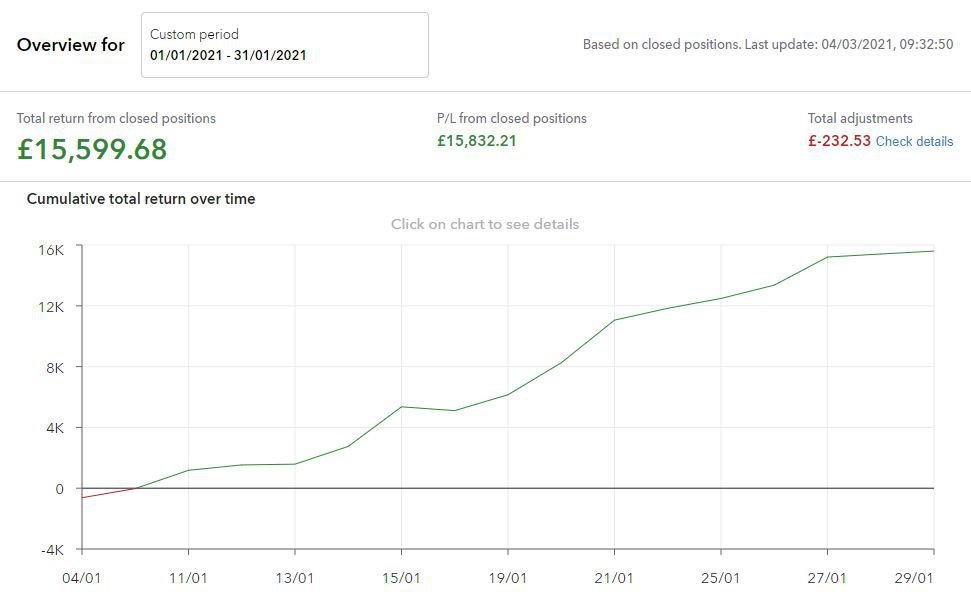

Most investors in the UK will look to buy shares in the traditional sense – meaning you will likely keep hold of the stocks for several months or years. But, by ‘spread betting’ shares – you can take advantage of 0% commissions, leverage, and short-selling capabilities – and all your profits will be exempt from capital gains tax.

In this guide, we explore the pros and cons of Spread Betting Shares UK and how you can get started with a top-rated broker today.

Want to know how to start shares spread betting UK? This simple 5-step walk-through below will show you how to get started from the comfort of your home. We explain the ins and outs of how shares spread betting works in more detail further down in this guide.

And that’s it – you’ve just placed your first spread betting shares trade at Capital.com without paying any commission!

Shares spread betting is a short-term way to speculate on the future value of stocks. This means that you will look to enter frequent trades throughout the week – targeting modest profits.

Unlike traditional share investments – spread betting positions are rarely kept open for more than a few days or weeks. In some cases, you might only even keep a position open for hours or even minutes.

With this in mind, there is a lot to learn about financial spread betting shares UK before you take the financial plunge. We clear the mist in the sections below by explaining everything there is to know about this short-term trading instrument.

Shares spread betting platforms offer a popular alternative to traditional stock investments. In the case of the latter, you will simply be looking to invest in a company that you think will be worth more in years to come. Spread betting, however, is a short-term form of trading where you will be looking to speculate on the future value of the respective stock over the next few hours, days, or weeks.

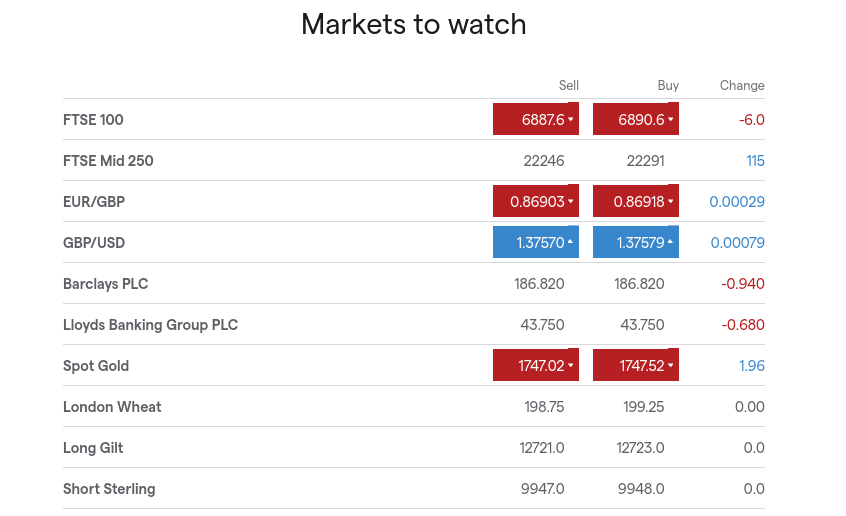

As per the above, brokers offering financial markets on spread betting shares UK, allow you to make gains from both rising and falling markets. In order words, not only can you speculate on a company’s stock price increasing, but decreasing too.

Additionally, the best shares spread betting sites allow you to apply leverage of up to 1:5. This means that you can multiply the size of your position by a factor of 5 – so a £100 account balance would give you access to £500 in stock trading capital.

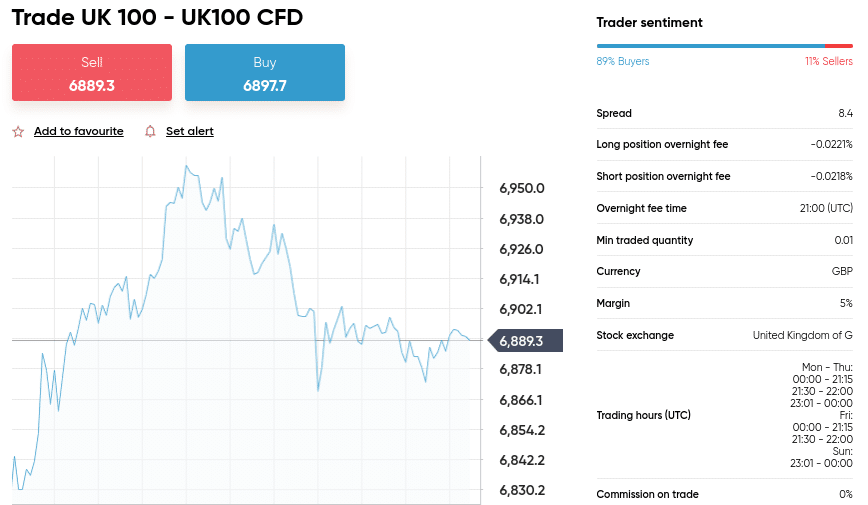

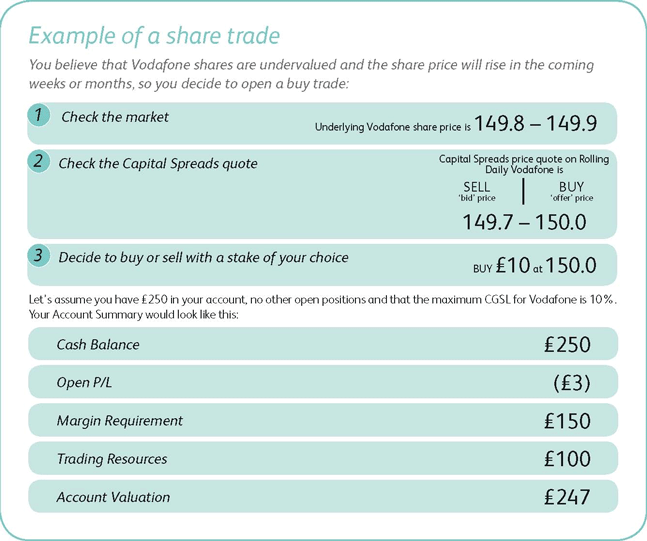

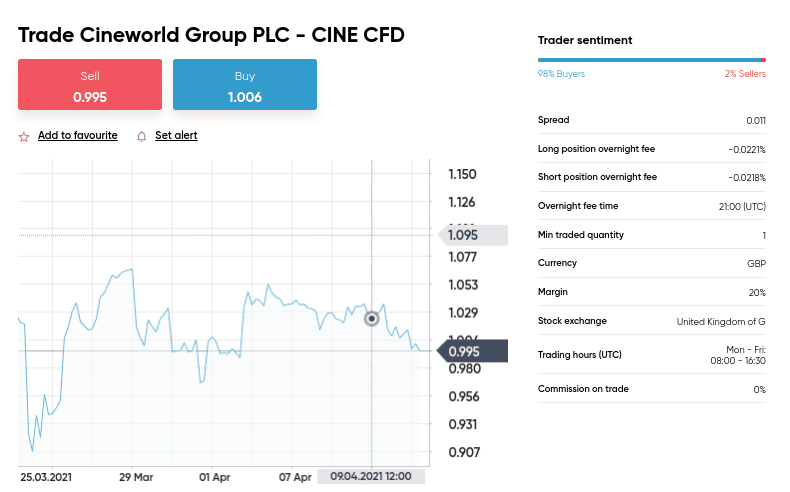

We should, however, note that spread betting shares UK operates in a different manner to traditional stock investments. This is because stock market price movements – and subsequently profits and losses, are determined in points as opposed to pounds and pence.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

For example, if HSBC stocks increase by 10p – this might be reflected as 10 points at your chosen broker. In turn, if you went long at £5 per point – you would have made a profit of £50. More on this in the sections below.

We now need to elaborate further on the core principles of shares spread betting UK – as there are many key differences from that of traditional stock investments.

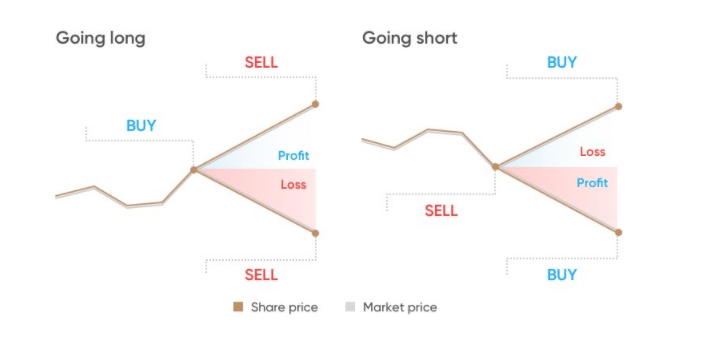

As we briefly covered above – shares spread betting UK sites give you the option of going long or short on your chosen stock. This simply tells the broker whether you think the share price will increase or decrease in short-term.

This is a major benefit from spread betting shares UK – as traditional stock brokers only allow you to make gains if the respective company increases in value. But, when using a spread betting platform, you can also profit if you think the stocks will lose value.

When you buy shares in the traditional sense – you own stock in the company. This means that you are entitled to certain stockholder rights – such as receiving your share of any dividend payments. But, spread betting shares UK are financial derivatives.

This means that the underlying asset does not exist. Instead, all you are doing is speculating on the future value of the shares. On top of being able to short-sell and apply leverage – not owning the shares means that you will not need to pay any stamp duty tax. This saves you 0.5% from the very get-go.

In the world of spread betting shares UK – price movements are determined in ‘points’. This is very similar to conventional stock indexes like the FTSE 100 or Dow Jones – which are priced in points rather than pounds or dollars. The exact price unit will be determined by your chosen spread betting provider and the respective market.

With that said, if you are spread betting shares with a much higher valuation – then the point movement might be different.

Crucially, brokers offering markets on spread betting shares UK will always tell you the unit value of each point movement. This is important to understand, as you need to ensure that you know exactly how much you are staking on the spread betting position.

Now that you know that spread betting shares UK markets move in points as opposed to pounds – this should make it easier to understand how stakes work. In the traditional stock trading space, you will simply specify the amount you wish to invest. For example, you might decide to invest £200 in GlaxoSmithKline shares.

However, when using a shares spread betting broker – you will need to specify your desired stake per price movement.

As you can see, the more you stake per point movement, the more you stand to make or lose. This is why you need to have a firm grasp of what price movement unit the broker has set up on the share market you wish to access.

Another major benefit of the spread betting shares UK arena is that you can always apply leverage to your positions. As per FCA regulations – retail traders in the UK can apply leverage of up to 1:5 on share derivatives. This covers both CFD trading and spread betting.

If you’re new to leverage, this is simply a multiple that boosts your stake. For example, if you used leverage of 1:4 – then your profits and losses would be magnified by a factor of 4.

An example of how leverage can be used effectively when spread betting shares UK can be found below:

At first glance, it might appear that applying leverage to all of your spread betting shares UK trades is a no-brainer. After all, you can amplify the size of you’re potential gains. However, leverage will also do the same for your losses – so make sure you understand the risks involved.

Once again, when you buy shares in the conventional sense you will likely hold on to your investment for several years. In fact, you can keep hold of the shares for as long as you wish – as you own them outright.

But, when you trade shares spread betting markets – the underlying instrument will come with an expiry date. When the market does expire, your position will be closed by the broker. This is why spread betting shares UK is conducive for short-term speculation and not long-term investing.

In most cases, the range of markets offered by spread betting brokers will come with two expiry date options for you to choose from.

Again, you just need to make sure that you understand the expiry date attached to the market before you trade it.

If you’ve read our guide up to this point – then you will likely know that there are some major differences between spread betting and traditional stock investing. Both come with their pros and cons – so below we outline the main differences in a bit more detail.

The points outlined above show that there are some clear differences between stock trading and shares spread betting. Ultimately, if you are a short-term trader that wishes to access leverage, short-selling, and tax-free profits – the latter is likely to be of interest.

If you’re still unsure whether spread betting shares is the right trading strategy for you – below we explain the main benefits that should help you make up your mind.

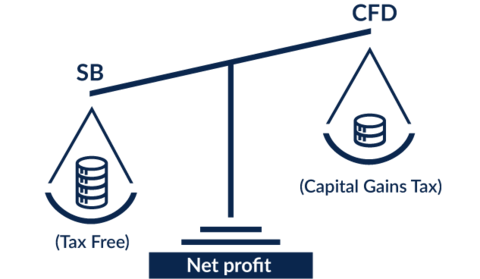

We briefly mentioned above that the UK spread betting market is exempt from stamp duty and capital gains tax. The former is because the underlying shares do not exist – as you will be trading financial derivatives that simply track the real-world price of the stocks.

The latter is because spread betting profits are determined as ‘gambling’ winnings by HMRC. This means that they are not liable for capital gains tax.

This is the only trading sector in the UK that offers this perk. Ordinarily, any profits you make from stocks, forex, cryptocurrencies, ETFs, or any investment for that matter – are potentially taxable.

We say ‘potentially’, as all UK residents get a capital gains tax-free allowance each year. Plus, you also have ways to shield your profits from HMRC, via a SIPP or ISA. Nevertheless, these come with limits. Meaning – once you go over your annual capital gains limits – tax will be applicable. This isn’t the case with shares spread betting – as it doesn’t matter how much you make – everything is tax-free.

As share spread betting markets simply track the respective stock price – this allows brokers to offer a huge number of tradable instruments. For example, at top-rated spread betting broker Capital.com – you have access to 18 stock exchanges.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

This covers the London Stock Exchange and AIM in the UK, as well as markets in the US, Singapore, Germany, Japan, and France. You can also trade shares from smaller stock exchanges based in Russia, Spain, Ireland, and Italy. This allows you to trade a diversified range of share markets – rather than having to stick with FTSE 100 entrants.

A lot of UK stock brokers require you to deposit hundreds of pounds to get started with an investment. You might also find that you are required to purchase a minimum number of shares – which can make the process unviable for those on a budget.

But, when using a spread betting shares UK broker – account minimums are often very small. At Capital.com, for example, the minimum deposit is just £20.

In early 2020 – the global stock markets lost anywhere between 30% and 50% in the space of a few weeks. By using a traditional stock broker, the only options on the table would have been to sit tight or cash out your shares. Crucially, by instead using a shares spread betting broker – you could have profited from this market crash by going short.

In doing so, you would have made a sizable profit. This once again illustrates why the spread betting shares UK scene is so popular with seasoned traders – as you can make a profit irrespective of how the wider markets are performing.

The vast majority of spread betting platforms in the UK allow you to trade shares without paying any dealing fees or commissions. This means that you can enter and exit as many share trading markets as you wish without getting hammered by brokerage charges.

For example, at Capital.com, all fees are built into the ‘spread’ – which is the difference between the long and short price offered on the respective market.

Spread betting shares UK is a short-term trading arena – so you need to have a number of entry and exit strategies in place before you get started. This will give you the best chance possible of making consistent gains.

Below we discuss some of the best spread betting shares strategies to consider if you are a beginner in this trading field.

Irrespective of whether you are a newbie or seasoned spread betting trader – it is imperative that you always have a risk management strategy in place. This simply means that you are able to trade in a risk-averse way by keeping your potential losses in check.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

After all, even the most successful spread betting traders encounter losses. But, what sets these traders apart is that they know how to trade without taking too much risk. As a beginner, the best way you can achieve this goal, is to ensure you always have a stop-loss and take-profit order deployed on your spread betting positions.

Once you have placed both a take-profit and stop-loss order on your shares spread betting position – you can then allow the trade to play out. That is to say, you don’t need to sit at your laptop for hours or days on end waiting to close the trade manually. Instead, this will happen automatically when either your stop-loss or take-profit target is triggered.

If you are able to gauge the wider market sentiment – making gains from your shares spread betting endeavors can be a lot easier to achieve. For example, in the midst of the coronavirus pandemic in early 2020 – the market sentiment was centered on fear.

This led to some of the biggest companies in the world losing more than 50% in market valuation. More specifically, certain sectors were hit harder than others.

Again, by gauging this market sentiment yourself – you can place sensible orders at your chosen shares spread betting site without needing to have an understanding of technical analysis.

Spread betting is one of the most effective ways to hedge – in terms of cost, liquidity, and convenience. Hedging is a strategy employed to mitigate the risks of an investment going against you.

In doing so, you are covering both potential outcomes.

Ultimately, it takes just seconds to set up a shares spread betting position – meaning that any time you are concerned by market uncertainty – you always have the option of hedging.

If you want to spread bet shares from the comfort of your home – you first need to find a broker that meets your needs. There are a handful of good options in the UK market – all of which are regulated by the FCA. You do, however, need to look at what share spread betting markets are supported and how much you will be charged to trade.

Below we review two of the best spread betting shares UK sites in the market right now.

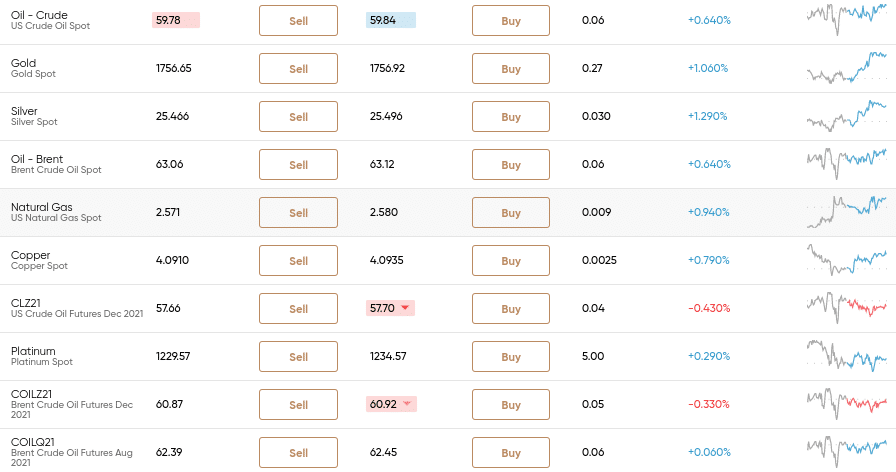

Capital.com is an FCA-regulated CFD trading and spread betting broker. You will have access to 18 share markets at this platform – covering both the London Stock Exchange and AIM in the UK, as well as markets in North America, Asia, Europe, and more. All tradable share markets on Capital.com are free of commission.

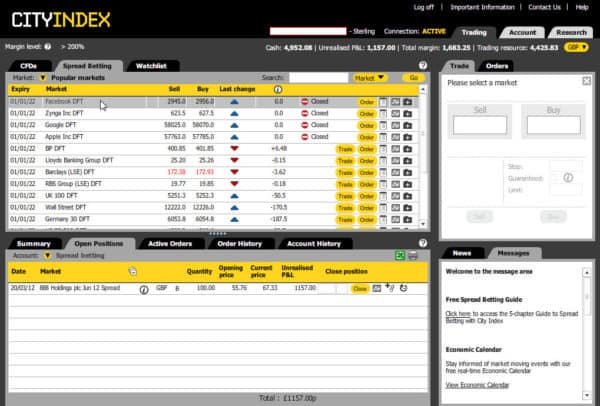

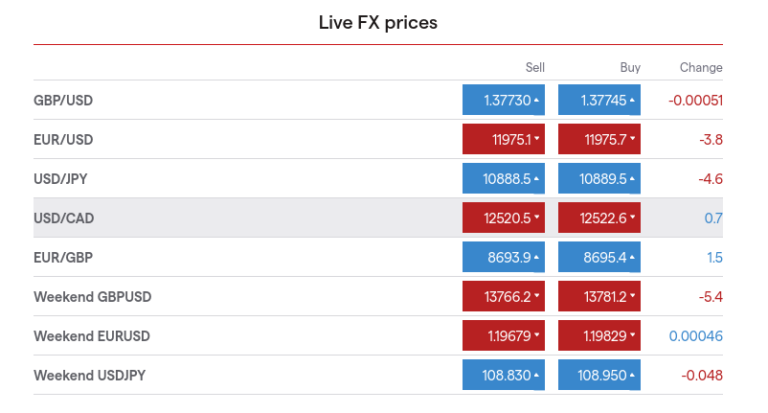

The broker instead makes its money from the gap between the long and short price on the spread betting market in question. You might also be interested in other spread betting instruments. If so, Capital.com covers ETFs, indices for FTSE 100 spread betting, gold, oil, silver, forex, and more. If this is your first time using a shares spread betting platform – Capital.com allows you to trade risk-free via its demo account. All you need to do is quickly register and you can start using the paper trading facility straight away.

In terms of real money trading, Capital.com requires a minimum deposit of just £20. You can use a UK debit card, credit card, or an e-wallet to benefit from this low minimum. Bank transfers come with a much higher minimum at £250 – so this is best avoided if you want to trade with small stakes. Once you are set up, you can spread bet shares via the Capital.com website or via its mobile app. This is compatible with both iOS and Android mobile devices.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Pepperstone is a great option if you are an experienced shares spread betting pro that likes to trade large volumes. By opening a Razor Account at this top-rated broker, you will benefit from very tight spreads. This is because your orders will be matched directly with other traders in this space. For this, you will pay a very small commission that averages $3.50 per slide.

Much like Capital.com, Pepperstone allows you to trade with leverage and benefit from short-selling facilities. If you are a professional trader and meet the requirements set out by the FCA – you will get leverage of up to 1:500. If not, you will be capped by the 1:5 limit offered by UK retail traders. In terms of supported markets, Pepperstone gives you access to four major exchanges.

In the US, this covers the NYSE and NASDAQ – meaning you can trade shares like Apple, IBM, Facebook, and Tesla. Other tradable exchanges include Germany and Australia. Unfortunately, the platform does not offer markets on UK stocks – so you’ll need to divert to Capital.com if this is what you are after. Nevertheless, getting started at this FCA-regulated shares spread betting site is simple – and you can deposit funds with a debit/credit card, bank transfer, or Paypal.

Spread betting – no capital gains tax

Compatible with numerous platforms

0% commission accounts

Raw accounts for zero spreads

FCA licensed

Accepts PayPal

No proprietary platform

Doesn’t offer ETFs

If you are ready to benefit from tax-free share spread betting markets and want to get started with an account right now – follow the steps outlined below. We show you how to open an account, deposit funds, and place your first spread betting shares UK trade with FCA broker Capital.com.

The account opening process at Capital.com should take you no more than a few minutes. You can do this online or via your mobile web browser. Simply head over to the Capital.com website, click on the ‘Sign Up’ button and then enter your personal information.

You also need to supply contact details and choose a username and password. As an FCA-regulated broker, Capital.com will ask you to upload a copy of your driver’s license or passport. You can usually do this at a later stage – but it does need to be done before you can make a withdrawal.

Now that you have a spread betting account with Capital.com – you can proceed to make a deposit. If this is your first time spread betting shares – you might want to deposit a modest amount. Fortunately, the minimum at this trading platform is just £20 – as long as you use a debit/credit card or e-wallet.

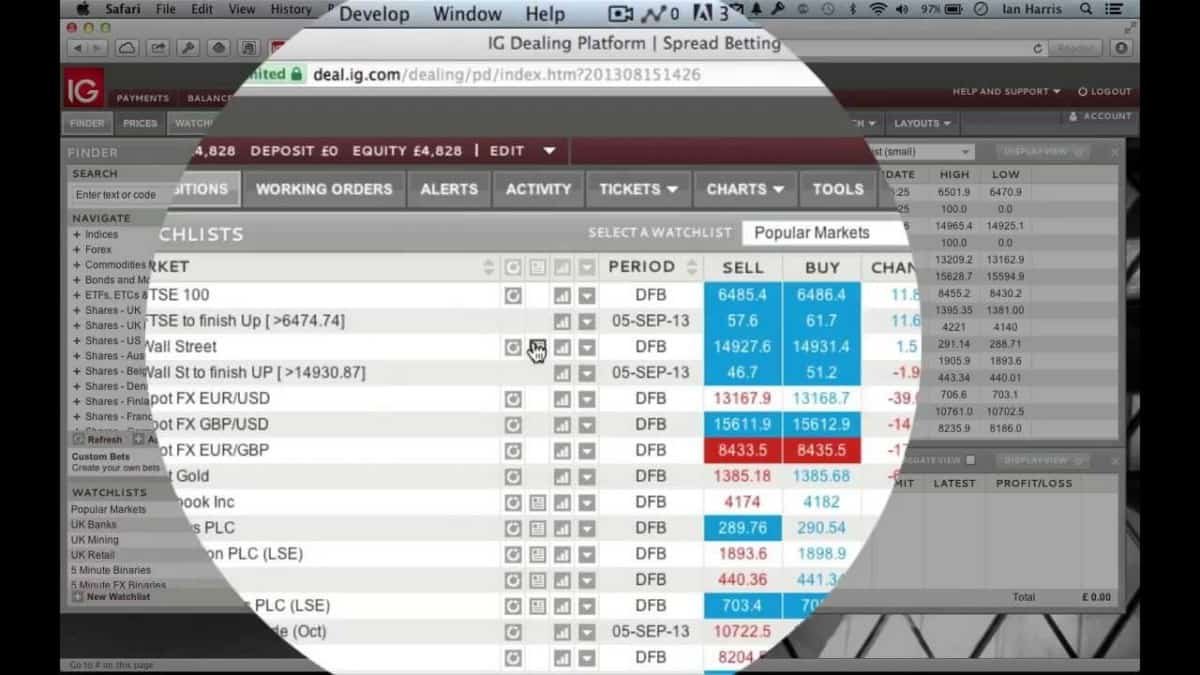

With a funded account, you are now ready to place your first spread betting trade. Capital.com offers thousands of share markets – so you can use the filter button based on the location of the exchange (e.g. UK) or the sector the stock operates in (e.g. technology).

If, however, you know which shares you wish to spread bet – it’s easier to use the search facility at the top of the page. In the example above, we are searching for Royal Mail.

Once you know which shares you wish to spread bet – you need to choose from a long or sell position. This tells Capital.com whether you think the shares will rise or fall in value.

You then need to enter your stake per point, and ideally – set up a stop-loss and take-profit order to mitigate your risks.

To complete the process – confirm your spread betting position.

Although spread betting shares UK won’t be for all investor profiles – the arena offers plenty of benefits

Mom 45 Years

Busty Skylar Vk

Pigtails Xxx

Handjob Creampie Compilation

Porn Summer Brielle Kink

Spread Betting Shares UK - Beginner’s Guide - BuyShares.co.uk

Spread Betting Shares | Major Spread Betting Markets ...

Best Spread Betting Platform UK 2021 - Trading Platforms UK

Spread Betting Vs Shares Dealing - City Index UK

Spread Betting Tax in the UK: The 2021 Guide - Shifting Shares

Top 10 Spread Betting Platforms With Low Spreads for UK ...

Best Spread Betting Platform UK - Top 7 Brokers Compared

Spread Betting Uk Shares