Spread Betting Uk Explained

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

РекламаНаучитесь составлять эффективные прогнозы и управлять линиями. Скидка до -30%! · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

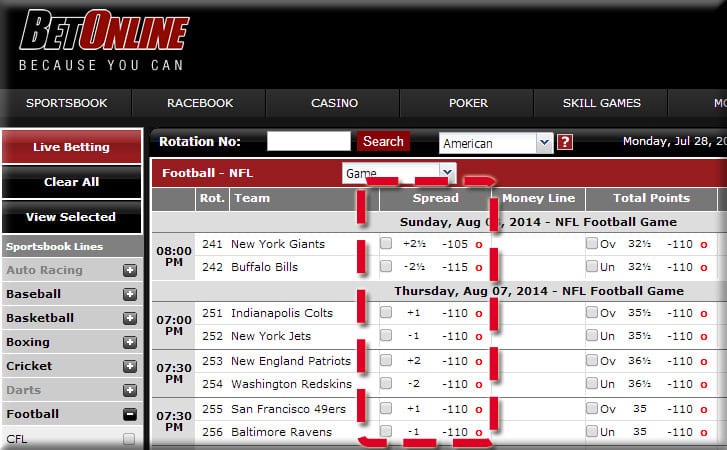

Spread Betting. A Tax-free* way to take advantage of rising or falling markets, created specifically for UK clients. Spread betting is a tax-free financial derivative. It enables traders to speculate on the price movement of a financial market, including FX, commodities and indices. Traders can speculate without owning the underlying asset.

Is it legal to spread bet in the UK?

Is it legal to spread bet in the UK?

In the UK spreadbetting is regulated by the Financial Conduct Authority (FCA). Unfortunately, financial spread betting in America (USA), is still not yet available as it is still considered to be online gambling there. Next: Financial Betting Explained.

www.tradersdaytrading.com/financial-sprea…

How does spread betting work in the market?

How does spread betting work in the market?

A financial spread bet is an easy way of speculating on the rise and fall of prices as it is simply a bet as to which direction you feel the price of a specific asset will go. How much profit or loss you make is based on the actual rise and fall of the market, just as it would if you had purchased the shares through a traditional investment.

www.tradersdaytrading.com/financial-sprea…

What kind of tax do you pay on spread betting?

What kind of tax do you pay on spread betting?

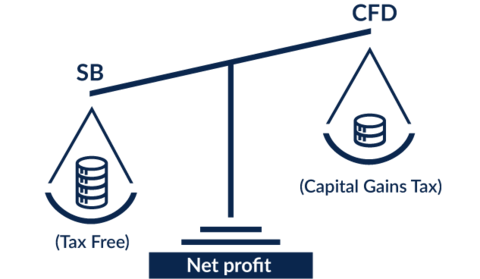

UK tax laws mean any gains made from CFD trading are subject to Capital Gains Tax (CGT). As spread betting involves no contracts, profits avoid both stamp duty and Capital Gains Tax, which means it can be considered a tax-free trading strategy.

www.compareforexbrokers.com/uk/best-spr…

Who is the best spread betting broker in the UK?

Who is the best spread betting broker in the UK?

As a spread betting and CFD broker, Pepperstone is overseen by the Financial Conduct Authority in the United Kingdom. The FCA ensures brokers follow UK regulation and that retail investor accounts are receiving a fair brokerage service.

www.compareforexbrokers.com/uk/best-spr…

https://buyshares.co.uk/spread-betting

Spread betting UK platforms also permit leverage. This means that you can boost the size of your trade – in line with FCA limits. Unlike CFD trading, however, …

If you're based in the UK or Ireland - the tax laws on spread betting are very favorable. In fact, as spread betting is classed as 'gambling' - you...

Do you get dividends when spread betting UK?

In some cases, yes. Although you do not own the underlying dividend stock - a lot of spread betting platforms will adjust your account balance when...

Is spread betting better than CFDs?

CFDs are more suitable if you want to trade an instrument that never expires. Spread betting, on the other hand, allows you to trade without paying...

Yes, spread betting in the UK is regulated by the FCA.

Can you hedge with spread betting??

Yes, spread betting offers a great way to hedge an open position. All you need to do is place an opposite order to the one you currently have in pl...

Financial spread betting is a form of line trading where you speculate on the future value of an asset like gold, oil, stocks, or forex. All profit...

https://www.economywatch.com/uk/spread-betting

Benefits of Spread Betting UK. So now that you have a firm understanding of how spread betting UK works – we can now talk about the many benefits that this form of financial trading offers. Spread Betting UK Tax. As we briefly covered earlier, spread betting profits in the UK …

https://tradingreview.uk/spread-betting-explained

Spread Betting Explained _x000D_ _x000D_ Spread Betting is a derivative-based financial trading product that that enables …

https://www.footballgambler.co.uk/spread-betting-explained

Spread Betting Explained: One of the most popular ways of placing spread bets is on football. And there is no better league for variety of spread bet markets, than the Premier League. Visit Sporting Index Here For Premier League Spread Betting. New clients get £75 (non-withdrawable) to bet …

https://www.sharesexplained.com/spread-betting-explained

Spread betting explained. Spread betting explained. Spread betting is essentially betting on an outcome. It is used for events such as sports, the stock market, house prices, the FTSE 100 etc. However unlike normal betting when you either win or lose, spread betting …

Spread betting vs CFDs | IG Academy

How to spread bet | How to trade with IG

What is Spread Betting? | CMC Markets

Beginner's Guide to Spread Betting 👍

How does spread betting work? - MoneyWeek Investment Tutorials

Spread Betting For Shares Traders | IG

https://www.shiftingshares.com/what-is-spread-betting

23.04.2020 · Spread betting is a financial derivative product which traders do not take ownership of the underlying asset that they are betting on. Spread …

www.tradersdaytrading.com/financial-spread-betting.html

Financial Spread Betting Explained The concept was originally devised in the UK for sports spread betting but when combined with the vast potential …

https://www.freebets.com/spread-betting-explained

All this means is that your account has a built in added security of limiting risk. Spread betting with a safety net UNTIL such a time as you are more confident with the way spread betting works. These accounts also have small minimum stakes (down to 5p) allowing you to learn and see if spread betting …

РекламаНаучитесь составлять эффективные прогнозы и управлять линиями. Скидка до -30%! · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

By clicking 'Continue' you are agreeing to have read our privacy policy.

What is Spread Betting? Spread Betting UK Explained

9, April 2021 | Last Updated: 25, August 2021

Spread betting allows you to trade a wide variety of financial instruments – with all profits exempt from tax! You can apply leverage, choose from a long or short position, and generally trade without paying any commission.

Here we discuss the ins and outs of how Spread Betting UK works and how you can start spread betting without tax today.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

If you’re looking to try spread betting UK for the very first time – you might want to try Capital.com. The FCA-regulated platform offers a free spread betting demo account that allows you to trade without risking any money. Then, if you want to start spread betting with real money – the minimum deposit is just £20.

Here’s a quickfire guide on how to start spread betting UK right now:

And that’s it – you’ve just placed your first commission-free spread betting trade at Capital.com!

There is often a misconception that spread betting is a form of gambling. Although HMRC views the industry of gambling – insofar that profits are exempt from tax, spread betting is actually a form of short-term trading. In a similar nature to CFD trading, your primary goal is to speculate on whether an asset will rise or fall in value.

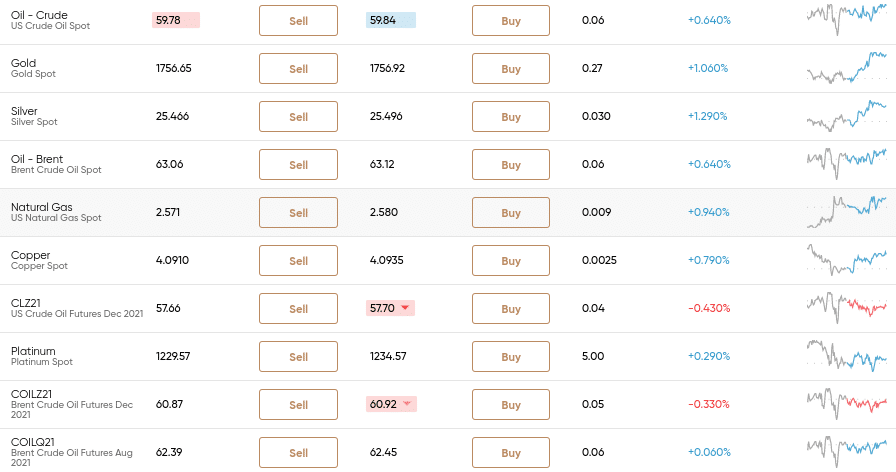

Most financial spread betting platforms give you access to thousands of markets – covering everything from gold, stocks, and ETFs, to indices, bonds, and oil. As we cover in more detail shortly, spread betting platforms allow you to go long or short on your chosen asset. This means that you can benefit from both rising and falling markets.

Spread betting UK platforms also permit leverage. This means that you can boost the size of your trade – in line with FCA limits. Unlike CFD trading, however, spread betting markets typically come with an expiry date. This means that when the market expires – your trade will be automatically closed by the broker. More on this shortly. You can read our spread betting vs CFD guide to learn more about how these types of trading differ.

If you’re looking to invest in shares or ETFs over the course of many months or years – spread betting UK will not be for you. But, if you’re a short-term trader that likes to enter and exit positions in a matter of hours, days, or weeks – spreading betting is well worth considering.

You do, however, need to understand the basics of spread betting UK before taking the plunge.

Your first port of call is to determine whether the value of your chosen financial instrument will increase or decrease in the short term.

Crucially, this is why spread betting UK is so popular with short-term traders – as you always have the option of benefiting from rising and falling asset prices.

Here’s a quick example of how going long and short works in spread betting:

Had you thought that GBP/USD was overpriced and thus – would decline in value, you would instead have placed a short order.

Perhaps the most challenging aspect of spread betting UK is that price movements are determined in points. Ordinarilly, when trading online, the asset price movement is determined in pounds and pence.

The above example is fairly easy to grasp – as on each stock price movement of 1p – that’s 1 point. However, the unit of each market can and will vary depending on which asset you are trading.

As we cover in the section below, your profit or losses are determined by the amount you stake ‘per point’.

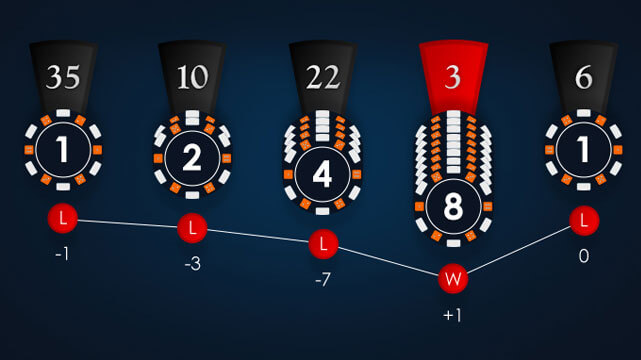

So that you know how spread betting price movements are calculated – you then need to think about stakes. This simply refers to the amount of money you wish to risk on the respective spread betting trade.

In the example above, we noted that the price of gold increased by 89 points. If you had stakes £1 per point and you went long on the position – you would have made a profit of £89.

Let’s look at another quick example to help clear the mist:

It is important to note that in the above example, 1 point amounts to a stock price movement of 1p. However, some spread betting platforms might stipulate that 1 point equates to 0.1p of a stock price movement.

For example, is BT stocks were priced at 154.50p and dropped to 154.10p – that’s a price movement of 40 points. This means that your profits and losses are going rise and fall in a much faster manner – so make sure you understand the unit structure of your chosen spread betting market.

A major attraction of opting for a spread betting platform over a traditional brokerage firm is that you will always be offered leverage. If you’re new to this financial term – leverage simply means that you can amplify the size of your spread betting position.

This can be beneficial if you only have access to a small amount of trading capital. Additionally, leverage is also beneficial if you are looking to target small margins on each position and thus – want to boost the value of your potential gains.

Here’s an example of how a leveraged spread betting trade would work in practice:

It is important to note that leverage will also magnify your losses. This is why spread betting leverage is now governed by the FCA. In simpler terms, if you’re a retail client (meaning you do not trade in a professional manner), the amount of leverage you can apply will be capped.

This is based on the financial instrument you are trading and looks like the following:

The above limits ensure that you do not risk more than you can afford to lose.

If you are interested in applying leverage to your spread betting trades, you also need to understand how ‘margin‘ works. In its most basic form, this is the amount of money you need to cover the leveraged trade that you wish to open. This is not too dissimilar to a security deposit.

Crucially, if your leveraged spread betting position goes against you by an amount equal to the margin requirement – your trade will be closed by the broker. Before this happens, most spread betting UK sites will send you a notification (usually via email) – which is known as a ‘margin call’.

This will let you know that your leveraged trade is close to automatic liquidation – so you might want to consider adding additional margin to your account to avoid this happening.

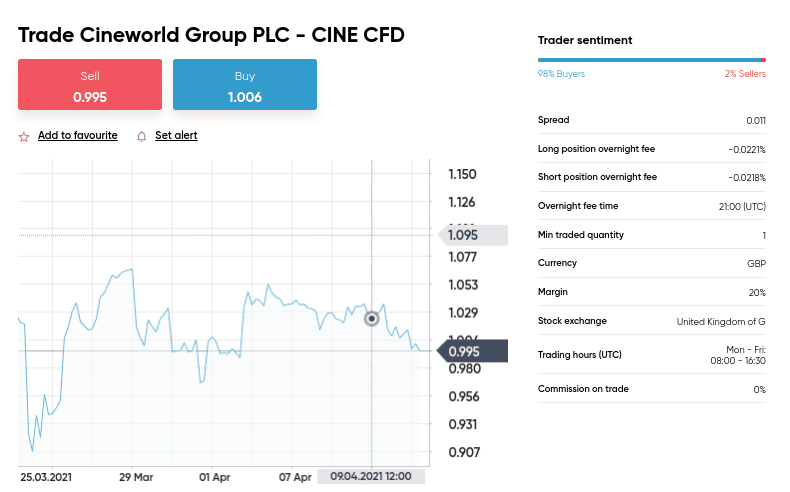

The terms ‘spread betting’ and the ‘spread’ actually refer to two different things. We have already explained how spread betting UK works, so allow us to elaborate on the latter.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Irrespective of how you trade online – whether that’s via spread betting, CFDs, or traditional stock investing – brokers always charge a spread. This is the difference between the buy and sell price of your chosen instrument. In the case of spread betting, this will be the gap between the long and short prices that your broker offers.

In simple terms, this means that you need to make gains of 10 points to break even on this trade. If your position increased by 15 points, your actual profit would stand at 5 points. Ultimately, the spread is how commission-free brokers make money irrespective of which way the marketers move.

As such, this is why Capital.com is a great option to consider in your search for a spread betting UK site – as spreads are typically very competitive.

When you invest in a traditional asset like stocks or ETFs, you can keep your position open for as long as you want. This is because by investing in your chosen asset – you retain ownership until you decide to sell. But, when you trade via spread betting instruments – you do not own the asset. On the contrary, you are simply speculating on whether the price of the asset will rise or fall.

Most importantly, spread betting markets always come with a ‘trade duration’. This means that at some point in time – the market will expire. When it does, your trade will be closed by the broker automatically. We find that trade duration times at spread betting brokers are typically broken into two – daily bets and quarterly bets.

Once again, the fact that all spread betting UK markets have an expiry date in place should remind you that this form of online trading is best suited for short-term strategies

A huge advantage of trading via a spread betting platform is that you will have access to thousands of financial markets. Don’t forget – irrespective of which market you trade – you do not own the underlying asset.

Instead, spread betting instruments simply track the real-time price of the market. For example, if BP stocks go from 298p to 301p – the spread betting instrument will mirror the exact same movement like-for-like.

With this in mind, the best spread betting UK sites typically allow you to trade the following markets:

The one asset class that you can no longer trade when spread betting in the UK is cryptocurrencies. This falls within the remit of cryptocurrency derivatives – which were prohibited by the FCA in early 2021.

If you’re still wondering whether or not spread betting UK is right for you – below you will find an overview of what benefits this popular trading arena offers.

Since 2010 – gambling winnings in the UK are not subjected to taxation. Spread betting is defined as gambling by HMRC – meaning that all profits are yours to keep. This is a major benefit – like all other financial markets – whether that’s CFD trading or traditional stock investments – are liable for capital gains tax.

Additionally, when spread betting in the UK, you are not purchasing the underlying asset. This also means that you will avoid stamp duty tax. This is ordinarilly payable when you buy shares or ETFs that are listed on the London Stock Exchange.

In addition to being able to trade without paying any capital gains tax – there are a number of other benefits to consider when spread betting, such as:

Spread betting consists of speculating on complex financial instruments – so it’s crucial that you have a strategy in place. This is no different from any other type of online trading and will ensure that you have clear financial goals and an appreciation for risk management.

Below we discuss some of the best strategies to consider when using a spread betting UK platform.

One of the easiest spread betting UK strategies to implement is to keep an eye on key financial news. After all, important news developments will impact the value of an asset.

If your speculation was correct and the FTSE 100 did decline as a result of increased interest rates – you would make a profit on this trade.

Another popular spread betting strategy is to take advantage of an upcoming dividend payment. For those unaware, the ‘ex-dividend date’ is typically the day before the ‘record date’. Any investor that buys share on or after the ex-dividend date will not be entitled to a dividend.

Now, when the dividend amount is announced, you will often find that the respective stock price drops by the same amount. For example, if HSBC announces a dividend yield of 2.5%, in theory, the stock price will also decline by this amount. This is because dividends are paid with cash – which comes out of the company’s balance sheet.

Taking the above into account, some spread betting traders will look to place a short position on a stock the day before the ex-dividend date. This would allow them to profit if and when the stock price declines in correlation to the size of the proposed dividend yield.

Once you have a firm grasp of how spread betting UK works, you then need to find a suitable broker.

The most important metrics that you need to look for when choosing a spread betting platform are as follows:

To save you from having to perform in-depth research, below we discuss a selection of the best spread betting UK sites for 2021.

Capital.com is by far the best spread betting UK site for those of you that are trying this form of online trading for the first time. The broker requires a very modest minimum deposit of just £20 – which is an inconsequential amount in trading terms. Plus, the broker also offers a free demo trading facility – meaning that you can try spread betting risk-free.

In terms of supported markets, the Capital.com spread betting shares department covers more than 2,400 stocks from heaps of exchanges. This covers UK markets, as well as those in the US, Europe, Australia, and Asia. You can also trade hard metals, energies, indices if you are interested in FTSE 100 spread betting, ETFs, and currencies. There are no commissions to pay when spread betting at Capital.com – so it’s only the spread you need to look out for.

Capital.com also offers leverage – should you wish to amplify the size of your position. You can access the spread betting facility online or via the provider’s mobile

How Women Orgasm

Private Lives Online

Where Is My Mind Solo

Russian Cam Slut

Fucked Free Xxx Videos

What is Spread Betting? Spread Betting UK Explained ...

Spread Betting UK | What Is Spread Betting? Full 2021 Guide

Spread Betting Explained | tradingreview.uk

Spread Betting Explained - How football spread betting works

Spread betting explained | SharesExplained.comShares Ex…

Spread Betting Explained: What is Spread Betting & How ...

UK Financial Spread Betting Explained, How to Spread Bet

Spread Betting Explained, What Is Spread Betting ...

Spread Betting Uk Explained